As companies in all industries explore the rising power of artificial intelligence (AI), they face a familiar dilemma: Should we build or buy? This is rarely an either-or choice. AI vendors have attracted most of the AI talent, so companies are compelled to work with them. At the same time, AI vendors rely heavily on data that only their customers can provide, so such vendors need to work more closely with clients than they may be accustomed to doing.

Consequently, companies have several challenges. They must decide how to select and work with AI vendors both efficiently and in ways that strengthen rather than sacrifice competitive advantage. And they should have a plan for building their internal AI capabilities in an era of short-term scarcity.

Why AI Is Different

Recent computing advances—fostered by Moore’s law and its corollaries, as well as big data and algorithmic advances—have caused AI business applications to mushroom. Many of them also take advantage of recent advances in vision and language by machines. (See “Competing in the Age of Artificial Intelligence,” BCG article, January 2017.) Machine vision, for example, is a core component of robots, drones, and self-driving vehicles, while speech recognition and natural language processing are integral to document processing, chatbots, and translation devices.

But until recently, AI was largely relegated to an academic niche. As a result, few seasoned professionals currently work in the field—and still fewer of them understand business processes, such as supply chains, or have experience interacting with business executives. This supply-and-demand imbalance will eventually self-correct as academic institutions around the world, including those in China and Eastern Europe, respond to market demand by churning out greater numbers of AI-trained graduates. Until that happens, the question remains how—not whether—to work with AI vendors.

Vendors play a distinct role in an AI world. That’s because AI learns inductively—through trial and error, best guesses, and feedback. Vendors, therefore, need to train their AI tools using data, which often includes sensitive information from their clients. As a result, vendors normally cannot sell plug-and-play applications; they need to work closely with their clients on AI training both during and after the run-time deployment. (See the sidebar.)

Getting Smart About AI

Getting Smart About AI

Companies that pursue AI strategies should have a grounded understanding of how the field differs from other technological endeavors and how they should approach their decisions about what tasks to outsource, what things to do in-house, and what skills to develop.

Data and Tools

Most AI algorithms are available for free, and by themselves they are rarely a source of competitive strength. They need to be trained on data. Vendors should be measured by their ability to help companies manage the interplay of data and tools and by their ability to work side by side with business executives. At the same time, business executives should develop a practical and intuitive understanding of AI in order to maximize the effectiveness of their supplier relationships.

Bias

Because AI is inductive, looking for similarities in the training data, the algorithms are subject to three biases: observation bias, selection bias, and model or forecasting bias. In particular, when the training data is not carefully scrutinized, companies can inadvertently discriminate against minorities, run afoul of regulators, or be exposed to “black swan” events. This is aspect of data-tool interdependence is absent from most other technological domains; it requires companies to understand, adjust, and potentially complement the data feeding their AI engines.

Black Box

The use of inductive learning essentially makes AI an “intuition machine.” As a result, it is often hard to understand in hindsight why an algorithm generated a particular answer. Remedies to this black-box problem constitute an active field of research. For the practitioner, a simple rule of thumb is to build transparency into the upfront design specification. This is especially relevant in regulated industries and situations in which liability issues can arise.

Cybersecurity

Since AI always involves partial or full automation of decision making and action, and often includes highly sensitive data and cloud-based architecture, cybersecurity becomes a top priority. When choosing a vendor or platform, companies should make sure that their data will be protected from a potential breach.

AI can bring both enormous benefits and disruption. With such high stakes, companies cannot afford to play a passive role. If they are careless, for example, they may share valuable intelligence that weakens their competitive position. And if they don’t build internal capabilities, they risk becoming dependent on vendors.

When assessing AI’s potential, executives should be familiar with the current capabilities, limitations, and potential of what we call the AI building blocks. These blocks, such as machine vision, are functioning units that contribute to creating an operational application. Every use of AI incorporates one or more of these building blocks, and each block relies on a collection of algorithms, application programming interfaces, and often pretrained data. (See “The Building Blocks of Artificial Intelligence,” BCG article, September 2017.)

Dissecting the Build-or-Buy Dilemma

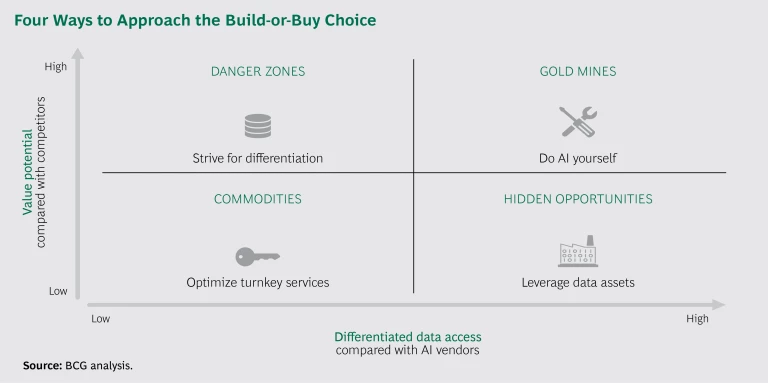

Companies can work with AI vendors in many ways, ranging from outsourcing an entire process to buying selected services, seeking help in building in-house solutions or training internal staff. Executives should view these options in light of two questions:

- How valuable is the process or offering to your future success?

- How strong is your ownership, control, or access to high-quality, unique data, relative to the AI vendor?

By analyzing the AI landscape in this way, companies will discover that their AI efforts land in one of four groups. While the boundaries may be fuzzy, and assessments may shift over time, each of these groups shares similar sets of challenges and opportunities. (See the exhibit.)

Commodities. This area is the closest to an off-the-shelf solution and a great entry portal into AI for companies. They can share data with vendors without fear of losing competitive differentiation. If they manage their relationship with vendors properly, they can lower costs and improve the performance of such processes as HR, finance, IT infrastructure, and maintenance. It is the proverbial low-hanging fruit of AI.

Business process outsourcers are revising their business models to take advantage of these opportunities. Infosys, for example, recently required all employees to undergo intensive design-thinking training in order to spur them to come up with ways both to automate their current jobs and to offer clients creative AI-technology-enabled solutions.

Many smaller vendors offer turnkey AI services for specific subprocesses. For example, HireVue screens job candidates for Goldman Sachs on the basis of such characteristics as word choice and facial expression, which an AI engine analyzes. HireVue currently has a database of more than 20 million video interviews—a data trove that an individual user company would be challenged to duplicate.

Before entering into negotiations with a vendor, companies should do their homework to understand the value of these AI-enabled offerings and the vendor’s distinctive contribution. A wind park operator, for example, conducted proof-of-concept work internally before negotiating with an AI turbine vendor on a predictive maintenance contract. By establishing a new baseline of what it could achieve without the help of the vendor in terms of greater uptime and lower maintenance of its turbines, the operator managed to strike a better deal.

Hidden Opportunities. Sometimes companies have access to data sources in areas that are not critical to competitive advantage. These data sources provide an opportunity for companies to tap into the technological expertise of AI suppliers and to generate quick wins and insights.

Woodside Energy, for example, worked with IBM Watson to make 30 years of expert knowledge gained from oil platform operations accessible to all employees in the company. The company relied on Watson’s natural language processing technology to analyze and classify all data, including 38,000 written documents. Users can ask simple questions, such as “What is the maximum weight of a helicopter landing on the platform?” Although Woodside worked with IBM Watson on the project, it maintained proprietary control of the underlying data.

These approaches can pay dividends in several ways. Often companies can uncover a hidden treasure in massive collections of data and gain skill and experience in training AI algorithms. More ambitiously, companies could conceivably partner with a data-constrained AI vendor to sell application services, pretrained on the company’s data, to other companies in related fields. These arrangements could be exclusive, or several companies could work on a data-sharing pool with a vendor.

Danger Zones. Danger zones pose both perils and opportunities. The perils arise because vendors have better access to data than the companies themselves in strategically critical areas. When companies are in a danger zone, they should take care to limit their dependency on the vendor and minimize the possible loss of competitive differentiation. But if companies can manage the relationship well and develop or acquire their own competitive sources of data, danger zones can morph into gold mines—areas of strong competitive importance and data differentiation.

For health care providers, machine diagnosis of radiological images is a danger zone. By working with hospitals, research organizations, and others, a vendor could conceivably create a comprehensive, high-quality database of images that would trump the capability of any single provider. For instance, a company called Arterys is building an AI system in the cardiovascular field that protects patient privacy and is continually improving.

Arterys is a small company. But at scale, automated diagnostics can fundamentally alter industry dynamics and value creation for health care providers, medical technology companies, and insurers. All these companies need to develop strategies that take advantage of the transformative capabilities of AI.

A large metals producer recently took those steps when it recognized that competitors, suppliers, and other vendors within its industry could pool data and gain a powerful edge. The company began to acquire data on prices, suppliers, and materials from a wide variety of public, research, and industry sources. This database will allow the company to accelerate both its AI and R&D efforts and its success in the market. It can potentially open new business opportunities by providing complementary services to other industry participants.

Companies in a similar situation should have data-acquisition strategies that will support their AI activities. They need to find ways to acquire differentiated data, create a novel data mashup from multiple sources, or even acquire suppliers of data in areas critical to their competitive advantage. Without a distinct collection of data to feed into their AI engines, they will be stuck in a bad place.

Gold Mines. Companies need to do AI themselves when they have a gold mine. Vendors and experts can be brought in to accelerate development but only in supportive roles.

A global tire manufacturer followed this approach when it developed an AI platform to predict demand at individual stores for individual models of tires based on anticipated tire wear. The tool, whose development BCG Gamma supported, relies on more than 1.6 billion public and private data points and helped to increase overall sales and reduce inventory levels at dealers.

Many of the most promising gold mines will necessarily involve managing complex “frenemy” relationships with suppliers. In the self-driving vehicle market, for example, all manufacturers deal with the leading AI vendors for various services. In such an environment, companies must have a sharp sense of what they should manage in-house, when they must look externally for data or expertise, and how to protect their competitive position. Ultimately the greatest value may emerge through cooperation. By partnering with other companies, vehicle manufacturers could conceivably create a global platform that facilitates self-driving vehicles more effectively than any of them could do on their own.

More so than for the other three groups, gold mines require strong in-house talent and the right mix of vendors providing expertise and project management. Robust negotiation and vendor management skills are critical, as are the transfer of knowledge and the training of in-house staff.

The analysis outlined here should help companies become more efficient and effective in structuring and sourcing AI applications and capabilities. Decisions such as whether to build or buy an AI product or service are too important to be approached haphazardly, but uncertainties should not stand in the way of progress. Companies should make decisions within the context of a coherent data strategy, the pursuit of competitive advantage, and a recognition that boundaries will continually shift over time. Areas of competitive differentiation will evolve, and data pools that are distinctive today may lose their value as data continues to proliferate. In this dynamic environment, acting systematically, intelligently, and decisively will itself help secure the future.

The BCG Henderson Institute is Boston Consulting Group’s strategy think tank, dedicated to exploring and developing valuable new insights from business, technology, and science by embracing the powerful technology of ideas. The Institute engages leaders in provocative discussion and experimentation to expand the boundaries of business theory and practice and to translate innovative ideas from within and beyond business. For more ideas and inspiration from the Institute, please visit Featured Insights.