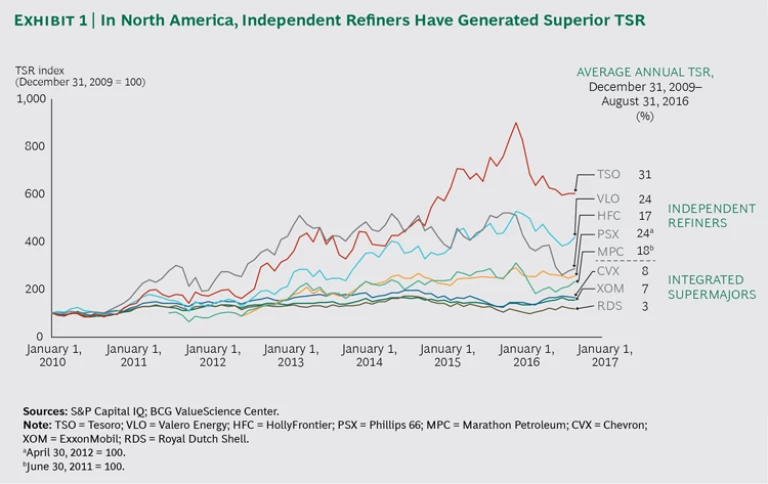

North American refiners had the wind at their backs from 2010 through 2015, their margins pushed higher by the combination of falling crude prices and rising fuel demand. Total shareholder return (TSR) for the group soared, with downstream players outdistancing integrated supermajors by substantial margins. (See Exhibit 1.)

In 2016, however, conditions for these businesses turned much less supportive, and refiners faced rising product inventories and signs of peaking fuel demand. To surmount these and other challenges and position themselves for the future, these companies need to move strategically and tactically by, for example, adjusting their wholesale and retail strategies, building scale through M&A, divesting noncore assets, and making efforts to boost operational efficiency.

Rising Challenges, Growing Uncertainty

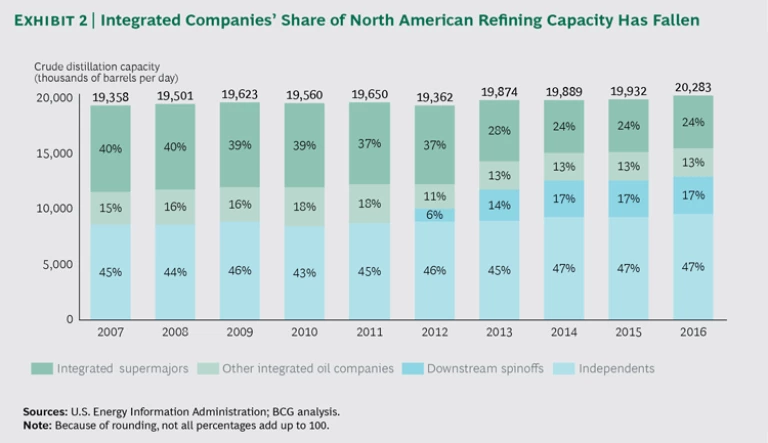

The North American refining landscape has evolved considerably in the past several years. Once largely the domain of integrated oil companies, it is now populated by independent refiners (such as Valero Energy, Tesoro, and HollyFrontier), large-company spinoffs (such as Marathon Petroleum and Phillips 66), and private-equity-created refiners (such as PBF Energy and Philadelphia Energy Solutions). This evolution reflects the change in refining capacity ownership over the past decade. In 2007, integrated oil companies owned 55% of North America’s crude distillation capacity; by 2016, their ownership had declined to 37%. (See Exhibit 2.)

Amid this shift, the backdrop for most North American refiners was largely favorable. The biggest winners were refiners with access to midcontinent and other crude oils that were priced at a discount to international benchmark crudes for much of the period. These players saw particularly strong growth in margins and profitability.

The tide has turned for North American refiners, however. Fuel supply has caught up with demand, and refining margins have returned to historical averages. Companies that had benefited from access to relatively inexpensive midcontinent crudes have seen their competitive advantage fade as a result of the cross-continental buildup of transportation infrastructure, especially pipelines, and the US government’s elimination of its ban on crude-oil exports.

And worse may be yet to come. North American refiners will have to contend with several sizable challenges and uncertainties in the months and years ahead.

Potentially Lower Demand for Fuel Products. North American demand for gasoline, now showing signs of approaching its peak, is poised to fall. The US Energy Information Administration projects an annual decrease of 1.3% in US consumption through 2025. This is attributable to a number of factors, including an increasingly stringent regulatory environment in the US at both the federal and the state levels. Prominent examples of regulations that have already moved the needle on US gasoline consumption are the federal government’s Corporate Average Fuel Economy, or CAFE, standards, which are scheduled to tighten significantly in the coming years, and California’s Clean Energy and Pollution Reduction Act. That 2015 legislation aims to cut California’s motor vehicle petroleum-based fuel consumption in half by 2030. Another factor likely to reduce US demand is the projected increase in carpooling and ride sharing.

Furthermore, the growing penetration of electric vehicles (EVs) will also reduce North American gasoline demand. The EV market in the US has enjoyed significant growth since 2011: the 500,000th EV was sold in mid-2016. And growth could surge over the next few years, with annual EV sales in the US potentially reaching 200,000 to 300,000 units by 2020 (or more if there is a substantial reduction in battery prices).

Prospects for North American diesel fuel, meanwhile, are a bit more favorable. Demand is supported by booming growth in e-commerce and heightened economic activity. Overall, however, demand is likely to be flat or to show only modest growth through 2025, with the small, expected rise in demand from light-duty vehicles largely offset by a decrease from heavy-duty vehicles, which are expanding their use of natural gas.

Volatility in Crude Prices and Refining Margins. Growing volatility in crude prices in the past few years has increased volatility in refined products and, hence, in refining margins. It has also led to increased trading activity, which has resulted in surging profits for major trading powerhouses. Vitol, for example, reported earnings of $1.6 billion in 2015—the highest in five years.

Growth of the Retail Convenience Industry. The gross profits of retail convenience stores, such as 7-Eleven and Couche-Tard, have been climbing an average of 3% annually over the past decade. This growth has been driven by changes in consumers’ habits, retailers’ revamped product offerings, and higher fuel sales. The trend has caught the attention of major oil companies, which had exited the convenience store market roughly a decade ago and are now reconsidering, eager for additional sources of growth in the face of declining—or negative—cash flow in upstream operations.

The Cost of Renewable Identification Number Credits. As part of its Renewable Fuel Standard Program, the US Environmental Protection Agency continues to raise the volume of ethanol and other renewable fuels that refiners must use in their products.

Refiners unable to meet their obligations must buy Renewable Identification Numbers (RINs)—credits that signify compliance with the program—on the open market. From January through October 2016, the cost of RINs rose about 20%, pushing up some refiners’ costs considerably. In fact, the cost of RINs is now as much as 15% to 20% of EBITDA for some refiners.

Barring changes to the program, we expect RIN prices to rise through 2020 or 2021 as the federal government continues to raise yearly volume requirements for renewables.

While the rising cost of RINs is a hardship for some refiners, it is a windfall for other players: some major oil companies that possess refining operations were expecting to generate more than $1 billion in 2016 revenues through such sales. The potential for generating revenues through RIN sales is prompting some independent refiners to consider expanding their blending operations so that they can be net RIN sellers. (It is noteworthy that, given the strong competition between gasoline producers that are net producers of RINs and those that are net buyers, there is little evidence that higher RIN costs are being passed along to end consumers.)

New and More Stringent Environmental Regulations. Refiners will have to deal with new and increasingly stringent standards other than those related to gasoline. For example, the International Maritime Organization recently confirmed that it will reduce the permissible limit of sulfur in marine fuel: sulfur will be capped at 0.5% starting in 2020, requiring many refiners to make major plant and equipment investments. This regulatory change will, however, also create opportunities, especially for refiners that have the infrastructure and blending components necessary to economically produce fuel that meets these requirements.

Increased Shareholder Activism. Many activist investors have set their sights on energy companies, including refiners: the number of campaigns targeting energy companies has climbed an average of 28% per year from 2010 through 2015. These investors have been seeking progressively bigger targets within the industry: the average market capitalization of targeted companies rose from $1.8 billion in 2006 to $6.8 billion in 2016. And these forays have become more successful. Before 2010, about 65% of such efforts succeeded; in 2015, about 70% were successful.

In sum, North American refiners, after a lengthy stretch with the wind at their backs, now face strong headwinds. How are they reacting?

The Industry’s Next Big Moves

To shore up their businesses and boost TSR, North American refiners are employing a variety of strategies.

Optimizing Refinery Operations. Virtually all North American refiners are working to improve operational efficiency and flexibility through a combination of levers. In our experience, focused efforts to improve operational efficiency and flexibility can improve profitability by $1.50 to $3.00 per barrel. The largest cost reductions are typically the result of efforts to optimize gross margins through the application of commercial levers, such as stream rerouting and feedstock optimization, as well as efforts to boost the efficiency of energy operations through, for instance, the optimization of furnace operations and the performance of stream and condensate systems.

The next-largest lever for generating cost savings is routine maintenance and operational improvement. We have found that refiners can achieve savings of up to $0.75 per barrel in routine maintenance and nonenergy operating costs through such means as increasing worker productivity, improving maintenance-scheduling processes, and streamlining the small-projects portfolio.

Efforts to reduce head count through automation and improvements to process efficiency have, for some time, been common among North American refiners, and they have netted impressive results: over the past 15 years, head count has fallen by about 14% while production capacity has increased slightly. We expect Industry 4.0 digital innovation to unlock the next wave of efficiency and effectiveness on this front, but to realize the potential benefits, refineries will need to focus on factors that influence employee productivity, such as organizational processes, reward systems, and definition of roles.

BCG’s Smart Simplicity approach can lead to substantial improvements in employee productivity that allow for potentially significant reductions in head count. Oil and gas companies that have employed this approach have managed to generate efficiency-related labor cost savings of 5% to 20% over a three-year period.

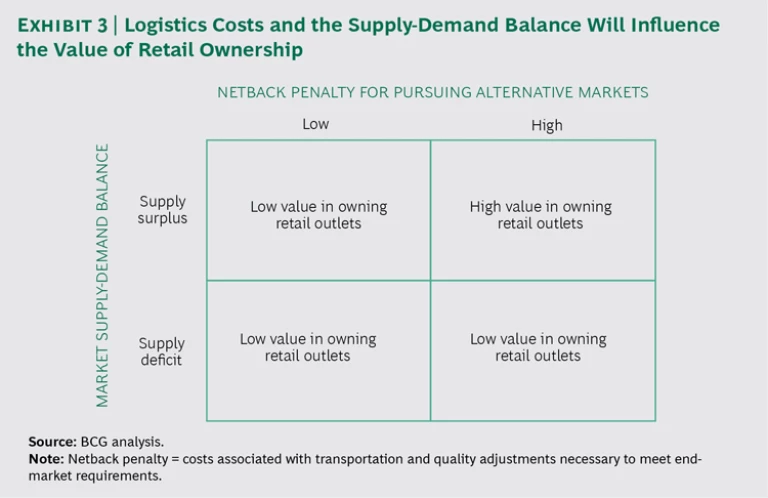

Optimizing Wholesale and Retail Channels. Demand for oil products may be approaching peak levels, and recently Mexico and South America (both export destinations for US-refined products) have added to their production capacity. It is critical, therefore, that North American refineries increase their sales capacity. In the next few years, we expect to see certain refiners continuing to adjust their distribution capabilities toward this end. Their efforts could deliver sizable financial benefits. Refiners that operate in markets with surplus supply and relatively high barriers to entry could find it particularly advantageous to acquire retail outlets, for example. (See Exhibit 3.) One refiner identified opportunities to raise margins by as much as $0.20 per gallon by acquiring a regional retail chain and selling products through its retail channel rather than the local wholesale market.

Paring Assets from the Portfolio. Super-majors, in an effort to narrow their focus and simplify their business, are selectively divesting noncore refinery assets. Examples over the past five years include ExxonMobil’s sale of its Chalmette, Louisiana, and Torrance, California, refineries; BP’s sale of its Texas refineries in Carson and Texas City; and Chevron’s sale of its refinery in Hawaii. We expect this trend to continue. At the same time, some of these companies are restructuring their remaining refining assets. BP, for example, has launched simplification and efficiency programs to improve the operating efficiency of its global downstream business—a move that the company anticipated would reduce costs by $2.5 billion by the end of 2016 relative to 2014.

Building Scale Through M&A. In an effort to optimize their footprint and achieve scale advantages in the face of rising feed-stock costs and decreasing refining margins, several large independent North American refiners are likely to pursue acquisitions. In November 2016, for example, Tesoro announced its acquisition of Western Refining.

Enhancing Capital Project Efficiency. Aiming to tap into new market opportunities (for instance, to take further advantage of feedstock-related opportunities or to comply with stricter marine-fuel standards), refiners face decisions about upgrading their refining assets. They need to carefully evaluate business cases for investments in desulfurization facilities and in coker units. This will require long-term demand and scenario planning in order to identify opportunities that maximize capital efficiency. Small, disadvantaged refiners might find it uneconomical to invest in such capabilities and might instead choose to convert facilities into terminals.

Entering Adjacent Sectors and Asset-Backed Trading. Many refiners will try to diversify revenue streams and boost revenue growth by selectively building their presence in growing segments of petrochemicals and lubricants. Some integrated oil companies (for example, BP and Chevron) are pursuing this strategy; independents that are doing so include Tesoro and HollyFrontier.

We expect more refiners to pursue such strategies, especially as growth in fuel demand slows. Petrochemicals will be a particularly ripe sector for many businesses: low ethane prices and new products will likely continue to drive growth and returns. The market for lubricants, a traditionally high-return market supported by high barriers to entry, could also prove lucrative for refiners.

We also expect that some refiners will seek to exploit asset-backed trading, which can present sizable revenue-generating opportunities, especially in times of high price volatility.

The next several years will present significant challenges to North American refiners. Decisions made today could set the course for a successful future. No single plan fits all companies, but all players need certain elements and capabilities if they hope to succeed. They need to formulate and clearly articulate their portfolio logic and execute on divestments, M&A, and their organic-growth agenda. They need a feedstock strategy that is effective in every crude-oil-price environment; wholesale and retail strategies that prepare them for peaking demand for refined products; and operational performance that enables them to be competitive even with lower margins. And they need to launch and execute their plans quickly.