An Australian bank is deploying a robotic workforce to cut the time of onboarding new business clients from days to minutes. Banks around the world are experimenting with chatbots to help their customers resolve issues immediately, at any time of day or night, without human intervention. And an Asian bank recently deployed artificial intelligence (AI) to reduce its consumer loan approval times, as well as the number of staff required to gain such approvals, by more than half.

The excitement about these early successes is not hard to understand. Automated systems work three to five times faster than humans, and they operate 24-7. Our experience suggests that these systems can help banks reduce costs by 30% to 40% in targeted areas, including middle- and back-office operations and shared services. If machine learning (ML) is incorporated, the automated agents keep getting smarter and more efficient, and the savings go up. Automation based on ML also has the potential to improve customer experience—creating the kind of intuitive digital service that until now has mainly been the province of fintech firms.

That banks are still struggling to fully realize the promise of what we call smart processing reflects the difficulty of scaling up these fantastically promising early experiments. Proofs of concept—supported by a rapidly evolving ecosystem of software vendors, systems integrators, implementation partners, and startups—are happening in banks all over the world. The difficulty has been to move past the proof-of-concept stage and create true enterprise-wide impact. Few banks have managed that feat.

A Mash-Up of Promising Technologies

Smart processing brings together two primary categories of tools and approaches. The first category is rule based, and it comprises two technologies: robotic-process automation (RPA) and business process management (BPM). RPA software automates mechanical tasks, including those traditionally done by humans, and the vendors that offer it are relatively mature. Indeed, because of their comfort with the idea, some banks are using “robotics” as an umbrella term for all of their process technology initiatives. BPM is a way to deal with the handoff of tasks along a chain. Making this process as efficient as possible is essential because so much of smart processing has to do with digitizing and stringing together activities that were previously disconnected and manual.

The second category of smart processing involves judgment-based approaches enabled by various types of AI software. While some types have been used for years, others—such as ML and natural language processing (NLP)—are much newer. A number of prominent software vendors are bringing these old and new technologies together. These companies include Blue Prism and NICE, which are moving beyond their rule-based approach to add more learning-oriented capabilities, and WorkFusion and IBM (through its Watson unit), which are adding rule-based capabilities to their foundation of AI and ML technologies. The mash-up of technologies that such vendors are creating gives banks an opportunity to radically improve their traditional services.

We believe that several core areas of banking are ripe for smart-processing-led transformation, including deposits and payments processing, loan operations, trade finance, fraud prevention, and mortgage processing. These areas are all costly and require manually intensive labor, with many elements that are either mechanical or learnable through smart software.

Consider fraud prevention, for example. A bank could use ML software to detect suspicious transactions, voice recognition software to confirm the identity of a bank customer whose credit card information has been stolen, and cognitive-automation technology to recommend an action—perhaps via a chatbot—to that customer. These AI elements dramatically lessen the time required for such an exchange, help focus the bank’s expert staff on cases that are more difficult or of higher value, and frequently reduce the overall number of employees needed.

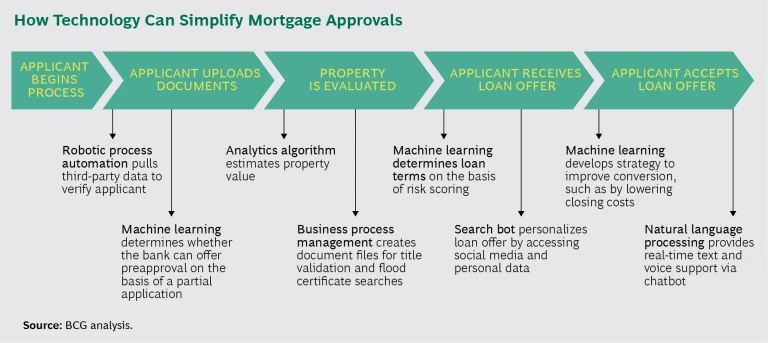

Another example is mortgage loan approvals. Today, applying for a mortgage is a frustrating, paper-heavy process that takes several months to complete and can involve dozens of often-repetitive requests for information by the bank’s lending department—a suboptimal customer experience that decreases the chance of a successful outcome. A bank that uses ML technology to approve loans more quickly—for instance, by comparing a smaller set of data about the applicant’s finances with data for existing loan holders—can gain a big advantage by providing an improved experience. (See the exhibit.)

Yet despite its potential, smart processing has not fundamentally changed either banks’ economics or customers’ experiences. Pilots and gradual expansions from pilots may prove the potential of smart processing, but they do not create value on an enterprise-wide scale.

Hampered by Short-Term Thinking

If the potential of smart processing is realized, it will do much more than make a few processes better and overcome legacy system challenges. It will upend banks’ operating models and permanently change how work is distributed between people and systems. So far, however, banks have failed to recognize the sea change that smart processing represents and have instead approached it as a tactical opportunity. This has prevented them from successfully scaling up smart processing across their operations.

In fact, banks are doing a number of things that may actually be undermining their smart-processing initiatives. Overemphasizing the speed of development and trying to expand too quickly, for example, is a common mistake. Ambition is a good thing, but if banks scale up these initiatives without thinking about the end-to-end processes they are trying to simplify, they can end up with too many robots doing tactical things, a crushingly long list of applications to debug, and a counterproductive level of complexity.

Another mistake is to make an end run around the IT department instead of ensuring that smart processing will fit with the bank’s core technology. The reality is that smart processing, just like more mature technologies and systems, requires a disciplined approach to development and support and must function within the larger tech environment. One American bank recently learned this the hard way. A development team at the bank had automated some processes using RPA but had not kept the IT department informed. When IT changed an underlying application, the automated processes stopped working.

In addition to IT, other functions and stakeholder groups—such as cybersecurity, risk, and compliance—also need to be involved throughout the program. As with any new technology, smart processing can create vulnerabilities, whether actual or perceived, that must be managed. It is crucial that managers responsible for maintaining the internal lines of defense be fully educated about the risks and how to manage them.

Finally, most banks are not doing enough to build the broad and deeply ingrained knowledge that they will need to take full advantage of smart processing. Just as with other operational improvement disciplines, such as lean and Six Sigma, it is important to start with a small group of experimenters and build up to a larger cadre of experts throughout the company. Otherwise, and without such supporting tools as knowledge bases and communities of practice, the organization as a whole won’t develop the new muscles it needs to capitalize on the benefits of smart processing.

Getting Smart Processing Right

On the basis of our experience, we have identified five key success factors:

- Understand where smart processing can help you the most. Banks should resist the temptation to focus on the processes or services that can be transformed the fastest. Instead, they should take a more strategic approach, prioritizing areas that would provide the greatest economic returns and have the biggest impact on key customer experiences. They should also challenge their teams to fundamentally reimagine, rather than simply improve, existing processes. These exercises will generate a list of possibilities that will serve as the basis for selecting the right initiatives and developing an initial roadmap.

- Form a picture of how your operating model and talent pool will evolve. Smart processing fundamentally reshapes how and where work is done and provides an opportunity to reevaluate staffing levels, skill mix, and demand management models. For example, smart processing can have significant implications for a company’s offshoring footprint and shared-services approaches.

- Integrate IT from day one. Banks’ core IT systems and processes weren’t designed with robotics and AI applications in mind. For example, human operators can quickly adjust to a modification in login procedures, such as for security purposes, whereas a robot may need significant reconfiguration to handle the change. Smart-processing teams also need to have agile but disciplined development and support methodologies, similar to standard scrum or DevOps models—though different forms of quality assurance and control may be required because robots work so directly with production data and live transactions. In addition, smart-processing teams must adopt IT’s release and change management practices to avoid surprises.

- Establish a center of excellence. Staffed by experts from multiple disciplines—operations, IT, and the business—a center of excellence (CoE) plays a critical role in banks’ smart-processing initiatives. The role of the CoE will vary depending on the focus of those initiatives and on the bank’s level of readiness to carry them out. At a bank that is new to smart processing, for example, a CoE could be used to develop a core team of implementation experts, push for clarity on the final design, evaluate technologies and vendors, and develop the roadmap. The CoE at such a company would also be responsible for expanding the base of expertise, such as through a “learn one, do one, teach one” approach. Deeper into the life cycle of the program, the CoE would manage change, establish common standards, and coordinate projects, ensuring that no part of the bank spent time recreating the wheel.

- Implement a change management plan. Smart-processing initiatives require time and perseverance. They also affect the size of operations teams and the nature of the work they do. Frontline operational employees, in particular, will experience significant shifts in their work—including major changes to processes and roles—and staff reductions, in most cases. A successful automation program needs the full commitment of frontline operational employees because they have the detailed process expertise required to successfully automate specific tasks, handle exceptions and errors, and ensure that the new process is sustainable. Thus it is essential not only to communicate what’s happening in a thoughtful and timely way but also to build real commitment to the change throughout the organization. This is especially true for the people who will be asked to become new “power users”—local smart-processing experts who understand the process as well as the technology. They will be the ones to transition from overseeing processes to overseeing the robots that handle the processes.

While the anxiety of the existing staff can’t be eliminated altogether during a change program of this magnitude, it can be managed. The key is to communicate regularly and directly and to segment and manage different stakeholders with appropriate messaging. Employees should be able to envision a future in which they spend less time on mechanical tasks, spend more time applying judgment, and acquire new skills to accommodate their higher-value work. Although the transition will not be easy, when it is handled skillfully, the automation rollout will go more smoothly—and employees may even respond with enthusiasm.

Banks that follow all five practices are rare. But a bank in Asia that has embraced the strategy imperative and the idea of a CoE has some significant results to show for its efforts. (See the sidebar “Asian Bank Takes Methodical Approach to Transforming Its Processes.”)

ASIAN BANK TAKES METHODICAL APPROACH TO TRANSFORMING ITS PROCESSES

A major Asian bank is leveraging smart processing as a key part of a transformation to decrease costs, enhance customer experience, and improve process quality.

To create a shortlist of priorities, the bank evaluated some 200 back-office processes for their suitability for robotic process automation (RPA) and machine learning (ML) interventions and determined the extent to which other enablers, such as optical character recognition, would be needed. As a result of this exercise, the bank decided to roll out the implementation in four waves. It also rigorously vetted potential software vendors for the main pieces of technology, including data digitization, RPA, and artificial intelligence. Some 50 vendors were evaluated.

The initial wave of implementation focused on 20 processes, including mobile customer onboarding and trade finance—and the results have been sizable. The bank went in believing that it would save 50% to 75% on costs for the selected processes, reduce the need for data entry by 80%, and achieve significantly faster turnaround times. Not only has the bank met those targets, but the processes have continued to become more efficient because of ML. (See the exhibit below for an illustration of how an ML algorithm quickly jumped ahead of manual operation for a process involving data extraction.)

Encouraged by its initial success, the bank has decided to accelerate the transformation’s rollout and to focus on multiple waves in parallel. It has also formed a center of excellence that offers a full suite of capabilities for vendor selection, an implementation playbook, and approaches to change management, operational oversight, training, and knowledge management. The goal is to sustain and continue scaling the transformation, which is currently in its third wave, as the implementation proceeds.

The Opportunity Ahead

That so few institutions have solved the challenges of smart processing isn’t surprising. This is a new area that requires disciplined execution. And, as with many of the operational and customer-facing innovations that banks might consider, technology is only part of the challenge. To succeed with smart processing, banks must be willing to make many changes to their operations.

The opportunities are substantial. A bank that can figure out how to use automation to cut its costs in sustainable ways is going to have a huge advantage over its rivals, as is a bank that can figure out how to transform its products and services and remove some of the friction that has been inherent in bank customers’ experiences.

However, the benefits of smart processing won’t result from small-scale wins, important though they might be to establish momentum. Instead, the benefits will come from thinking long term and taking a strategic approach to the opportunities that exist. There will still be some false starts; banks are not past that point yet. But the groundwork is in place for greater successes.