The term artificial intelligence (AI) refers to the collection of techniques machines use to solve problems that historically had been restricted to human capabilities. AI relies on both breadth and depth of data to learn underlying patterns and make correlations, enabling computer systems to engage in, for example, complex decision making, behavior propensity, visual perception, speech recognition, and language translation.

AI has become increasingly relevant owing to recent advancements in computer processing power and statistical techniques such as deep learning, coupled with the decreasing cost of storing and managing data and the impressive expansion of open-source technology—technology that is accessible and available to the general public.

Because of its unprecedented power to change the way humans relate to technology and to each other, AI has become a topic of discussion at the tables of politicians, business leaders, and academics. Many industries have made promising progress using AI to transform supply chains and manufacturing, operations and support, marketing and sales, and customer service. Investment in AI is now an imperative. The question for senior executives is no longer, Should we invest? The question today is, When and how should we invest? To answer that question, business leaders must first engage in an in-depth exploration of AI.

Many business leaders have made significant strides in learning about and applying AI. In a blog article in 2017, Risto Siilasmaa, founder of F-Secure and chair of Nokia’s board of directors, wrote that until he’d come across Stanford University’s Adjunct Professor Andrew Yan-Tak Ng’s course on machine learning on Coursera, a free online-learning platform, he’d had trouble finding “good material explaining how machine learning works.” With the goal of studying machine learning to explain what he had “learned to others who are struggling with the same questions,” he enrolled in the course, learning—from others—the shortcomings and strengths of AI through programming algorithms and unveiling the opportunity that currently exists for business leaders. At the moment, few companies are successfully deploying AI, and because it is in a nascent stage, even small gains in understanding AI can lead to large rewards in the future. As this imbalance rebalances, and more companies learn how to get the most out of AI, the returns from AI investment will diminish.

Reviewing the current impact of AI in the business landscape, we see two types of companies. In industries, such as insurance and finance that have historically relied on the heavy use of statistics to analyze data sets, many incumbents are leading AI development to enhance their existing capabilities. For example, showcasing the adoption of AI by incumbents to deliver what they already do more effectively, the insurance giant Allianz and financial services conglomerate Citibank have enhanced their existing fraud detection algorithms by harnessing deep swaths of increasingly relevant data. And investment funds such as Two Sigma and Bridgewater Associates have shifted toward a more nuanced and quantitative approach to trading.

Other industries, such as transportation and health care, are using available data in completely new ways. Startups and tech giants are finding avenues to augment the status quo while incumbents are playing catch up. Companies such as Uber Technologies, GrabTaxi, and Lyft are disrupting the ways that people and goods move; Amazon.com, Alibaba Group, and JD.com have changed the way consumers interact with marketplaces; and Apple, Google, and Microsoft have become platforms for online assistants and are even dabbling in health care. (See “JD.com Implements AI Across the Value Chain.”)

JD.COM IMPLEMENTS AI ACROSS THE VALUE CHAIN

JD.COM IMPLEMENTS AI ACROSS THE VALUE CHAIN

JD.com. the world’s third-largest internet company—after Amazon and Alphabet—serves 300 million customers, offering more than 10 billion products of its own and of more than 170,000 merchants. With its 515 warehouses, the company delivers 90% of its online orders within 24 hours.

The company’s successful AI strategy is anchored in four imperatives:

Use big data analytics to understand customer needs. Customers’ requirements vary by location, time, special events, and personal preference. Their requirements are complicated by such factors as high variability, stock availability, product-to-region pair selection, vendor lead times, and supply chain logistics. To solve the demand-forecasting challenge, the team at JD.com compared stochastic time series, machine learning (ML), and deep-learning (DL) models to understand the strengths and weaknesses of each. The team members’ findings led them to conclude that ML—albeit slightly worse at forecasting sales peaks than DL models—was the best option: its demand forecasts were better than those generated with stochastic time series models, and it was computationally more efficient and easier to interpret than DL.

Connect customers directly and seamlessly to products and services. The team understood that retail success was about delivering the right product to the right customer at the right place and right time. The challenge was to match all customer variables—demographic background, location, activities, and social connections—with physical, digital, service, and content product variables through the appropriate context: browsing, search, recommendation, advertising, social, and content-to-mobile delivery. The team evaluated content-based models, collaborative filtering models, and DL-based models, testing them to see which would be the best application for their business. Their findings prompted the development of their own scalable deep online-ranking system, which is a relevant, responsive, and scalable recommendation system that is able to precisely capture users’ real-time purchasing intent.

Serve customer requirements with a shorter and more efficient supply chain. To overcome the challenges involved in serving customers—related, for example, to capacity at local warehouses, delivery speed, inventory placement and replenishment, local demand, and omnichannel fulfillment—the team leveraged cutting-edge big data technology and operations research to cater to customers’ local needs and online demand.

Develop an AI ecosystem by providing in-house AI capabilities as services for third-party small and midsize enterprises. Recognizing AI’s value, the team at JD.com created a platform for an AI ecosystem, enabling third-party vendors to leverage their AI capabilities and creating more reasons for their vendors to prefer JD.com over peers. The AI platform supports point-of-purchase merchants with extensive pricing and market analysis, explores market opportunities and industrial trends to boost sales volume, optimizes inventory decisions on the basis of big data and operations research, and monitors market trends and public opinions on social media to improve PR.

Thus, the role of C-suite officers is shifting toward understanding a trifecta of technology, data, and analytics: senior leaders not only have to drive adoption of data and AI and to stay up-to-date on the ways that AI will change their industry and organizations, they also, for example, have to learn how to retrain their employees and hire talent with new skill sets.

Despite significant advances in technology, R&D, and awareness among top executives, companies still struggle to realize value from AI. The failure to realize value can be traced across many types of organizations in various stages of AI maturity. In organizations that are passively exploring AI, there is a clear lack of direction and commitment, and they are forfeiting value while the leaders that leverage AI are becoming bigger, bolder, and faster. Companies that have been experimenting and investigating AI use cases have managed to crack the code with a few successful AI pilots, but they lack the internal capabilities to scale up their solutions across the broader organization. The challenge is not only in scaling the technology but also in having the people and capabilities to serve many use cases simultaneously.

Even organizations that have pioneered AI efforts face challenges in ramping up platforms to serve AI algorithms, in building algorithms that can repeatedly serve various parts of the value chain, and in managing the changes in the processes, decision making, culture, and skills required to deliver value at scale. Essentially, this is because AI is a new topic for businesses, and it presents immeasurable implications for the workforce, regulation and compliance, and traditional value creation levers.

With the goal of gaining a clearer understanding of the global view and adoption of AI, BCG, working with MIT Sloan Management Review, conducted a survey focused on the maturity of global companies’ AI implementation. (See “Study Methodology.”) This study has implications for Nordic organizations as well.

Study Methodology

Study Methodology

In 2018, working with MIT Sloan Management Review, BCG conducted a detailed online global survey focused on AI implementation. BCG then conducted a localized survey to secure 78 Nordic responses. These 78 responses were then merged with the responses from Nordic organizations in the global survey. Overall, the 160 Nordic responses represent various functions of Nordic companies in a variety of industries and functions, from board-level and C-suite to senior and junior managers. (See the exhibits “Nordic Survey Respondents, by Function” and “Participating Companies from the Nordic Countries.”)

We compared the results of the Nordic survey with the findings from the global version, which included 26 countries and garnered responses from more than 3,000 business executives, managers, and analysts in 29 industries.

There is simply no precedent model to which business leaders and advisors can turn for decision-making guidance and strategy. Many of the hard decisions are, therefore, being made by each industry’s early adopters—pioneers paving the way for the rest of their industry. Because being first means unforeseen pitfalls and failures, we’ve outlined robust guidelines—an AI agenda—for successfully deploying and realizing value from AI. The process of navigating toward long-term goals to harness the benefits of AI involves three imperatives: think big, start small, and scale fast. In our case experience, we’ve found, however, that most organizations are currently only thinking big. Very few have started to tackle the two remaining steps successfully.

Key Findings

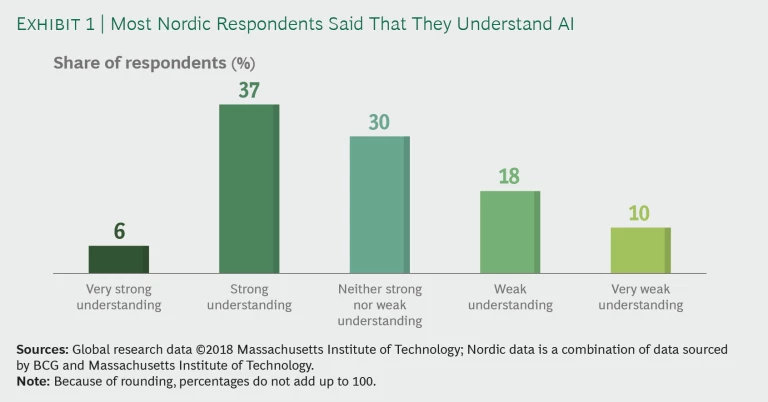

Currently in the discovery phase, Nordic companies are actively engaged in understanding and implementing AI. The Nordics have a rich history of innovation—from the era when magnetic compasses, long boats with keels, and tents gave Vikings the competitive edge to today, when Denmark, Sweden, and Finland all rank in the top 10, and Norway and Iceland (not included in this study) are in the top 25 of the 2018 Global Innovation Index. So it comes as no surprise that only 28% of Nordic companies reported having a weak or very weak understanding of AI. (See Exhibit 1.) Nordic companies operate in a business environment that has ample support for digital initiatives from respective government institutions, a large number of residents who are connected to broadband internet and are active in the digital land-scape, and high-quality academic institutions that generate a relevant and capable talent pool. The R&D ethos is strong in the Nordics: all Nordic countries were in the upper percentiles of developed nations for the number of professionals per million of the population engaged in R&D.

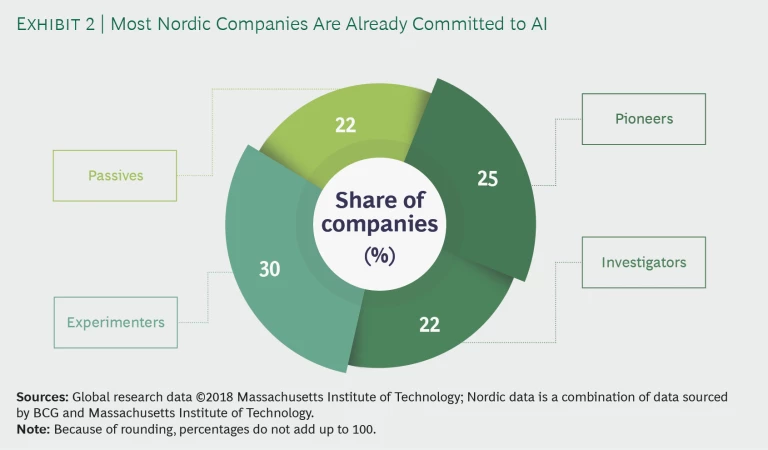

We reported in 2017 that Nordic companies were falling short on execution of digital strategies. (See Bigger, Bolder, and Faster: The Digital Agenda for Nordic Companies, BCG report, November 2017.) By contrast, our more recent research indicates that in AI, Nordic companies are actively experimenting and willing to lead in a field that is quickly evolving. To evaluate how and to what level companies are engaging in AI, BCG and MIT Sloan Management Review have classified respondents into the following four maturity clusters on the basis of their level of understanding and engagement in AI-related activity:

- Pioneers. The organizations in this cluster both understand and have adopted AI. These organizations are on the leading edge, incorporating AI into both end-user offerings and internal processes.

- Investigators. The organizations in this cluster understand AI but have not deployed it beyond the pilot stage. Their investigation into AI highlights thoughtfulness: they are looking before they leap.

- Experimenters. These organizations are piloting or adopting AI without having a deep understanding. They are learning by doing and haven’t put much emphasis on setting a long-term strategy.

- Passives. The organizations in this cluster have not adopted AI, and they believe that they don’t understand it.

Among the Nordic companies surveyed, we found a relatively even distribution across the four maturity clusters, illustrating Nordic companies’ high level of engagement in AI. Of the total, 77% of companies reported having at least some level of exploration in and understanding of AI. (See Exhibit 2.)

Higher Revenues over Lower Costs

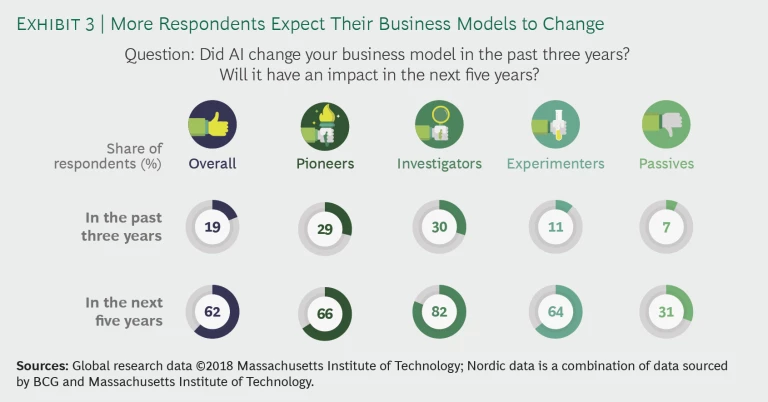

Of the responding Nordic companies, 62% reported that they expect that AI will bring about a shift in their business model within the next five years—significantly more than the 19% that reported that AI had changed their business model in the past three years. Investigators and experimenters reported the biggest changes in opinion: roughly 53 percentage point differences. (See Exhibit 3.)

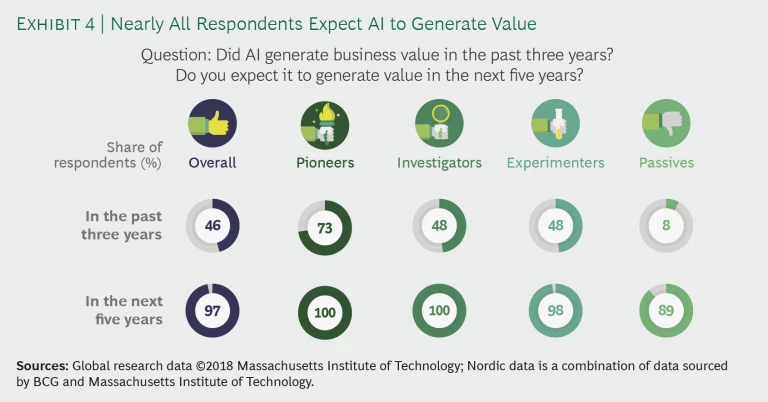

In addition to the heightened anticipation that AI will affect business models, almost 100% of pioneers, investigators, and experimenters predicted that the implementation of AI will generate business value within the next five years. And 89% of passives expect to see positive effects in the near future even though they trail behind peers in AI adoption. (See Exhibit 4.)

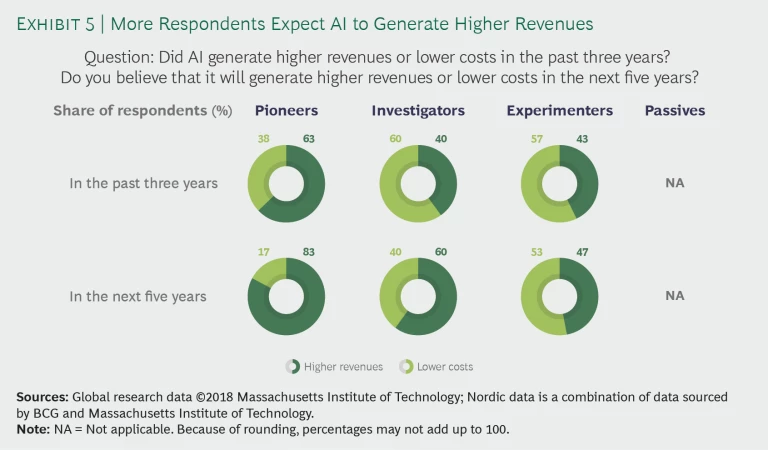

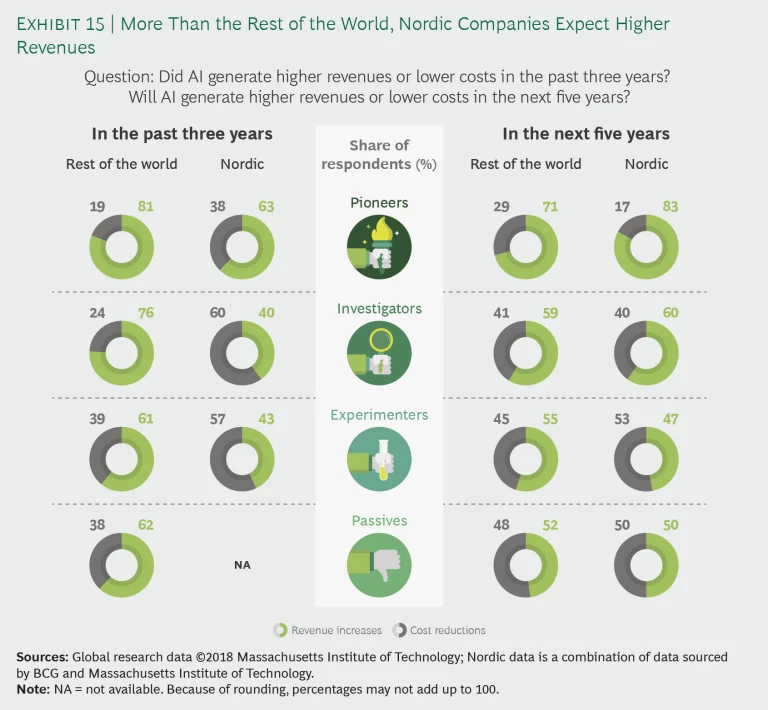

Digging deeper, we found that many companies are starting to expect the value from revenue increases rather than cost reductions. While 63% of pioneers reported generating incremental revenues from the implementation of AI in the past three years, a whopping 83% are now focusing on leveraging AI to increase revenues rather than reduce costs in the next five years. It’s worth noting that investigators have flip-flopped their opinions. A majority had believed that AI would reduce costs in the past three years, and now a majority expect AI will increase revenues over the next five years. Experimenters lag: the number of those who expect higher revenues rather than cost reductions increased by only 4 percentage points. Combining the top three clusters, 30% more companies have shifted their thinking toward counting on increased revenues. (See Exhibit 5.)

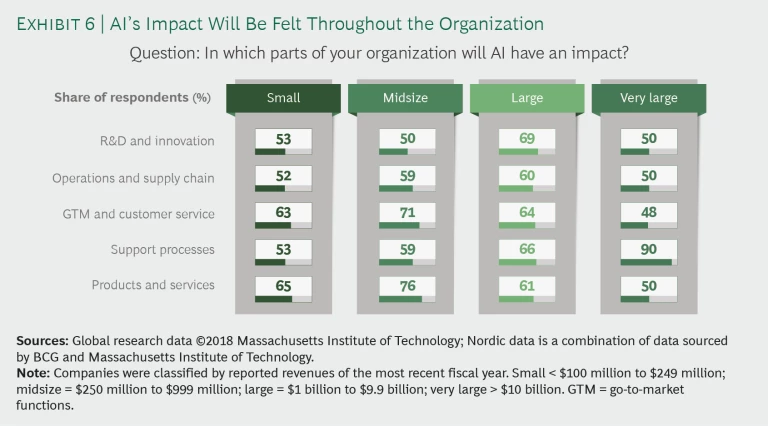

As they gain increasingly specific understanding of the effects of AI on functional parts of their business, small and midsize enterprises expect significant changes in go-to-market functions, customer service, and products and services. Large enterprises expect noteworthy changes in R&D and innovation and support processes, while very large enterprises expect that the changes will be in support processes. Although go-to-market functions, customer service, and products and services may offer opportunities for reducing costs, many of the AI use cases today indicate that pricing and marketing offer clear revenue-increasing opportunities. More of the cost reduction opportunities come from implementing AI in support processes—the functional area in which very large enterprises expect a significant impact. (See Exhibit 6.)

Pioneers: Trailblazing the Path

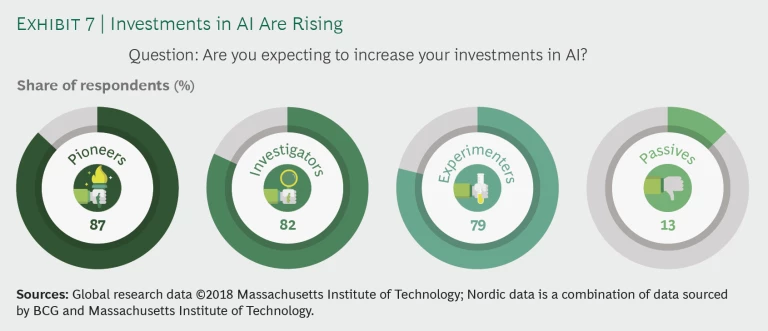

Of all the responding companies, 67% reported that they had increased their investment: specifically 87% of pioneers, 82% of investigators, 79% of experimenters, and 13% of passives. (See Exhibit 7.) Investments in AI include sourcing and hiring AI talent, acquiring and developing AI technology, acquiring and man- aging the data required, as well as implementing the new processes for training AI algorithms. The fact that such large proportions of pioneers, investigators, and experimenters are financially committed to AI supports Nordic companies’ claims that they have high expectations for business value from AI within the next five years.

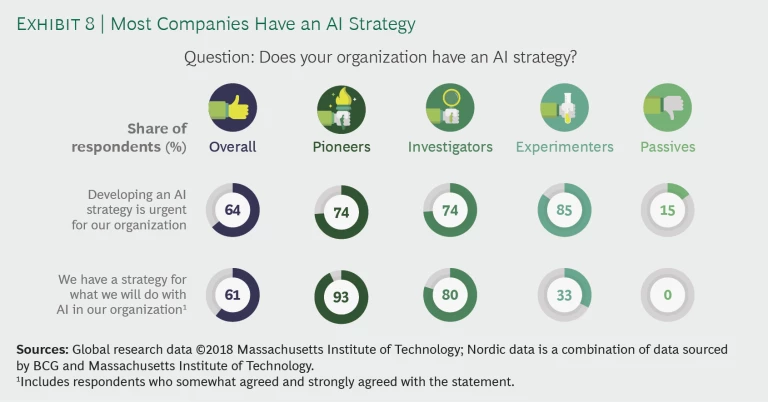

In addition to having high expectations and increasing their investments, approximately 77% of pioneers, investigators, and experimenters recognize the urgency for charting an AI strategy. Of the group that recognizes the urgency, 93% of pioneers and 80% of investigators responded that they have an AI strategy. Experimenters are straggling far behind with 33% reporting that they have a strategy. This is surprising, given that 85% of experimenters reported that they recognized the urgency for developing one. (See Exhibit 8.)

Key Challenges

Many Nordic companies have a decent understanding of AI, expect significant value, and are increasing investments in AI, but most companies—in all maturity clusters—reported some to very low adoption of AI. Many of the respondents reported that they had started pilots but had been unable to scale their AI solutions or drive the necessary change at scale. In this section of the report, we take a deeper look into how companies are thinking about data and how that can impact their success with AI, as well as other challenges companies are facing.

Insufficient Use of Data

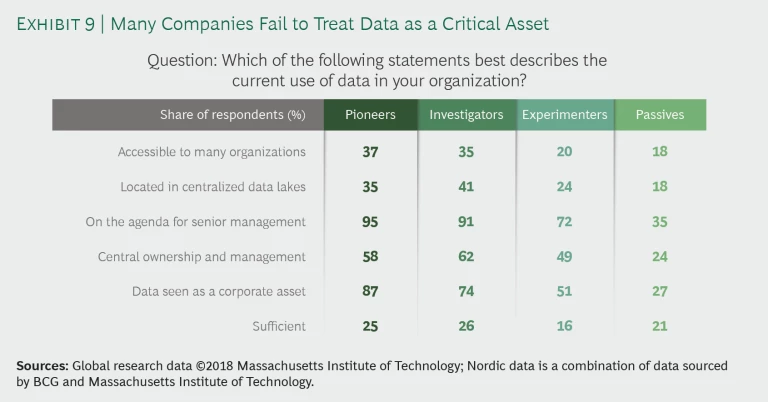

Although data is a topic for senior management, and pioneers and investigators rank it high in importance (95% and 91%, respectively) and understand the significance of treating data as a corporate asset (87% and 74%, respectively), these companies have yet to fully harness the power of their data. Only slightly more than half of all pioneers, investigators, and experimenters reported central ownership and management—a key success factor for launching AI at scale—as a top pick. Without central ownership and management, companies would find it difficult to implement any data and AI strategy—even as a top agenda topic and viewed as a corporate asset. For the most part, data is located in silos rather than in a centralized data lake, creating inefficiencies for AI use cases in processing data ingest and egress. (See Exhibit 9.)

Barriers to Success

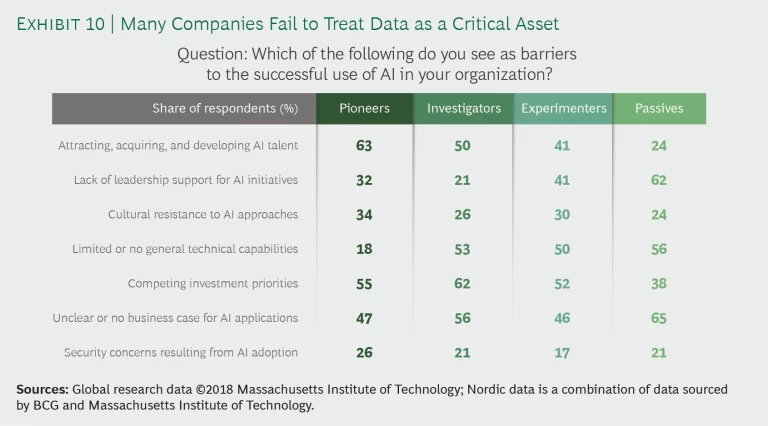

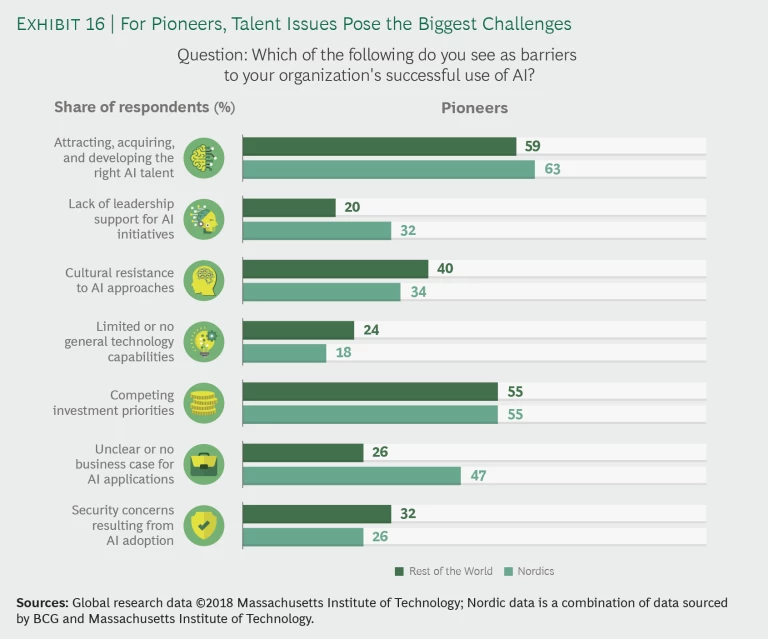

Asked to name the top three barriers to their successful adoption of AI, companies listed a host of challenges, but the most widely noted barriers were attracting, acquiring, and developing AI talent; dealing with competing investment priorities; having an unclear or no business case for AI applications; and dealing with cultural resistance to AI approaches. It’s interesting that attracting, acquiring, and developing AI talent grows monotonically popular with AI maturity. This, perhaps, should signal passives and experimenters that they should expect further challenges in finding the right AI talent as their maturity develops. It makes sense that experimenters also ranked lack of leadership support for AI initiatives high: only 33% of experimenters have a strategy in place. While investigators and experimenters said that having limited or no general technology capabilities (for example, analytics, data, and IT) was a key barrier to AI adoption, only 18% of pioneers reported this as a top reason. We do see, however, that pioneers understand the core technological competencies required to enable AI. Companies have to learn how to walk before they run: their technology must have a strong foundation upon which they can build a more advanced technology such as AI. (See Exhibit 10.)

Embracing AI’s Impact on the Workforce

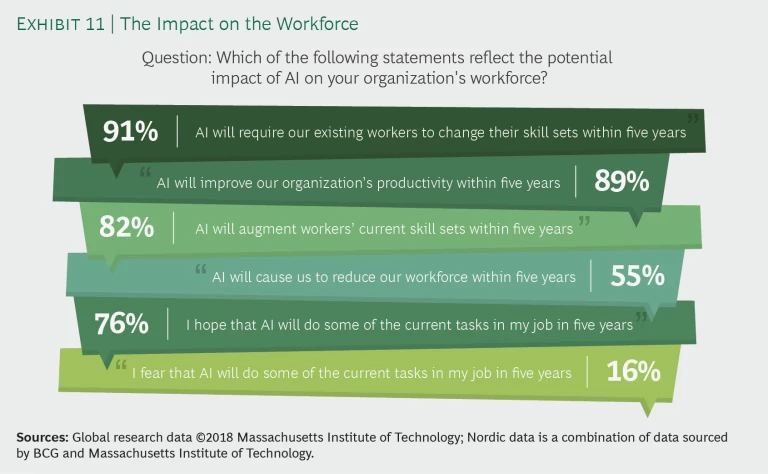

Among the respondents, 89% said that AI will improve the organization’s productivity. Only 55% said that productivity will come about in tandem with a reduction of the workforce within five years. Rather, 91% expect AI will require existing workers to acquire new skill sets within the five-year period, and 82% believe that the change will be an augmentation of existing skill sets. One implicit understanding is that many companies recognize that AI talent will be scarce in the years to come, so there will be a need to develop capabilities internally. Companies can retrain the existing workforce with the skills required, and they need to learn how to make the best use of AI within employees’ roles. This implicit understanding coincides with a general enthusiasm for AI: 76% of respondents said that they hope that AI will take on some of their current tasks, while 16% reported that they fear that AI will take on some of their current tasks within the next five years.

Another reason for the Nordic countries’ low level of fear of AI and its replacing current tasks is that Nordic countries rank high among developed nations for knowledge workers as a percentage of the workforce. Many are employed in knowledge-intensive services, and, given that AI has historically been seen as taking over tasks that can be automated, these workers may be nonchalant about the impact of AI on their jobs. (See Exhibit 11.)

Comparison with Global Peers

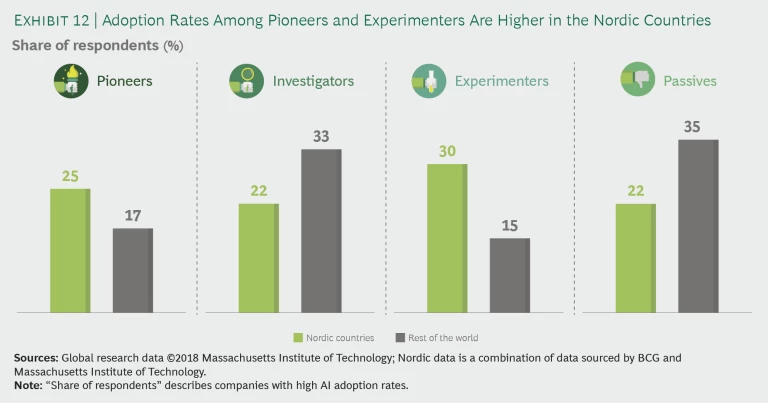

Nordic companies have a higher AI adoption rate than their global peers. Compared with the rest of the world, they have more pioneers and experimenters and fewer passives. (See Exhibit 12.)

Nordic Companies Bet More on AI

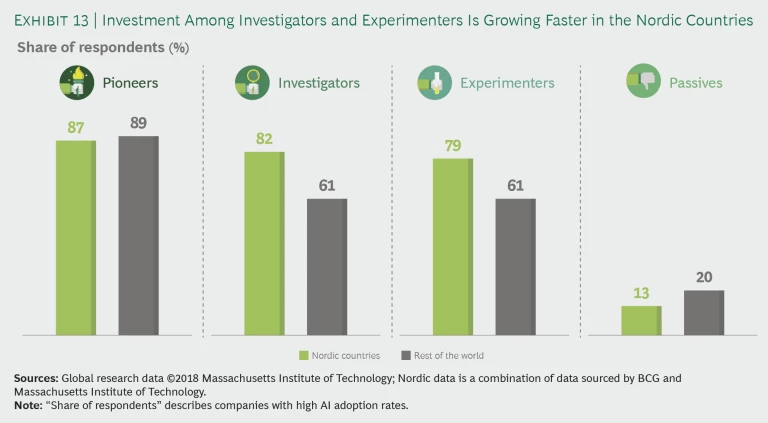

Nordic investigator and experimenter companies have, in the past year, increased their investments in AI more than investigator and experimenter companies in the rest of the world. (See Exhibit 13.)

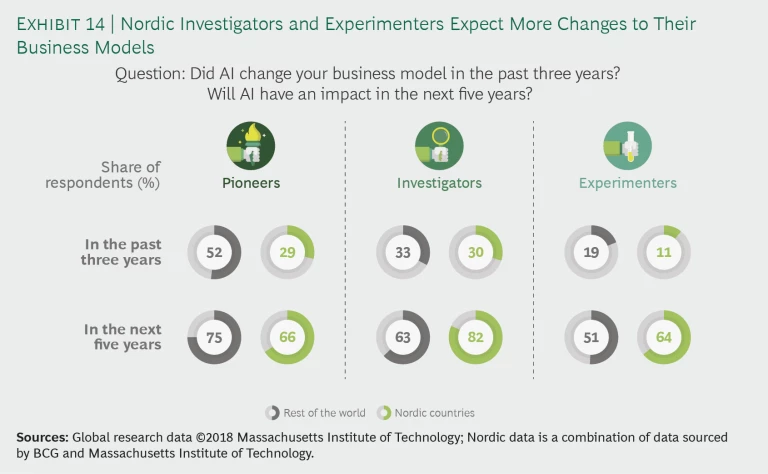

Nordic investigators and experimenters have also responded more frequently to expected AI-related business model shifts. Specifically, 72% of investigator and experimenter Nordic companies (82% of investigators and 64% of experimenters) expect that AI adoption will mean a shift in their business models, whereas approximately 75% of global peers (63% of investigators and 51% of experimenters) anticipate such a shift. (See Exhibit 14.) Nordic companies could be acting preemptively about the impact of AI on their businesses and are investing in AI to actively shape the outcome.

AI Business Value: Revenue Increases

In surprising contrast to Nordic companies, more global peers across maturity clusters reported believing that AI will reduce costs, rather than drive revenues, compared with the past three years. This trend is the inverse of the opinion in Nordic companies, most of which reported that they expect revenue increases rather than cost reductions. (See Exhibit 15.)

Global Pioneers: Little Need for a Clear Business Case

Pioneers around the globe report mostly similar barriers toward AI adoption: attracting, acquiring, and developing the right talent; cultural resistance to AI approaches; limited general-technology capabilities; and competing investment priorities. The telling detail is the largest gap between Nordic and global pioneers. Global pioneers are less hindered (26%) by having unclear or no business case for AI applications than Nordic pioneers (47%). (See Exhibit 16.)

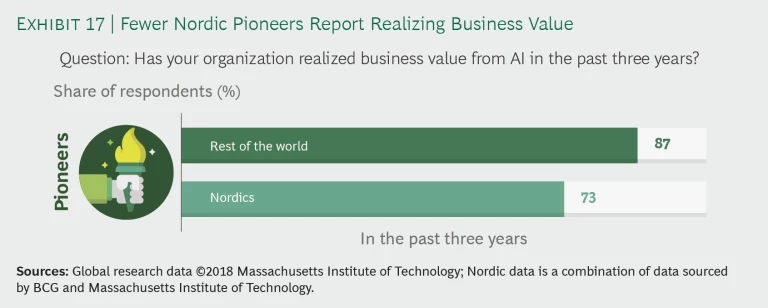

This is interesting in light of the fact that the Nordic companies surveyed comprised a larger proportion of pioneers than the rest of the world. A possible explanation for global pioneers’ more mature business sense may be seen in the high percentage—87%—of them reporting that they’d realized business value from AI in the past three years compared with 73% of Nordic pioneers. (See Exhibit 17.) The learning and experience that global pioneers had acquired over the past three years may have provided them with valuable insight into developing more coherent business cases for AI applications.

Why did almost half of the pioneers report that unclear or no business case for AI applications is a barrier? The reason could be related to the companies’ expectations for achieving business value. We noted above that Nordic companies generally expect revenue increases from AI, whereas global peers expect cost reductions. Common business sense suggests that it is easier to realize cost savings and efficiencies than to raise revenues, so perhaps the global pioneers have found strong business cases in cutting costs, and the Nordic pioneers find it difficult to substantiate business cases that anticipate an upside in revenues.

The AI Agenda for Nordic Companies

Most companies are just starting their AI journey. As they mature, they are bound to discover an increasing number of possible applications, as well as the hurdles that they need to overcome before they can turn ambitions into reality. In short, we advise companies to think big, start small, and scale fast. To do this, companies must be mindful of several imperatives.

Focus on business value over technology. Start by using the business lens to evaluate problems and gain a clear view of where and how value can be extracted to identify the company’s high-value use cases: increasing the marketing effectiveness with AI-driven personalization, providing machine-learning-enabled forecasts, optimizing production for better asset utilization, or using advanced image recognition to support decision making. Depending on its sector and internal starting point, each company should be determining its own set of “unicorns.” (See The Big Leap Toward AI at Scale, BCG report, June 2018.)

Once the high-value use cases have been identified and deemed feasible, companies can avoid fragmenting scarce resources by focusing resources on a select few use cases. We advise companies to focus on business value over technology: all too many companies spend years and lots of money building analytics platforms and setting up data lakes before they have a clear idea of which high-value use cases they will address. There are plenty of open-source standards and easy-to-use tools that companies can use to get started at relatively low cost.

Get started early—and take a leap of faith. Even simple AI models and solutions can bring great value when they are applied in the right ways. Not only will starting early set the company ahead of the competition in the short term, it will also get it to start moving up a steep curve and learning what’s required, how to adjust ways of working, and how to “upskill” the organization.

We advise our clients to conduct proof-of-concept studies and pilots, underscoring the critical importance of testing pilots early and frequently to prove value and—perhaps more important—to create appetite for the imperative change journey to come.

Too often, data science teams are confined to the lab, and good concepts never reach real-life business applications.

The organization must create an environment that encourages the willingness to test, learn from mistakes, adjust course, and test again, supporting a cycle of continuous improvement. An important component is the sponsorship of willing executives who want to learn and who demand value delivery with the right mandates and resources.

Focus relentlessly on delivering value. A great idea is worthless without delivery execution, while a less “sexy” idea with the right delivery execution can generate significant value. The focus on delivering value must start with senior leadership’s identifying a razor-sharp definition of value creation, linking it to operational and financial KPIs, and outlining the small steps—for example, the pilots—required to realize value. Once the pilots have been validated, teams can industrialize and scale pilots to production-grade technology and processes. By starting small and keeping the end in sight—be that rolling out the AI solution to global users or scaling to additional plants—organizations can leverage available resources effectively and efficiently.

This approach allows for shifting quickly and pivoting as demands change on the charted course to value creation. With agile cross-functional teams who have a clear mandate for value creation, business processes can be easily amended and decision making can be simplified. But even small teams face challenges, and those challenges usually come from working with IT and data integration.

In most cases, IT integration involves dealing with the differences in the technology and culture of the AI project teams and the broader IT organization. Our advice is to leverage existing tools and platforms when possible and to push for inexpensive, secure, scalable solutions when needed. With regard to culture, project teams and the rest of IT should engage early on to align on shared goals: IT organizations, by nature, are more averse to taking risks than the project teams, and this could possibly lead to problems of agency.

The challenge of data integration generally arises from legacy systems cobbled together to provide the minimum viable view of business metrics. The result can be conflicting sources of truth, as well as scheduling and formatting differences across silos. We recommend testing incoming and outgoing data pipelines early in the process and building robust support mechanisms for checking, monitoring, and reporting on quality together with the IT function.

Overinvest in business transformation and change. All too often, we’ve seen AI initiatives hit a wall when the organization starts to move from the pilot stage to wider deployment of models and solutions. While training, model deployment, and designing and developing AI solutions certainly require effort, the greater challenges stem from inadequate attention to understanding how processes, decision making, and ways of working need to change to accommodate value delivery.

User-centric design is as critical here as in any other digital project. The requisites for user-centric design include deep understanding of the ways decisions are made today and the ways that the AI solution can support a more efficient approach. Moreover, involving end users and domain experts—for example, the maintenance engineer, pricing manager, and supply chain planner—throughout the design and modeling process helps avoid black-box approaches and increases trust in the model’s output, thereby accelerating the change process. End users and domain experts boost data scientists’ ability to make sense of data, and their involvement ensures that data, insights, and recommendations are derived and presented in a manner that matters and helps secure a high chance that the business will use the solution, once deployed.

Build the team and upskill the organization. Appoint a senior person with responsibility for the AI initiatives and the authority to hire the team and to align with business owners, sharing goals and providing domain expertise. Whether the organization is building a project team that is centralized, hybrid, or within divisions, the team must have access to the right resources—funding, people, data, and tools—and the space needed to test and learn.

A team that can drive a production-grade implementation should comprise not only data scientists but also data and IT architects, scrum masters, product managers, DevOps engineers, and data engineers. By steering team priorities along the way, the cross-functional product manager can make sure that the AI solution that is being developed is tailor-made for the business application. Project governance should be overseen by cross-functional “troikas” that include AI leaders, business leaders, and IT leaders.

Treat data as the business’s most valued asset. Storage costs today are relatively low, so people have a tendency to store everything in anticipation of the distant day in the future when it might be needed. Although this is an acceptable strategy, it requires diligently managing and structuring data so that project teams can leverage high-quality data for their models and algorithms. On a tactical level, data architects and data engineers should be responsible for ensuring that data assets are captured, described, and structured efficiently and in a manner that is useful for the data scientists. On a strategic level, data governance, which is critical for any business, involves filling roles throughout the organization to manage data mapping, policies, and guidelines, as well as overseeing ethical charters that detail the ways that data should and should not be used.

Establish and take part in the ecosystem. Engagement with the broader ecosystem—partners, startups, contract developers, and system integrators—is critical to achieving AI at scale. The ecosystem provides additional leverage through access to scarce resources and skills, IP, and know-how. By participating in the broader ecosystem and helping and leveraging others, the organization can secure its place in the AI landscape with an economic moat.

Internally, incubating and nourishing a knowledge ecosystem can facilitate the development of a homegrown network of practitioners who are well-versed in AI applications in business intelligence, data science, IT, and business. This will accelerate organizational learning and reduce the time required to activate AI, shortening the time to value creation and enabling participation in the broader AI ecosystem.

For more information and guidance, please see the BCG website AI at Scale: The Next Frontier in Digital Transformation.

Nordic Companies and the Future of AI

In summary, our findings show that AI for business applications has become a serious consideration for all companies. From understanding the enablers behind successful AI initiatives to preparing for the impact on the workforce, Nordic companies show an enthusiasm for AI that is competitive with global peers. Building on top of the strong enthusiasm for AI in the Nordics, Nordic companies should take the next step, cementing lab innovations in AI into reliable, scalable, business models. To be successful, they should think big, start small, and scale fast, incrementally building on the work done thus far and identifying tangible business value from AI applications. In this way, companies in the Nordics have the opportunity to help shape the global stage for AI and pave the way for companies around the world.