With the Internet of Things (IoT) poised to generate billions of dollars in economic value over the next ten years, companies have flocked to the IoT platform market, vying to become the go-to vendor. Platforms account for just €15 billion of the €250 billion that will be spent on IoT in 2020. (See “ Winning in IoT: It’s All About the Business Processes,” BCG article, January 2017.) Nevertheless, they have a pivotal strategic role to play in a much higher-stakes competition. Equipped with a superior platform and with incentives for developers to use it, platform vendors can gain market share in the fast-growing upper layers of the technology stack—namely, IoT applications and analytics. More than 400 companies offer IoT platforms today. Enterprise software and service companies and IoT startups account for the largest portion (22% and 32%, respectively) of companies that claim to offer IoT platforms. In addition, industrial technology providers (at 18%) are offering IoT platforms in an effort to shift away from a hardware-centric business model. Internet companies and telcos make up the remainder of the IoT platform vendors.

Although some companies are emerging from the pack as possible leaders, choosing the right provider from the plethora of companies vying for the platform market remains a challenge. Buyers are looking for insight into how to make the best choice when selecting an IoT platform today. The most useful approach, we believe, includes analyzing the ecosystem from the vendor’s perspective and identifying the key factors that will determine which companies win the IoT platform wars.

The IoT Platform Market Is Not as Crowded as It Looks

Despite the abundance of IoT platform vendors, most offer only partial solutions. In our view, partial solutions shouldn’t be called IoT platforms at all. A product that simply manages connectivity or enables applications is a connectivity management platform or an application enablement platform, but it’s not a comprehensive IoT platform. The term platform is so loosely defined and overused that it has lost its significance, contributing to buyers’ confusion.

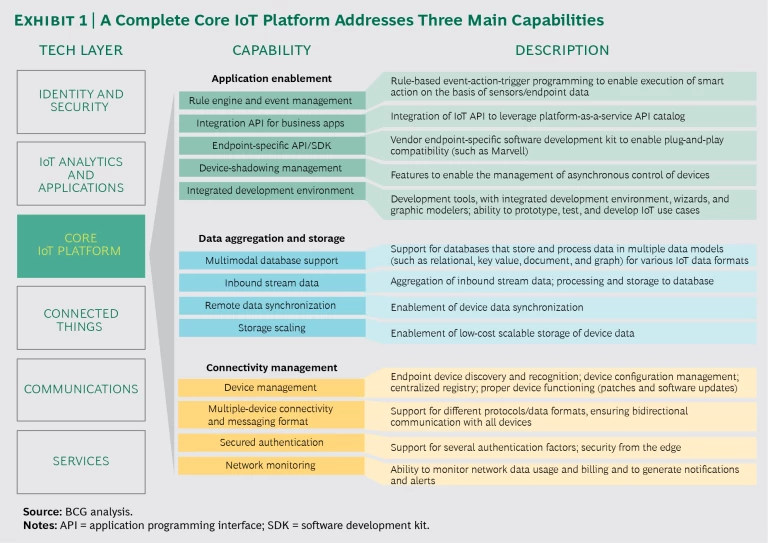

Fundamentally, an IoT platform connects devices, applications, and data so that users can focus on their use case rather than on the wiring linking the various platform components. A comprehensive IoT platform delivers three main capabilities: application enablement (to customize IoT solutions), data aggregation and storage (to capture and store data that will generate insights), and connectivity management (to automatically connect systems, networks, and devices). (See Exhibit 1.) This view of a core IoT platform excludes technology layers where reliance on multiple vendors may be desirable (such as network management) or where a one-size-fits-all enterprise solution (such as security or analytics) is unlikely.

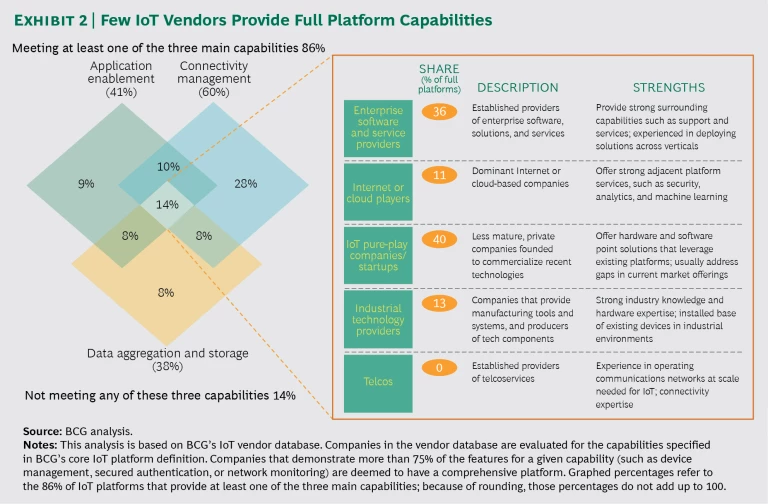

In our analysis of vendors that claim to offer an IoT platform, only a small percentage (less than 15%) met the criteria we have defined. (See Exhibit 2.) However, that still leaves approximately 50 vendors to choose from. It might seem prudent for buyers to wait until one or two platforms emerge as winners, but that approach poses its own inherent risks. Bearing in mind that note of caution, we have highlighted some key characteristics that will help determine which platforms ultimately prevail over the competition.

Developers Drive Platform Adoption

Many factors contribute to the success or failure of an IoT platform, but one of the most important is the question of whether developers want to use it. When members of a community of developers rally around a platform, the benefits compound quickly, leading to a host of innovative applications and a strong talent pool. So far, no single IoT platform has attracted a uniquely large and loyal developer community.

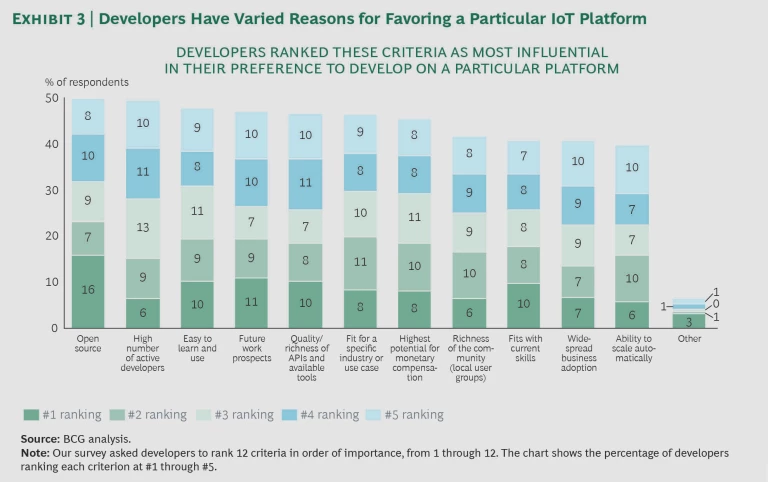

To assess what makes a platform attractive to the developer community, we asked more than 300 developers to rank their top criteria. (See Exhibit 3.) In our survey, developers reported being roughly evenly divided in their use of the top six platforms. But history tells us that two or three IoT platforms will ultimately prevail, as happened with Windows and Mac OS in computer operating systems, Android and iOS in mobile phone operating systems, and PlayStation and Xbox in gaming systems.

First and foremost, developers want a platform to be open (and the industry is certainly moving that way these days), giving them access to communities and knowledge sharing. Survey respondents also highlighted four other criteria that they look for in a platform: it should improve their future work prospects, be easy to learn and use, offer rich application program interfaces (APIs) and developer tools, and fit with their current skills. Some businesses have effectively used financial incentives, as well, to attract developers to a specific platform. In 2006, for example, the venture capital firm Kleiner Perkins Caufield & Byers invested $100 million to fund companies that created apps for Apple’s iPhone (iOS) mobile platform, a move that ultimately helped the iPhone displace the BlackBerry (and its BlackBerry OS) as the leading smartphone platform.

It follows that developer communities are likely to play a key role in separating the winners from the losers in IoT platforms. But with hundreds of companies competing in a fast-growing market—the IoT platform market has a compound annual growth rate of nearly 40%—companies can’t afford to wait for the dust to settle before choosing a platform. With that in mind, we have identified four factors that companies can use to identify the right IoT platform amid all the noise.

Key Factors in Selecting the Right IoT Platform

These guidelines can help buyers narrow the field and zero in on the IoT platform that best suits their business needs.

Select a fully capable platform. The first priority is to select a vendor that offers all three IoT capabilities outlined previously: application enablement, data aggregation and storage, and connectivity management. Having these elements in place and fully integrated is important. If a company buys a platform that lacks one or more of these layers, it must import them from elsewhere, introducing unnecessary complexity and cost. Adjacent capabilities such as analytics and machine learning are also becoming increasingly important in unlocking value in IoT. That said, in some situations companies may not need all three primary capabilities. For example, a company that works with a machine-to-machine or IoT connectivity provider will already have built-in connectivity and device management capabilities. In short, the right path forward depends on the company’s starting point.

Evaluate your risk appetite. Startups are responsible for a significant portion (40%) of comprehensive IoT platforms. In 2015, startups offering IoT platforms attracted $450 million in funding. A number of them have developed attractive products. They also move quickly and are responsive to customers’ needs—but they have a common vulnerability with regard to stability and staying power. By their nature, startups tend to be untested, and their long-term potential is unclear. Buyers that accept the risk of working with startups can benefit from a platform customized to their needs. Still, 65% of the enterprise buyers we surveyed expressed a strong preference for platforms sold by large software and industrial technology companies. The large software companies catering to these buyers will likely try to maintain their popularity by continuing to fill the gaps in their platform capabilities through organic and inorganic moves. The industrial players, for their part, have offered IoT platforms to complement the connected machinery and equipment they provide. Their expertise in industrial applications and the backward compatibility of their offerings with existing equipment could tip the scales in their favor in certain sectors, at least among current customers.

Match the platform to your developers’ skills. Companies should ensure that the core IoT platform fits with their development team’s skills, bearing in mind that even comprehensive platform offerings will require some implementation work. IoT platforms may require proficiency in a specific programming language. If developers are expert Java programmers but need to become proficient in Python for the new IoT platform, for example, the skills gap will slow implementation. In our survey, 40% of developers reported that they were never consulted during the IoT platform selection process. But most developers (69%) rated the difficulty of filling gaps in their current IoT platform as “moderate” or “hard,” and a fair share (40%) found learning a new IoT platform harder than learning other programming frameworks.

Consider openness and ease of integration. Companies should select an IoT platform that meets their business needs and permits deployment with minimal disruption to existing systems. Buyers should consider up front whether the IoT platform features openness and ease of integration. An open framework will be modular, with easy-to-use APIs, and an easy-to-integrate framework will fit smoothly with existing IT architecture. This is particularly important for companies that have an enterprise service bus or a complex event-processing architecture in place. Industrial providers are often in a good position to handle manufacturing and logistics because their connection to the IT environment for those sectors can help them smoothly integrate the new framework with legacy systems. Attention to these factors can make the difference between a fast deployment and one plagued by lengthy and costly delays.

Select the platform business model that fits your needs. Although several leading platforms offer horizontal connectivity, as well as application and data capabilities, others add a number of vertical-specific applications and services. These services can help shorten the time to value for an IoT platform and reduce the resources that companies developing IoT applications must devote to getting their IoT endeavor off the ground. Vendors that offer apps often give away the platform for free and use a subscription or consumption model to charge customers for applications and other services. The economics of such a model can be favorable for tighter budgets as well as for companies starting to test the potential of new IoT-based services.

With so much change occurring in the IoT space, the platform ecosystem will continue to be fragmented for the foreseeable future. But companies stand to lose more than they gain by waiting for the dust to settle. Buyers should follow the five guidelines suggested in this article to avoid getting bogged down in a painful effort to obtain full functionality from an incomplete platform. In particular, companies need to find a comprehensive platform provider that matches their risk profile and business model for IoT. And platform providers need to be very clear about how they differ from their rivals. For any hope of longevity in the market, providers must offer a complete platform that appeals to developers—because developers will ultimately decide who wins and who loses the platform wars.