It’s an all-too-common scenario in the container-shipping industry: A company (we’ll call it CarrierCo) has 200 empty containers in Hamburg that must be transported to China to carry export cargo. None of CarrierCo’s northern European customers needs these boxes to ship goods to China. So CarrierCo must pay $500 per container, mainly fees charged by terminals and trucking companies, to transport its empty boxes from Hamburg to Shanghai.

The costs of repositioning empty containers in scenarios such as this one are far from trivial. Indeed, they amount to as much as $15 billion to $20 billion per year industry-wide. (Affected companies include container carriers, leasing companies, and other logistics companies.) For a typical carrier, repositioning costs represent 5 to 8 percent of total operating costs. By implementing an efficient marketplace for interchanging their empty boxes, carriers could avoid the roughly one-third of repositioning costs that arise from the limitations of their own operations. Such a marketplace would allow carriers to lend containers for one or multiple bookings, temporarily swap containers among two or more parties in multiple locations, or sublease containers. How much money could be saved, and how could such an interchange be successfully implemented?

The Pursuit of Interchange Opportunities

In the past, some carriers pursued interchange opportunities through personal contacts at other companies or by using brokers. However, those informal or small-scale approaches proved inefficient and failed to deliver significant benefits. Consider that, in 2011, the ownership of more than 30 million containers

To help industry players collaborate more efficiently at scale, The Boston Consulting Group has developed a global interchange marketplace for empty containers: the xChange. This undertaking, as well as our work with many of the world’s top 20 carriers, has provided valuable insights into the extent of container imbalances globally and the opportunities for the container-shipping industry to use interchanges to overcome its repositioning challenges.

Since its inception in September 2014, the xChange has seen the number of potential opportunities to interchange containers surpass 35,000 per week. The average savings is $200 to $400 per interchanged container, arising mainly from the avoidance of expenses related to land transportation and the use of terminals. This corresponds to potental annual savings of approximately $350 million to $700 million. Scaling up this impact to the top 100 carriers would promote annual savings of up to $4.5 billion. Including all other equipment providers and operators, such as leasing companies and other logistics companies, would increase the potential savings to $5 billion to $7 billion annually.

To fully realize this potential, marketplace participants will need to employ a number of success factors aimed at increasing their collaboration and their use of advanced repositioning strategies.

Finding innovative ways to solve the repositioning puzzle is part of a broader effort to reduce or avoid costs in the container-shipping industry, which is vital to overcome the industry’s ongoing profitability crisis. (See The Transformation Imperative in Container Shipping, BCG report, March 2015.)

Managing the High Costs of Repositioning

For large, vessel-owning carriers, the handling fees that they pay to terminals, depots, and intermodal operators generally represent 60 to 75 percent of total repositioning costs. Their remaining repositioning costs relate to intermodal transport provided by rail, truck, and barge operators. Because these carriers own their vessels, they do not pay for vessel slots for empty containers. For container owners and operators that do not own vessels, such as leasing companies and other logistics companies, repositioning is an even bigger headache. These players must pay for vessel slots, so their repositioning costs hit the bottom line harder.

Carriers must reposition empty containers because equipment flows typically are not balanced in opposing directions. Approximately two-thirds of all movements of empty containers arise from structural imbalances. Some countries, such as China, export more than they import; as a result, carriers must inevitably transport empty containers to these countries.

As noted, the remaining one-third of repositioning costs relate to carrier-specific imbalances. A carrier whose customers are scattered among port and inland destinations within a given country or whose portfolio of export and import business within the country is imbalanced will likely end up having to move empty containers. Sales forces contribute to imbalances by focusing on increasing head-haul volume, rather than optimizing overall container flows across services. Issues within a carrier’s network, such as delays and the absence of direct vessel- or inland-network links between locations served, can also promote imbalances and make them harder to correct. Moreover, most carriers are not able to forecast their positioning needs with sufficient accuracy to fully optimize flows before imbalances arise.

Although carriers must live with the inevitable costs that stem from structural imbalances, they can pursue a variety of approaches to reduce or avoid costs that arise from carrier-specific imbalances. Approaches to reducing the costs of moving empty containers include negotiating better rates with terminals, depots, and intermodal operators; forming strategic partnerships with trucking and rail companies; and jointly procuring repositioning services with other carriers. Carriers can avoid repositioning costs by deploying IT solutions to optimize flow forecasting and planning, implementing performance measurement systems that create incentives for sales forces to improve flow balancing, steering older units to those locations with surplus demand that offer good sales opportunities, and “triangulating” hinterland movements by sending containers directly to export customers’ sites from locations where imports are unloaded. Container interchanges, our focus here, are also a means of cost avoidance.

An Interchange Marketplace Shows Great Potential for All Carriers

BCG provides technical support for the xChange by serving as a neutral, global clearinghouse for information about container demand and availability and the potential for interchanges at specific locations. We also provide the marketplace’s technological infrastructure, which facilitates the exchange of information and automates processes and will soon support equipment tracking and billing and accounting. Having successfully completed the testing phase, we are formally launching the xChange in November 2015.

To date, 11 carriers, representing one-third of global container-vessel capacity, have participated in the marketplace. BCG has collected weekly reports from marketplace participants on imbalances for the three main container types (20-foot dry containers, 40-foot dry containers, and 40-foot high-cube containers) at more than 2,500 locations globally. Analyzing this data reveals potential interchanges involving each carrier and in each region and each inland or port location. A weekly report presenting this analysis is distributed to all participants and provides the basis for marketplace participants to contact each other to discuss interchanges.

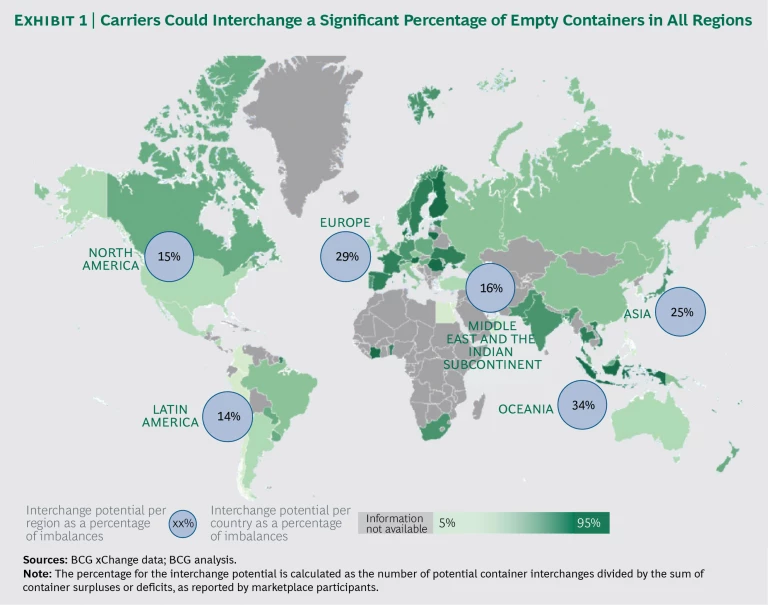

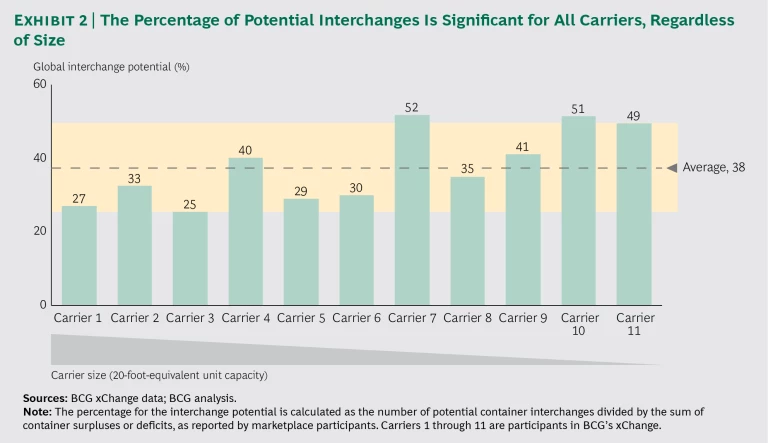

Data collected during the past year indicates that there are significant opportunities to interchange containers in all regions and for all carriers regardless of their size. From a regional perspective, the interchange potential for the marketplace has ranged from 15 percent of supply and demand imbalances in North America to 34 percent of such imbalances in Oceania. (See Exhibit 1.) From the perspective of the 11 carriers participating in the marketplace, the global interchange potential as a percentage of imbalances has ranged from 25 percent to 52 percent, with an average of 38 percent. (See Exhibit 2.) (The interchange potential on a regional basis does not include redundant opportunities for interchanges among carriers and thus is less in all cases than the global average for the 11 carriers.)

In addition to helping carriers avoid costs to move empty containers, the marketplace promotes a host of other benefits by ultimately allowing carriers to downsize their equipment pools. These benefits include lower capital expenditures, reduced consumption of resources (such as steel and wood), and reduced costs for depot and terminal space. As carriers downsize their equipment pools and become more comfortable using other parties’ containers, they will likely increase their use of leased containers. Carriers can also improve their environmental footprint. We estimate that avoiding all movements of empty containers for carrier-specific reasons would allow the industry to reduce carbon dioxide emissions by more than 6 million tons annually. The emissions reductions are also significant for other greenhouse gases.

Success Factors for Capturing the Full Potential

To fully capture the benefits of participating in the interchange marketplace, each carrier will need to adopt an operating model that facilitates cross-carrier collaboration and advanced repositioning strategies:

-

Define clear responsibilities. Each participant’s organizational setup must allow for the smooth execution of the interchange process. Roles and responsibilities need to be clear, and staff members must be empowered to fulfill these responsibilities and held accountable for their performance. The logistics staff should be accountable for both realized interchanges and the viable opportunities that they did not pursue. Accountability for the realization rate of interchange opportunities helps to ensure that the logistics staff considers and pursues equipment interchange options within the full scope of the marketplace.

-

Commit to pursuing interchanges. Each carrier’s organization must be committed to proactively pursuing interchanges with other marketplace participants, even when the sales department would prefer not to. Organizational commitment is essential for setting the right expectations and ensuring that the pursuit of interchanges prevails over the interests of the sales department. It will also help the carrier to withstand the inevitable criticism if problems arise, such as when units are returned late, at the wrong location, or in disrepair.

-

Work with all potential interchange partners. Participants need to be open to working with the full scope of interchange partners. Many companies currently forgo a significant number of interchanges by imposing limits on which types of players they will collaborate with. For example, some container carriers may hesitate to pursue interchanges with leasing companies, fearing that they will lose leverage in negotiating equipment leases if a leasing company gains insights into their equipment needs. However, by properly managing the disclosure of information, companies can mitigate such risks.

-

Define KPIs and set targets. Carriers need to establish a clear, holistic system to measure the performance of their efforts to optimize repositioning costs. KPIs need to be clearly defined and rigorously applied to measure employees’ performance relative to specific targets. Ideally, all carriers in an interchange marketplace will use the same KPIs. Incentives for the logistics staff should be aligned with the new metrics and targets.

- Adopt clear standards. Marketplace participants must adopt a common set of clearly defined standards, data formats, and tools as well as specific information requirements for each type of transaction. They also must adopt a contractual framework that regulates how interchanged units are treated, when and how units need to be returned, and which party is responsible for specific costs. Moreover, participants need processes to track and move other companies’ containers within their network, to ensure that the containers can be returned to the owner at a specific time and location. Each carrier must integrate these standards into its existing approach to equipment flow planning.

Additionally, carriers need an effective change-management program to ease the transition to participation in the marketplace. This program should include support for the adoption of new tools, changes in operating processes, and the training of staff. A “health check” can be used to assess the current state of a carrier’s performance and identify the priorities for improvement initiatives. For example, a top 20 carrier participating in the xChange found that it could increase its weekly interchanges by 20 to 30 percent by making just a few modifications to its decision-making processes. By applying all of the success factors outlined here, carriers can go beyond the initial “low-hanging fruit” to achieve significantly higher increases in the number of interchanges.

A global interchange marketplace applies the concepts of the “sharing economy” to the container-shipping industry. Exchanging information about container imbalances and sharing their containers to optimize the deployment of resources will enable industry participants to realize the elusive goal of overcoming carrier-specific repositioning challenges. By thinking outside their own boxes to solve the global repositioning puzzle, carriers will take an important step toward achieving the transformation that is essential to restore their industry’s profitability.