One insurance firm models its property and casualty exposure using digital twin and virtual reality (VR) technologies. Another invites clients to use augmented reality (AR) goggles to examine a commercial property and suggest repair options. Some firms use blockchain records to process claims and detect fraud, while others deploy the technology to offer customized insurance products.

These are all real-world examples of insurance companies shaping their future and that of their industry by embracing metaverse technologies (VR and AR) and blockchain technology. As the digital landscape continues to evolve at a fast rate, many insurers are strategically positioned to embrace the transformative potential of these technologies.

Six Strategic Opportunities

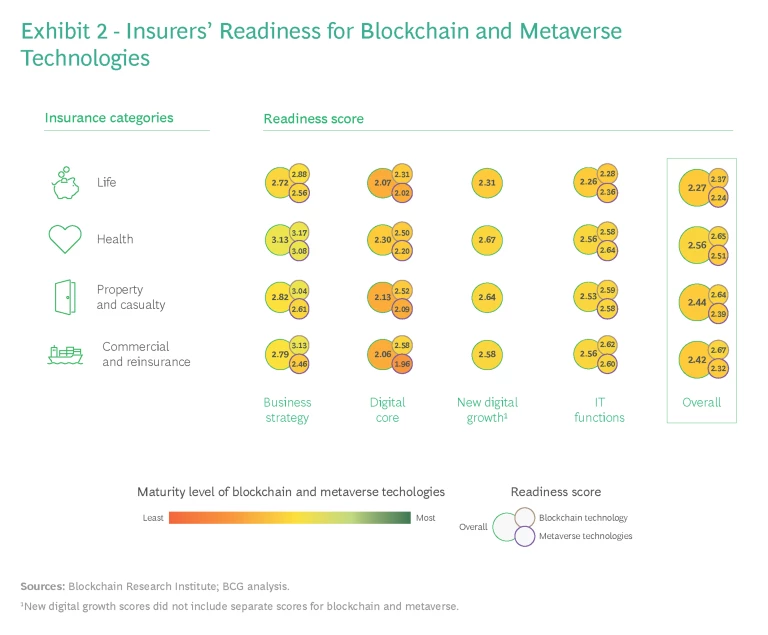

To assess the insurance industry’s level of readiness for metaverse and blockchain technologies, BCG evaluated leading companies worldwide on 43 relevant dimensions and found that for most insurers, adoption is feasible. The assessment also found some willingness to adopt these technologies in every line of business.

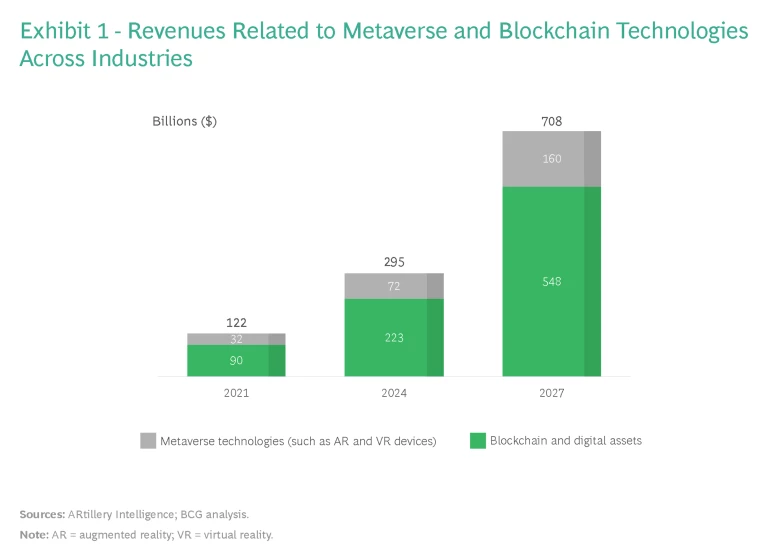

Insurers have reason to be intrigued because these technologies are expected to boost revenues. For example, blockchain technology-related revenues for the insurance industry are expected to rise from their 2022 level of $425 million to about $37 billion by 2030. This represents revenue growth of 70% per year. BCG’s analysis found that 60% of insurance companies are already investing in blockchain, and 80% of their C-suite executives believe that blockchain can enable efficiencies. The increase in revenues is expected to develop within the broader context of a $708 billion revenue gain across all industries and regions from metaverse and blockchain technologies. (See Exhibit 1.)

The many use cases for metaverse and blockchain technologies fall into six broad strategic opportunities that can unlock substantial business value.

Creating New Revenue Streams. Implementing blockchain technology, including smart contracts, provides insurers with opportunities to expand their revenue streams. Firms can underwrite policies that insure digital assets, such as nonfungible tokens, cryptocurrency investments, and cryptocurrency keys. Firms can also commercialize the assessment tools used to underwrite emerging risks.

Smart contracts—programs stored in a blockchain that run when certain conditions are met and that keep a verified record of all related transactions—can particularly help insurers expand their product portfolio. Firms can use smart contracts to create new types of policies that can be activated and deactivated on demand. Specialized underwriters can pool their knowledge to write multiparty insurance policies—each underwriting the risks with which they feel comfortable—and use smart contracts to manage the complexity. And carriers can use smart contracts to offer inexpensive contingency-based insurance for many small risks that would otherwise be difficult to insure. For example, companies could cover short-term work engagements for freelancers, one-time events for commercial venues, seasonal residential rentals for homeowners, and transactions by drivers working with ride-sharing services.

Insurers can also create new revenue streams by developing offerings to address risks related to metaverse technologies. For example, virtual-asset policies can insure against risks such as cyber attacks and data loses, which are inherent to virtual environments.

Firms that experiment will gain a reputation for digital innovation that, in turn, can provide an opportunity to cross-sell more traditional products. Technologically advanced customers who purchase a digital asset policy, for example, are likely to look to the same insurer for traditional types of coverage.

Expanding Customer Engagement and Market Reach. Customer engagement is critically important across the insurance industry. By employing metaverse technologies, insurers can open metaverse channels—or shared VR environments—thereby increasing the number of ways to reach customers and providing more touch points for interactions. (See the sidebar “Understanding the Metaverse.”) Metaverse channels also attract younger, technologically savvy consumers, such as those in Generation Z and those who are gamers. These consumers may not purchase many forms of traditional insurance, but they are still exposed to risks, and insurance can offer them protection. Marketing on metaverse channels by sponsoring e-sports events or by advertising at virtual concerts can help establish brand awareness among these elusive cohorts.

Understanding the Metaverse

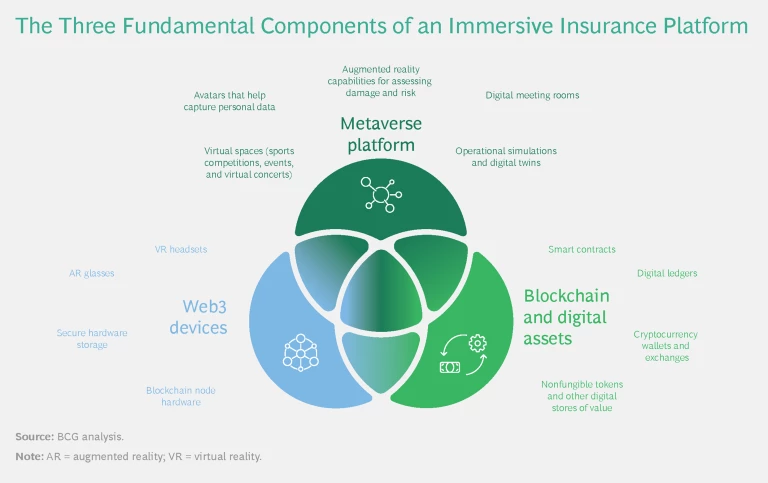

Metaverse platforms enable virtual reality (VR), augmented reality (AR), and extended reality (XR) digital experiences. VR presents a completely simulated environment, typically accessed using a headset. AR enhances users’ perception of the real world by superimposing a layer of digital information (such as sensor readings, instructions, or diagrams) on the physical environment. Users typically don goggles or glasses to experience AR. XR refers to more elaborate combinations of the physical and virtual worlds using VR and AR.

Blockchain is the distributed digital ledger technology used to secure virtual transactions. Blockchain systems build trust by systematizing verification. They automatically track every purchase, sale, or event in a chain of transactions and confirm the validity of participants even when they are anonymous. This process enables transparent operations without an authority to oversee the chain and, thus, reduces concerns about favoritism or fraud within the chain.

In addition, blockchain systems can improve efficiency and reduce costs. By implementing smart contracts—programs that are built into a blockchain and that run when certain conditions are met and verified—companies can automate manual tasks, such as releasing a payment after a delivery is made or enabling data to be shared only when it is needed.

Web3 devices are smart gadgets that support AR, VR, and XR technologies. These devices include headsets, eyeglasses, secure hardware storage, and blockchain node hardware.

It has taken until now for these three components to be ready. Insurers should consider using them to develop an immersive platform for internal and external purposes. For example, insurers could use digital ledgers to tokenize insurance policies. Sales representatives could use VR to help customers understand complex data and issues relating to risk factors and claims.

Several major technology players will be providing Web3 native wallets and related infrastructure. These may be available to use as a basis to store and sell digital representations of insurance policies. The OpenXR standard, released in 2019 by an open-source consortium, enables interoperability among a wide variety of AR, VR, and XR applications. This interoperability reduces development costs and eases the marketing of metaverse platforms.

Younger millennials and Generation Z have adopted digital habits enthusiastically. They tend to prefer virtual meetings over face-to-face encounters in their everyday interactions. Interestingly, concerns about data privacy and identity are also contributing to the growth of the metaverse. Regulators are promoting the use of sovereign identities to preserve data privacy, and tech providers increasingly use data ownership to distinguish themselves. Insurance firms, which work with highly sensitive information, are naturally positioned to market in this space.

Perhaps most important is the technological augmentation of market reach. Metaverse channels enable fully traceable leads, storing prospects’ personal data in the blockchain and, thereby, establishing lifelong connections.

Improving Underwriting and Claims Processes. Insurers can use blockchain and metaverse technologies to improve some underwriting and claims processes. In doing so, companies can improve the reliability of customer data, reducing existing loss ratios and decreasing the risk profile of the entire portfolio.

By implementing blockchain, an insurer can access the end-to-end record of an insured object’s life cycle, enabling more accurate underwriting and preventing fraud. An insurer can not only store the current value of the insured object but also trace back its provenance, seeing the object’s value whenever it was bought and sold. The insurer will also be able to see its value at the time of all subsequent transactions.

Full access to an object’s life cycle accelerates the processes involved with underwriting transactions.

Full access to an object’s life cycle also accelerates the processes involved with underwriting transactions and reduces the time and effort involved in client interaction. The result is a win-win for insurers and clients. They can exchange reliable data that’s complete, enabling a more accurate assessment of the risks and a more mutually acceptable pricing arrangement.

Some firms can use AR technology to improve claims processes. For example, property and casualty insurers can encourage customers to assess damage using an AR app on their smartphone. Then, guided by a remote claims adjuster, customers can simulate the effects of various types of repairs to mitigate or prevent future damage. In addition, underwriters and claims adjusters can use the data collected by the customer’s AR app to assess the company's risk more effectively.

A firm can also use VR technology to create a digital twin of an incident and test the outcomes of various risk scenarios. For example, flood damage to a building can make adjacent property and casualty policies riskier. Liabilities related to an earthquake or a hurricane can expand beyond the real estate that is damaged. A digital twin simulation can help a firm create a risk model for a vulnerable neighborhood or region and can also help clarify the likely effect of preventative interventions.

Boosting Efficiency, Detecting Fraud, and Reducing Costs. Metaverse technologies can help solve several operational challenges endemic in the insurance industry. For example, AR and VR technologies can assist with claims investigations by using simulations of a physical environment. When used in combination with digital twin technology, AR and VR can help underwriters and investigators explore possible risks that may not otherwise be obvious and then articulate multiple scenarios for the outcomes of different claim settlement solutions.

Blockchain systems can help detect fraud by assessing data reliability, thereby avoiding settlement costs for false claims. The systems can also reduce the costs associated with high-volume, low-value claims by making it easier to manage them. Additionally, the automated ledger and tracking inherent in blockchain systems can streamline operational inefficiencies and reduce delays in settling claims. The latter two benefits are possible given the immutability of a blockchain ledger and blockchain’s capability to monitor policyholders’ digital identities using digital identity wallets.

Insurance firms are experimenting with more-comprehensive automated claims-processing systems in which these features are combined so that little or no human intervention is required, potentially reducing the need for claims handlers. Firms are also evaluating blockchain-based smart contracts to automatically check terms against reliable external pools of data (for example, data on airline flight delays, weather conditions, or health care assessments). Together, these innovations can add up to a relatively seamless process, leading to rapid settlements and lower costs.

There are some challenges involved in implementing such solutions. Automated systems’ rules—the parameters that determine which factors trigger a change, what evidence is needed for a transaction, and which settlements are approved—may have to be codified on short notice. It’s not always clear which decisions to automate first. There may be difficulty integrating the metaverse technologies with legacy policies and practices. If cryptocurrencies are involved, then their exchange with fiat currencies must be managed. Finally, there may be challenges related to the reliability of external data sources. However, the outcomes—higher efficiency, reduced fraud, and lower costs, as well as an improved customer experience—make the transition to metaverse and blockchain technologies worthwhile.

Establishing Trustworthy Ecosystems. Insurers have always depended on a robust business ecosystem that includes a network of brokers, third-party specialists, and reinsurance firms. Now, blockchain provides a trustworthy layer of connectivity that can strengthen the trust of business ecosystems.

Blockchain can provide a single trustworthy source of truth for data shared among companies in an ecosystem.

Blockchain can provide a single trustworthy source of truth for data shared among companies in an ecosystem. It can trace changes in shared data, confirm them, and reconcile duplicated data in separate data pools instantaneously. Specific blockchain applications include verification systems (such as shared know-your-customer identification systems), the portability of customer data to the point of sale or contact, and the detection of fraud in the first notice of loss.

Trustworthy ecosystems will be increasingly essential as governments expand their regulation of data sharing and blockchain-based financial services. Firms with a good track record of managing data with integrity will be better equipped to address regulatory challenges related to the privacy of personal data, reducing the risk of noncompliance with broad regulatory requirements, such as the European Union’s General Data Protection Regulation. Trustworthy ecosystems will also be needed to help address the fraudulent use of financial data.

When data is shared, privacy must be guaranteed. In a decentralized ecosystem, there are two possible roles for an insurance firm: a data issuer or a data verifier. No one firm has a full view, by itself, of all the activity of its customers. Firms must thus share relevant data related to transactions and milestones (such as explicit consent and the issuance, deletion, or revocation of a policy) and business-related metrics (such as customer satisfaction scores). The data is collected and verified automatically and exchanged in a mutually transparent way—among firms and, ideally, with customers and regulators as well—through dashboards and other forms of communication. By using blockchain technologies, firms can build shared platforms and guarantee the integrity of their data more easily and effectively.

Enabling Digital Ways of Working. Insurance firms can use metaverse technologies to enable new forms of collaboration and interaction. For example, on-the-scene inspectors can show underwriters at headquarters the condition of a property in real time. However, companies could also use these technologies to help address a lack of standardization in workforce skills, such as underwriting, and to provide more effective, convenient, and inexpensive training.

For example, traditionally, on-the-job training has been conducted at individual offices. However, using metaverse technologies, employees throughout a corporate ecosystem could meet in metaverse-based learning and development environments to gain more advanced skills and learn from experts who are based around the country or the world.

Embracing metaverse technologies has several benefits. Working remotely with colleagues improves employee satisfaction and talent retention. Remote training can help employees acquire technical and managerial skills they could not otherwise learn. Learning how to use metaverse technologies can enable managers and staff to improve ways of working. And simulating client interactions and using virtual experiences can help train employees who are on the frontlines.

Insurers Are Ready

BCG’s analysis of insurance companies worldwide found that their maturity levels of blockchain and metaverse technologies, as well as their overall readiness to adopt blockchain and metaverse technologies, are at the right levels to start driving the change associated with these technologies. Blockchain is likely to become a positive disruptor in the short term because insurers expect it to increase revenues and reduce costs. Some use cases are already gaining traction. Metaverse technologies will drive change in the middle term as firms use them to boost revenues and expand capabilities.

Some critical functions are ahead of the curve. In many insurers, HR, including the learning and development function, has set up innovation labs to experiment with blockchain and metaverse technologies. Operations functions are also willing to accelerate investment in these technologies because improved efficiency and lower costs are seen as sources of competitive advantage. Some leading-edge firms with high levels of digital maturity have built specialized squads to lead the change.

Meanwhile, businesses across industries increasingly recognize the potential benefits of blockchain and metaverse technologies. Companies have identified use cases and are starting to implement them. It is thus imperative for insurance IT functions, led by chief information officers and chief technology officers, to proactively prepare for the integration of these technologies. To meet customer demands effectively, insurers must begin exploring proof-of-concept initiatives and targeted testing.

Insurance categories vary in their readiness to adopt blockchain and metaverse technologies. (See Exhibit 2.) Health insurance has the highest overall readiness score. These insurers have a strong interest in reducing costs and using blockchain for third-party settlements and payment-reconciliation management.

Many property and casualty players are considering these technologies, in part because of their digital maturity. The higher frequency of customer interactions in this category also positions these firms to experiment with blockchain. Unlike health care carriers, relatively few companies in this category have digitized the core.

Life insurance, commercial, and reinsurance firms tend to be more skeptical. Life insurance players prioritize more conventional, structural IT investments first. Although some are using blockchain and metaverse technologies to capture new business, fear of changing regulation and comfortable market positions tend to moderate their investments.

Commercial and reinsurance carriers have expressed little interest in adopting blockchain. However, these lines of business may find the technology more valuable as it matures and the business ecosystem becomes more difficult and competitive.

Taking the Next Steps

Insurers have an opportunity to embrace these technologies profitably. A company can start by picking one or two crucial use cases that meet its distinct market profile. For each use case, the insurer should develop a proof of concept. After demonstrating that a use case will create business value, the firm should launch a minimum viable product: an offering that is designed to quickly generate savings and revenues and that can be scaled rapidly when it succeeds.

Because there is already momentum and maturity in this industry, the resources and expertise exist to move forward. The elements that a company needs most are a strategy and persistence: a company must know where to start and remain steadfast in its effort. For most insurers, the six strategic opportunities provide ample reason to start. Firms may be surprised to find that they already have many of the capabilities that they need and can rapidly gain the rest.