Sustainable farming is getting a new lease on life. The deterioration of the environment and the depletion of resources—both of which are already limiting the amount of food produced by the world’s farmlands—are motivating regulators, consumers, food companies, and farmers to compel agricultural companies to adopt sustainable methods and processes. Despite companies’ lingering complacency, these stakeholders are driving a transformation that seemed impossible only a few years ago.

Some agricultural companies—including seed companies, crop nutrition providers, crop protection producers, and farming equipment manufacturers—have adopted aspects of sustainable practices in disparate parts of their operations. And many have launched new products or improved existing ones, such as crop protection agents, that facilitate sustainable activities, target specific pests, and can be used in smaller doses. These are welcomed innovations that may enable farmers to increase their profitability while preserving the environment. But while some companies are innovating and paying more attention to sustainable practices, most are still lagging behind and have not made sustainable farming an essential element of their fundamental business activities. The new pressure from stakeholders makes that attitude, well, unsustainable.

Agricultural businesses need to rethink their approach to sustainable farming and develop growth plans that create and maximize economic value while improving social and environmental conditions. In doing so, agricultural companies can find fresh opportunities to partner with farmers and lead the transition toward sustainable practices. By providing leading-edge expertise, tools, products, and technology, these companies can put themselves in a position to participate in markets for innovative seeds, crop nutrition, crop protection, and farm equipment that, in some cases, are projected to grow by double digits annually.

Simply put, agricultural companies must stop treating sustainable farming as a noncore topic and embrace it instead. Considering the various types of stakeholders that are lining up in support of sustainable farming, it is becoming a strategic necessity for agricultural companies. Yet, equally important, it is also a strategic opportunity.

What’s Wrong with the Status Quo?

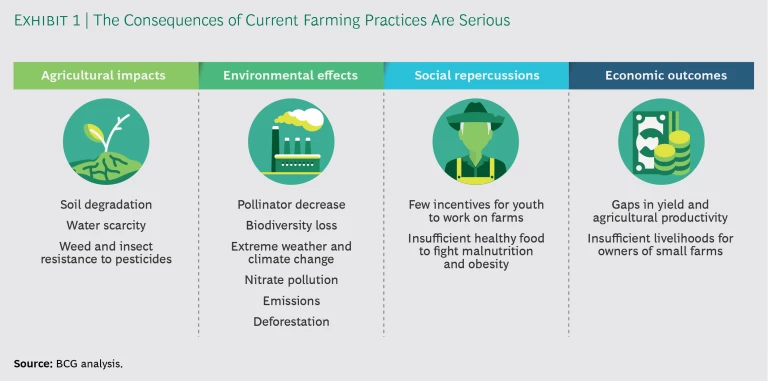

Traditional agricultural practices emerged for good reasons and from good intentions. To fulfill the nutritional needs of a rapidly expanding global population, agricultural companies and farmers sought the best approaches to enhance productivity, but they often prioritized output over sustainability and resilience. Today, we are beginning to clearly see that current farming methods, practiced by most farmers worldwide, have serious consequences for land stewardship, resources, the environment, and society. The detrimental outcomes cover a wide variety of troubling conditions. (See Exhibit 1.) For instance, about 30% of all land globally is considered degraded—eroded or robbed of its nutrients by poor land management. This land is rapidly losing its ability to provide sufficient food to local and far-flung populations. Meanwhile, climate change—in part driven by greenhouse gases produced by farms—is aggravating soil damage and making agricultural systems worldwide much more fragile.

Current farming methods have serious consequences for resources, the environment, and society.

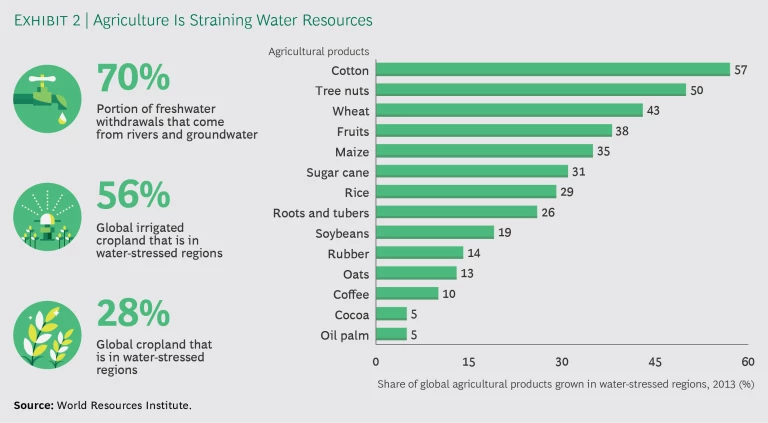

Another concern: The production of food and other agricultural products takes 70% of the freshwater withdrawals from rivers and groundwater. But because of pollution and other issues that result from the mismanagement of water resources, 28% of cropland (including 56% of irrigated cropland) is already in water-stressed regions. (See Exhibit 2.)

An overreliance on herbicides and pesticides has led to an increase worldwide in the number of weeds and insects that are resistant to the chemicals intended to contain them. This outcome, in turn, is reducing the production of wheat, corn, soybeans, and other plants that are critical to feeding a growing global population.

A loss of biodiversity and the destruction of insect and animal habitats by commercial and residential construction are also lowering agricultural production. Consider, for instance, that 75% of food crops rely on pollinators, mainly bees, and the present extinction rates for pollinator species are 100 to 1,000 times higher than normal due to human impacts.

These examples describe only a few of the problems that farmers are facing worldwide. Perhaps most significantly, farming is becoming a much less attractive occupation, owing in part to worsening agricultural conditions and the negative impact on farm profitability as well as less accessible financing and increasing labor costs, among other economic factors. From 2005 through 2010, about 17% of the farms in the European Union (EU) went out of business. Also telling is that the average age of farmers as of 2014 was 60 years old, according to the Food and Agriculture Organization of the United Nations. This is true in developed countries, such as the US, and in developing regions, such as Africa, where about half of all farms are located and where 60% of the population is younger than 24 years old. Generally, when young, next-generation farmers have taken more active roles in the family business, new technologies have been implemented—such as using drones to determine irrigation needs or the vitality of crop pests. Such advances give old farms a new and more modern lease on life.

The disturbing picture of global farming is emerging as pressure rises for farmers to sharply increase land output to levels never before seen. Currently, about 1 billion people are undernourished around the world. By 2050, the world’s population is expected to reach nearly 10 billion, up from about 8 billion in 2018; caloric intake will climb even faster, especially as improved living standards and dietary habits in developing countries spike the demand for food. Some of this demand could be met by reducing food loss and waste throughout the supply chain; about one-third of all food produced for human consumption is spoiled or wasted. But even with improvements in those areas, the need to increase the productivity of farmland will still be significant.

Changing Attitudes

The continuing deterioration of agricultural land has reached crisis proportions. If farms around the world are to deliver sufficient amounts of high-quality crops to feed a growing and increasingly health-conscious global population, protect natural resources, and provide an acceptable income for owners and workers, traditional agricultural practices will have to change. The alternative—maintaining the status quo—is no longer an option, whether viewed through an economic, production, environmental, or nutritional lens.

The sheer indisputability of this is the basis of the paradigm shift that is currently underway. The traditional approach to farming focused on ever-increasing yields and neglected crop quality and resource depletion. The goal of the new sustainability initiative is fourfold: increase output; cultivate exceptional crops using farming practices that support high-quality food production, and distribute those crops via transparent supply chains; provide acceptable livelihoods for farmers and workers; and embrace environmentally sound practices that conserve precious resources (such as soil and water), protect biodiversity, and reduce greenhouse gas emissions.

Recently, agricultural companies have started to play a more active role in this transformation, but by and large, the other crucial stakeholders—regulators, consumers, food companies, and farmers—are leading the way with a sense of urgency and even creativity. Because these stakeholders can directly influence the markets and revenue streams that agricultural companies depend on, some agricultural companies are making concerted attempts to integrate sustainability into new products and services. Stakeholders’ continuing efforts could soon force lagging agricultural companies to commit to this change or be left behind.

Regulators

For at least the past decade, government regulators and policymakers in many countries have expressed increasingly strong support for sustainable agriculture. Initially, their intent was to safeguard the environment by promulgating rules to protect scarce resources and minimize the impact of climate change. Over time, these officials expanded the regulations to encompass sustainable agriculture practices.

In 2015, governments around the world made clear their support for sustainable agriculture with unanimous backing for the UN’s 17 Sustainable Development Goals (SDGs). These include ending poverty; making cities inclusive, safe, resilient, and sustainable; combating climate change and its impacts; and sustainably managing forests, fighting desertification, and halting land degradation and biodiversity loss. The SDG to end hunger specifically focuses on promoting sustainable agriculture. And one of the goal’s targets for 2030 is to have full implementation of sustainable food production systems and resilient practices that double the agricultural productivity and incomes of small-scale food producers while maintaining the genetic diversity of seeds, cultivated plants, and farmed and domesticated animals.

Many regulators have implemented these goals along with similar objectives that have been shared by their counterparts in other countries. These regulators set change in motion primarily by linking farm subsidies to sustainable agriculture practices. That, in turn, created a significant financial incentive for farmers to explore eco-friendly agricultural methods. For instance, in the EU today, 50% of all direct payments to farmers are linked to mandated requirements involving specific environmentally sound farming practices, such as crop diversification. It is likely that the EU’s common agricultural policy, which is currently under review and slated to be released in 2020, will include additional sustainability provisions. Some of these will align more closely with the UN’s SDGs as well as endorse improvements in protocols for monitoring environmental measures taken by farmers. By comparison, the US lags behind. Only 6% of US farmers’ gross receipts is generated by subsidies for sustainable agriculture programs, which isn’t surprising in light of the relatively scant attention that sustainable farming receives in the US. In fact, recent omnibus US farm legislation barely mentioned shifting to or promoting sustainable farming practices.

Many regulators have set change in motion by linking farm subsidies to sustainable agricultural practices.

In less economically developed countries, the need for sustainable agriculture is often even more urgent. China and India, in particular, have huge populations to feed, yet environmental degradation that hinders prospects for farming output and agricultural growth is imminent or underway. Because developing countries are already experiencing repercussions from climate change and environmental disasters on a larger scale than the EU or the US, some have begun to implement stricter regulations to protect the quality and volume of their agricultural output.

In China, for instance, Policy Document No. 1, released in February 2017, focused on land and rural issues. For the first time, policymakers seriously addressed environmental problems related to the country’s farms. The policy document stated that land and water are scarce and that environmental pollution caused by farming is becoming an alarming issue. The document calls for some sustainable agriculture targets (such as zero growth in the use of chemical fertilizers and pesticides) and imperatives (such as requiring farmers to use organic fertilizers). It also favors the creation of pilot zones for sustainable agriculture. India, which is potentially facing significant yield declines by 2020 as a result of climate change, has established the National Mission for Sustainable Agriculture to focus on measures such as efficiently using water, judiciously using chemicals and energy, improving crop management, and implementing soil-treatment practices.

Increasingly, regulators and policymakers in large agricultural regions are realizing that support for sustainable agriculture is critical to their country’s economic future. They are also addressing the shortcomings in their country’s farming approaches. This trend will have an outsize impact on the pace of change in global farming practices.

Consumers and Food Companies

Regulators have paid more attention to sustainable agriculture in part because consumers have increasingly favored it. (See “From Farm to Table: Where Has My Food Been?”)

FROM FARM TO TABLE: WHERE HAS MY FOOD BEEN?

FROM FARM TO TABLE: WHERE HAS MY FOOD BEEN?

Despite all the sustainability initiatives that are underway, satisfying consumer demand for farm-to-table transparency will also require substantial changes in the infrastructure and logistics processes for transporting commodities.

In most agricultural markets, large volumes of crops are combined first in silos and then in railcars and vessels to minimize the transportation cost per unit of food shipped. In addition, food producers increasingly purchase grains and other crops from complex global supply chains that have dozens of sources in numerous regions. This infrastructure model has a critical shortcoming: it is challenging, if not impossible, to determine the origin of, and growing practices used to produce, any given unit of food. As a result, the infrastructure model hinders the ability of food companies to capitalize on consumer demand for higher-quality products (as defined, for example, by protein, fat, or sugar content) and crops grown using sustainable practices.

If sustainable agriculture is to become more widely adopted, agricultural supply chains must adapt to accommodate a greater portion of identity-preserved or “traceable” products. A role will always remain for large-scale commodity distribution networks; for example, the majority of corn and soy grown in many food-exporting countries is used for animal feed and industrial products, such as ethanol, and the way those crops are processed and shipped is of little concern. But the shift to sustainable farming—and to healthier food grown on farms that apply sustainable tenets—must be combined with the ability to identify a crop’s origin, verify the use of sustainability practices, and ensure that all participants in the farm-to-table supply chain are appropriately compensated.

Advances in new technologies—such as Internet of Things sensors and networks, GPS, remote and mobile computing, and automation equipment—are offering a glimpse into how a more traceable food supply would work. Being able to collect and digitize data about where crops originated—as well as the various steps they took through production processes and, ultimately, the supply chain—would provide remarkable levels of detail and insight for tracking and differentiating crops and products.

Moreover, emerging blockchain technology—a peer-to-peer, decentralized, and secure ledger system—could support a monitoring system for high-value food. Put simply, a token that is attached to a product grown, picked, and produced using sustainable agriculture techniques could authenticate the trail it travels from farm to consumer, sending its data privately via blockchain networks.

To complement these new technologies, supply chains should be shortened as well. Selling products closer to where they were grown would reduce logistics and infrastructure environmental shortcomings—such as the heavy use of fossil fuels—that negate the benefits of sustainable farming.

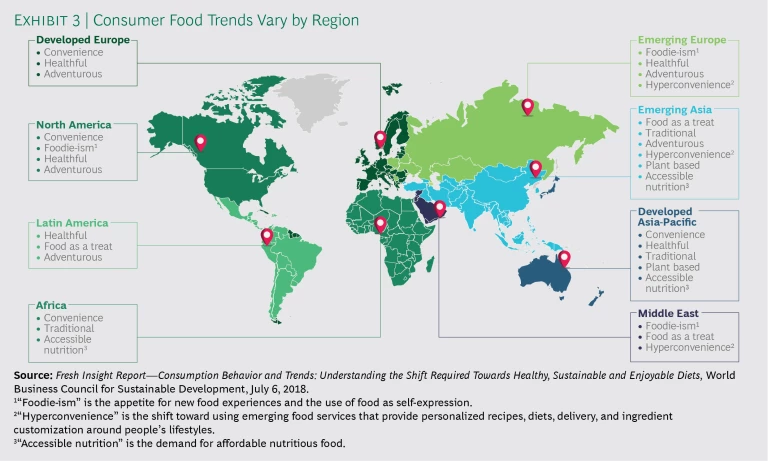

A BCG survey of 9,000 consumers in nine countries found that most (86%) want food products that are “good for the world and me”—items that are labeled organic, natural, ecological, or fair trade. Indeed, according to another BCG study completed a few years ago, 70% of US sales growth in retail chains from 2011 through 2014 came from sales of so-called responsible-consumption products. And an analysis of consumer attitudes by the World Business Council for Sustainable Development (WBCSD) found that in most regions of the world, convenient or healthy food is a priority—and sometimes both are important. (See Exhibit 3.)

Recent food scandals—among them, eggs in the EU contaminated by pesticides and horsemeat sold as beef—have raised public awareness about agricultural practices and their impact on health. With social media and 24-hour news cycles, reports of these incidents are reaching people faster and more frequently than ever before. This heightens the growing sentiment among consumers for full transparency from farm to table and catalyzes demand for better and safer products—such as produce that is locally grown with fewer chemicals and meat from animals that are raised with fewer antibiotics—from more eco-friendly farms.

To address consumers’ concerns, some food companies have joined the cause, in part to gain a competitive advantage in the lucrative healthier foods market—which can deliver gross profit margins that are as high as 40%, owing to 25% price premiums. These companies are directly compelling farmers to embrace sustainable practices as a condition of their sourcing agreements.

Some food companies are compelling farmers to embrace sustainable practices.

For instance, by 2020, Kellogg has pledged to buy ten priority ingredients—including corn, wheat, rice, potatoes, sugar, and cocoa—only from farms that prioritize using fertilizers safely, minimizing greenhouse gas emissions, and protecting water supplies and soil health. And Unilever is working with more than 500,000 farmers in its supply chain to “make sustainable agriculture mainstream,” according to its website. The program has made a difference in its top line. In 2016, revenue growth from brands that use ingredients sourced from sustainable agriculture farms was 50% greater than the revenue growth of other brands; the outperforming brands contributed more than half of Unilever’s total sales gains that year.

Other food companies are prioritizing resource protection and sustainable agriculture, whether in large or small ways, to safeguard their future in global markets. Danone and Mars cofounded the Livelihoods Fund for Family Farming, which will invest €120 million to develop sustainable agriculture projects that can improve incomes for small farmers while enhancing food security and restoring ecosystems. Meanwhile, PepsiCo has created a series of sustainable agriculture sourcing programs that are designed to annually increase the amount of crops purchased from farms practicing sustainable agriculture. These programs are also intended to help farmers achieve improvements in water and soil resource management, greenhouse gas emissions, air pollution, the use of pesticides, and safety.

The EAT Foundation and WBCSD have launched the Food Reform for Sustainability and Health project. This research initiative has brought together dozens of companies to develop solutions that can transform global food systems to responsibly produce healthy food while protecting resources around the globe. Similarly, the Sustainable Agriculture Initiative Platform—which appears to be the largest program of this kind sponsored by food and beverage companies—has established a roadmap for direct collaboration between farmers and food companies. The platform has not only set sustainability requirements for priority ingredients throughout the supply chain but also implemented training programs to help farmers achieve the higher standards.

Consumers’ increasing support for products grown using sustainable farming processes is crossing over into other categories as well. For instance, under pressure from customers, the textile and apparel industry is beginning to take steps that would compel cotton suppliers to improve their relatively dismal record in working conditions, resource protection, and chemicals use. Industry groups, such as the Better Cotton Initiative (BCI)—whose members include retailers, farmers, textile and apparel manufacturers, and nongovernmental organizations—have begun extensive sustainable farming training and implementation programs in virtually every region. BCI’s current goal is for 30% of global cotton to be grown using sustainable techniques by 2020.

Farmers

As the demand for more nutritious and safer food rises, the onus, of course, is falling on farmers to implement new practices to produce higher-quality crops. If farmers don’t rise to the occasion, they stand to lose a lot of revenue as sustainable farming methods become compulsory (mandated by either regulators or food companies) and as their farm’s output recedes. These challenges, though, represent a somewhat immovable obstacle in less developed regions, where farmers don’t have access to modern technologies.

Another hurdle is the lack of a specific set of rules that define sustainable agriculture. Nonetheless, most farmers, environmentalists, and farming observers would be comfortable defining sustainable agriculture as the development of smart approaches that suit local conditions, maintain high yields, grow healthy foods, provide a good living for farmers, and protect the environment and its resources. (See Exhibit 4.)

Although implementing sustainable agriculture methods often leads to a farm reducing its use of chemicals, the concept doesn’t require that they be eliminated. In fact, in some cases, a limited use of pesticides may help to achieve a sustainable outcome. For instance, if a farmer has adopted no-till farming to reduce soil erosion and maintain high levels of nutrients in the ground, some pesticides may be required to control weeds that would otherwise be plucked out by tilling equipment. In other words, the best decisions about sustainable agriculture methods are not of the one-size-fits-all variety. Rather, the best decisions result from dispassionate assessments of what would achieve the optimum level of sustainability on a given farm.

Because sustainable farming is somewhat of a catchall term, precise data that quantifies how rapidly farmers are choosing that approach isn’t available. But data about the growing acceptance of organic farming methods correlates at least broadly to the adoption of sustainable agriculture. As of 2016, about 2.7 million farmers worldwide were following organic agricultural practices, a 12.5% increase over the prior year, and the global organic food market had grown to more than €80 billion. The countries with the most organic producers were India, Mexico, and Uganda.

More-specific evidence emerged from a series of interviews that BCG conducted with about 50 farmers at Agritechnica 2017, an agricultural trade fair. In these informal discussions, 75% of the farmers said that they are already using crop rotations and organic fertilizers, and 60% said that they are cultivating nitrogen-efficient crop varieties to naturally improve soil fertility. In addition, 14% have adopted precision agriculture (PA) methods.

For most of the farmers, securing economic advantages—including being able to better serve market needs and improve productivity—was the primary reason for adopting sustainable farming practices. Ecological considerations, followed by regulatory requirements, were next. Perhaps most important, a whopping 86% of those interviewed believe that sustainable agriculture is essential—and, in fact, is the only real path toward improving agricultural conditions and farmers’ economic prospects in the short term as well as the long term.

The shift toward sustainable farming is unrelenting, but many agricultural companies have not made it central to their business model.

A Huge Opportunity for Agricultural Companies

What is most telling about our interviews is what the farmers didn’t say. They did not indicate that they consider agricultural companies to be a critical influence or even a stakeholder in the transition toward more sustainable farming practices. That’s problematic from a variety of vantage points. The shift toward sustainable farming—propelled by the actions of regulators, consumers, food companies, and farmers—is unrelenting; the relative absence of agricultural companies means they are missing out on an opportunity not only to help shape and advance this movement but also to participate in the economic gains that are likely to result.

Although many agricultural companies are taking this movement seriously, they have generally not adopted the concept as a central aspect of their business models. (See “Agricultural Companies Take Sustainability Seriously—Just Not Seriously Enough.”)

AGRICULTURAL COMPANIES TAKE SUSTAINABILITY SERIOUSLY—JUST NOT SERIOUSLY ENOUGH

AGRICULTURAL COMPANIES TAKE SUSTAINABILITY SERIOUSLY—JUST NOT SERIOUSLY ENOUGH

To get a sense of how deeply agricultural companies are participating in the sustainability movement, BCG analyzed nine of the largest companies, including makers of seeds, crop nutrition, protection products, and equipment. We found that all the companies had assessed the UN’s 17 Sustainable Development Goals to determine the relevance to their organizations and in total identified more than 40 possible sustainability targets. These targets fell into four categories: the environment, business practices, products, and social issues. But the median number of sustainability targets that the agricultural companies actually committed to was only nine, with one company listing 24, which was nine more than the next-highest number of targets. Four out of the nine companies identified seven or fewer sustainability objectives. (See the exhibit.) Of course, the number of targets that companies commit to only reveals part of the story. More important (and impossible to gauge from a long-distance analysis) is how aggressively these businesses work on implementing sustainability objectives.

We found, however, that for five of the nine companies, more than 90% of the sustainability targets are linked to basic operations, such as taking steps to minimize energy use in their production systems and achieve operational carbon-neutral footprints. In other words, these sustainability measures are connected to the success of their businesses and the health and safety of their employees, rather than to the core business or to activities that would impact the global agricultural environment—such as helping farmers adopt sustainability meas-ures that would improve yields or better manage water resources, among numerous other possibilities. At the remaining four companies, at least 75% of the targets are similarly tied to operations. In short, the effect of their sustainable efforts outside of their companies is minimal.

This isn’t to say that all companies are equally deficient in this regard. But more than small initiatives are required now. As a group, agricultural companies must develop products and services that help farmers in different regions confront their unique sustainability challenges. And they must help address the needs of farmers who are in difficult economic straits and require financial support and training to adopt sustainable practices.

The good news is that agricultural companies are neither strangers to nor estranged from sustainability concepts. They can play a larger role in sustainable farming, become knowledge partners with their customers, and make sustainable farming an integral element of their core business.

Agricultural Input Producers

This category includes seed, crop nutrition, and crop protection companies. Seed companies should continue to produce a large number of seed types, especially varieties that are suited to farmers’ local environments. In addition, these companies should focus on developing biotech seeds that are more tolerant of droughts, floods, weeds, pests, and diseases. Genetically modified seeds may play a large role in sustainable farming’s future, but given stakeholders’ resistance to them, the market, particularly in the EU in the immediate future, will be limited.

Moreover, undertaking the development of new planting methods that support smarter and more productive land use could provide an avenue for seed producers to collaborate with farmers. To illustrate, DuPont’s Pioneer division, working with Chinese equipment manufacturer Hebei Nonghaha Agricultural Machinery Group, designed a vacuum planter that allows Chinese farmers to plant corn using one seed per mound. The planter not only lowers the amount of seed that farmers need to purchase and sow but also improves yields because seeds are more accurately and expertly placed in the soil. In turn, this frees up land for other crops, increasing food production. In addition, the vacuum planter will relieve farmers from manually thinning corn plants—a necessary process when multiple seeds are planted in the same spot, but a wasteful one that discards one out of every three corn plants.

Crop nutrition companies should work with farmers to develop fertilization programs that are appropriate for their local conditions and target outcomes. Crops will struggle to overcome stresses from drought, heat, and changing rainfall patterns as extreme weather conditions that are caused by climate change become more routine. Fertilization, used prudently, will be critical to support plant growth and the production of healthy food.

Crop protection companies must also find innovative ways to embrace sustainable farming before it negatively affects their businesses. They should focus on PA, which applies chemicals more accurately, significantly reducing the amount of herbicides and pesticides needed. PA is still a nascent concept: one-quarter of farms in the EU, and far fewer in developing regions, use technologies that include a PA component. That represents a wide-open opportunity for crop protection companies to develop products suited to PA. A $3.2 billion market in 2015, PA is expected to reach $7.9 billion in sales by 2022, an increase in the compound annual growth rate (CAGR) of 13.5%.

An example of an innovative PA application is “smart spraying,” currently being developed by Bayer and Bosch. This method calls for digital field managers to scan farmland, continuously taking pictures of the surface, identifying weeds, and determining the optimum amounts of herbicide required to destroy them. The system then applies herbicide only where it is needed and only in the dose required. Smart spraying also calls for alternating the active ingredients used, to prevent weeds from becoming resistant.

One of the biggest markets for crop protection companies will be biopesticides, a category that includes naturally occurring substances such as biochemical pesticides, microbial pesticides (also known as biocontrol agents), and pesticide-related substances produced by plants. These products pose fewer environmental risks than conventional chemicals, because they are either nonpolluting or break down quickly and can be effective in very small quantities.

One of the biggest markets for crop protection companies will be biopesticides.

The global biopesticides market is slated to grow at a CAGR of 15.3% from 2016 through 2022, reaching sales of $6.6 billion. That expansion is anticipated to outpace the growth of the chemical pesticides market and continue doing so over the longer term. Although the North American biopesticides market is the most lucrative, the EU market is expected to be the fastest-growing over the next few years, as it implements stringent policies and regulations on pesticide use and the demand grows for organic products in that region. Still, all biopesticides need to be tested and evaluated, as they are not necessarily naturally beneficial.

But even as sales of biopesticides grow, the use of traditional pesticides could be with us for some time, in part, ironically, because of the sustainable agriculture movement. For example, farmers that have adopted the sustainable practice of no-till farming may find that they need a chemical to kill persistent weeds. One of the more popular solutions is the herbicide glyphosate, a powerful chemical. France has announced a ban on glyphosate that will take effect in 2020; the EU debated following suit but decided to keep it on the market for at least the next five years. Still, if the EU or any other region ultimately bars glyphosate, farmers may have to return to frequently tilling their land, which is less desirable. Given this, crop protection producers would do well to develop an innovative solution to this Gordian knot, one that involves no tillage and limits pesticide use.

As traditional crop protection companies begin to move into the sustainability sphere, it is essential that they work more closely with farmers, providing information and education about pesticides and other chemicals. Companies’ efforts should educate farmers on, among other things, how to properly use chemicals, how new technologies make chemicals more efficient, and how chemicals can provide benefits in terms of yield, revenue, profits, environmental safety, and long-term success. By partnering with their customers, crop protection companies can gain the loyalty of farmers as well as open up new, untapped revenue streams.

Farming Equipment Manufacturers

Makers of farming equipment can take advantage of the need for new tools and technologies that deal with the environmental challenges that sustainable agriculture is intended to mitigate. For example, one area ripe for improvement is irrigation. Currently, the efficiency of water irrigation systems is low: the amount of water that reaches crops is only about 56% in the US and 60% in the EU; the rest is lost to runoff and evaporation without watering crops. Surface irrigation, in use on 86% of irrigated farmland, is the primary culprit. Drip irrigation systems, which apply water directly to plant roots through low-pressure piping, are a less wasteful option, but they typically require a lot of maintenance and are more expensive.

Makers of farming equipment can take advantage of the need for new tools and technologies.

That presents a huge opportunity for farming equipment makers. By enhancing drip irrigation systems with high-tech features that are designed to improve their effectiveness and reliability while cutting operating costs, manufacturers can fill a vacuum and solve a sustainability issue at the same time. The best of these systems are linked to the internet via the cloud and are automated, driven by sensors that determine the appropriate amount of water needed at specific crop sites. A recent study on the efficiency of irrigation methods and the potential for improving them found that replacing a surface sprinkler system with drip lines could reduce nonbeneficial water use by as much as 76%, while maintaining yield production.

Water irrigation systems are just one area in which agricultural equipment manufacturers could work with their customers to develop solutions and become more integral to their operations. New equipment should support PA and have strong digital components. Indeed, most new products will be cloud-based, which will enable manufacturers to amass and analyze huge amounts of data about customers’ farming operations and performance and use the information to help further improve a farm’s yield and efficacy. Although Internet of Things devices provide tremendous benefits, a battle is brewing over who owns the data collected by this equipment—the farmers, the manufacturers, or the government—and which privacy rules should be imposed to protect this data. Equipment companies that hope to expand their collaboration with their customers must deal with this thorny question in a way that satisfies them.

Importantly, to successfully enter new markets, especially the smaller-farm market in emerging nations, PA approaches must be practical, affordable, and simple. Some surveys have found that many less well-heeled farmers consider much of the PA equipment to be too complicated and expensive. In seeking business from smaller farms in more developing regions, equipment manufacturers could collaborate with local banks to offer loans to farmers who are usually unable to get financial support for big-ticket purchases.

A Pivotal Juncture

Clearly, now is a critical turning point in agriculture’s long history—a juncture reached because of a profound shift in thinking about the right way to farm in the midst of environmental and resource crises and to produce sufficient quantities of safe, nutritious food. Seed companies, crop nutrition providers, crop protection producers, and farming equipment manufacturers can participate in this new order by embracing the following tenets:

- The sustainable agriculture trend is real—and companies must prepare for it.

- To benefit from this paradigm shift, agricultural companies need to integrate the sustainability concept into their core business activities, not just into separate, disparate parts of their operations.

- Integrating the concept requires reaching out to farmers in various regions, understanding their unique concerns and how they could benefit from sustainable agriculture, and allocating resources to develop the best solutions. Companies should avoid one-size-fits-all solutions and prioritize creating economic and educational programs for farmers who have neither access to the latest technologies nor the money to buy them.

- R&D should be guided by its impact on improving sustainability metrics, not only by the return on investment.

- Companies should think holistically about the agriculture industry and the impact that their products and services have on regulators, consumers, food companies, farmers, and global economic and social development.

- Capturing new markets will require a diverse portfolio. Sustainable farmers can’t use boilerplate practices; rather, they need solutions that are appropriate for local conditions, consumers’ needs, and agricultural constraints.

- Making the best decisions about new and existing products in a complex and challenging landscape requires balancing their environmental impacts. Sustainability decisions can have unintended effects on other aspects of farming and food production, which, in turn, may affect critical environmental resources. So, companies must view these decisions broadly.

That’s a long list and a tall order for some companies, but sustainable agriculture is a movement with significant momentum. Agricultural companies are in the perfect position to become central players in sustainable agriculture, driving innovation and technological solutions. Many have already begun to develop products that align with sustainable goals. And now more than ever, agricultural companies have the opportunity to join forces with other stakeholders to improve crop yields, enhance the quality of food for people in developed and developing regions, and protect environmental resources.