Construction and property development companies have not historically been on the forefront of innovation. But new and impending advances in robotics—such as the increasing ability to work in open, unstructured work sites and interact with human coworkers—along with a sustained drop in costs promise to change that and profoundly disrupt the competitive landscape.

In fact, startups in the industry are already forging ahead with robotics technologies, putting pressure on incumbents to act quickly. Executives must not only consider how they will apply and integrate robotics technologies into their current operations, but they must also develop a long-term view on how these technologies will alter the industry over time and how they want to position themselves 5, 10, or even 20 years from now.

Another consideration is that despite lower costs these technologies still aren’t cheap. For an industry that operates on very thin margins, it’s vital to identify the investments that will generate the most sustainable advantage. To this end, we will identify here the implications of robotics technologies that should be included in strategic planning.

For an industry that operates on very thin margins, it’s vital to identify the investments that will generate the most sustainable advantage.

Rise of the Machines

The already rapid growth of the global robotics market is accelerating. It more than doubled from 2005 to 2015 and is projected to more than triple from 2015 to 2025. This growth is broad-based, touching almost the entire economy, and two simple truths are behind it: robots are becoming cheaper (the cost of industrial robot systems dropped by nearly 30% in the decade leading up to 2015), while their applications and capabilities are widening and improving.

In construction, the big leap is that robots are getting better at operating in uncontrolled environments. Previously, they could work only in highly structured environments such as automobile production lines, doing repetitive, relatively simple tasks. However, advances in sensing, vision, mobility, and dexterity mean that they can now work in mines and construction sites, and interact with human workers. Emerging robotics applications include onsite construction such as demolition and bricklaying, autonomous haulage, 3D printing and prefabrication, and inspections.

These applications are advancing rapidly and may disrupt construction sooner than many anticipate. A new generation of innovative companies is leading the charge as they experiment with new construction processes. For example, Shanghai-based Winsun, an engineering services firm, made headlines in 2013 by 3D printing 10 houses in 24 hours, and by delivering the first 3D-printed office in Dubai. Another example is Broad Sustainable Building, a Chinese construction company that erected a 57-story skyscraper in 19 days in central China using modularization and prefab construction. Meanwhile, Australian startup Fastbrick Robotics has created a bricklaying robot, the “Hadrian X,” which can lay bricks eight times faster than a human bricklayer.

The experimentation is not just among newcomers. Established players, such as Skanska, are getting involved with robotics applications. For example, Skanska has partnered with Yaskawa Electric to apply robot arc welding to steel reinforcements for pre-cast concrete, dramatically reducing both production time and safety risks. And, in partnership with ABB, it has awarded £700,000 to develop construction robots for onsite tasks such as cutting, drilling, and fixing.

All this activity makes sense given how much robotics can improve construction’s core performance factors: speed, cost, predictability, and safety. The benefits of robotics in construction are in many ways the endpoint of the digitization that is sweeping many industries. Robotics is a physical manifestation of the digital trend, allowing systems to interact with the physical world.

Four Business Model Implications

The implications for the industry’s future are profound, and we have focused on four areas that executives should consider in their long-term strategic planning.

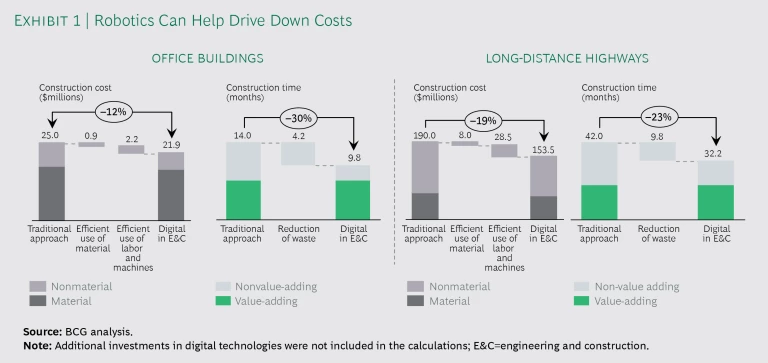

Early adopters accrue productivity and cost advantages. Robotics will yield a step change in onsite productivity. Construction processes will become more efficient and predictable with better use of materials, increased resources utilization, and reduction of waste on job sites, while reducing human error and improving safety at the same time. These productivity gains will lower the cost curve for early adopters, allowing them to improve their margins under the “price umbrella” of their less productive peers. (See Exhibit 1.)

These productivity gains will lower the cost curve for early adopters.

Over time, as more in the industry adopt these technologies, this cost advantage will disappear. However, we expect a lengthy transition period for the industry, so early adopters are likely to enjoy a competitive advantage for 10 or 15 years, or three to four project cycles.

Land becomes the scarce resource. Robotics technologies won’t just reduce costs, they will reduce construction times by 20% to 30%. Since robots will ultimately be able to work day and night and don’t need to sleep, a company with this technology will be able to complete five projects in the time it takes others to complete four. That is a huge advantage in construction and property development, which ties up significant capital in each project; the faster that capital can move, the faster owners generate returns that they can invest in the next project.

But to keep this conveyor belt moving, they will need a strong pipeline of property for new projects. Choice parcels have always been important in the industry, of course, but they will become more so. As the pace of construction increases, the constraints on development are likely to shift from capital and labor to land.

There is another aspect to the robotics revolution that’s likely to increase the demand for land. Today, many construction companies have variable costs. Their human workforce, for example, can rise or fall depending on the demands of the projects—or lack of projects—underway. But if, in the future, these same companies have lots of capital tied up in robots—creating higher fixed costs—they will need land to keep fleets of robots working at maximum capacity at all times.

Value shifts from construction to developers and asset owners. In the longer term, as robotics technologies are commoditized and the early adopter advantage disappears, construction profits will shrink again. Meanwhile, developers’ margins will hold up as they continue to benefit from lower capital needs and shorter project cycles, and because they hold the scarce resource: land. Construction could become more challenging as a standalone business, and looking forward, companies with integrated business models will have a natural hedge against this eventual commoditization and the redistribution of profits across the value chain.

Value also shifts to data, IP ownership, and platforms. Historically, developers have managed physical assets and financial assets. But increasingly they will need to manage a third asset: data and intellectual property (IP). The owners of IP are already capturing the most value. For example, the economic value created by autonomous equipment in mining mostly goes to OEMs, which own the IP, rather than to the mining companies. In fact, in the first wave of automation of mine sites, mining companies have given up more than half of their labor-cost savings to OEMs through annual license fees and related purchases.

As robotics technology applications become commoditized and profits from robotics are competed away, value in the industry will become even more concentrated in the hands of those who hold the IP and who innovate, particularly the owners of the platforms that integrate and coordinate robots. As Apple, Amazon, Facebook, and Google have all proven, the returns to scale for platform ownership are enormous.

Value in the industry will become even more concentrated in the hands of those who hold the IP and who innovate.

So, for long-term sustainable advantage to capture the most value, companies will need to think carefully about how to acquire data and IP, who to partner with, and how to innovate. For example, companies might consider several options: partner with OEMs to improve existing solutions and share the benefits; invest in the development of industry standards for interoperability across existing solutions; and strike more attractive partnership terms with new industry players to develop alternative solutions.

Prepare for a Changing Competitive Landscape

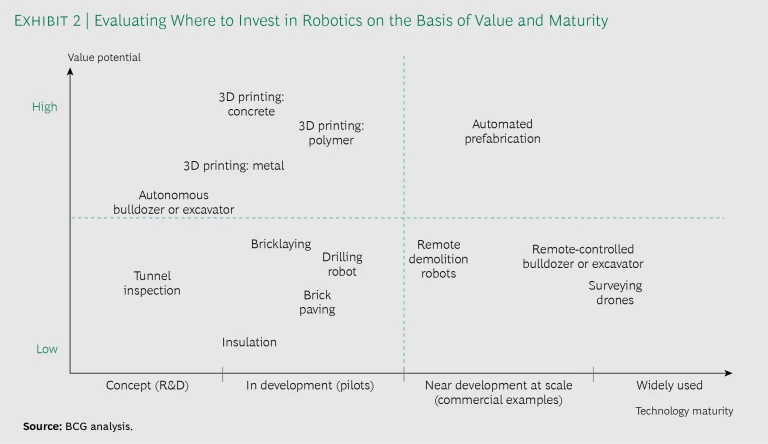

Some of the implications listed above may still be a few years out. Robotics technologies are advancing rapidly and are at different stages today. (See Exhibit 2.) With this in mind, companies need to begin positioning themselves today, and we recommend four action areas.

Invest in capabilities. Integrating robotics technologies into the enterprise and then running day-to-day operations will require completely new skill sets. Today, construction and property development companies have civil engineers, architects, supervisors, foremen, laborers, and mechanics. But going forward they are going to also need data scientists, analysts, and software engineers. Not only are these skills different, they are scarce and in demand by many companies in many different industries. Whether companies should acquire these skills or grow their own will become a pressing strategic issue made more challenging by the industry’s reputation as conservative and far from the cutting edge—not the kind of place that young ambitious digital experts with lots of options would naturally consider. This will require construction companies to develop new employee value propositions, make strategic acquisitions, and enter into partnerships and joint ventures.

Pilot and experiment. New players from technology and adjacent industries are entering the market and pushing the boundaries of traditional construction processes. Given the very real risk of falling behind, companies need to pursue pilot projects to experiment with new robotics applications and invest in scaling up solutions. But this experimentation will demand a certain tolerance for failure—sometimes even expensive failure. That is tough for conservative engineering cultures to accept, so some measure of cultural change will be necessary to keep up with the robotics revolution. Companies will also have to think carefully about which customers to partner with for these pilots and how to structure the benefits.

Given the very real risk of falling behind, companies need to pursue pilot projects to experiment with new robotics applications and invest in scaling up solutions.

Place strategic bets today. Most robotics applications have a high degree of uncertainty, making it hard for companies to predict which applications will take off, or when to invest. These unknowns can easily lead to analysis paralysis. But construction and property development companies don’t have the luxury of sitting back and waiting five years to see which technologies pan out. By that time the first movers will have stepped in and captured the benefits while those that took a wait-and-see approach could find themselves at a competitive disadvantage for years. Ideally, companies will develop a portfolio management approach for investments in robotic applications.

(Co)develop integrated business models. The value shift to data, IP, and platform providers is making innovation and experimentation critical to ongoing competitiveness and the control of prime land parcels. More important than that, it also puts a financial squeeze on construction. Given all this, companies should focus on developing integrated business models by striking the right partnerships in multiple areas. This will be a source of long-term strategic competitive value and a hedge against changing fortunes in the industry.

Advancements in robotics technologies portend seismic change in the construction and property development industry. This future is not far off. Companies need to start planning now—putting the right digital capabilities in place, making strategic bets, orienting the culture toward experimentation, and identifying partners to create an integrated business model. The early adopters stand to gain significant cost and competitive advantages. The laggards will find themselves trying to catch up for years.