Despite the consistently impressive returns of certain technology stocks over the past decade, the industry’s performance as a whole has been highly variable. Yet this economic volatility is but one facet of an uncertain and even adverse environment for tech companies today. Moreover, the numerous sources of adversity that the industry now faces are causing, and amplifying the effects of, the types of market fluctuations that have long afflicted it.

Although the many sources of adversity confronting the industry pose threats to individual tech businesses, they also present opportunities to gain advantage over rivals. Using BCG’s four-step method, we can help tech companies understand the sources of adversity that are most relevant to their businesses, develop possible scenarios, and identify the risks and opportunities associated with each. We then can formulate strategic options that reflect companies’ unique capabilities, competitive positioning, and stakeholder interests, providing paths to minimizing risks and acquiring competitive advantage.

Seven Sources of Adversity for Tech

Over the past decade, the tech industry has consistently outperformed the overall market, with ten-year returns that were approximately 1.6 times those of the S&P 500. These results were driven largely by valuation premiums (measured as a forward price to earnings); tech companies’ valuations were 30% to 50% higher than those of companies in the S&P 500. This rapid growth, however, could become a source of vulnerability in an economic downturn when valuation premiums decline, as they did during the 2008 financial crisis; premiums on tech stocks, including those of Amazon, Apple, Facebook, Google, and Netflix, typically dropped by 40% to 60%.

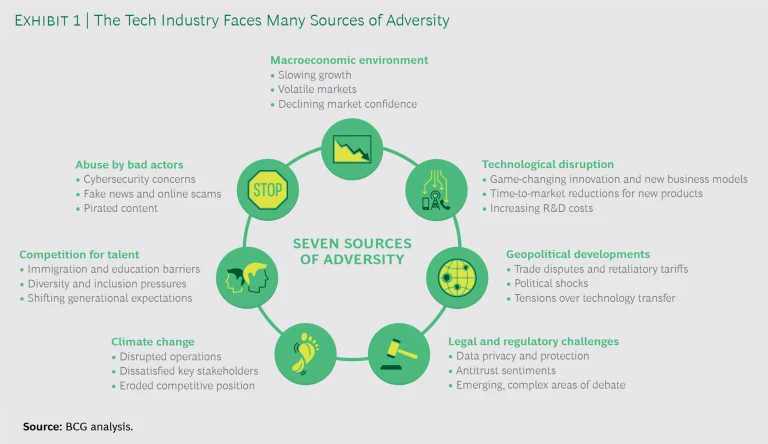

As unsettling as the prospect of such volatility may be, the macroeconomic environment is only one of many sources of adversity for the tech industry. We have identified seven principal sources. (See Exhibit 1.)

Macroeconomic Environment. Although the bull market is long in the tooth, many leading indicators remain remarkably positive. But a downturn—at some point—is inevitable. And what may be a macroeconomic trend can mask microtrends in certain parts of the industry that are more economically challenged.

Technological Disruption. Game-changing product innovation and new business models pose a threat, as do shrinking timetables for getting new products to market, increasing R&D costs, and intensifying competition.

Geopolitical Developments. Trade disputes—between the US and China, for example, and between the US and its North American and European trading partners—are causing great uncertainty in global markets for tech companies, as are political shocks from the rise of antiglobalization sentiment and nationalist political forces. Technology transfer is another area in which geopolitical tensions are creating an antagonistic environment for tech companies.

Legal and Regulatory Challenges. Consumers and governments around the world are increasingly concerned about data privacy and protection, and some governments have taken steps to enact regulations. The European Union’s issuance of General Data Protection Regulation 2016/679 and California’s 2018 enactment of its Consumer Privacy Act are two examples. Both groups also increasingly favor antitrust regulation aimed at the tech industry.

These shifts are becoming major sources of risk. Emerging areas of debate include such complex issues as a digital tax in the EU (already imposed in France, Spain, and Italy); the regulation of game-changing technologies (for example, artificial intelligence, autonomous vehicles, and digital currencies); and approaches to data supervision. Although many tech companies welcome additional regulation to provide operational certainty, others fear that the regulations will be poorly designed and have unintended consequences.

Increasing concerns about data privacy and protection are becoming major sources of risk.

Climate Change. Leaders across the globe are collectively putting climate change at the center of their agendas, as was evident at the 2020 World Economic Forum meeting in Davos; the climate-related factors for tech companies are numerous.

The potential disruption of operations from the effects of climate change (for example, fires, flooding, and tornadoes) is one clear risk. Another is the dissatisfaction of key stakeholders. Companies that fail to put forth a strategy that addresses carbon reduction and sustainability could disappoint stakeholders that prioritize those factors. The failure to address climate change in business strategies could also erode tech companies’ competitive positions.

Competition for Talent. Several factors are making the competition for the best talent a major source of adversity. US immigration policy—particularly the restriction of visas required for foreign nationals to work in the US—is one such factor. Another is the uneven geographical distribution of individuals with technology degrees, given that geopolitical tensions could reduce tech companies’ access to qualified workers from abroad.

Still, other factors include the gap between the skills that employees and college graduates have and the skills required for jobs; diversity and inclusion pressures, which are intensifying the competition for women and underrepresented minorities; and shifting generational expectations regarding work-life balance, opportunities for learning and training, and job security, for example. Generational differences mean that many tech companies will have to rethink the way they attract, develop, and retain talent.

Abuse by Bad Actors. Cyber attacks and cyber crimes, fake news (a threat that is intensified by what’s known as deepfake technology), online scams and election interference, pirating of content via electronic means, and frequent, massive data breaches—these instances of abuse by rogue elements are contributing to a climate of serious hazard for the tech industry.

Overarching Strategies for Confronting Adversity

Despite the many sources of adversity that the tech industry has to navigate, companies that learn to address them proactively can find significant opportunities. The BCG Henderson Institute (BHI) has identified a number of strategies that companies can use to Advantage in Adversity: Winning the Next Downturn. Three of these are particularly useful for tech companies looking to be proactive about seeking out opportunities in adversity.

Acting Early. In the aftermath of the 2008 financial crisis, BHI conducted a study of 5,000 large US companies. The analysis compared the 2009 total shareholder returns (TSRs) of companies that mentioned a downturn in their 2007 earnings calls with those of companies that did not discuss the downturn until their 2008 earnings calls. The result: the TSRs of companies that discussed a downturn sooner fell by 6 percentage points, which was less than the decline experienced by companies that discussed it later.

Additionally, companies that took preemptive action had a median three-year TSR that was 1.8% higher than that of their industries; companies that responded to the downturn reactively saw their median three-year TSR decline by 1.2%, compared with that of their industries.

In tech—where the future is perhaps more uncertain, and anticipating it more critical, than in most other industries—being proactive has also helped companies thrive despite the fast pace of change and the often-long R&D lead times that game-changing shifts require. Microsoft, for example, invested early on to convert its on-premises and licensed products to cloud solutions. Although Azure made its debut in February 2010, and Office 365 followed in June 2011, the engineering work on them was started many years prior.

Being proactive has helped tech companies thrive despite the fast pace of change.

Adopting a Long-Term, Competitive Perspective. BHI’s research also found that companies that took a long-term perspective during the 2008 financial crisis surpassed their industry peers on two metrics: average TSR and average revenue growth. The results for companies that took the long view were 1.4% and 4.2%, respectively, while those for companies with a short-term perspective were 0.9% and 0.3%, respectively.

Amazon Web Services (AWS) was still a new business when the Great Recession started in late 2007. However, owing to Amazon’s long-term view and heavy investment, by 2009, AWS had strengthened its position in the US and launched in Europe, both of which helped to put it on track to become one of the most successful businesses of the next decade.

Investing in Growth. BHI also determined that during the downturns following the 2000 dot-com crash and the 2008 financial crisis, top performers (defined as companies with annual increases in TSR of 10% or more during a downturn) grew their revenues by, on average, 8.8%, compared with revenue growth of only 1.6%, on average, for all other companies.

In 2009, amid a deepening economic recession and massive internal cost cutting, Intel announced a multiyear investment of $7 billion in the next generation of US-based microchip manufacturing plants—a move that enabled the company to introduce smaller and faster 32-nanometer processors into the marketplace. These microchips consumed less energy than previous ones and fueled Intel’s growth.

A Four-Step Approach for Realizing Advantage

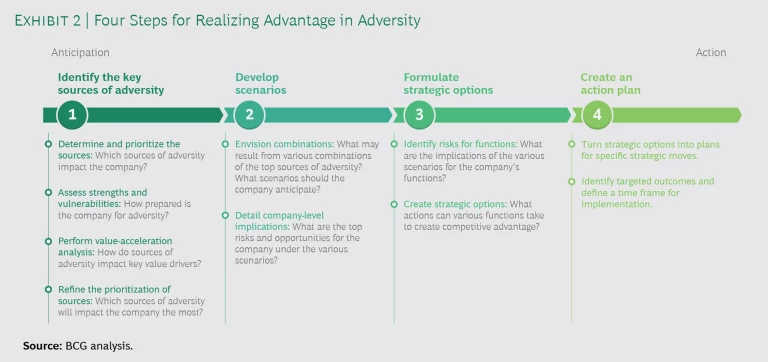

The many sources of adversity that tech faces pose very stark challenges to an industry that could be vulnerable to a reversal of the good fortune it has enjoyed for the past decade. Yet tech companies can not only weather these sources of adversity but also use them to create competitive advantage by following BCG’s four-step approach. (See Exhibit 2.)

Identify the key sources of adversity. We begin by determining and prioritizing which of the seven principal sources of adversity will most likely affect a company. For this task, we use a proprietary database, maintained by BCG’s Center for Sensing and Mining the Future, which tracks more than 90 megatrends across the latest technologies, demographic shifts, and economic developments. An analysis of that data helps us ascertain which sources of adversity are most relevant for the company.

Next, we analyze the company’s competitive positioning and shareholder dynamics, as well as assess its capabilities for weathering various adversities. Performing a value acceleration (or ValueX) analysis, which deploys BCG’s robust tool set for TSR analysis, shows how sources of adversity impact the company’s value drivers. These analyses help us prioritize the sources of adversity that the company most needs to anticipate.

Develop scenarios. In this step, we work with the company to envision various combinations of prioritized sources of adversity and create potential scenarios that the company may face. Through a combination of workshops, interviews, and stochastic modeling, we help the company think expansively and creatively about the plausible options. Then we perform risk and opportunity assessments for each of the scenarios.

The goal of this step is to help the company get a clear picture not only of its greatest risks but also of its greatest opportunities in each scenario. The idea is not to predict the future but to understand how it could unfold. That way, the company can be ready for the future and possibly even nudge it in a particular direction.

The goal is to help the company get a clear picture not only of its greatest risks but also of its greatest opportunities.

Formulate strategic options. Having detailed the company’s risks and opportunities under each scenario, we identify risks for specific functions. For operations, for example, the implications of a particular risk assessment may include potential disruptions to the supply chain owing to weather or geopolitical events; for sales and marketing, the same assessment may warn of a drop in sales volume owing to reputational damage from a cyber attack; and for product teams, the assessment may highlight a potential loss of market share stemming from disruption by a competitor.

Armed with such understanding, we build a range of hypothetical strategic options that would put the function and company on a better footing if the adversity were to materialize. These options might include, for example, divesting a particularly vulnerable product line, disrupting a business before a competitor has a chance to, and changing the pricing model in response to certain megatrends. Just as in developing the scenarios, the goal is to stretch the company’s thinking in bold ways.

Create an action plan. The last step to creating advantage in adversity is to use the strategic options to develop an action plan for specific strategic moves. Potential actions should be evaluated on their own merits. Some should be taken before a particular adversity materializes. Others should be predesigned but executed only if warranted by certain leading indicators or triggers. Part of this step, therefore, is to identify such indicators and triggers and to establish both a mechanism to monitor relevant external conditions and a preconfigured decision framework to be used should those conditions meet certain thresholds.

For leadership teams, uncertainty is daunting. As a result, company leaders often undermanage uncertainty or neglect to manage it altogether. But while the future is uncertain, the process of examining it and planning for it can be made straightforward and concrete. Our rigorous four-step approach to finding—and seizing—opportunities in adversity does not banish uncertainty. But it does create clarity, enabling management teams to move quickly to take advantage of challenging conditions while competitors either freeze or make the wrong moves too fast.

BCG TURN is a special unit of BCG that helps CEOs and business leaders deliver rapid, visible, and sustainable step-change improvement in business performance while strengthening their organizations and positioning them to win in the years ahead. BCG TURN helps organizations change their trajectories by turning their upside potential into radical performance gains. The BCG TURN team consists of transformation practitioners and battle-tested experts with a proven track record in large-scale transformation. BCG TURN is invested in the sustainable success of clients, with a focus on performance acceleration and a commitment to value delivered.