This article, the first in a two-part series, explores how medtech companies can reignite growth by refreshing their current product-related offerings and adding more services. A second article, “Venturing into Value-Added Services in Medtech,” examines how medtech companies can both pull through product sales and develop new revenue streams by integrating value-added services into customer offerings.

The growth of medtech product sales has slowed in recent years (hovering stubbornly in the low-to-mid single digits). But a number of progressive companies have invested in building service capabilities and digital platforms to augment product sales and offer customers more broad-based solutions to both the care- and business-related challenges that they face.

For the companies that have jumped headlong into this large but somewhat murky pool, the results have been mixed. Many have made well-intentioned investments, acquisitions, and attempts at decentralized, organic business development. But more often than not, the resulting hodgepodge has left senior leaders contemplating how to create value from a portfolio of service businesses that are dispersed across the company, buried in product-based business units, and generally isolated and segregated. To unlock real value, service-based businesses must be scaled up. This requires an approach that drives service revenue and profits in addition to product sales.

To unlock real value, service-based businesses must be scaled up.

A Big Opportunity

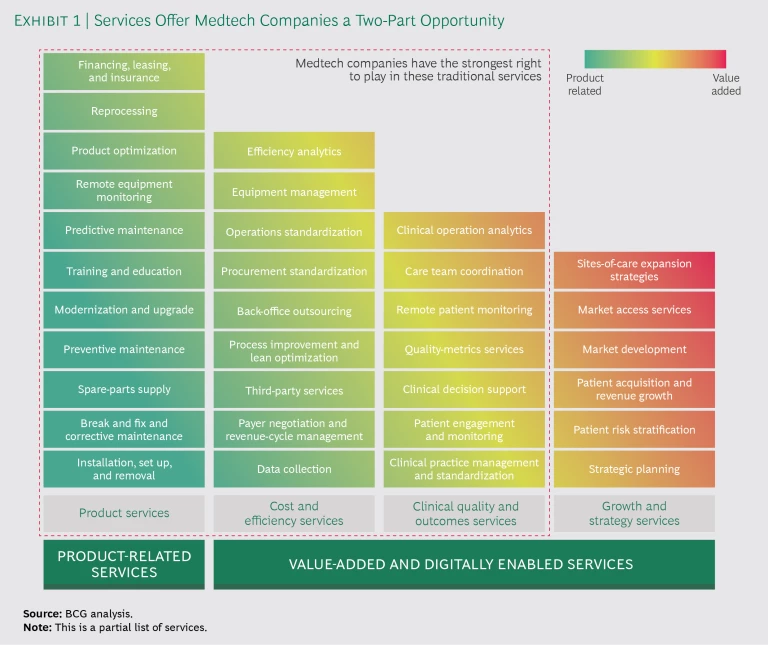

The medtech services market is large—about $60 billion—and it is expected to grow at 10% a year through 2021, when it will approach $90 billion. It helps to think of services as a two-part opportunity. (See Exhibit 1.) The first and biggest part is traditional product-related services, where there is plenty of room for growth. Sales of medtech companies’ services, such as the financing, maintenance, and repair of small equipment and surgical devices, are growing at 4% to 5% a year—the upper range of sales growth for traditional medtech products. Multivendor services, such as third-party reprocessing or remote equipment monitoring, are growing more quickly, up to 20% annually. The second and fastest-growing part is value-added services. (For a discussion of this segment, see “Venturing into Value-Added Services in Medtech,” BCG article, December 2018.)

Product-related services have long been an essential part of equipment sales, and most medtech companies already offer services such as the ones described above. But scale is required in order to be profitable and to be seen as a market leader. It is also needed to have the ability to amortize the required infrastructure investments. Scale is difficult to achieve, though, without a concerted corporate commitment. Aside from the large capital equipment players, most medtech companies have not approached product-related services as a value-creation engine; as a result, they have been leaving money and customer satisfaction on the table.

Making money in services also depends on adopting a service-oriented business model, which will require making choices—ones that may differ significantly from the choices made under a product sales model. A company’s strategic intent and its potential service offering will also affect the choices it makes. Some product-related services—for example, financing, training, education, and preventive maintenance—are inextricably linked to the core product portfolio. Despite their traditional nature, however, many services can be reinvigorated with digital technologies, which can boost service revenue and drive greater efficiency in delivery. But implementing new technologies can require new skills, cultural change, and different operating models.

Making money in services depends on adopting a service-oriented business model.

Medtech companies should ask themselves the following questions:

- How should our company-wide portfolio of service offerings be characterized and managed?

- Where should we be investing or divesting across the services portfolio?

- How should we extract the most value from traditional product-related services?

- How should we move beyond small bets to scale up the services that are core to a broader solutions offering?

- For which product-related services should we adopt new digital tools and build new capabilities?

- Which organizational capabilities should we develop internally, acquire, or obtain through partnerships?

The Product Service Journey

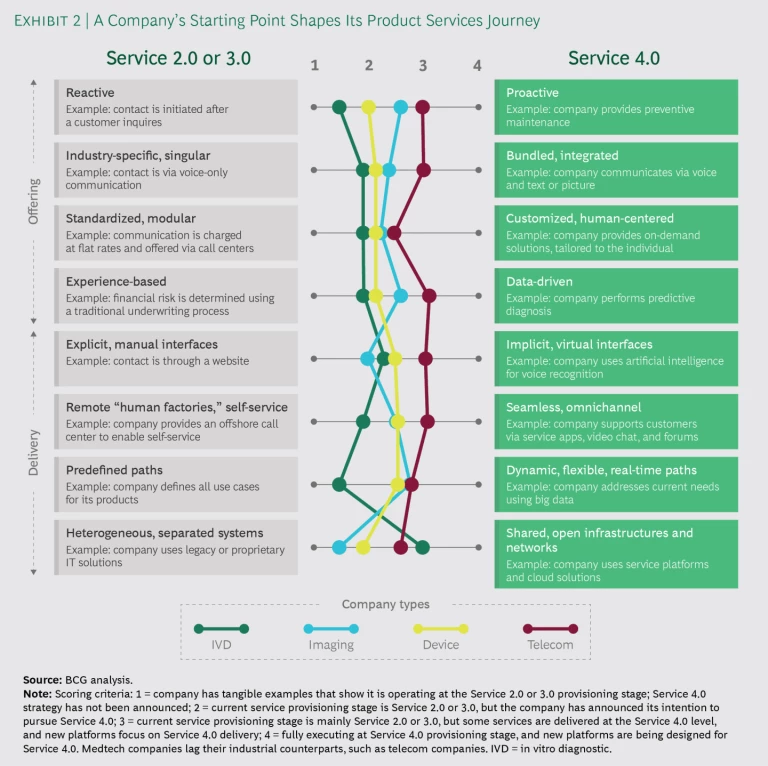

Success in product services will be measured in years, and the shape of the journey will be determined in part by each company’s starting point. (See Exhibit 2.) Most medtech companies operate at the Service 2.0 or 3.0 provisioning stage, which is to say that they are using information technology, the internet, and open standards to enable automation, value chain integration, and self-service. But they have yet to make the leap to Service 4.0—using digital technologies to offer truly customized services and to deliver them through multiple channels and shared, open infrastructures. (See Tapping into the Transformative Power of Service 4.0, BCG Focus, September 2016.)

Our research among medtech customers shows that there is plenty of room for improvement: most medtech companies that offer product-related services lag their industrial counterparts in applying technology to improve operational efficiency and enhance customer satisfaction. Although different medtech segments are at different stages, even the large capital equipment players, typically the most advanced at offering product-related services on a standalone basis, have room to do more.

Customers buy services from medtech manufacturers less than 40% of the time (using third-party providers or self-servicing the remainder of the time). And medtech companies successfully attach product-related service contracts to only approximately 33% of new-equipment sales. Customer service satisfaction levels, as measured by the net promoter score, are above average, from 45% to 55%, but those are still far from world class. (Apple and USAA score above 80%, for example.)

Medtech companies should address several key issues, including their high costs of providing services—the result of an aging base of installed products, a lack of tools, and inefficient processes—and their one-size-fits-all service packages. Companies should also shift from internally focused product development to customer-focused solutions.

Medtech companies should address key issues, such as their one-size-fits-all service packages.

Building a Product-Related Service Strategy

Although medtech companies already offer product services, to generate value, as well as to support customers and patients, senior leaders should take a step back and have a fresh look at their service businesses—individually and as part of the company’s portfolio. We see six core dimensions to building a successful service strategy.

Strategic Intent. What is the role of services in the company’s business portfolio? Along a continuum from the costs of doing business to the differentiated drivers of value, where does the current service offering stand? Where should it stand in the future? What are the company’s financial aspirations in terms of revenue growth and margins for the service business? Various types of companies—large-equipment manufacturers and small-equipment or surgical-device suppliers, for example—will have very different answers to these questions, but all can derive value from a sound service strategy.

The Scope of Products and Services. To define the scope of its product-related services, a company should consider which products are covered by its own service offerings and which ones are covered by multivendor service agreements. Our research shows that medtech companies have a strong right to play in multiple areas of direct product-related services.

Service Pricing and Packaging. Companies need to decide their service pricing (complimentary, fee based, or value based) and packaging (à la carte or bundled). This task is not made any easier by the industry’s history of “giving away” many product-related services while pretending that it could sustain product profit margins. The challenge for many companies will be moving from the traditional model, which provides services as part of a new-equipment sale, to an emerging model, which identifies a standalone value proposition that can be clearly demonstrated to customers for each service. Under the latter model, which is being pursued by a few successful product service suppliers, medtech companies capture value through sales of bundled solutions, rather than by focusing on product margins.

The Service Selling Model. Medtech companies need to rethink their service selling model. This involves recasting, or most likely reimagining, the role of sales representatives across the spectrum of its service offering (different types of services require different knowledge and skills). Rethinking the service selling model also requires determining how to set up the sales force: Should it be at the company’s headquarters or in the field? And should it be an independent function or one that is combined with product sales? Regardless of a company’s choice, it will have to work out many coordination issues among the various sales functions at the main selling stages (initial product sale, installation, and service contract renewal). The new model will also involve redefining the internal roles and responsibilities (for example, the extent of involvement in product design processes) of the service sales force.

The Service Delivery Model. Companies will need to develop a model and processes for delivering high-quality services. In fact, some services or components of services may be more effectively outsourced and delivered by others. But doing so raises issues of coordination, oversight, and quality control—issues with which many suppliers may not be familiar or at which the product side of the house may balk.

Cultural Change. Because few medtech companies actively sell services, a cultural change toward a more sales-oriented way of working will likely be required. Most companies will need to overcome internal barriers in order to align the organization around the strategic role of services, create the perception that services are a critical component of the initial product sale, and embed the expectation that everyone contributes to the sales process. Implementing incentives, changing the organization structure, and manifesting visible leadership will all be critical to making the change.

Steps to Success

Companies that are focused on building profitable product-related service businesses will do the following:

- Invest in digital capabilities, systems, and processes to improve customer service levels and the customer experience, while boosting efficiency, thereby reducing the cost of providing services.

- Implement selling incentives for the service and product sales teams that are based on the customer’s total cost of ownership.

- Expand share of wallet with a tiered service offering that is based on each customer’s needs and value potential.

- Invest in expanded technical service offerings to build a base of service-related intellectual property and enhance competitive advantage.

- Adopt feedback loops with product development to ensure design for serviceability, product differentiation, and connectivity that reduces down time by, for example, enabling predictive maintenance.

For the companies that make the commitment and follow through, the results can be impressive. One global medtech equipment company increased its service revenue from less than 10% to almost 20% of its total sales with a five-year plan that redefined its service mission and ambitions. The company realigned its global service portfolio in three tiers—base services, advanced services, and customer solutions—and developed a clear rollout roadmap for each tier. It refined its commercial priorities and approach, designing value-oriented part pricing and part bundles, developing a multitiered global contract scheme, and redefining its field service engineer training and deployment. It also established a global service business unit, giving it a clear mandate to roll out and drive the implementation roadmap.

Another manufacturer defined services as a major growth driver and the primary enabler of its business strategy. To select services for the company’s portfolio and develop new ones, management assessed the relevance of a service to health care providers’ C-suites, customers’ ability to differentiate a service in the marketplace, the attractiveness of a service in the marketplace, and whether a service acted as an enabler for other business units. The company also performed a top-down assessment of sales, profit, and spillover to other businesses. The manufacturer has a detailed plan to double its service business in five years in several service categories: core, adjacent, and new.

Companies that can successfully reposition their service capabilities stand to generate substantial standalone revenues with profit margins in the 35% to 40% range—more than 50% for best-in-class perfomers—while they also improve customer satisfaction and provide a source of competitive differentiation.

Most medtech companies have the fundamental pieces in place for providing product-related services. Now is the time to rethink how to unlock additional value from these hidden assets.