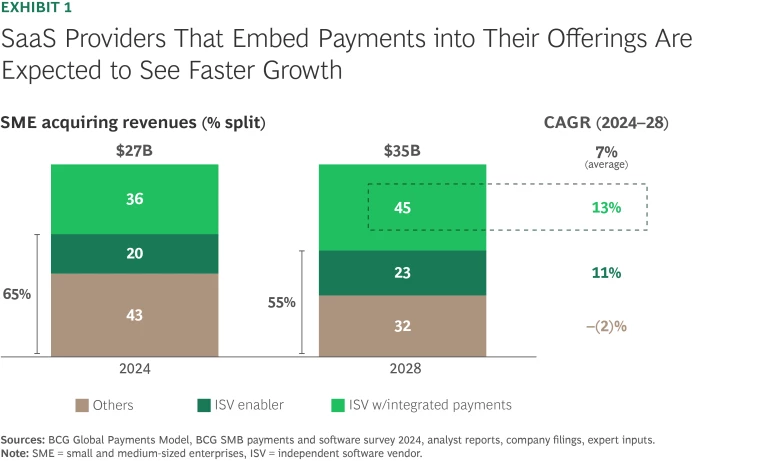

In recent years, the trend of embedding payments in verticalized SaaS products has become commonplace, with more than half of relevant independent software vendors offering embedded payments in North America in 2025. Many small and medium enterprises (SMEs) are now accustomed to using payments integrated directly into their SaaS platforms, and scaled providers have become extremely adept at leveraging payments acceptance to create greater SME stickiness and add a powerful monetization lever. For context, SME adoption of vertical software reached 59% in the US in 2024, compared with 50% just two years earlier. And last year, SaaS providers offering integrated payments solutions accounted for 36% of SME acquiring revenues. By 2028, we expect they will expand their share to 45%. (See Exhibit 1.)

But while other embedded financial products—such as merchant cash advance, cards, and accounts—have expanded in recent years, most SMEs still look elsewhere for banking solutions. Given that vertical SaaS platforms have become the de facto “operating systems” for many SMEs, they have a right to play in a broader suite of SME financial services as well. Yet SaaS providers and supporting embedded finance platforms have much to do to turn this right to play into a right to win.

Stay ahead with BCG insights on financial institutions

Growth and Headwinds for the Embedded Finance Market

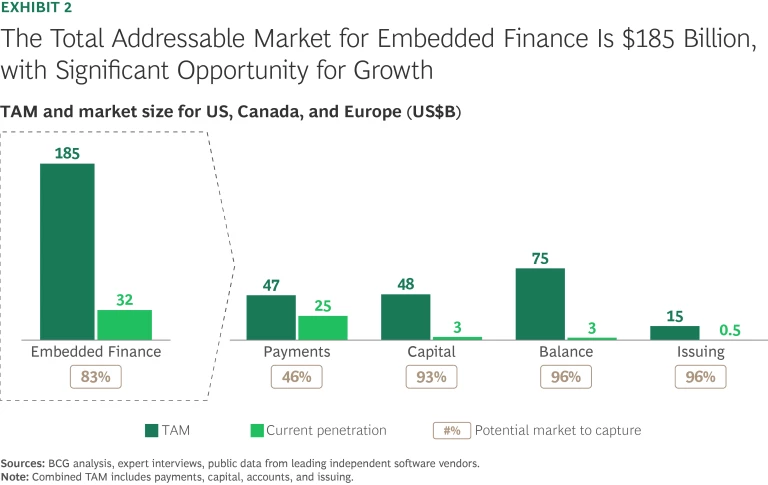

This article builds on research conducted last year by Adyen and BCG, which showed that more than 80% of the embedded finance market remains in play. In North America and Europe, we estimate the total addressable market (TAM) for embedded finance is about $185 billion across four core products—payments, capital solutions, accounts, and card issuing. That compares to current penetration of around $32 billion. Given the gap between TAM and current uptake, we see significant room for growth across both payments and nonpayments products. (See Exhibit 2.)

In a relatively nascent market, SaaS providers increasingly recognize the opportunity to extend their offerings beyond the payments silo. While the market opportunity is there, implementation is proving more difficult and time consuming than when they began to offer embedded payments. This is because SME’s relationships with their banks are far stickier than the relationship with their software providers. In addition, embedded finance offerings are more complex to underwrite than payments.

To be successful, SaaS vendors must pivot to strategies that enable them to offer a better holistic value proposition than commercial banks can offer. Three stand out as being especially compelling:

- Underwriting data. SaaS providers have access to real-time cashflow data allowing them to underwrite more thoughtfully and, given current product constructs and economics, they are well-positioned to cater to previously underserved SME niches—for example, the higher risk tolerance inherent in merchant cash advance products.

- Distribution channel. Vertical software is typically used on a daily basis by SMEs. This creates a highly efficient distribution channel to target customers in need of embedded finance products. SaaS providers can leverage this channel with contextual messaging and targeting strategies. While banks also have highly efficient distribution strategies via their online/mobile banking and branch networks, the immediacy and consistent use of SaaS platforms often creates deeper, more consistent engagement for SMEs—creating a powerful sandbox in which to offer embedded finance products (among other value-added services).

- Deep connectivity. SaaS providers have an inherent understanding of the nuances of the verticals they serve, making them uniquely positioned to offer value-added services (VAS) in parallel to enabling daily workflows. Many do this remarkably well across a range of VAS (such as marketing, payroll, scheduling, invoicing, and many others), creating a self-reinforcing financial ecosystem. This can and should be extended both to the marketing and product design of embedded finance products. One example would be to offer merchants the option to automatically move settlements into checking or savings accounts. While SMEs generally are well served by their banks, many FIs struggle to tailor their offerings to this level of nuance and deep digital UX integration—giving SaaS providers a structural advantage in tailoring products to specific vertical use cases.

Given the upsides, why has rollout of new embedded finance solutions to this market been so slow? In general—beyond payments and, in narrow use cases, merchant cash advance—it is because these products have not provided enough material value to SMEs versus their current banking services. Another factor inhibiting SME take-up of wider embedded finance solutions is that banking relationships are sticky, with broad, bundled product offerings that often curtail switching to a new provider. Many merchants are satisfied enough with their banking services to not incur the pain of making a switch. Finally, the product ecosystem of many embedded finance providers is less mature, limiting the data, distribution channels, and deep customer connection advantages.

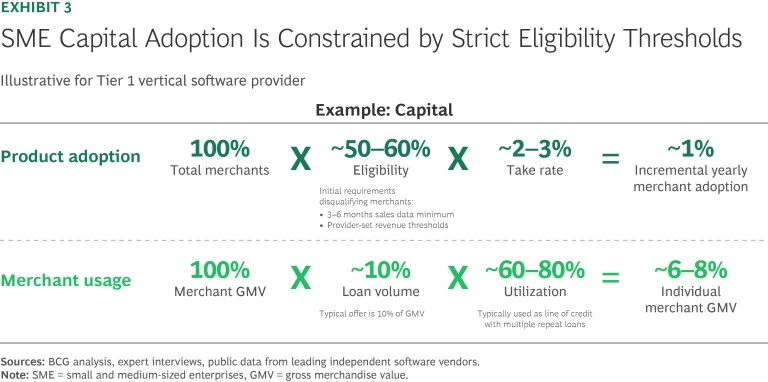

As a result, only a single-digit percentage of merchants consistently use software finance products such as cash advances. (See Exhibit 3.) Similarly, in the accounting space, the biggest draw for merchants is instant payouts from account receivables—a solution that is often tightly bundled with a checking account product.

The user experience for many embedded finance products presents another headwind for software vendors looking to scale their SME reach. While SaaS providers often do have the bandwidth to offer customized solutions, some of their products do not fully integrate with client businesses. Instead, many providers rely on pre-approved batches of offerings, such as cash advances from referral partnerships, across a few digital channels. This “spamming” approach naturally generates a low rate of uptake.

Finally, many SaaS vendors have found there is sufficient TAM in their core software and payments offerings for continued “guaranteed” growth that does not require the significant risk required to develop new embedded finance products. While penetration is rising, the software-plus-payments combination remains highly attractive, with a 2.5x lower attrition rate of embedded payments versus non-embedded. In addition, investments in sales and marketing functions to drive growth are seen by many investors in these vendors as a lower-risk approach compared to significant new product development.

The Future and How To Get There

In a growing market, SaaS providers have an opportunity to offer SMEs a deeper and more expansive embedded finance proposition. But in making the transition, the most successful firms will do more than expand their product ecosystems. They will also seek to elevate their contextual offerings to deliver a complete package for their clients. To unlock this vision, leading providers should focus on three key enablers.

Achieve the right product–market fit.

Product fit for embedded finance is all about anticipating and meeting SME needs through the business lifecycle—something that successful SaaS providers are well positioned to offer with their vertically tailored software solutions.

For example, a construction business in its early days will factor in seasonality to its borrowing decisions. In that scenario, a merchant cash advance may be best suited to its needs. As the business grows, it may require consumer-facing solutions such as point-of-sale financing for big ticket projects, alongside products such as commercial cards with sophisticated expense management tools for day-to-day spending. For payrolls and subcontractor payments, the company could need an instant payouts solution, alongside accounting products such as accounts receivable and payable reconciliations. As they scale, insurance would be appropriate to protect the business against risks such as project delays or equipment damage.

In making offers to SMEs, software providers should consider the specific verticals and consumer purchase pathways they are addressing. Armed with those insights—and the real-time data of their customers—they may, for example, judge that insurance is a better option than an extended warranty, or that buy-now-pay-later is better than an installment loan. The bottom line: tailored products offered with intent for specific use cases will encourage customer stickiness and boost monetization opportunities.

Go to market effectively.

Two key components of an effective go-to-market strategy that most software vendors have not cracked in embedded finance are bundling/pricing and targeted outreach.

First, a key piece of the go-to-market effort should address how SaaS providers bundle and price product sets. Banks have long been masters of product bundling and pricing. SaaS providers and their supporting embedded finance platforms must take a page from the banking book and think about offering holistic pricing and reinforcing value on their finance products. For example, having an embedded deposit account with a certain average balance could impact credit on a loan or cash advance.

Second, SaaS vendors’ go-to-market approaches should leverage the vast amount of data they have on their customers to target them with compelling, personalized offerings. This will require providers to develop or partner with others that possess deep experience in underwriting and pairing that with expertise in the vertical and its particular characteristics.

Looking to the future of customized embedded finance, SaaS providers must also consider preparing embedded finance products for a world where AI agents guide search, navigation, and purchase pathways. This involves integrating agentic AI into their own platforms to guide SMEs as they consider financial services—for example, an agent helping to make product recommendations based on a SME’s operating conditions. It also requires helping SMEs structure purchase pathways and embedded payments/financing offers for their customers.

Design and scale capabilities thoughtfully.

As SaaS providers invest in embedded finance capabilities, they must carefully balance three key objectives; efficiently allocating their own capital and focus, maximizing the experience of their SMEs, and managing holistic risk.

Although embedded finance products can have SaaS-like margins and can enhance the stickiness of the SaaS products, they come with more macro- and microeconomic exposure (such as business cycles and credit risk). They also have a higher regulatory burden than traditional SaaS offerings. Finally, embedded finance can often include balance sheet implications. All these factors, even when growth-adjusted, mean that the multiple on a dollar of embedded finance earnings is lower than for SaaS.

Therefore, all else being equal, SaaS platforms should bias toward allocating capital in embedded finance to maximize the experience to their users while minimizing their own risk and regulatory burden. A logical starting point is to own the user experience, product selection, marketing, and partner oversight—which should include some degree of risk management—while partnering on product offerings themselves. Over time, SaaS providers can evolve this model to always solve for the right north star for their SMEs. Key evolutions include choices around:

Vertical-specific products

SaaS players should start by tailoring their products to specific industries, the demographics of their SME base (tenure, location, size, etc.), and platform data.

Front-end UI/UX

To own the customer experience, SaaS providers should ensure that all their products are seamlessly integrated into the platform and are intuitive for merchants to use. They should keep a firm grip on all user engagement from the outset, even if they are relying on partners to manage core parts of the embedded finance offering such as underwriting and the balance sheet.

Underwriting and credit risk

Underwriting credit risk is a complex capability that few software vendors possess. Initially, providers typically should outsource these underwriting activities to an embedded lending partner that has established risk models and credit teams. This can help a SaaS platform test and learn their way to growth in credit more quickly and to manage and scale their lending balance sheet. Effective embedded lending partners need to embrace the vertical-specific expertise and customer-specific data advantage that the vendor has in order to develop compelling products that banks will struggle to match.

As SaaS providers expand their offerings, they can work more closely with their partners to develop pricing and underwriting guidelines. Over time it may become possible to move underwriting and credit risk management in house, which would create flexibility around loan sizing, pricing, risk management, and the customer experience—but the impact of balance sheet risk on SaaS multiples should always be kept in mind.

Risk management

Compliance, KYC/AML, and other forms of nonfinancial risk are often highly complex operations, requiring years of experience and sophisticated tools. This type of risk management is not a core capability of many SaaS providers, especially smaller ones. Vendors should seek to leverage partner capabilities for the core operational components of risk management. However, the SaaS provider ultimately is accountable for their reputation and the quality of service to their customers. Therefore, they must be sharp enough on these topics to effectively manage their partners. This means having some dedicated capacity, which should scale over time, with deep expertise in risk management and financial partner oversight. Although this is often seen as noncore to growth, poor risk operations can have a material impact on the core business.

Funding

Funding mechanisms for lending products cover a broad spectrum, including retained cash, warehouse loans, private credit, and deposits. Providers that are beginning to offer these products should start with the simplest option available, likely outsourcing to a third party, with a view to developing more complex funding models as adoption increases (for example, forward flow agreements, warehouse loans, and even directly accessing capital markets). This will improve the economics, ensure they can prioritize growth, and enable them to compete more effectively on price and product.

Servicing

SaaS providers should aspire to link together Level 1 finance features in the core platform, including access to balances, bill payments, and statement generation—working closely with partners to embed those features into the customer experience. Agentic AI can play a role here, helping providers tackle basic queries, such as those relating to account balances or card blocking.

Partner oversight

While partners can support important functions in embedded finance, SaaS providers should perform thorough oversight of their activities, with the goal of carefully managing risk and maximizing value to their SMEs though careful and close collaboration. The focus should be on test-and-learn approaches, characterized by proofs of concept and continuous feedback loops designed to unlock solutions that enhance the merchant experience—with a constant understanding that SaaS firms should not become overexposed to credit risks before they have developed deep understanding of their underwriting models.

Embedded finance represents a significant opportunity for vertical SaaS platforms and the platforms supporting them. But to realize this potential, providers must invest smartly in the right products and bundles, right awareness, and right capability models. In the product sphere, the imperative should be to move from core products such as payments, basic credit, and cards to more refined, bundled offerings tailored to the needs of specific verticals. Through these efforts, providers can build mutually reinforcing spirals of demand—that is, payments feed deposits, which feed lending and cards—that are deeply integrated into merchants’ workflows. The opportunity is clear. With the right product, marketing, and capability mix, SaaS players can become the finance tool of choice for a large and growing segment of merchants, leveraging their underwriting data, distribution channels, and customer intimacy.