The time has come for manufacturing companies to redesign their operations using a clean-sheet approach. To enhance their competitiveness, they must simultaneously improve their value proposition, strengthen their operational resilience, and pursue sustainability. Optimizing operations to achieve these objectives requires a holistic zero-based vision of what, where, and how to manufacture—a concept we call “the zero-based factory.” This vision provides the basis for identifying a medium-term target state and devising an action plan for achieving it.

A BCG study examined the design choices for zero-based manufacturing and supply chain operations, as well as industry and operating-environment factors that influence decisions about these options. We also considered how design choices differ among industries and countries. The study builds on the results of a global survey of more than 1,700 operations executives from numerous producing industries. (See “About the Study.”)

About the Study

We selected the survey participants at random from 1,705 global companies that had at least 250 employees each. The companies represent a broad array of producing industries: automotive, consumer goods, energy, engineered products, health care, machinery, process industries, technology, and transportation and logistics. Survey participants were based in 13 countries: Austria, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Switzerland, the UK, and the US.

The survey sought to evaluate the current operational priorities of the participants’ companies. It also sought to identify the specific design choices necessary to address future challenges at each company. In addition, the survey asked about the characteristics of each design choice that participants would apply.

The study found that improving their value proposition, especially through cost reduction, is the top priority for executives considering design choices in the context of the COVID-19 pandemic. The opportunity at stake is tremendous: by combining multiple levers in a clean-sheet approach, a company can reduce costs by up to 25%. Although sustainability has gained importance, many companies have not yet acted on the imperative to improve resilience.

Notably, for design choices—even within an industry—location matters. For example, the study found that automakers in Western Europe were far more likely than those in China to pursue cost savings through outsourcing. And complementing this tendency was a greater willingness among Western European companies to shift production offshore. At the same time, automakers in China were much more willing than those in Western Europe to invest in digitization, perhaps as a response to their diminishing labor-cost advantage.

Overall, the study’s findings point to the need for companies to take an individualized approach to designing the zero-based factory.

Competing Strategic Objectives Demand a Comprehensive Approach

In the past, successful manufacturers optimized their operations for cost, quality, and service. Today, however, the objectives that manufacturers must pursue in order to ensure competitiveness have evolved. Major global trends require manufacturers to address three key strategic objectives: improving the value proposition, strengthening operational resilience, and pursuing sustainability ambitions. Our study provides insights into how companies are currently prioritizing each of these objectives.

Improving the Value Proposition. Established companies need to rapidly improve their value proposition to stay on top in the fast-changing market environment. Product cost and quality, the technology incorporated in products, and the service level offered are important factors in determining a company’s value proposition. In the past, manufacturers operating in regions with high labor costs could offset their price disadvantage by selling products with superior technology, quality, or service. In recent years, however, manufacturers in regions with low labor costs have begun to compete on the basis of quality, technology, and service, as well as price. Moreover, startups have entered the market with new disruptive approaches that enhance their competitiveness.

Two-thirds of study participants perceive cost reduction as more important because of the COVID-19 pandemic.

Going back to 2016, participants in our “factory of the future” studies have selected cost reduction as their top priority each year. Indeed, its relative importance has increased over the past year: two-thirds of study participants consider cost reduction to be more important because of the COVID-19 pandemic. However, the need for continual cost reduction as an important means of optimizing the value proposition extends beyond recovering from shocks such as the pandemic.

Strengthening Operational Resilience. Resilience is a company’s capacity to absorb stress, recover critical functionality, and thrive in altered circumstances. Resilient companies enjoy better outcomes than their peers in one or more of three ways: the immediate impact of an external shock on their performance can be lower; the speed of their recovery can be higher; and the extent of their recovery can be higher. To inform new resilience strategies, companies need to better understand their exposure, vulnerabilities, and potential losses.

The risks are especially high with respect to manufacturing footprint. Manufacturing and supply chain networks have become increasingly global. Lower trade barriers have enabled companies to gain the benefits of labor arbitrage by shifting even small aspects of production to best-cost countries. In addition, more goods can be shipped economically over international trade routes today than in the past. The feasibility of global trade has encouraged many companies to manufacture goods in low-cost regions and then ship them to the consuming market. Moreover, many companies have outsourced the manufacturing of product components to offshore contractors in order to gain flexibility and access to the required specialists. Unfortunately, global networks increase a company’s exposure to risks arising from trade wars, protectionism, pandemics, and other disruptions.

Perhaps surprisingly, the COVID-19 pandemic has not greatly influenced study participants’ prioritization of resilience. On the one hand, nearly two-thirds of participants said that they will strengthen resilience to avoid future operational disruptions (such as COVID-19), in response to the weaknesses that the crisis exposed. On the other hand, only about 10% of participants said that resilience will be a top priority for their operations in the years ahead. This split in responses suggests that most participants do not yet fully recognize the imperative to improve resilience in order to achieve long-term success.

Pursuing Sustainability Ambitions. Manufacturers’ production and logistics operations account for more than half of all global CO2 equivalent emissions from fuel combustion. Although shutdowns caused by the COVID-19 pandemic have contributed to a short-term reduction in emissions, the longer-term trend indicates that emissions from production and logistics would have to decrease by approximately 45% by 2030 to be on a path to meet the Paris Agreement’s target of limiting the global temperature increase to 1.5°C. As longstanding environmental concerns intensify, manufacturing companies are feeling increasing economic pressure to tackle the problem.

Sustainability has steadily gained importance in our surveys since 2016. This year, more than 80% of study participants said that their company plans to transition to carbon-neutral operations. Many participants said that their company has set an aggressive timeline: nearly one-third (31%) plan to become carbon neutral by 2025, and approximately 60% plan to achieve this goal by 2030. Participants said that the two most relevant levers for achieving carbon neutrality are increasing efficiency (for example, improving energy efficiency through operational excellence) and recycling and remanufacturing (for example, adopting closed-looped systems and component reuse). Most participants said that they expect these levers to have a significant impact on their progress toward carbon neutrality in three to five years.

Participants seem to be rather optimistic, however. A previous study by BCG and the World Economic Forum found that relatively few companies have set science-based targets for achieving their net-zero ambitions. Another obstacle relates to the current technical constraints on increasing efficiency and recycling, which are the main levers for reducing carbon emissions. To get close to meeting their aggressive timelines for carbon neutrality, companies need to be more realistic about setting targets and defining plans to achieve them. For example, they must find ways to overcome a scarcity of resources for implementing sustainability initiatives, and they must use bridging technologies such as offsetting.

Core Design Choices Define the Zero-Based Factory

Ideally, companies would strive to improve value, resilience, and sustainability simultaneously. In reality, however, they must consider tradeoffs when pursuing these objectives, such as centralizing production to reduce costs versus localizing production to improve resilience. Isolated, incremental improvements are simply not enough to address the wide variety of tradeoffs among the objectives.

The concept of the zero-based factory offers a solution: companies determine a holistic vision for the optimal design of their operations, independent of the limitations imposed by the existing setup. Working backward from this vision, they develop a medium-term target state and an action plan to achieve it. To apply the concept, companies should develop comprehensive answers to three guiding questions that encompass the key operational topics:

- What will we manufacture?

- Where will we manufacture?

- How will we manufacture?

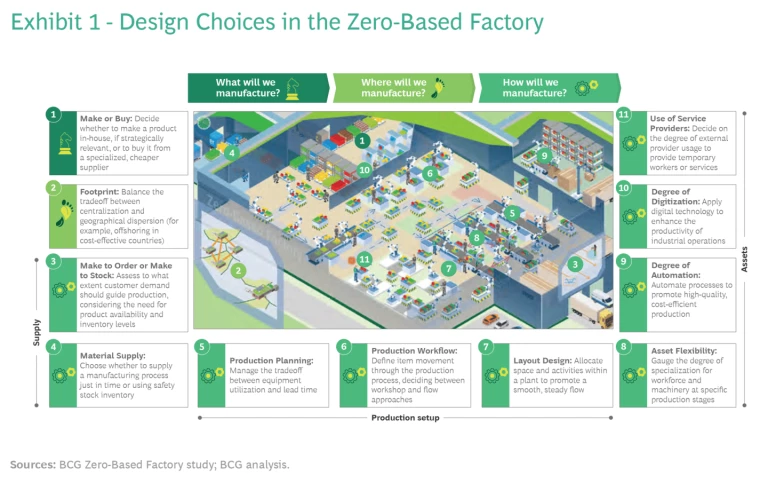

We have identified 11 design choices that companies should assess in answering these questions. (See Exhibit 1.) Our study, including a survey of more than 1,700 executives and operations managers, confirmed that these choices are the most important ones to evaluate. Although they are universally applicable, these design choices have characteristics that are specific to each industry. As a result, the optimal outcome for the tradeoffs varies depending on the industry and on the company’s operating environment and specific priorities.

Below, we discuss the design choices and illustrate the tradeoffs with examples from across industries.

What Will We Manufacture?

Companies need to decide whether to make a product or its components in-house or to buy them from an external supplier. For example, Apple designs the hardware and software for the iPhone, but it outsources production of the devices to Foxconn, a provider of electronics manufacturing services. Participants in our survey ranked make-or-buy decisions among the top design choices, with 69% saying they would use this choice in designing a zero-based factory.

One key consideration is how much value the company wants to create in the manufacturing process. Another is how much flexibility the company wants to maintain in response to changes in manufacturing volume, especially for products that are subject to large fluctuations in demand.

Automotive OEMs, for example, can achieve cost advantages by buying commodity components, such as sun visors, without worrying about losing any product differentiation. For some automakers, commodity components extend to key components, such as the engine and other drive technology because many customers no longer view driving dynamics as being a differentiating factor. In the coming years, OEMs will find new strategically relevant ways to differentiate their products, such as battery systems, and these components will be strong candidates for in-house manufacturing.

The optimal outcome for the design tradeoffs varies depending on the industry, as well as the company’s operating environment and specific priorities.

Manufacturers of consumer goods, meanwhile, need to reevaluate make-or-buy decisions in the context of their evolving markets. Because consumers are buying an increasing number of narrow-cast products, small companies are taking market share from big ones across almost all categories. To remain competitive, large players are buying smaller brands and increasing the pace of innovation. These developments have created complexity for manufacturing plants that must accommodate greater flexibility and smaller-scale production. Smart make-or-buy decisions offer a solution: companies can strategically outsource smaller-scale production while keeping larger-scale production in-house.

Where Will We Manufacture?

The location of a plant or distribution center has an important impact on overall value, resilience, and sustainability. As a starting point, a company needs to determine how to design a manufacturing and supply chain “footprint” to achieve its corporate goals. This entails balancing the tradeoffs between centralization and geographical dispersion, such as the benefits of locating production close to customers versus the benefits of offshoring production to labor-cost-effective countries. For example, Tesla is building factories around the world to ensure access to new markets and achieve its growth ambitions. In doing so, the company is transitioning from a centralized approach (producing vehicles in a single plant) to a decentralized network (producing them in multiple plants) to be closer to more customers. Among survey participants, nearly two-thirds (65%) said that they would use footprint decisions in designing a zero-based factory.

In determining its footprint, a manufacturer must first determine the optimal factory size, considering the tradeoff between having multiple smaller factories versus having a few larger factories that produce at higher volume. So-called megafactories have the potential to generate tremendous savings through scale effects. For example, a company can transition from two to three shifts to maximize use of machinery. Moreover, combining the operations of multiple factories in one location entails a disproportionately smaller increase in the size of indirect functions such as production planning.

Having determined the optimal factory size, a manufacturer can assess the optimal location by considering tradeoffs between high-cost countries (which may be their main markets or near such markets) and best-cost countries. Although manufacturers can consolidate the operations of several smaller factories, they should do so only within a free-trade zone in order to maintain market access. Recognizing the importance of staying close to customers while capturing cost advantages, Western European and US manufacturers have shifted some production to Eastern Europe and Mexico, respectively, in recent decades.

How Will We Manufacture?

A company must decide on the physical structure of its factory operations and on the processes and digital solutions to adopt. The best choices enable the company to achieve its overarching goal of optimizing value, resilience, and sustainability. We discuss the design choices in connection with three categories of topics: supply, production setup, and assets.

Supply

Manufacturers need to address two crucial supply-related considerations: how to meet customer demand, and what level of inventory to maintain.

Make to Order or Make to Stock. Companies must figure out the extent to which customer demand should determine production, considering requirements for product availability versus the need to maintain reasonable inventory levels. Companies typically adopt either a “make to order” approach (driven by customer demand) or a “make to stock” approach (driven by a sales forecast). As an example of the make-to-order approach, Adidas offers custom-made products: a customer order triggers production of a particular shoe. Gasoline production exemplifies the make-to-stock approach: production is largely decoupled from local demand. Even within the same industry, however, companies do not use the same approach, which points to an opportunity to establish competitive advantage by making the optimal design choice. Among survey participants, nearly two-thirds (63%) said that they would use this design choice in a zero-based factory.

Material Supply. The manufacturing process can set up a supply system on a just-in-time basis or one that incorporates safety stock inventory. For example, automotive companies supply a significant number of the components to their assembly lines on a just-in-time (or just-in-sequence) basis to ensure lean production. In contrast, in industries where planning is difficult, maintaining high inventory stocks is essential. For example, manufacturers of parasols have limited on-demand sourcing options and must maintain high inventory levels to accommodate a very short phase of seasonal demand. They need to be prepared for an instant increase in demand as soon as the weather improves.

Production Setup

Companies need to consider both their planning process and the overall plant setup.

Production Planning. In planning production, companies must manage the tradeoff between equipment utilization and lead time (the latency between initiating and completing the manufacturing process). In a process industry (such as chemicals), manufacturers often make products in a large batch, which typically involves mixing ingredients according to specific formulas or recipes. This single-product approach enables the maker to focus on maximum use of the bottleneck machinery without negatively impacting lead time. In discrete manufacturing, the use of assembly lines or manufacturing cells entails a somewhat different tradeoff: high utilization with long lead times or low utilization with short lead times. Environmental regulations are a consideration, too, as costs related to carbon emissions encourage a higher level of machine utilization to avoid additional expenditure.

The tradeoff between lead time and utilization is evident in the 3-D printing service industry. Service providers can keep their costs down by heavily utilizing a small number of printers, but this means that customers must wait longer for delivery of their printed products. Alternatively, providers can operate with enough printers to ensure short delivery times—but they must be willing to accept relatively low utilization levels per printer.

Production Workflow. Companies must decide on an approach to moving items through the production process. In a “workshop” approach, the company produces a relatively small number of items (such as furniture) individually at a single workstation; there is no movement among workstations. At the other extreme, the “flow” approach (which is used to produce microchips, for example) employs highly automated processes to reduce cost and time. Manufacturers commonly use continuous line production (a version of the flow approach) to reduce costs and increase output. Today, however, new technologies, such as mobile robots, are creating opportunities for companies to apply a workshop approach in some processes by boosting the efficiency of human workers. For example, automotive OEMs are deploying robots to assist human workers in efficiently assembling suspension struts. The increased efficiency improves the cost competitiveness of the workshop approach in comparison with the flow approach.

New technologies, such as mobile robots, create opportunities for companies to apply a workshop approach in some processes by boosting the efficiency of human workers.

Layout Design. The allocation of space and activities within a plant should promote a smooth and steady flow of production material, equipment, and manpower at minimum cost. A company can choose between highly flexible setups (such as modular or flexible-cell manufacturing) and highly specialized setups (such as conventional assembly lines with a standard takt, or pace of production). For example, Audi produces its e-tron GT model using a flexible assembly process supported by an automatic guided vehicle system that carries vehicles between workstations.

Assets

Asset-related topics consider the flexibility and productivity of people and equipment.

Asset Flexibility. Companies need to decide on the degree of specialization to adopt for two types of assets—the workforce and machinery—at each production stage. The degree of specialization determines the level of flexibility available to the company in deploying the assets.

A workforce with a high degree of specialization at certain production stages can be more productive (owing to greater experience) and may need only a moderate level of focused training. A less specialized workforce provides high flexibility across production stages because the company can deploy it in multiple production stages and assignments. To gain this flexibility, however, a company must provide training in a greater range of topics. For example, in industrial production, the plant operator oversees the machinery and ensures a stable production process. If the company wants the flexibility to have the operator perform maintenance in case of a breakdown, it must give the operator additional training.

Highly specialized machinery is more productive (owing to its capacity to increase output), and it requires relatively moderate investments to purchase and operate. Less specialized machinery provides high flexibility—because it can be used for multiple production stages or product variations—but it costs more and may reduce productivity (owing to decreased output). For example, in the tool-making industry, a manufacturer must decide whether to use a machining center with three or five axes. A five-axis machining center requires a larger monetary investment but offers greater flexibility.

Companies need to decide on the degree of specialization for two types of assets—the workforce and machinery—in each production stage.

Degree of Automation. Today, nearly all manufacturing sites apply some degree of automation to promote high-quality, cost-efficient production. Automation is especially prevalent in locations with high labor costs, because the cost savings yield a solid return on investment. In the coming years, we expect to see manufacturers that operate in countries with rising labor costs increase their adoption of automation. Moreover, new technologies such as advanced robotics allow companies to automate processes that have traditionally involved manual work because of their complexity. For example, advanced robots can perform complex tasks such as picking items from a bin. One producer of sealing solutions uses more than 40 robots to load and unload machines in its manufacturing cells. Survey participants ranked degree of automation among the top design choices, with 71% saying that they would use this choice in designing a zero-based factory.

Degree of Digitization. Manufacturers have demonstrated the value of digitizing their operations. For example, artificial intelligence is rapidly becoming essential for enhancing the productivity of industrial operations, and mobile solutions provide operators and maintenance staff with valuable information as they move around the plant. However, many companies have implemented only a low to moderate degree of digitization, usually in small-scale programs. Degree of digitization was among the top-ranked design choices in our survey, as 70% of participants said that they would use it to develop a zero-based factory.

Use of Service Providers. By relying on external organizations to provide temporary workers or services, a manufacturer can increase its operational flexibility. At many companies, workers from temporary employment agencies make up a significant proportion of the operational staff. Temporary workers are especially valuable for helping companies achieve production goals during peak periods without incurring long-term contractual liabilities. On the other hand, the manufacturer does not benefit from retaining skilled temporary workers’ knowledge and experience in the organization over the long term.

Boundary Conditions Set Priorities for Design Choices

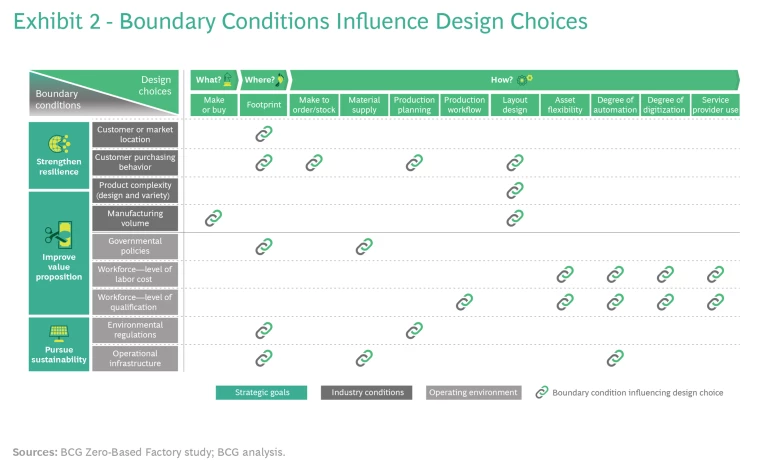

A company must decide how to prioritize value, resilience, and sustainability in order to enhance its competitiveness. To do this, it must assess its boundary conditions, which encompass its strategic goals, industry conditions, and operational environment. These conditions influence tradeoffs and priorities for design choices. (See Exhibit 2.)

The strategic goals should respond to specific industry conditions or aspects of the operating environment:

- To strengthen resilience, a company must consider industry factors relating to customers (location and purchasing behavior) and product complexity (design and variety).

- Efforts to improve the value proposition must take into account industry conditions (product complexity and manufacturing volume) and operating environment factors (government policies, workforce costs, and workforce qualification).

- Sustainability decisions deal with environmental regulations and operating infrastructure (such as supply chains and suppliers). In some industries (such as consumer goods), customer preference is an additional condition motivating sustainability decisions.

Specific industry conditions are relevant to choices about what, where, and how to produce. Operating environment has the greatest impact on the latter two issues.

The following examples illustrate the interdependencies between the boundary conditions and design choices:

- Workforce Cost and Degree of Automation. Factories in countries with low labor costs typically have a low degree of automation. Investments in machinery are usually not justified by the returns. For example, car body shops in Brazil, where labor costs are low, use a low degree of automation, but in Germany they use a higher degree of automation. Moreover, in some emerging markets, such as South Africa, government policies require manufacturers to create jobs.

- Operational Infrastructure and Material Supply. In situations where a company cannot locate a factory near suppliers, the local infrastructure in the supplier network plays a major role in determining whether just-in-time delivery of parts and components to the manufacturing line is a feasible option. Just-in-time delivery requires a sufficient number of qualified local suppliers and a stable supply chain insulated from major disruptions (such as sudden road closures). Consequently, in many cases, a factory’s location predetermines the tradeoff between sufficient supplies and low inventory, as the company may have no realistic alternative to maintaining high inventory stocks.

Location Matters for Design Choices

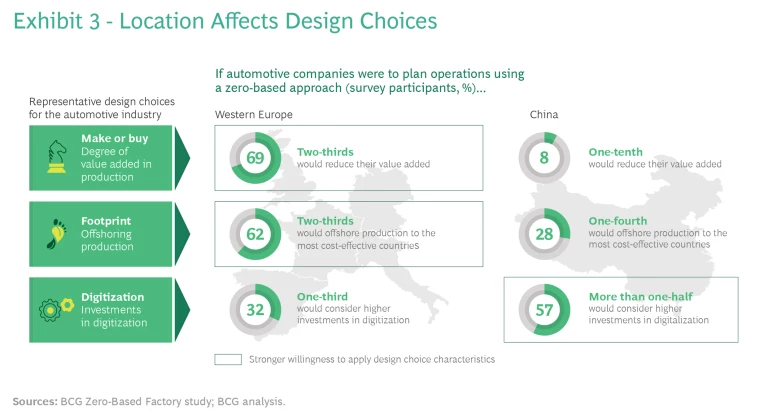

Our study found that the region in which a manufacturer is located is a key factor in making the right tradeoffs for each design choice. To explore regional design choices, we focused on responses from study participants in the automotive industry— a global industry that produces similar products around the world. This feature of the industry allowed us to make regional comparisons and assess how their different contexts affected decisions.

From a global perspective, we found that automakers’ most important design choices involve make or buy, digitization, and automation. In each case, about 70% of study participants said that their company plans to use the design choice to evolve toward a zero-based factory. Companies are likely reevaluating their make-or-buy decisions in response to supply chain vulnerabilities that the COVID-19 pandemic has exposed. Their emphasis on digitization and automation reflects the ongoing importance of technology as a driver of operational improvements.

The results from automotive participants in Western Europe and China provide insights into the influence of location on design choices. (See Exhibit 3.)

Three differences related to what, where, and how to manufacture are especially noteworthy:

- Make or Buy. In Western Europe, 69% of participants said that their company would try to save costs by reducing the value it added in manufacturing (that is, by outsourcing rather than producing in-house). In China, only 8% of participants said that their company would seek to reduce the value added in production.

- Footprint. Among Western European participants, 62% said that their companies are willing to offshore production to more labor-cost-effective countries. The combination of footprint and make-or-buy decisions is especially important in Western Europe. On the one hand, supply chain complexity and vulnerability to shocks tilt the tradeoff toward producing in-house or a least domestically. On the other hand, outsourcing and offshoring production are attractive in view of the high costs of domestic production. In contrast, only 28% of Chinese participants said that their companies are willing to produce offshore. Most would rather manufacture close to the customer and add high value through in-house production.

- Digitization. Chinese participants expressed significantly greater willingness to invest in digitization than did Western European participants. Among Chinese participants, 57% said that their company would make substantial investments in digitization using a zero-based approach, compared with only 32% of Western European participants. This may seem counterintuitive, given that labor costs in China are lower than in Europe and the US. It indicates, however, that although Western European companies harbor a degree of skepticism toward digitizing operations, Chinese companies recognize that they need to catch up in implementing digitization as their labor-cost advantage diminishes.

Overall, we found a correlation between the levers that companies applied and the potential for conversion cost reduction, with companies usually applying the levers that have a high impact on costs in their country. This explains why companies in specific countries or regions have different design preferences.

A Closer Look at the Potential to Enhance Competitiveness

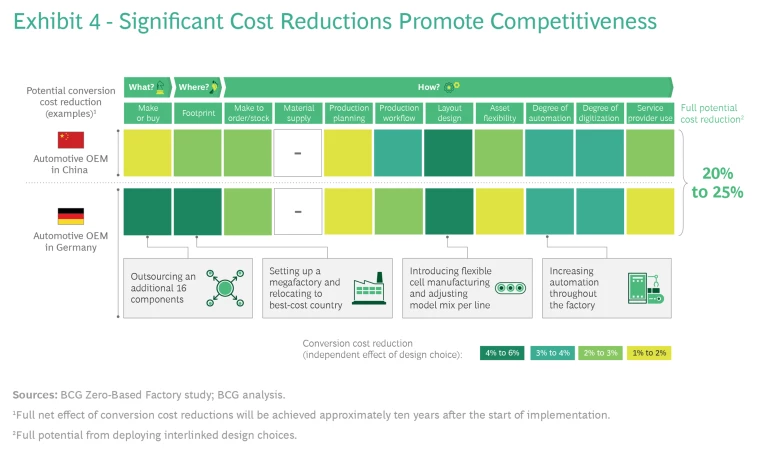

To examine the tradeoff decisions and cost-reduction potential associated with different design choices, we applied our zero-based model to automotive OEMs based in Germany and China. We conducted the modeling for a midsize manufacturer with an existing factory network and a broad product portfolio. Our base case assumes that the company’s operations already incorporate an advanced level of optimization. In the following discussion, we focus on our findings for the OEM based in Germany.

Make or Buy. In our model’s base case, a standard car’s bill of material has approximately 73 components. The company buys about 70% of these from external suppliers. Our zero-based modeling indicates that the German OEM could achieve cost advantages by shifting 16 components from in-house production to external manufacturers. The reduction in conversion cost could amount to 4% to 6% of the total manufacturing cost of a car.

Footprint. The German automotive OEM that we assessed in our model has a decentralized network of multiple smaller factories located across several high-cost countries. In a zero-based approach, a company would locate a megafactory in a best-cost country to reduce costs through economies of scale and lower labor costs. In our example, the company could reduce the percentage of indirect employees in its workforce while increasing the number of produced cars. But a company also needs to consider whether shifting to centralization or best-cost countries would increase customs and logistics costs. After taking into account these factors, the model found that a zero-based approach could reduce conversion costs by a total of 4% to 6%.

Make to Order or Make to Stock. Two demand-management approaches are common in the automotive industry: make to order, for customized cars (entailing longer delivery times); and make to stock, for standardized cars (with short delivery times). In our model’s base case, a partial shift from a make to order to make to stock reduces costs while maintaining the required strategic flexibility. Applying a zero-based approach, the company could adopt a make-to-stock approach to produce cars with limited customization and high demand while using a make-to-order approach to manufacture cars with high customization and variable demand. This adaptation, for which strategic alignment with the sales function is a prerequisite, leads to a conversion cost reduction of 2% to 3%.

A company needs to consider whether a shift to centralization or best-cost countries would lead to higher customs and logistics costs.

Production Planning. In our model’s base case, the automotive OEM accepts lower utilization of machinery in order to achieve short lead time. Although a zero-based approach can reduce costs by shifting to high utilization with longer lead time, this may not align with a company’s strategy. Another option for increasing utilization of machinery is to use enhanced sequencing by means of empirical data, simulations, and machine-learning tools to achieve short lead time with medium utilization. Our model found that this approach could reduce total conversion costs by 1% to 2%.

Production Workflow. In the automotive industry, production workflow decisions focus on the tradeoff between in-line focused assembly and near-line preassembly. In-line focused assembly leads to a longer manufacturing line, with stations closely linked and only a short buffer between segments of stations. This setup increases the risk that a stoppage at one station in one segment will force the entire line to stop. Near-line preassembly allows for a shorter manufacturing line, a slight decoupling of the main line and the preassembly line, and an increased buffer between the two lines. These attributes reduce the risk of a full line stoppage.

In our base case, the automotive OEM uses a hybrid approach that combines in-line assembly with some near-line preassembly. In a zero-based approach, a manufacturer would apply near-line preassembly to a greater number of components. By better balancing takts across multiple activities and increasing the use of automation, the company can reduce costs. Moreover, decoupling preassembly from the main line makes greater automation possible because brief machinery breakdowns will not cause stoppage of the main line. Our model calculated conversion cost reductions totaling 2% to 3% from this approach.

Layout Design. In taking a zero-based approach, automakers must figure out where and to what extent flexible cell manufacturing to reduce costs in final assembly is beneficial within a plant. For example, flexible-cell production in final assembly increases worker utilization and reduces idle time. Preassembly work—such as for doors—can reduce costs related to subsequent assembly on the main line as well.

Automakers also need to decide how many different models to produce on each assembly line or in each plant, considering the tradeoffs of assembling one versus multiple models. The company’s specific manufacturing requirements should drive this decision. Some OEMs build multiple models per line in order to gain the flexibility to react quickly to changes in demand. In our model’s base case, the OEM produces at least two vehicle models per line and multiple models in each plant.

In our zero-based modeling, the company would partially convert final assembly to flexible-cell manufacturing in order to reduce labor and machinery costs. It would achieve additional savings by shifting manufacturing lines within the plant to one-vehicle specialization and one entire factory to one-vehicle specialization. Our model found these three changes, in combination, could reduce conversion costs by a total of 4% to 6%.

Degree of Automation. Automotive OEMs apply a different degree of automation in each area of the factory (press shop, body shop, paint shop, and final assembly). In our base case, the OEM uses a medium degree of automation in the press shop and a low degree in final assembly. In a zero-based factory, greater automation in the press shop and final assembly would reduce labor costs, although machinery costs would increase slightly. For example, in the press shop, robotics could be used to take finished parts off the line and sort them into carrier trays. In final assembly, collaborative robotics could assist with underbody bolting and windscreen installation, among other operations. Our model found that such changes could reduce conversion costs by a total of 3% to 4%.

Summing Up the Potential Cost Reductions

Exhibit 4 summarizes potential conversion cost reductions for automotive OEMs based in Germany and China. Each design choice can reduce conversion costs by 1% to 6%. In combination, the design choices can drive extraordinarily high conversion cost reductions, totaling 20% to 25%.

Starting points help to explain regional variations. German automotive OEMs can significantly reduce costs through make-or-buy and footprint decisions as they seek to lower their labor costs and get closer to customers in foreign markets. Chinese automotive OEMs can achieve cost reductions through enhanced automation and digitization, which would give them additional opportunities to optimize factory operations. Although applying a zero-based approach could yield similar cost reductions for German and Chinese automotive OEMs, these companies need to apply different levers for each design choice to account for their starting points.

Getting Started

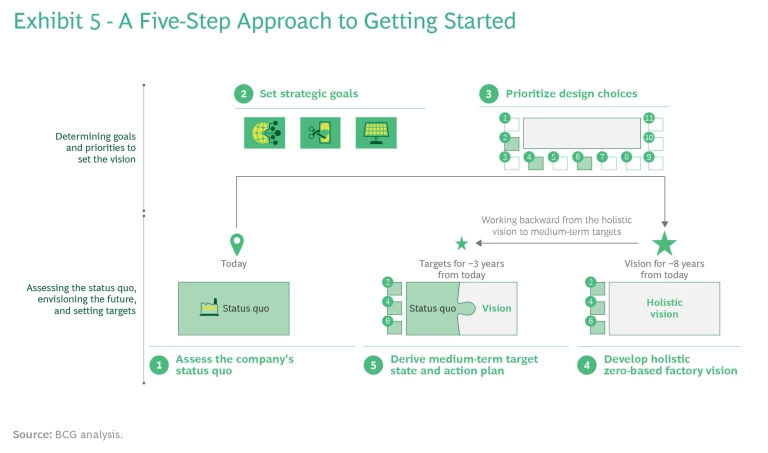

Implementing a zero-based factory begins with taking a clean-sheet approach to designing a holistic vision of optimal operations. A company can then identify the potential for improvement on each design choice relative to the existing network and determine how to close the gap between its legacy operations and the zero-based vision. The process entails five main steps (see Exhibit 5):

- Assess the company’s status quo. Understanding the industry conditions and the operational environment provides the basis for pursuing transformative change.

- Set strategic goals. The company must settle on its strategic goals after weighing value, resilience, and sustainability. Pursuing each objective entails making tradeoffs that require careful consideration.

- Prioritize design choices. The boundary conditions established in steps 1 and 2 allow the company to create a prioritized list of design choices. The company must then determine the right tradeoff for each prioritized choice.

- Develop a holistic zero-based vision. Applying the prioritized design choices and associated tradeoffs will enable the company to derive a holistic vision for achieving its overall goal of a zero-based factory. The time frame for realizing this vision is approximately eight years.

- Derive a medium-term target state and a specific action plan. By comparing its holistic vision with the status quo, the company can determine the actions it needs to take in order to realize the vision. It can then develop a roadmap for implementing a zero-based factory, identifying the medium-term target state for approximately three years from today and specifying an action plan for achieving it.

Manufacturers cannot expect to achieve their objectives for value, resilience, and sustainability by incrementally improving their operations. Effectively addressing multiple prioritized objectives requires a zero-based approach across the full spectrum of design choices in factory operations. As the base case in our modeling demonstrates, even companies—such as automotive OEMs based in Germany—whose operations are already well designed have important opportunities to optimize further. To capture these opportunities, each company needs to develop a detailed understanding of the most influential industry and operating-environment factors and the ability to assess tradeoffs among design choices. Companies that successfully deploy the zero-based approach will be rewarded with improvements that enhance their competitiveness in the years ahead.