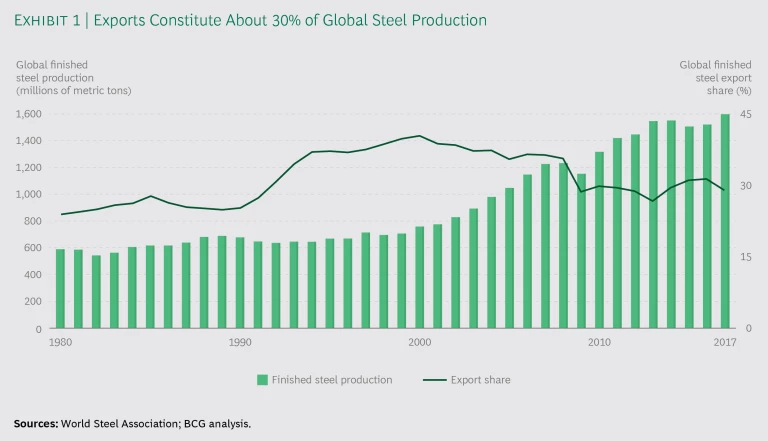

Trade has been enormously important to the steel-producing and steel-consuming industries. Global steel exports have been growing in absolute terms for the past 70 years, virtually without interruption, and they have accounted for 30% to 40% of all steel produced during the past three decades. (See Exhibit 1.) The benefits of the steel trade, which amounts to more than 400 million metric tons shipped per year, have been incalculable: abundant supply, lower material costs for construction companies and manufacturers, more affordable products for consumers, and competitive pressures that have encouraged steel producers all over the world to specialize and innovate.

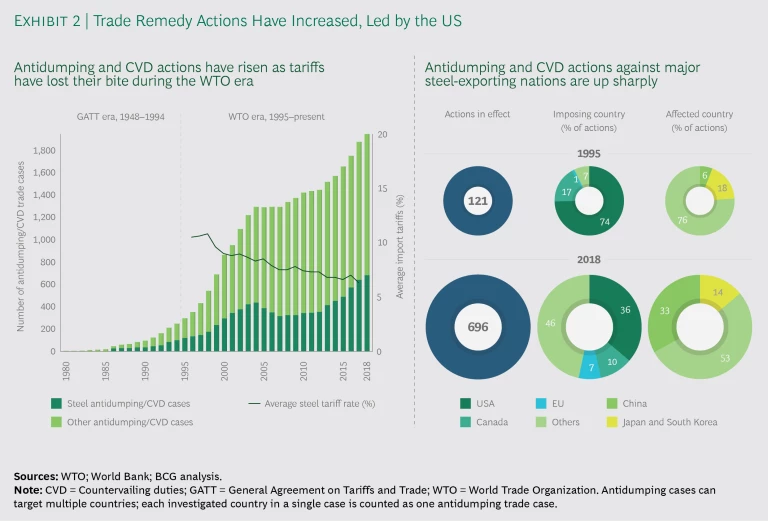

But just as trade has been a fixture of the steel business, so has trade conflict. Both producers and consumers of steel have grown accustomed to coping with legal battles over allegations of dumping and unfair subsidies that have led to sharp spikes in tariffs on traded steel products. Rarely, however, has the global business landscape been as challenging to navigate as it is today. The number of antidumping duty orders in force on specific countries’ steel exports has been rising by around 10% per year since 2012, according to World Trade Organization (WTO) data. The US added a complex new dimension to the steel trade in March 2018 by citing national security as a justification for imposing a 25% tariff on steel imports from virtually all countries. In response, the European Union and Canada have moved to safeguard their own producers from a surge in steel imports.

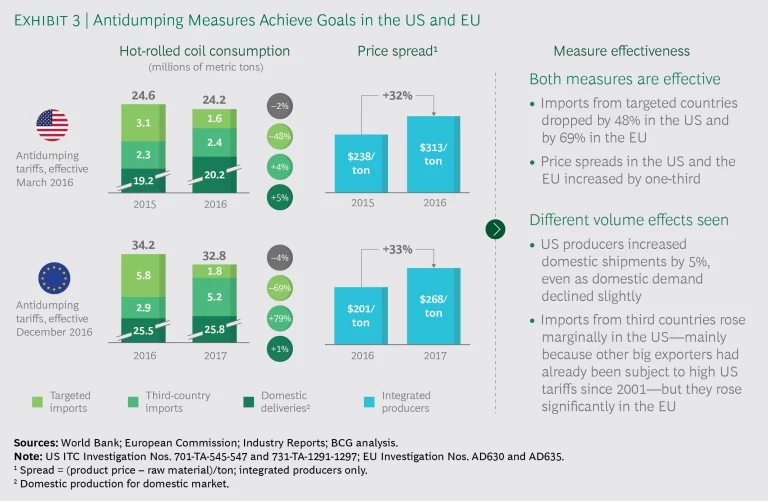

These antidumping actions and high US national-security tariffs have achieved their desired first-order effects. Our analysis reveals that the antidumping duties imposed by the US and Europe over the past two years on carbon flat steel have sharply reduced imported steel products from the targeted countries—by from 50% to 95%. The 25% tariffs that the US imposed in 2018 have boosted profit margins for domestic producers and increased capacity utilization in the domestic industry.

But these policy interventions have come at a cost. Higher steel prices have raised material costs for construction companies and domestic manufacturers of goods as diverse as screws, vehicles, and kitchen appliances, and not all of these companies are in a position to pass the added costs on to their customers. Because far more workers are employed in steel-consuming companies than in steel-producing ones, some economists warn that high tariffs will cause more economic harm than good in the US, by forcing steel users to shift production or procurement of assembled components offshore. The various trade actions have also created uncertainty. Because recently imposed tariffs could change again as a result of further trade negotiations, it is more difficult for companies to enter into long-term contracts with steel suppliers and for steel producers to make investment decisions regarding new capacity, technologies, and products that could define their competitiveness years into the future.

Some economists warn that high tariffs will cause more harm than good in the US, by forcing steel users to shift production or procurement of components offshore.

Steel Trade Disputes in Context

Historical context helps to explain why the current trade environment is so challenging. Steel has long been at the center of global trade policy. And though trade has been good for steel consumers, domestic steel makers and workers have generally opposed imports and more open trade. In general, there has been considerable political support for protecting domestic steel industries, which are seen as critical sources of high-paying jobs and are strategically important for other sectors.

Traditionally, nations have protected their steel industries with tariffs. The post–World War II movement to ease protectionism, which began with the 1948 General Agreement on Tariffs and Trade (GATT), resulted in the first rounds of international tariff cuts. All GATT member nations agreed to grant each other equal trade privileges. In 1952, six European nations began managing their steel production and markets through the European Coal and Steel Community—the precursor of the European Union. Intended to make wars between France and Germany materially impossible, the move also eliminated tariffs on coal and steel between member nations and resulted in an alignment of tariffs for nonmembers.

By the 1970s, however, claims of unfair steel exports began to appear. The US accused European steel makers of damaging its domestic steel industry by dumping their products at prices lower than they charged in their home markets. As more nations entered global steel markets, complaints proliferated that governments were unfairly subsidizing their steel industries in order to seize competitive advantage in export markets. In antidumping and countervailing duty (CVD) actions, which occur in response to subsidies, importing nations assess tariffs against the goods of targeted nations as a remedy for damage that the market presence of those goods inflicts on domestic producers. The EU and the US employ both instruments, but they follow significantly different approaches in doing so. (See the sidebar.) These policy tools are supposed to follow frameworks and rules set by WTO agreements concluded in 1994, which built on earlier GATT agreements and replaced the GATT organization with the WTO.

Key Trade Remedy Actions Explained

Key Trade Remedy Actions Explained

Actions against alleged unfair trading practices in steel and other industries generally fall into three categories:

- Antidumping measures are taken when a foreign company is found to be harming domestic industries by selling its goods for less than their production costs, or at a price below what the company charges in its home market.

- Countervailing duty (CVD) measures are taken when domestic industries are found to be suffering because a foreign competitor is benefiting from subsidies.

- Safeguards are quotas and/or tariffs implemented to protect domestic producers that are under threat of a sudden surge of imports.

The importing country takes action under its own domestic trade remedy laws, which must be consistent with baseline WTO rules. According to these rules, the complaining party must not only prove that imports were dumped or unfairly subsidized, but also that one or more domestic producers suffered material injury (in the case of antidumping and CVD actions) or serious injury or the threat thereof (in the case of safeguards). Injury is essentially the economic cost of lost revenue and profits. Normally, if companies cannot prove that they have suffered injury, national authorities are not legally permitted to apply tariffs.

Even though trade remedy laws must conform to WTO rules, countries’ policy and legal processes are marked in practice by considerable variation. This, in turn, gives countries significant latitude to manage their own trade policy levers.

The EU and the US, for example, use different methods to determine remedy tariffs in antidumping and CVD actions. The EU imposes a duty that compensates for the dumping margin or unfair subsidies, or it imposes a duty that compensates for the injury to domestic producers—whichever is lower. This is known as the lesser duty rule. Often, the difference between the dumping margin and the injury margin is significant but difficult to calculate. Furthermore, the EU considers the potential economic harm of a remedy duty on domestic companies that use steel as well as on EU consumers. This is known as the community interest test in EU trade policy.

The US, by contrast, imposes remedy tariffs equal to both the full dumping margin and the unfair subsidies. As a result, trade remedy tariffs on imported goods from targeted countries tend to be much higher in the US than in the EU. Moreover, when determining the duty, the US considers the economic impact on producers only, not on steel users and end consumers.

The high tariffs that the US imposed on all steel and aluminum imports in March 2018 represent a different kind of action. The government asserted that the action was necessary under Section 232 of the Trade Expansion Act of 1962, which seeks to ensure that the US is not beholden to hostile foreign powers for defense and security procurement. Prior to the 2018 action, Section 232 tariffs had been implemented only five times since 1962—and against petroleum imports in each instance, never against steel.

The use of national security provisions in domestic trade law has not yet been tested before a WTO dispute settlement panel. WTO members Canada, China, the EU, India, Mexico, Norway, Russia, Switzerland, and Turkey have filed WTO complaints alleging that the US’s Section 232 tariffs on steel and aluminum violate WTO rules. Some observers believe that a WTO panel would be reluctant to define what is or is not in the national security interest of a member state. However, a panel might rule on whether the trade policy implemented is necessary to achieve an asserted national security interest. In any event, WTO processes can take many years to reach a conclusion, so any near- to middle-term relief from the Section 232 tariffs would require a negotiated solution.

China’s arrival as a steel superpower has further altered the industry’s dynamics. Even though China exports only a small percentage of its output, the sheer scale of its production has generated annual steel exports that in some years have exceeded 100 million tons, leading to trade friction around the globe. Antidumping and CVD actions accelerated in 2015 and 2016 following a surge of Chinese steel exports. In 2018, 33% of the 696 steel antidumping and CVD trade actions that were then in force targeted China. (See Exhibit 2.)

The use of antidumping and CVD actions is a policy choice, however. In practice, many WTO member states do not use these trade defense instruments at all.

The Impact of Trade Actions on Steel Markets

To assess the impact of trade remedies on steel markets, we analyzed antidumping cases brought by the US and the EU against countries that accounted for similar volume shares of imports during roughly the same time frame—from 2015 through 2017—in four categories of carbon flat steel: hot-rolled coil, cold-rolled coil, cut-to-length plate, and hot-dipped galvanized steel. Coil refers to sheets and strips of steel that are shipped in rolls.

We analyzed import volumes, steel prices, and spreads between steel prices and the prices of the raw materials required to produce a ton of steel for each steel product category, as well as overall producer profit margins following the imposition of higher duties.

Our analysis found that antidumping actions are generally effective in achieving their stated goals. In each case we examined, the trade actions led to an immediate reduction, ranging from almost 50% to 95%, in imports from the targeted countries. Market prices for the steel products and producer profit margins were significantly higher one year later.

Hot-Rolled Coil and Cut-to-Length Plate. Hot-rolled flat products constitute the largest internationally traded steel category. Trade actions by the EU and the US had similar effects on price spreads in hot-rolled coil and cut-to-length plate, although the effect on market shares of foreign versus domestic suppliers differed. From 2006 to 2016, the EU did not protect its industry for these products at all. In 2016, after a surge in imports, the EU targeted hot-rolled coil from China, Russia, Ukraine, and Brazil and cut-to-length steel plate from China and India. High duties helped EU countries dramatically slash imports of both types of products from the targeted nations. However, suppliers from other, nontargeted nations captured most of the resulting shift in market share. In the case of hot-rolled coil, while imports from targeted countries fell by 69% and spreads rose by 33%, imports from nontargeted countries increased by 79%. Ultimately, shipments by domestic EU producers rose by only 1%. (See Exhibit 3.)

In contrast, the US had for nearly two decades used high antidumping duties and CVDs to shut out major foreign suppliers such as China, Russia, and Ukraine from its domestic market for hot-rolled coil and cut-to-length plate. In 2015 and 2016, the US imposed high duties on additional countries, including South Korea, Brazil, and Australia. By the following year, imports from these targeted nations fell by more than 40%. But because few other nations could economically ship large quantities of hot-rolled coil and cut-to-length plate, US imports from third countries increased only slightly. Consequently, domestic US producers increased their shipments of hot-rolled coil by 5%, even as domestic demand declined slightly. Despite the significant reduction in steel imports, however, spreads in the US rose by 32%—a pace similar to that in the EU (33%)—even though steel imports in the EU remained steady.

Antidumping duties by the EU and the US on cold-rolled steel caused imports from targeted countries to plunge, but those imports were largely replaced by imports from other nations.

Cold-Rolled Coil and Hot-Dipped Galvanized Steel. Both the EU and the US pursued antidumping cases involving these further processed products, and these efforts yielded similar results. EU markets were open to cold-rolled and galvanized steel imports until 2016. The US had also largely opened its market during the period from 2006 to 2016. Then, when imports into both markets surged, the EU and the US responded with trade actions.

The EU targeted China and Russia, its two biggest import sources. A year after the EU enacted high duties, imports of cold-rolled coil and hot-dipped galvanized steel from China and Russia plunged. But EU imports of these same products from Turkey, India, Egypt, and other sources skyrocketed, leaving overall import levels stable. The US targeted more countries than the EU and imposed much higher remedial duties. But as was the case in the EU, imports of cold-rolled and galvanized steel from other nations into the US replaced those from the target countries, and total US import volume remained about the same.

The US Section 232 Steel Action and European Safeguards

In early 2017, the US Department of Commerce concluded that imports of steel and aluminum constituted a threat to national security. Then, in March 2018, the US levied protective duties of 25% on imported steel and 10% on aluminum under the rarely used Section 232 of the Trade Expansion Act of 1962, which authorizes the US president to restrict imports under certain circumstances.

This massive intervention against nearly all imported steel products from all foreign countries—regardless of the fairness of their trading practices—was unprecedented. The US’s stated goal was to increase its domestic steel industry’s capacity utilization to 80% by reducing imports by 13 million tons per year.

Article 21 of GATT permits a country to take “any action which it considers necessary for the protection of its essential security interests.” But several nations are challenging the legality of the US actions in the WTO Dispute Settlement Body, contending that its true aim in invoking Section 232 is protectionism, and that their steel exports to the US pose no threat to US national security. The US maintains that it is free to define what constitutes its national security and that, therefore, WTO rules do not prohibit its actions. A number of countries have responded with retaliatory tariffs on select US exports representing similar dollar volumes of steel, aluminum, and other, unrelated products.

Retaliatory tariffs are just one type of regulatory intervention that governments may adopt. Safeguards—temporary, emergency measures that countries enact to protect their industries from serious injury in the event of unforeseen, sharp, and sudden import surges—are another option. Such safeguards, which must meet tough preconditions, typically take the form of duties or quotas and apply to imports from all countries. Fearing that a diversion of steel exports from the US would lead to a surge in steel exports to their own markets, the EU, Canada, and other countries implemented their own safeguards soon after the US trade measure went into force.

The EU safeguards, which went into effect on February 2, 2019, and will remain in force until July 2021, impose tariff-rate quotas on 26 categories of steel products. Countries with more than a 5% market share in a steel product category are assigned country-specific import quotas; all other countries are assigned the residual global tariff-rate quota for those products. Quotas are based on the average steel import volume of each product for the previous three years plus 5%. Imports up to quota level will enter the EU according to its normal published tariff schedule. Once imports of specific products reach the specified level, the EU will impose a safeguard tariff of 25% on any additional volume. The free-from-safeguards quota level is set to rise by 5% in July 2019 and by another 5% in July 2020. Nations that were already subject to antidumping and CVD tariffs fall under the global quota. Because a large share of hot-rolled coil imports was already subject to antidumping duties, the EU did not set country-specific quotas in this important product category.

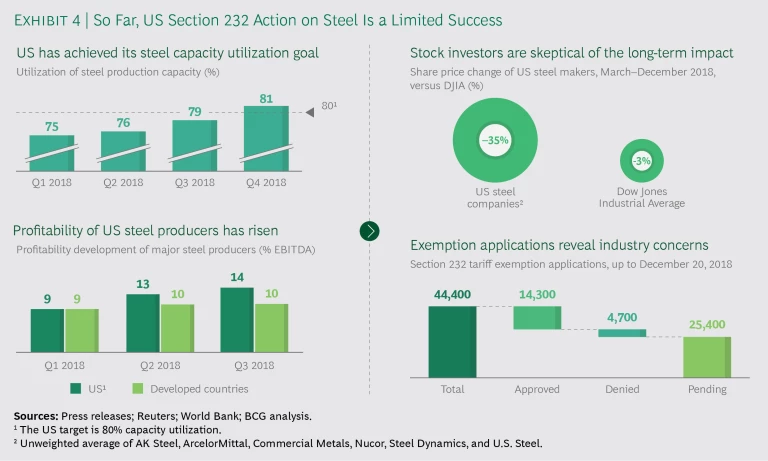

Initially, domestic US steel producers clearly benefited from the US’s 25% tariffs under Section 232, but questions remain about whether those gains are sustainable.

The Impact of Section 232 on the Steel Market

On the basis of data available so far, it appears that the US’s Section 232 intervention achieved some—but not all—of its desired effects. Initially, domestic US steel producers clearly benefited from the 25% tariffs. Domestic steel capacity utilization rose from 75% in the first quarter of 2018 to 81% in the fourth quarter, achieving the US target. As yet there is not enough data available to make clear the impact on US steel import levels, but data does indicate that sharply higher domestic prices have translated into higher profits for US steel producers. Profitability in the US increased by 5 percentage points, while it remained largely unchanged in other parts of the world. Earnings before interest, tax, depreciation, and amortization for major US steel producers rose from 9% in the first quarter of 2018 to 14% in the third quarter, surpassing the average for all steel producers in developed economies.

The big questions, however, are whether these gains are sustainable and whether they represent a net gain for the US economy. Global demand growth is slowing, and US steel prices have declined recently. There is some risk that they will fall further and that capacity utilization will drop as new production comes on line. Industry analysts estimate that if US steel makers follow through on all of their announcements, they will add more than 13 million metric tons of capacity during the period from early 2017 to 2023. Meanwhile, equity investors are concerned that the US government might roll back some of its tariff protections if it reaches new trade deals with major partners. After soaring initially, the shares of publicly listed US steel producers declined, on average, by 35% from March through December 2018, compared with a dip of only 3% in the Dow Jones Industrial Average.

For the US economy, the gains of steel producers have been partially offset by the negative impact of the tariffs on US companies that use steel. One indicator of that impact—and of the importance of imported steel—is the number of applications (more than 44,000) for exemptions from the Section 232 tariffs filed as of December 20, 2018, by companies asserting that a lack of steel of the required quality or volume in the market is damaging their businesses. More than 14,000 of these applications were approved as of that date—more than three times as many as were denied. Also as of that date, more than 25,000 applications were still pending, underscoring the immense administrative challenge that the Section 232 tariffs pose for the US government. (See Exhibit 4.)

Identifying Section 232’s Winners and Losers

The recent trade actions taken by the US are creating winners and losers among the world’s steel producers and consumers.

Among national producers, the most immediate winners are US steel makers and their employees. The profitability of US integrated steel producers has increased. However, it has also improved for minimills, which are likely to continue taking market share from integrated steel producers regardless of tariff protection. Minimills use electric-arc furnace technology to make steel products, generally by melting and refining scrap and direct-reduced iron, rather than the blast furnaces that integrated mills use to produce steel from iron ore. In the past three decades, flat-steel minimills have increased their production while the output of integrated steel mills has declined—a trend that tariff protection will not change. Minimills have seized about half of the US market for flat steel, not including steel that is processed in rerolling mills. As the quality of their products improves, minimills are making inroads in the critical automotive sector. Most new investment in US steel capacity is flowing into facilities that deploy electric-arc furnace technology, which is less labor-intensive than blast-furnace technology. What’s more, companies are building a significant number of leading-edge minimills in the US South, rather than in the Midwest, where many of the older integrated mills are located.

Integrated steel mills that are interested in seizing the opportunity currently offered by high tariff protection can do two things. First, they can invest in improving their efficiency. Second, they can focus on core business segments in which they still hold the strongest position and aim to deliver domestic high-quality products that require higher levels of customer service, such as just-in-time delivery, technical support, and collaborative R&D.

High-grade steel for automobiles is one product that meets these criteria. But producers must use this window of opportunity. The current tariff protection gives US producers the breathing room they need to take domestic market share from foreign producers and to improve their operations so that they will be stronger competitors after the tariffs are removed.

Among producers of steel, the biggest losses will be felt by foreign suppliers, which have become less competitive in what was once a lucrative export market. In the immediate aftermath of the Section 232 action, the US agreed to exempt imports from a number of major partners, but it revoked those exemptions soon thereafter. Imports from Canada—the biggest foreign supplier—and Mexico continue to be charged a 25% tariff, even after those countries agreed to the US-Mexico-Canada Agreement that is to replace NAFTA.

Among producers of steel, the biggest losses will be felt by foreign suppliers, which have become less competitive in what was once a lucrative export market.

Many American companies for which steel is an indispensable raw material will also pay a steep price, as will their customers. In the fabricated metals and steel-processing industries, steel often represents 30% to 80% of the material cost. Among highly steel-intensive manufacturers that have the most to lose are makers of boilers, storage tanks, shelving, springs, screws, pipes, tubes, and wire. The higher steel prices resulting from the Section 232 tariffs may endanger their ability to compete in domestic and export markets.

In many sectors, steel is the first step in extensive value chains. Higher steel prices, therefore, create cost pressures that get pushed down the chain to steel-consuming industries. Construction, automotive, and machinery companies—the steel industry’s biggest customers—will be negatively affected. Manufacturers of kitchen appliances, farm machinery, and motorcycles have already reported that higher material costs are affecting their profitability.

Given the vast size of steel-consuming industries—the fabricated metals and steel-processing industries alone employ ten times as many workers as US iron and steel mills do—the negative impact on overall US employment and investment could outweigh employment gains in the steel sector.

American manufacturers that are not directly affected by the steel tariffs also face risks as US trade partners decide whether to retaliate against their industries. The EU has imposed retaliatory tariffs on such important US products as motorcycles, Kentucky bourbon, and Florida orange juice. Canada has targeted cranberries from Wisconsin. The aim in each case is to produce a comparable financial effect and maximum political impact.

A Framework for Taking Strategic Action

The landscape of the global steel trade will continue to shift, sometimes radically. Tariff policy is just one element of this changing global environment, which is also being redefined by alterations in local-content requirements, nontariff barriers, and regulations. The impact of these changes on companies will depend on the companies’ position in the steel-processing value chain and on the locations of their production facilities or suppliers.

It is critical, therefore, that companies be proactive. They must develop an effective way to identify and mitigate the risks—and to capture the opportunities—created by changes in the global trade landscape. They must also ensure that their organizations are flexible enough to act quickly in response to different scenarios.

Managing these risks and opportunities should not be solely the responsibility of companies’ legal or government affairs departments, nor of operating units. Instead, companies should manage them as fundamental strategic issues, with direct involvement of the CEO. Hence we recommend that executives take the following actions.

As a first step, companies should dedicate resources to building their capacity to recognize, understand, and monitor shifts in geopolitics, macroeconomic trends, and the global trade order—and their impact on the company’s supply chain. One option might be to establish a trade impact unit, a dedicated cross-functional team that maintains connections with operations, procurement, legal affairs, communications, and marketing and sales.

Leaders along the steel supply chain should then allocate resources to several key initiatives. One such initiative would be to develop a trade strategy that defines clear guidelines for action under certain circumstances or in response to major changes in the business environment that affect the company’s strategic direction. The company should have a blueprint in place that identifies a specific response when a key component or raw material can no longer be sourced in the usual way.

Likewise, resources should be allocated to building internal and external networks that will help the company navigate challenges. It should acquire expertise in trade and compliance, for example, and build relationships with outside experts and associations that have relevant expertise and similar interests.

The company also needs to dedicate resources to creating visibility in its global supplier network. For instance, it can use digital tools that foster a clear, real-time understanding of activities and repercussions in its supply chain.

These initiatives will enable the trade impact team to carry out three key operational tasks, which we refer to as sense, prepare, and act. (See Exhibit 5.)

Sense. Companies should build an early-warning system for trade impact, on the basis of relevant data and close monitoring of political and economic developments. They should also understand how changes in the cost and flow of business inputs and outputs are likely to affect their competitive position, thereby enabling company leaders to make the necessary preparations to move boldly, regardless of the particular outcome.

For steel companies that export to nations that have their own domestic steel industries, the early-warning system should include a keen awareness of prices both at home and abroad to avoid incurring dumping sanctions. Leaders should ensure that sales agents are aware of the consequences of selling steel in such markets at prices below those in the domestic market.

Steel-consuming companies should conduct a bottom-up analysis of the entire value chain—from the upstream supplier base to operations and asset investments in each country in which they operate to downstream distribution channels and end customers. The trade impact team should assess the company’s vulnerability to changes in revenues, costs, and asset utilization under a number of plausible trade scenarios. Automotive OEMs, for example, should understand how higher steel costs in different countries will affect assembly operations and key components for each model line.

Companies should focus on building their capacity to recognize, understand, and monitor shifts in geopolitics, macroeconomic trends, and the global trade order.

This analysis should include assessment of the risk exposure of competitors. CEOs should understand whether their competitors are less vulnerable or more vulnerable to trade actions. The results could reveal opportunities on the revenue side. If a company’s competitor has to increase prices in a certain market as a result of tariffs, for example, this situation could create an opportunity for the first company to raise its own prices without increasing its cost base—or to go on the offensive and seize market share by maintaining prices that are too low for the competitor to match.

Prepare. To help the company remain agile, the trade impact team should use information and analysis to prepare responses to changes in trade policies. Having a flexible playbook of actions will enable leaders to respond to potential trade policy scenarios, reduce exposure to high tariffs, and seize windows of opportunity to create an advantage.

Steel producers in nations that are targets of a trade remedy action and wish to fight the action should prepare evidence to demonstrate that their exports are not damaging domestic industries in the importing country. They should also plan initiatives for winning additional customers in markets with low trade barriers. Steel producers who stand to benefit from tariffs should have plans on hand for ramping up production so that they can move as quickly as possible to gain share from foreign competitors in their domestic market when the latter find themselves at a disadvantage.

Steel-consuming companies can prepare by taking preemptive moves in anticipation of a trade action. They can secure supply and price protection with current suppliers and line up potential alternative suppliers to reduce exposure and provide strategic flexibility. When feasible, construction companies or manufacturers could prequalify suppliers from a different country so that they can shift to them as quickly as possible if antidumping tariffs go into effect. In some situations, importing a finished component that contains tariff-impacted steel, rather than making the component, may be another viable option.

Companies should be prepared to shift production or find new markets as soon as a country initiates trade action against them.

The playbook should include options for decisive moves when it becomes clear that a country’s trade policy will indeed change. Companies should be prepared to shift production or find new markets as soon as a country initiates trade action against them. Steel consumers should have plans to adjust manufacturing and supplier footprints under various scenarios. They should have strategies for negotiating prices and securing alternative production facilities, materials, and labor in new locations. Specific triggers for taking action—such as commencement of an antidumping investigation—can aid companies in reacting swiftly.

Leaders of steel-consuming companies should also pursue proactive strategies for influencing trade policy outcomes. Companies should communicate with government actors at all levels to impress upon decision makers how their businesses will be affected by new trade restrictions. They should seek allies among companies, community organizations, workers, and other stakeholders that benefit from their business. Companies must also clearly communicate to customers, employees, suppliers, and shareholders that they are prepared to survive and thrive in the face of altered trade agreements.

Act. Steel producers that are targets of an antidumping action must act as soon as the country’s investigation begins, because the risks involved in waiting until the government reaches its preliminary and final determinations are too high. In addition to examining the feasability of entering new markets, companies should consider significantly altering their products in ways that might allow them to be reclassified in a way that renders them no longer subject to tariffs. If an importing country decides to impose quotas on steel products from its country, the company needs to move quickly to secure quota allotments.

Steel-consuming companies that face little competitive pressure or that cannot shift production should determine how much of the added material costs of high tariffs they can pass on to customers in the form of higher prices—and how much they must absorb themselves. Manufacturers whose competitive position will be damaged by high steel tariffs should begin the process of shifting production and supply sources as soon as the country issues a preliminary determination. If a manufacturer relies on a particular steel material that is subject to import quotas, it must move as quickly as possible to secure supplies. Otherwise, the company will be at risk of not being able to procure a critical material once that quota is filled for the year.

If possible, steel consumers facing higher prices due to protective tariffs on their materials should seek tariff exemptions from their government. At the same time, they must shift their sources of supply and manufacturing operations as swiftly as possible. Agility is the key to minimizing the impact on costs—and seizing competitive advantage against competitors that are slower to respond.

Decades of relatively free world trade have been good for both producers and consumers of steel. While dealing with trade friction has always been part and parcel of the business, the global steel community must now adapt to a new era of prolonged, heightened volatility in an industry that has been accustomed to long-term planning. The companies that emerge as winners in this environment will be those that have the foresight to anticipate and mitigate risks and the agility to seize opportunity when it knocks.