This report—the third in a series—is based on a proprietary cross-industry survey of 700 corporate treasurers and CFOs from organizations worldwide with consolidated annual revenue of more than $500 million. The survey was conducted by Expand Research (a wholly owned subsidiary of The Boston Consulting Group) for BNP Paribas and BCG. In addition, the researchers interviewed 20 corporate treasurers and CFOs at multinational organizations included in the survey. This third edition builds on the findings of “Corporate Treasury Insights 2016: It’s All About Security and Client Experience” and “Corporate Treasury Insights 2015” The current report adds two topics that increasingly concern treasurers: trust and delivery excellence.

Winning the hearts, minds, and business of today’s corporate treasurers requires banks and other treasury service providers to demonstrate credibility, reliability, and relationship excellence. Those attributes build trust—and while banks once dominated in this area, gaining and maintaining that trust now has become far more challenging.

As treasurers respond to a more uncertain and complex environment, their transaction banking needs are becoming increasingly polarized, with half of the typical treasurer’s day spent coping with day-to-day transactions, cash flow, and liquidity-related operations, and the other half spent addressing long-term strategic needs and business risks. We call this day-to-day transactional role “the morning treasurer” and the strategic role “the afternoon treasurer.” While the morning treasurer seeks a fully digital and frictionless experience to manage recurring needs, the “afternoon” treasurer wants a business partner to advise on wide-ranging financial issues. These divergent needs have made it harder for transaction providers to understand and meet changing treasurer expectations. All of this threatens to erode long-standing relationships between treasurers and their transaction bank and have opened the door to nontraditional partners, such as technology providers and fintechs.

The Battle For Treasurers’ Trust Has Begun

For today’s treasurer, innovation has introduced complexity, new opportunities have brought risks, and new responsibilities have strained resources. Against that backdrop, treasurers are looking for a stable, reliable, and experienced partner. While banks would seem to have a natural advantage in this area, given their long-standing client relationships and strong governance, few banks have evolved their service models rapidly enough to keep pace with changing treasury needs. Compared with the digital processes and client-centric experiences technology providers and fintechs offer, many banks still rely heavily on decades-old methods—leaving them increasingly exposed to customer defection.

An Increasingly Uncertain and Complex Environment

Where treasurers were once charged with managing just a few critical threats to the broader business, that number has grown considerably. Since our last report in 2016 (“Corporate Treasury Insights 2016: It’s All About Security and Client Experience,” BCG and BNP Paribas, May 2016), the number of critical business risks that treasurers manage has more than doubled—growing from two to three in 2016 to five or six in 2018.

Economic risk continues to be the top concern for treasurers globally. At the same time, however, cybersecurity has become increasingly important. Our 2018 survey finds that treasurers now consider cybersecurity threats to be their second-most important risk, followed by operational risk, auditing, accounting, and reporting.

Treasurers also face increasing regulatory pressure. The combination of tougher international regulations and local regulation, especially in rapidly developing economies (RDE), means greater operational demands for most treasurers. As one treasurer we interviewed noted, “In Latin America, we need to comply with stricter national rules. But since part of our activity is with North American banks, we need to comply with their regulations as well.”

Moreover, the service provider ecosystem has become more complex and fragmented, with new fintech players entering the market and enterprise resource planners (ERP) and treasury management system (TMS) providers gaining traction. While those expanded options give treasurers more choice, they also throw up more complexity—leaving treasurers unsure which partners to trust to manage which set of needs.

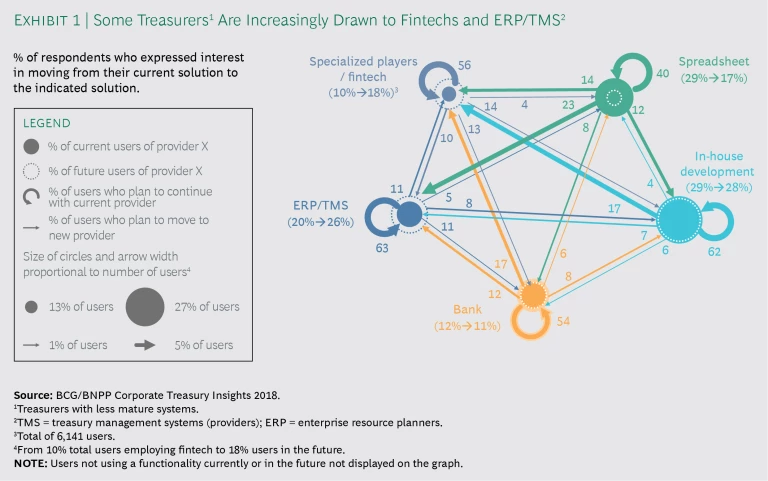

That uncertainty will likely lead to increased flux. One-half of survey respondents said they are considering changing their service provider in the coming years. ERP, TMS players, and fintechs will likely benefit from this shift, since 31% of treasurers who now rely on internal solutions, such as spreadsheets, say they’d be interested in moving to a TMS or fintech provider, compared with 7% who indicated they would prefer a bank portal. (See Exhibit 1.) Respondents from less-mature markets, many of whom currently rely on in-house solutions, are especially likely to move to fintechs. Interviewees from these markets said that they “are pretty receptive to fintechs” and that “fintechs are a hot area right now.” For many treasurers, “efficiency is a major goal,” and as one told us, “we’re pretty agnostic in how we get it.”

Banks’ Historical Edge Is Eroding

In this more complex environment, trust and confidence have become crucial attributes for treasurers. While price remains very important (“It’s a major element,” said one interviewee), delivery capabilities, service level, and business knowledge have become increasingly crucial. Time and again, the treasurers we interviewed mentioned the need for trust. One treasurer said he sought “a best friend.” Another said, “I need a trusted advisor to me, to my boss, to my boss’s boss, and finally to my business.”

This need for dependability and expert guidance explains why treasurers are sometimes described as conservative in their provider selection and why there has been relative stability and low churn in core provider relationships.

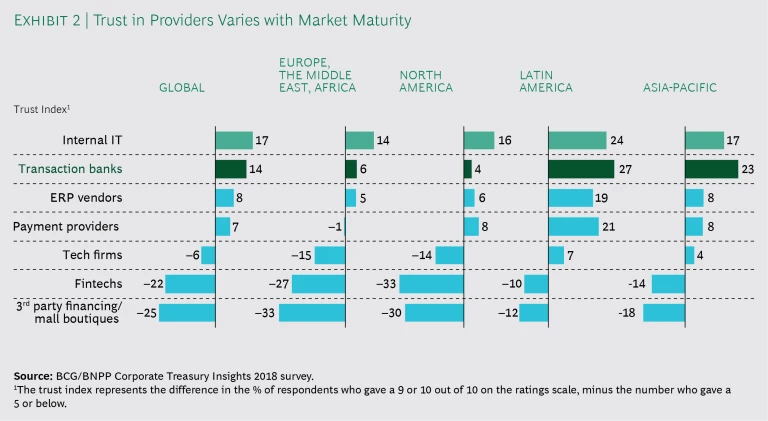

Many treasurers view banks as an intrinsic part of the corporate family, on a par with internal functions. Of those surveyed, for instance, approximately 65% said they have a high level of trust in their banks, which is nearly the same degree of trust that treasurers extend to internal IT (68%). At the same time, the survey revealed a shift: treasurers no longer see banks as their sole trusted advisor. As their needs have evolved, treasurers have become more open to working with other service providers. This is especially true in more mature locations, where treasurers’ interest in automated and self-service execution and the growing delivery and technological capabilities of ERP/TMS vendors has shifted the trust balance. In North America and in Europe, the Middle East, and Africa, treasurers regard banks with about the same degree of trust as they do technology providers, far lower than the level of trust that banks enjoy in other geographies. (See Exhibit 2.)

As the trust battle grows, our survey suggests that it will likely play out most acutely between banks and ERP/TMS. By contrast, many treasurers still look on digital giants as retail providers and fintechs as niche innovators. They see neither as mature or relevant enough to run critically important services. One treasurer said, “I don’t see what GAFAs [Google, Amazon, Facebook, Apple] would do here. It’s science fiction to me.”

Banks Need To Rethink Their Delivery And Relationship Models

Winning the confidence of corporate treasurers takes inherent trust, delivery excellence, and relationship excellence. Those factors are fairly simple to understand, but they come with subtleties that can shape a treasurer’s expectations. (See Exhibit 3.) The growing polarization in the treasurer’s role makes mastering those subtleties harder than ever.

Leveraging the Trust That Banks Command

Treasurers see banks as a safe harbor because they are highly regulated and command significant institutional strength and budgetary resources. That inherent trust makes it harder for other providers to enter the market, even if they get a banking license. Said one treasurer, “Trust is almost a given when you’re dealing with banks, especially since they need to comply with rules in order to conduct business and protect their business and assets.” Working with banking partners that understand and comply with local and cross-border regulations is a key requirement. This is especially true for treasurers in developing economies, where the regulatory environment is more challenging to navigate.

The reciprocal relationship treasurers have with their banks reinforces that trust. The fact that banks engage their balance sheet to contribute to company funding, for instance, makes them a privileged partner, with mutually aligned interest in the company’s success. In addition, because bank funding is often long-term in nature, that ongoing balance sheet relationship can continue to reinforce the client relationship.

Fintechs and ERPs are not able to create that same bond. As one interviewee stated, “I trust people who trust me. I am more likely to buy products from someone who has already proved their trustworthiness to me. There’s no such bond with services contracts.”

In addition, while banks often perceive their regulatory and compliance obligations as a constraint, their significant experience managing those requirements has become a marketable asset. Such experience can help banks provide treasurers with greater assurance and value, especially since treasurers face a growing compliance mandate of their own. The same is true of cybersecurity. Banks’ investments to improve their cybersecurity posture offer a competitive advantage: treasurers can feel confident that they are dealing with a partner that is fully compliant and that can advise them on cybersecurity matters.

Delivery Excellence Is Mandatory

Treasurers are increasingly polarized in their approach to delivery excellence, depending on whether they are managing business-as-usual activities (the “morning” treasurer) or longer-term strategic projects (the “afternoon” treasurer). While both needs depend on consistent, high-quality process execution and advisory services, they differ significantly in the types of operations performed, the time-period considered, and the people and interactions involved.

The morning treasurers want their transaction banking partners to deliver service over digital channels in order to streamline and speed the execution of core business activities. Our survey showed a clear uptick in interest in digital service. Fully 60% of treasurers now say they are interested in using digital channels, compared with 50% in 2016. Mobile applications, in particular, are likely to attract treasurers, a trend that was virtually nonexistent in 2015, when less than 5% of treasurers expressed interest. Now the number of those asking for mobile applications—and the use of mobile to assist with order execution—is close to 30%. That’s especially true in RDEs, where the use of mobile may leapfrog other digital channels. In general, we found that large companies and those operating in mature markets expected their transaction banking providers to demonstrate much greater digital sophistication and offer digital channels as part of their delivery models.

For afternoon treasurers—who are engaged in addressing strategic projects—data enrichment, subject matter expertise, and personalized service matter increasingly. Strong systems and security, and compliance with data security standards, including the General Data Protection Regulation (GDPR), are other important criteria for companies across regions. As one interviewee stressed, “I just assume that the [provider] system works.” Relevant advisory on more strategic issues as well as routine operations is also a basic requirement. Providers gain no differentiation from filling these requirements, but meeting them is still a prerequisite to qualify as a trusted partner.

One area where transaction banks can gain differentiation is through agility. Flexible, responsive processes, enhanced advisory capabilities, and high-end service 24/7 can help banks retain strong relationships with their treasury clients. That service should feature proactive communication and prompt investigation of issues, all backed by digitized, integrated, and frictionless processes. Many interviewees told us they are “striving to obtain technology-enabled services, with all layers automated.” That includes digital reporting and tracking tools, application programming interfaces, fully digitized know-your-customer services, and real-time advice and insights.

Many treasurers interviewed echoed the need for proactive service and advice, although regional preferences emerged in some areas. Treasurers in Asia-Pacific were more likely to favor transaction bankers that had strong IT systems, whereas those in North America and Latin America put a higher priority on service, and those in Europe and the Middle East wanted greater personalization.

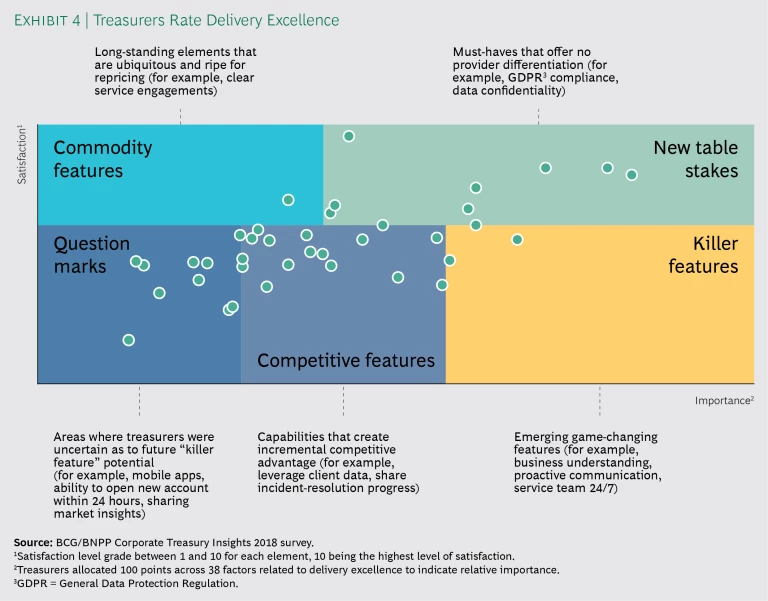

Our survey asked treasurers to consider which service criteria were most important to them. (See Exhibit 4.) Respondents chose among five categories. “Commodity features” are basic service requirements expected of all providers. “New table stakes” include more recent prerequisites, such as data security standards, that are important but provide no real differentiation. “Competitive features” include incremental improvements and extensions to existing features and capabilities. “Killer features” are game-changing capabilities and offerings, and items marked “question marks” encompassed features that treasurers weren’t sure would or should become differentiating factors.

Treasurer responses regarding “new table stakes” are broadly uniform across companies and geographic areas. Regarding “competitive features,” treasurers in North America and Latin America emphasize service level, while those in Asia-Pacific are especially interested in ensuring that providers have strong IT systems. Treasurers in Europe, the Middle East, and Africa are most interested in having their partners provide a customized relationship.

We then asked treasurers to rate their in-house or provider ability to deliver the best service in each category. Most respondents gave the highest scores to their internal teams, followed by fintechs, ERP/TMS, banks, and digital giants. Banks came in second-to-last in 36 of the 38 criteria tested in the survey—a fact that should be a wakeup call to banking organizations. The data suggests that banks should continue to invest in “new table stakes” while building out their “killer feature” and other differentiator capabilities.

Reinventing the Relationship Model

Although digitization is reshaping many aspects of service delivery, human interactions could play a decisive role in transaction banking, with the senior banker role becoming even more important. Making the most of that opportunity will require that banks fundamentally rethink the relationship model. The amount of change needed promises to leave many players out of the race.

Our survey finds that roughly 75% of treasurers say they are willing to pay for advisory services that help them navigate complexity and steer their business. Said one client, “I want my bank to help me prioritize, to share best practices, and help me be more efficient.” Delivering that value requires business expertise, deep industry and client knowledge, and greater transparency, especially around pricing. Characteristics such as business understanding ranked as a major differentiator in the survey. One interviewee told us, “The person [partner] you’re engaging with has to understand your business very well and be an expert of your industry”—something some interviewees we spoke to said was often “easy for [partners] to say, yet hard to get.”

In addition, treasurers no longer want their relationship manager or senior banker to act as a gatekeeper. Rather, they are looking for an integrated client-delivery team that can provide swift, easy access to subject matter experts from across the provider’s business. “I want IT talking to IT, with no intermediaries,” one treasurer said. Treasurers also want flexibility in how those teams are composed, so that different skill sets can be added to address specific issues as needs arise. Treasurers want “first-time right interactions,” whether or not that interaction begins in a digital channel, with the relationship manager, the middle office, the product, or the IT specialist. Codesigning new solutions with clients in a relaxed, fun setup is no longer enough.

To provide a superior relationship model, banks will need to use data in more effective ways—such as pooling client data from across the bank, mining industry or functional knowledge, and personalizing the service and advice provided. Morning treasurers want data-enabled processes that help them cut through noise, flag errors, and filter issues and requests more effectively. Afternoon treasurers want providers to push relevant, customized, and proactive communication to them. According to one treasurer we interviewed, “the first banks that can get their hands around this will win big.”

Leveraging client data would enable better insights and allow banks and other providers to deliver more relevant, customized, and proactive communication to the afternoon treasurer. After years of providers pushing data use cases that treasurers hadn’t asked for, today banks should use data in the context of providing better client service, letting superior client intelligence improve the treasurer’s everyday experience. One treasurer said, “If digital systems could consistently detect errors and contact me proactively, that would be a major breakthrough.”

What It Takes To Win The Trust Battle

To become a trust champion, the service model must meet the specific needs of morning and afternoon treasurers. That involves creating low- and no-touch digital service to speed productivity for routine treasury activities while adopting a new and more integrated service model to supply specialist insights and advice. Data is a critical enabler for both. Transaction partners need to harvest the value of data everywhere to simplify and enrich process steps.

Zero Interactions in the Morning. The morning treasurer is complexity-averse. Reducing noise, steps, and delays are key. By integrating customer journeys and applying robotic process automation at scale, transaction banking providers can adopt a “zero-interaction model” that would appeal to morning treasurers who are looking for fast, stable, and efficient processes and the ability to complete routine needs quickly and with no fuss. As one interviewee said, “Automation is at the top of my agenda.” These morning treasurers don’t want to have to engage directly with their providers to carry out day-to-day operations. What they want instead is seamless service. “I want silence,” one treasurer told us. This is a major paradigm shift that requires both agility and consistently stable and available systems and processes.

Agile in the Afternoon. The afternoon treasurer wants agility and business intelligence. Banks can respond in one of two ways: by organizing their client teams in an integrated and cross-functional way or by collaborating with ERP/TMS or a payment service provider to build technology platforms that aggregate a variety of advisory and other services. Providers need to eliminate low-value intermediaries and process steps and focus instead on enabling treasurers to receive rapid access to the most relevant insights and service.

Those that blend the cross-functional knowledge and intimacy of traditional transaction banking service with the digital savvy, speed, and data maturity of a TMS provider or technology company will enjoy significant competitive advantage and stand a much greater chance of becoming a dominant player in transaction banking.

Data-Enhanced Everywhere. To meet the needs of both the morning and the afternoon treasurer, providers need to aggregate and apply client intelligence in their everyday experience. Treasurers are eager for banks to demonstrate client centricity in their data practices. Many of those surveyed indicated that they would be willing to share extra data with their banking partners to enrich and streamline processes and enable better cybersecurity, business, and other insights, provided there is no risk to the treasurer’s data integrity. Banks should take advantage of that opportunity, especially since it can allow for a differentiation that fintechs can’t meet. Most treasurers do not feel comfortable sharing data with fintech partners. One interviewee noted, “If I gave data to a fintech, I would feel that it gets shared with everyone.”

The duality of the treasurer’s role today has changed service expectations. Amid growing complexity and a larger remit, treasurers are looking for a trusted provider that can anticipate their needs, know when to engage digitally, and when hands-on advice is needed. Few treasurers believe digital giants can meet all their needs, but unless banks make a fundamental and sustained commitment to overhauling their operating model—applying the best practices of technology firms and becoming more agile and data savvy—they risk losing significant share to ERPs and TMS providers.

The battle for treasurers’ hearts and minds is intensifying, and it is increasingly being waged over trust. That’s a battle that banks can win, but they must act now with an all-out push to create measurable, visible impact from the customer’s point of view.