BCG's Centre for Growth conducts a monthly Consumer Sentiment Snapshot to track public attitudes towards spending habits, disposable income and the UK's economic outlook.

In the second instalment of BCG’s monthly snapshot, we see signs of improving consumer sentiment.

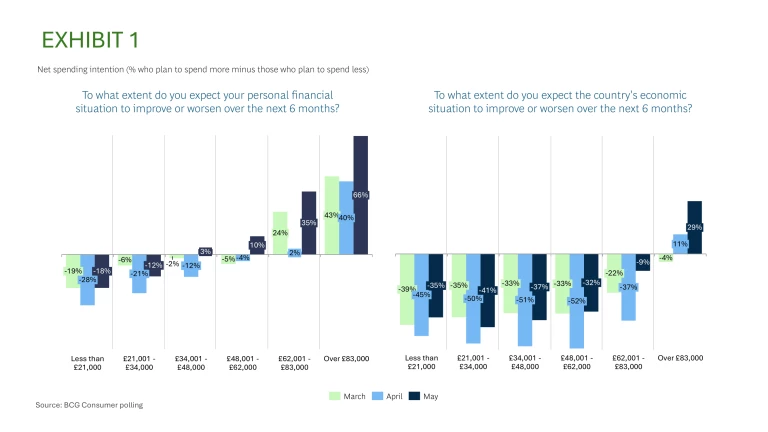

For the first time, more people (net +6%) say they think their personal financial situation will improve in the next six months than worsen.

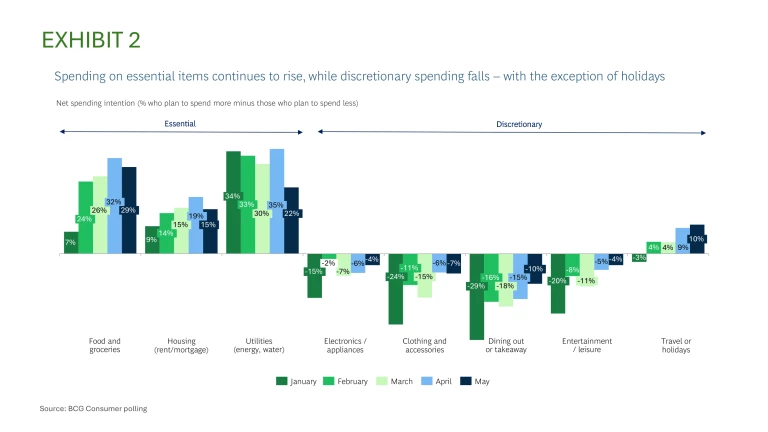

Consumers expect their essential spending to increase less than previous months and they plan to cut back slightly less on discretionary spending.

The survey, which was in the field between 2-6 May, found:

The public feels more optimistic about their own and the country’s finances this month, when compared to April. There has been:

- a 16% increase in respondents saying their personal finances are more likely to improve than worsen

- a 17% increase in individuals thinking the economy will improve than worsen

Despite this, people are still generally more pessimistic about the economy than they are optimistic.

Full results

Optimism regarding both the individuals and the country’s finances have improved. For the first time, more people (net +6%) say they think their personal financial situation will improve in the next six months than worsen. We are also starting to see greater optimism lower down the income scales, with those in a household earning a combined income of £34K+ marginally more likely to think their personal finances will improve. However, every income group except for those earning over £83K are more likely to say that they expect the UK economic situation to worsen rather than improve in the next six months.

Consumer sentiment has improved slightly this month. While the public still believes that they will generally increase spending on essentials and decrease spending on discretionary items this month, the intensity at which they intend to cut back in order to afford essential items has softened for the first time. There has been a 13% net fall in people expecting to spend more on utilities.

Aggregate spending on essentials and discretionary items is going in the right direction. The extent to which consumers are expecting to spend more on essentials and less on discretionary purchases is consistently reducing month on month.

Higher income households are driving consumer spending. Those living in households that earn a combined income of over £83,000 are the only category planning to significantly increase their spending across every category. There are however some signs that price pressures are easing for lower income groups. It is among those earning under £34,000 where there has been the biggest swing towards respondents saying they will spend less on essentials, relative to last month’s data.

Price increases are driving the changes in spending. When asked why consumers said they will spend more or less, price increases are the reason for almost every category. Where consumers say they will spend more, it is because they report that product has become more expensive to purchase. Where consumers say they will spend less, it is because they report the increase in price means they will purchase less of that product. This is true across every income category.

Raoul Ruparel, Director for BCG’s Centre for Growth, said:

“For the first time this year, people are more likely to think that their personal finances will improve in the next six months than worsen. There are some early signs that the negative consumer sentiment is starting to ease and that the worst has passed.

“However, all except high earners remain downbeat about the country’s economic outlook.

“Given the UK’s historic reliance on consumer-driven growth, this marginal improvement in consumer sentiment needs to increase if we’re to see a substantial impact on the wider economy.

“Today’s jump in inflation also reiterates the pressure on consumers to spend more on essentials, with household goods and services driving the bulk of the rise in inflation. This is likely to be largely a one off in April, with our own survey suggesting consumers are getting a bit more optimistic in May.”

Details on the survey:

These results are from a nationally representative poll of UK adults with a sample size of 1,500. Fieldwork was conducted between the 2nd May and 6th May. The poll results were weighted to the latest UK figures for gender, age, education, and region to ensure overall representativeness.

For further information on the findings, please contact Mel Walker.