Digital is influencing more and more Indians’ shopping activities. But the important details behind that—the where, when, how, and how much—are not well understood by many retailers trying to sell to shoppers in India. These companies must act fast to learn exactly how Indians are using both the internet and offline channels for making purchases. Retailers that fail to do so risk losing out to nimble startups that can more easily adapt to today’s purchasing pathways.

Like shoppers everywhere, Indians are making an increasing number of purchases online: recent BCG research shows that half the nation’s urban internet users now do so. And there are more than 90 million online shoppers in India today—eight times more than in 2013.

To get a better grasp of Indian consumers’ purchasing pathways—the series of steps they take, both online and offline, to find, consider, and purchase products and services—BCG’s Center for Customer Insight surveyed 600 urban consumers, all of them active internet users. The center tracked their shopping behaviors for a month across a wide variety of products, documenting all their online and offline activities en route to final purchase.

Almost 70% of respondents said that they are strongly influenced by ideas and information they’ve gleaned through digital channels prior to purchase. For some products and services, Indians are doing the research online but buying offline; for other products and services, it’s vice versa. For still others, consumers are using digital pathways from initial exploration to completed purchase. What’s more, they’re regularly mixing and matching both purchasing pathways, depending on the circumstances.

These survey results have huge implications for companies competing in consumer markets in India. Indeed, the research overturns assumptions about shopping behavior in the digital age, including long-held notions about the value of omnichannel approaches. The following five findings offer retailers important insights into the evolution of consumer behavior in India both online and offline.

Omnichannel is not necessarily the way to win with India’s connected consumers. It has become common wisdom that companies must accommodate cross-channel purchasing pathways in which shoppers switch between online and offline pathways as they research, shop, and buy. But the reality in India is different: only 5% of purchases, accounting for 16% of value, are made after consumers have followed a mixed pathway, using online and offline touch points. The purely offline pathway remains dominant, accounting for 78% of purchases and 58% of value. Only 16% of the purchases in our sample followed an online pathway from beginning to end, although those purchases represented 26% of value.

Only 5% of purchases in India are made after consumers have followed a mixed online-offline pathway.

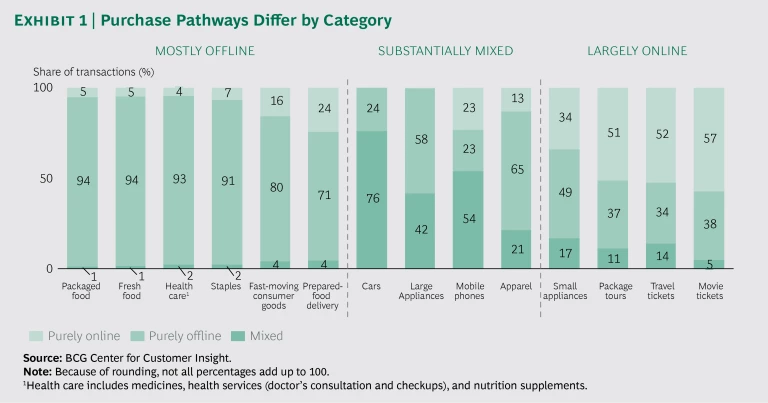

The importance of omnichannel presence varies considerably across categories. Companies also assume that shoppers in India are adopting omnichannel behaviors across categories. However, our research reveals large variations in behavior from category to category. The implication for consumer companies is clear: they must know which pathways best match their products and services. (See Exhibit 1.)

For example, almost all fresh-food purchases are made through purely offline pathways. Only 1% to 2% of fresh-food transactions are the result of mixed online-offline pathways—not surprising, given the frequency of purchases, low unit prices, and the limited need for research in food products. However, in big-ticket categories, such as mobile phones and large appliances, consumers often use mixed pathways. Some 40% to 50% of all purchases of mobile phones and major appliances by India’s urban internet users are made via mixed pathways.

Where online platforms for a category are well established, Indian consumers use purely online pathways. For example, Indians use mixed purchasing pathways to complete only about 10% of transactions for hotel rooms and airline tickets.

The survey revealed differences even across subcategories. For example, within the apparel category, 32% of shoppers are willing to buy accessories online sight unseen, but only 22% will use the internet to buy shoes. The other 78% still go to a store to see the new styles and try them on.

Impulse buying is making some purchasing pathways simpler. As more and more consumers use multiple channels and touch points, some purchasing pathways are becoming more complicated. At the same time, however, many pathways are actually getting simpler. This is because of the growth of impulse purchases, made possible by anytime-anywhere connectivity on smartphones. The fashion sector, for instance, is particularly prone to such impulse buying: more than half of online fashion purchases are unplanned. Many of the consumers we interviewed said that they browse for deals every day during their free time. A 35-year-old mother of two, for example, mentioned that she goes online while her children do their homework and will often make a purchase if she spots a good deal or sees attractive new styles.

Impulse buying is not limited to fashion. Online shoppers in India are also making unplanned purchases of packaged food and fast-moving consumer goods, such as detergent powder, often in response to special offers. Impulse buys account for 30% to 40% of online purchases in these categories.

The same shopper follows different purchasing pathways on different occasions. Companies typically segment consumers by demographics, attitude, and other factors, assuming that any given consumer’s behavior will remain constant despite varying contexts. In reality, however, consumers will take different pathways for different occasions. For example, a consumer might use one distinct pathway when shopping for apparel for a special event and another when shopping for everyday apparel. While the pathway to purchasing apparel for special events is more likely to be mixed, with research being done both online and offline, shopping for everyday clothing is likely to follow a pathway that is either purely online or purely offline.

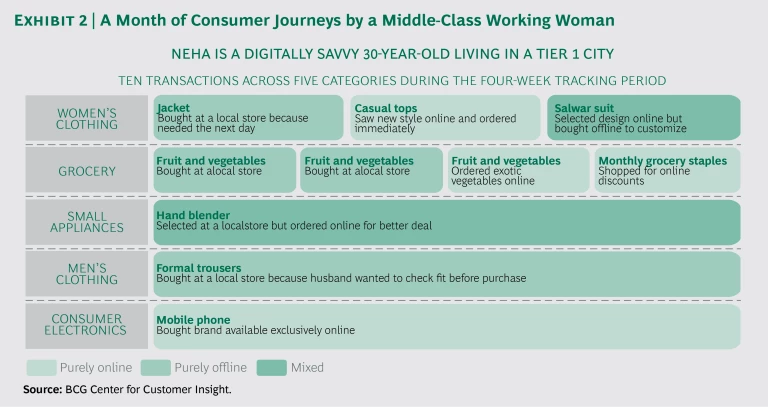

A shopper we’ll call Neha exemplifies these varying buying behaviors. Neha is a 30-year-old woman who lives in Lucknow with her husband and son. She and her husband both work, and they are members of the middle class. She has been using the internet for more than eight years and relies on online shopping sites for both research and purchases.

We tracked four weeks of Neha’s shopping behavior to understand her preferred pathways across transactions. She made ten purchases in five categories, using a variety of pathways. (See Exhibit 2.) She bought a jacket in a purely offline pathway because she needed it the next day. She bought two casual tops following a purely online pathway when she saw some new styles available at good prices. She followed a mixed pathway to buy a festive salwar suit, doing research both online and offline before purchasing offline. In food and grocery, she completed four transactions, each of which was achieved with a pathway that was either purely online or purely offline.

Comfort with digital—not demographics—determines purchasing pathways. While there are certainly differences in the shopping behaviors of consumers in their 20s and those in their 40s, we find that the more important divisions are between consumers who are very comfortable with online channels and those who are less invested in online shopping. Those who frequently buy online, for example, clearly have higher confidence in online channels than those still dabbling with digital shopping. Frequent online shoppers are also 3.5 times more likely to follow a purely online pathway to purchase. They’re far more willing to buy big-ticket items online, as well: 11% have bought major appliances, mobile phones, or furniture from websites, compared with 1% of occasional online shoppers.

That said, we do see demographic differences in some categories. City size, for example, appears to affect consumers’ choices of purchasing pathways. For example, only 20% of mobile phone buyers in tier 2 and tier 3 cities (those with populations of between 0.1 million and 1 million) adopt purely online pathways, compared with 51% of buyers in major metropolitan areas. In tier 2 and tier 3 cities, 68% of shoppers use mixed pathways to buy mobile phones.

A To-Do List for Consumer-Facing Companies

If long-held assumptions don’t match the realities of how Indians actually use the internet when making purchases, what must consumer-facing companies do now?

Their first priority must be to recognize the risks of doing nothing. India’s consumers are being targeted by a host of clever startups that respond rapidly to changing consumer needs. Incumbents must also keep a close watch on shifts in consumer pathways and build channel capabilities accordingly. BCG has identified the following actions that can help.

Incumbent retailers must keep a close watch on shifts in consumer pathways and build channel capabilities accordingly.

- Build and strengthen individual channels first. Given digital’s growing influence on Indians’ shopping, retailers have to be active in both online and offline channels. However, because only 5% of transactions in India follow a mixed pathway, it is important that retailers get each channel working effectively before attempting to integrate them. To do so, companies will need to develop a nuanced understanding of their consumers’ current experiences and identify opportunities to improve performance along each purchasing pathway.

- Strengthen the pathways relevant to your category, and target consumers. For categories in which many consumers use mixed pathways, companies must tightly integrate online and offline touch points. For example, in stores that sell consumer durables, an associate with a tablet or smartphone can help shoppers check the complete assortment of products—including stock that is not immediately available in the store that day—and video displays can provide unbiased brand comparisons. Such touch points can help improve closure rates for in-store sales. For other categories, optimizing the online experience should be the priority. This includes investing in digital marketing to drive site traffic, providing consumers with a great user experience, and developing ways to use consumer data to personalize shopping experiences and offers.

- Design to deliver for different needs in different situations. Consumer-facing companies have to get to know the context of shoppers’ use of different channels. They must identify which pathways are significant and ensure that they can deliver on consumers’ needs in each context. For example, in the eyewear sector, speed of implementation is crucial if a shopper wants to replace broken glasses.

- Align channels closely with the roles they play in consumer pathways. Channel roles are shifting. The online channel, for example, has become an important research tool for automobile shoppers. Today, 43% of India’s new-car buyers select the model they want through online research before visiting a dealer showroom. The visit to the dealer is about completing the transaction. So, much of the brand-building effort for car dealerships should move online, while the focus at the physical store should emphasize a superior customer service experience. Given these shifts in car buying, automobile companies worldwide are reexamining the roles of their dealership channels.

- Design for impulse purchases. Companies must design their channels to handle the significant volumes of impulse purchases now happening online. This can include sending personalized communications, optimizing digital placements, developing a digital presence across multiple online media channels, and providing easy-to-use payment and return options.

Indian consumers are embracing online channels, but they are doing so on their own terms. The rise of digital doesn’t translate directly into a rush to purchasing everything online. Rather, it is enabling Indians to complete their purchase journeys, both offline and online, in a wider variety of ways. Many consumer-facing companies must do much more to understand the shifts in Indians’ shopping behavior. They should study their customers’ use of different channels and track the shifts in purchasing patterns over time. They also must assemble the talent and build the capabilities needed to address those shifting patterns. Companies that stay on top of the changes in consumer behavior will be well placed to succeed, regardless of how Indians choose to shop.