Consumer health (CH) is entering a new era of strategic significance. Demographic shifts are expanding the over-50 population globally. Consumers are becoming more proactive about wellness. And as public health care systems strain under pressure, many are turning to CH companies for accessible, self-directed care. Together, these forces position CH favorably. The segment offers stable demand, attractive margins, and long‑term upside—at a time when growth is increasingly scarce across CPG overall.

M&A is a popular entry point into CH, enabling companies to gain scale more rapidly given regulatory requirements and long development cycles. But capturing that potential requires a different formula. Scale matters in CH, but not in the same way that it does in CPG. Success depends on a sharper grasp of nuanced and often local category dynamics, regulatory constraints, and translating scientific credentials into consumer positioning. Companies can falter if they lean too heavily on conventional CPG playbooks in what is a fundamentally different landscape.

This article offers a practical guide for investors and business leaders. It unpacks the unique scale logic of the CH segment, lays out distinct M&A archetypes, and outlines five actions that experienced acquirers use to turn deals into long-term growth.

Stay ahead with BCG insights on the consumer products industry

Consumer Health Is in Play

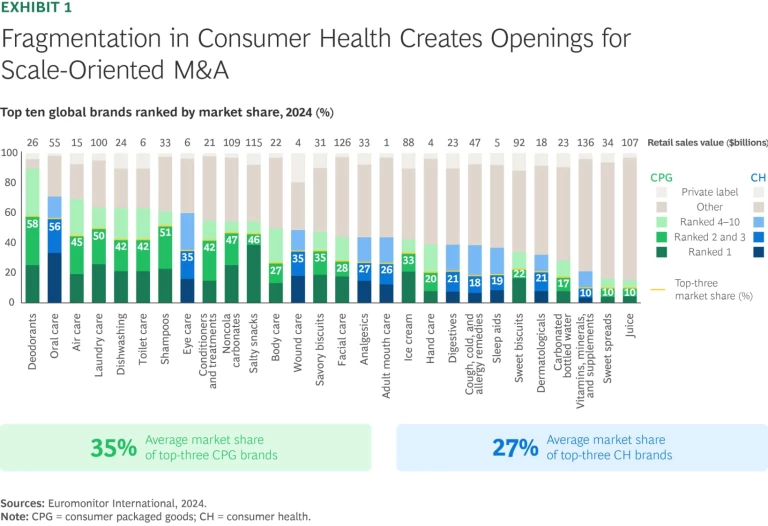

The CH segment is drawing heightened interest—and for good reason. Demand is growing, and the segment is more insulated from price pressure while remaining fragmented on a global basis. In contrast to more consolidated CPG categories such as deodorants or laundry care, the top three players in major CH categories hold just 27% market share, on average. (See Exhibit 1.)

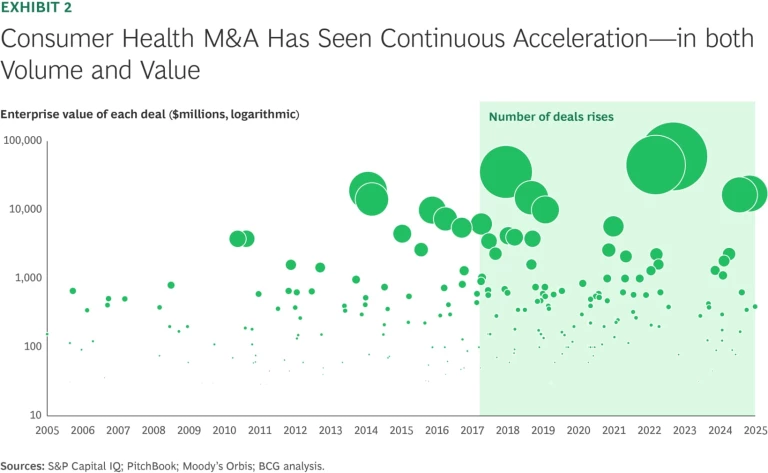

That fragmentation is fueling high levels of M&A. Deal activity has grown steadily over the past two decades, with a noticeable uptick in both the number of deals and enterprise value since 2018, partly driven by some of the largest CH assets becoming independent in recent years. (See Exhibit 2.) An array of actors, including multinationals, private equity (PE) funds, and regional players, are vying for leadership positions across CH subsegments. But the segment’s attractiveness means many owners are reluctant to exit, limiting the pool of available targets at any given time.

That competition is unfolding across a highly diverse landscape. At one end of the spectrum are over-the-counter (OTC) and infant nutrition products: highly regulated, stable demand, and built on scientific credibility and health care professional (HCP) trust. At the other end are consumer-driven categories such as vitamins, minerals, and supplements (VMS) and sports nutrition, both of which are less regulated, highly dynamic, and driven by innovation, marketing, and rapid adoption. In between are hybrid categories such as oral care and weight management that combine moderate regulatory oversight with opportunities for consumer-led differentiation. These structural differences shape value creation and the basis of competition.

Many CH assets remain underleveraged, particularly those divested from pharma owners that prioritized scientific rigor over brand strategy, consumer-led innovation, packaging, and go-to-market execution. These gaps present an opportunity for buyers with a strong consumer lens to unlock meaningful growth, provided they tailor their playbook to the segment’s distinct scaling dynamics.

Scale Has Its Own Rules

In CH, scale still matters—but the value levers, thresholds, and path to advantage follow a distinct logic that differs from broader consumer categories.

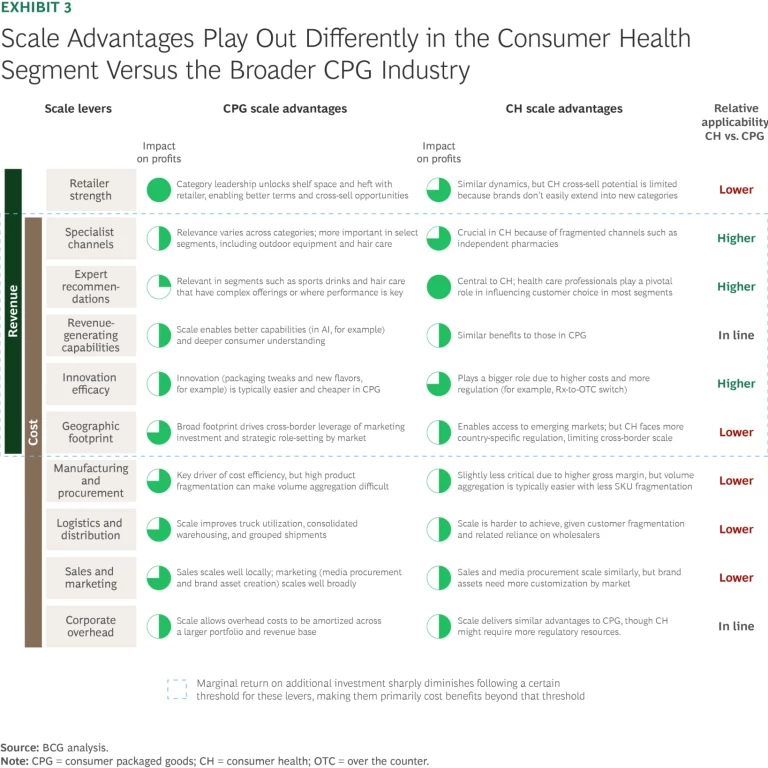

Dynamics That Shape Scale Advantage. Within CPG, CH has a fundamentally different margin structure from most other segments. It’s less dependent on scale for cost advantage but far more reliant on it to unlock crucial revenue drivers. (See Exhibit 3.) To win in CH, companies must use scale to get in, get trusted, and get returns on innovation. Three dynamics in particular reshape the scale equation:

- Specialist Channels. CH distribution often depends on fragmented, hard-to-access outlets such as independent pharmacies in addition to modern retail. In most European markets, these account for more than 50% of category sales. Go-to-market dynamics vary widely by country and require tailored strategies involving field reps, sampling, and shelf presence. Scale becomes critical to make these economics work. This stands in contrast to other CPG segments, where more consolidated modern retail channels typically drive a larger share of sales—except in niche categories such as outdoor gear.

- Expert Recommendations. Scale is what enables sustained engagement with HCPs, a critical lever in building consumer trust in CH. Leading companies invest deeply to earn that trust through global sponsorships (such as Haleon’s support of the FDI World Dental Federation) and targeted partnerships (such as Nutrafol’s work with trichologists and dermatologists). While expert endorsements can matter in select CPG segments where health, safety, or performance is paramount (such as hair stylists recommending hair products), in CH, they are essential.

- Innovation Efficacy. Innovation in CH is often more complex, regulated, and expensive than in most CPG segments. Rx-to-OTC switches, for example, typically require multiyear clinical studies and regulatory filings. Scale is essential to absorb these costs and commercialize effectively. Perrigo, for instance, drew on its broad production and distribution network to launch Opill—a daily oral contraceptive—across the US within a year of the US Federal Drug Administration’s approval, helping offset an eight-year development timeline that included multiple label comprehension studies and an actual use trial.

A Tiered Approach to Scale. Scale in CH is not linear. Each tier unlocks distinct value depending on a company’s category leadership and geographic footprint. These benefits compound when companies achieve a certain scale threshold, as leaders leverage their investment and realize greater cost efficiencies.

- Local In-Category Leadership. This is where a CH company’s scale starts—and where many of its unique advantages show up. Category leadership strengthens pricing power, shelf access, and relationships with pharmacists or health care professionals. For example, a leading cough and cold brand can more readily gain pharmacist endorsements and drive repeat purchases, securing priority shelf space others can’t buy.

- Local Scale. Operating across multiple CH categories in a single market creates both revenue and cost advantages. Companies can consolidate logistics, share R&D and regulatory resources, and negotiate stronger retailer terms. But the real advantage comes from sales density. With enough density, companies can justify deeper investment in expert recommendations, specialist channels, and step-change innovation. A company with strong positions in immunity, sleep, and gut health, for example, can cross-sell to the same store buyers and streamline sales operations and logistics.

- Global In-Category Leadership. Owning a category across borders creates new growth levers. Companies can invest in innovation at scale. And cost advantages emerge via harmonized marketing, global media procurement, partnerships with global HCP organizations, and centralized production. For example, a company leading in topicals could share clinical evidence across markets, consolidate production into one facility, and fast-track a new format through coordinated regulatory filings.

- Global Pan-Category Scale. This is the most complex tier—but it offers broad strategic benefits. Cross-category, cross-market leadership enables portfolio plays and sustains larger R&D bets, Rx-to-OTC switches, and market expansion. Cost synergies—especially in procurement and production—multiply when combining operations for the same dosage formats (such as tablets within tablets and injectables within injectables).

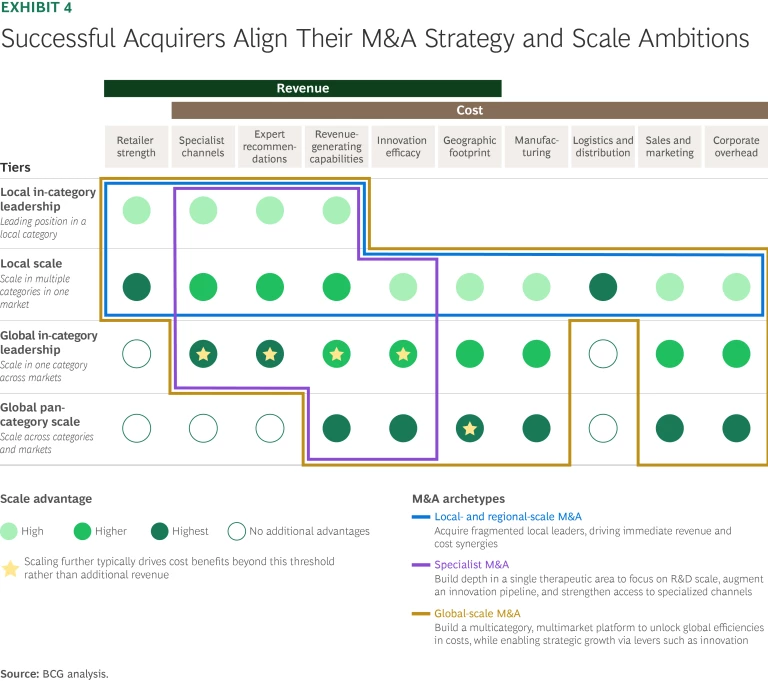

Aligning Scale Ambition with M&A Strategy. The most successful CH acquirers tailor their M&A approach to the specific scale benefits they’re targeting—and to the broader strategic focus of their CH business. Choosing the right strategic archetype and committing to it helps sharpen target selection and integration priorities. (See Exhibit 4.)

- Local- and Regional-Scale M&A. This strategy focuses on building national or regional platforms by acquiring trusted local brands. Strong in-market leadership, consumer familiarity, and deep retail relationships drive value. This archetype is common for PE-owned platforms, regional CH players, and global CPG companies entering the category. Stada Arzneimittel and Karo Healthcare exemplify this approach, having scaled through serial acquisitions of country-level CH leaders.

- Specialist M&A. This approach builds depth in a single therapeutic area—such as women’s health or eye care—often across markets and beyond CH alone. The payoff: accelerated innovation and clear category leadership, with synergies across the complete value chain. Acquirers include focused PE funds, pharma, and medtech players. Targets typically have defensible IP, differentiated products, a presence in adjacent verticals, or HCP trust. Examples include Alcon in eye care and Theramex in women’s health.

- Global-Scale M&A. These are at-scale deals—typically between CH or CPG players that already operate across categories in multiple countries. These deals aim to increase density in the combined sales footprint, strengthen average in-category leadership (for example, by boosting a market position from four or five to number one or two), and unlock major cost synergies through shared R&D, manufacturing, procurement, and overheads. Ideal targets complement the acquirer’s footprint and minimize antitrust risk.

Each path comes with tradeoffs. Local and regional plays offer greater availability and simpler execution—but integration can be patchy. Specialist M&A brings focus and differentiation, but opportunities are often limited to certain categories. Global-scale deals offer the greatest leverage but face constraints on capital, integration, and target availability.

Equally important is deciding where to play along the CH spectrum—from science-backed OTC to consumer-driven wellness segments such as VMS. This positioning shapes everything from target selection to postdeal integration priorities. Unilever, for example, has concentrated its M&A on VMS, building a more than $1 billion portfolio through acquisitions, including Liquid I.V. and Olly. Acquirers should also be willing to pursue revenue upside, even if that means trading off some cost synergies as brand permission and reach are scaled.

Close the Execution Gap

There are five actions unique to CH M&A that critically impact integration success.

Unlock value through consumer-centric thinking. Many CH assets originate from pharma, where commercial strategies center on science. Reframing these businesses through a CPG lens that is grounded in brand building, consumer insight, and demand-led innovation can spark stronger engagement and growth. Acquirers should use data to tailor messaging to emotional and functional needs, adapt formulations by segment, and pair CPG marketers with CH teams to embed a brand-first mindset.

Reckitt offers a strong example. After acquiring Mucinex, it launched bold, consumer-facing campaigns (including the mr. mucus mascot and TikTok activations) and expanded the product line to include tablets, liquids, and gels, as well as more powerful formulas such Fast-Max.

Protect—and build on—what makes the brand work. In CH, brand success often hinges on factors that don’t always fit a standardized integration formula, such as maintaining trust with HCPs or choosing the right operating model. Leaders must identify these value drivers early and plan around them.

Stada’s 2023 acquisition of several local Sanofi brands illustrates this approach. Rather than impose a global model, Stada preserved local autonomy and prioritized country-specific strategies, consistent with its local-hero brand philosophy.

Strong acquirers embed this thinking into day one planning, mapping where local control is essential, where scale can help, and how to engage specialist stakeholders to signal continuity and commitment under new ownership.

Manage regulatory execution with rigor. As part of a CH deal, companies face a substantial regulatory workload, particularly in global transactions. Large spinoffs have involved tens of thousands of market authorization transfers, while even a single brand sale may require hundreds, depending on regional reach and portfolio complexity. Packaging updates and continuous pharmacovigilance also add significant demands.

Leaders should engage regulatory experts early, anticipate country-specific timelines, and secure strong transition support with access to the seller’s filings, safety databases, and technical documentation. Continued access to clinical and manufacturing data is essential, as are strong governance, milestone tracking, and escalation protocols.

Safeguard supply continuity during integration. In CH, supply chain integration carries greater consequences than in broader CPG. Disruptions, whether from tech transfers, packaging delays, or regulatory missteps, can trigger stockouts and brand erosion, which can take years to recover from.

To avoid such pitfalls, leaders must plan compliant tech transfers, monitor critical knowledge handoffs, and manage packaging updates from the outset. Before consolidating the supply footprint, they should conduct site-by-site feasibility and regulatory impact assessments to avoid costly reapprovals, remediations, or delays.

Retain R&D talent to safeguard innovation. Innovation cycles are typically longer than in the broader CPG industry, making talent retention essential. Continuity postdeal keeps in-progress projects on track and preserves hard-to-transfer institutional knowledge—especially in vertical acquisitions, where expertise and pipelines underpin deal value.

When Colgate-Palmolive acquired Hello Products, founder Craig Dubitsky made full-team retention a deal-breaker. With its people secure, innovation both within oral care and beyond accelerated, now backed by Colgate’s global R&D and supply chain muscle.

Effective acquirers protect this talent by implementing targeted retention plans and establishing clear roles and strategic priorities that reduce attrition risk.

Traditional CPG playbooks don’t translate neatly to a segment shaped by scientific credibility, regulatory rigor, and diverse go-to-market models. Winning in CH M&A requires clear choices on where to play—across markets, categories, and archetypes—and disciplined execution in a landscape where integration spans everything from market authorizations to R&D continuity. The potential is enormous. But capturing it will depend on adapting fast to the logic of this space.

The authors thank Priya Mehta and Jonathan Yap for their contributions.