If history is any guide, M&A will be an important tool for building materials companies as they position themselves to thrive in the post-pandemic recovery. Although blockbuster megadeals have been relatively rare in this sector, the industry has seen a resilient volume of small deals over the longer term. These transactions have created significant value, exceeding the average returns of other industries. And this outperformance has been especially strong for deals made during economic downturns.

But superior returns are not guaranteed. The fragmented and diverse landscape of the building materials industry makes it especially important for companies to have a clear-cut strategic rationale for M&A that allows them to focus on the right industry subsectors. The relatively small average deal size also makes it imperative for companies to build their “M&A muscle” across all aspects of the process, from target identification through integration.

The M&A Landscape: Small Deals and Active PE Firms

M&A helps building materials companies counteract two challenging industry characteristics: structurally low revenue growth in most segments (owing to industry maturity) and low margins (stemming from commoditization). The use of M&A to grow the top line and create distinctive, integrated product offerings may explain why many such deals have succeeded in creating value.

Indeed, M&A has typically been the dominant source of revenue growth in building materials, and revenue growth has been the largest driver of total shareholder return (TSR) for building materials companies over 5-, 10- and 15-year time frames.

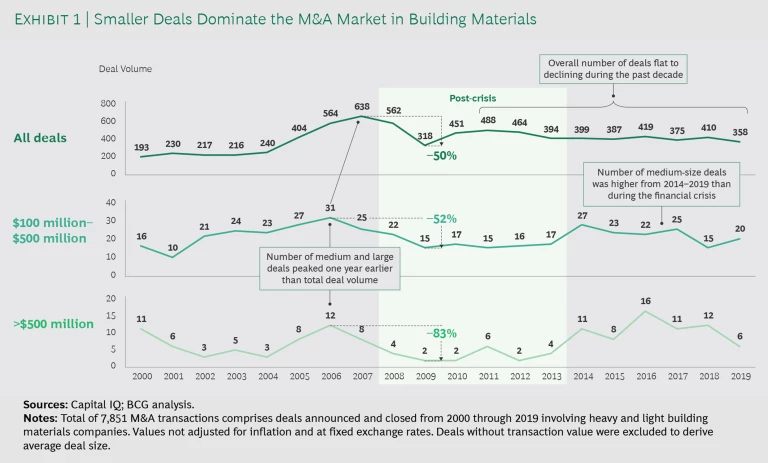

Small deals have dominated the M&A landscape in recent years. Since 2015, the average deal value in the building materials sector has been less than $200 million. The heavy and light materials segments have generally seen similarly small transactions. Although M&A activity has been punctuated by megadeals (for example, the $32 billion merger of Lafarge and Holcim in 2014), they are infrequent—fewer than 13 deals over $500 million in five of the past six years (out of a consistent baseline of roughly 400 per year). (See Exhibit 1.)

The number of large deals held at a particularly low level from 2008 through 2013, during and immediately after the financial crisis. The number of small acquisitions declined in 2008 and 2009 but recovered quickly. The resilient volume of small deals has led to relatively consistent overall deal volume from year to year over the past decade.

Private equity (PE) firms have ramped up their dealmaking in building materials in recent years. PE deals’ share of all acquisitions in building materials doubled from 11% from 2000 through 2007 to 22% from 2014 through 2019. PE deals have also become larger, representing more than 40% of total deal value in the industry in 2018 and 2019. Large PE buys include Lone Star’s acquisition of BASF’s Construction Chemicals business for €3 billion and Blackstone’s acquisition of CRH’s European distribution business for €1.6 billion.

Building Materials Deals Outperform Other Industries

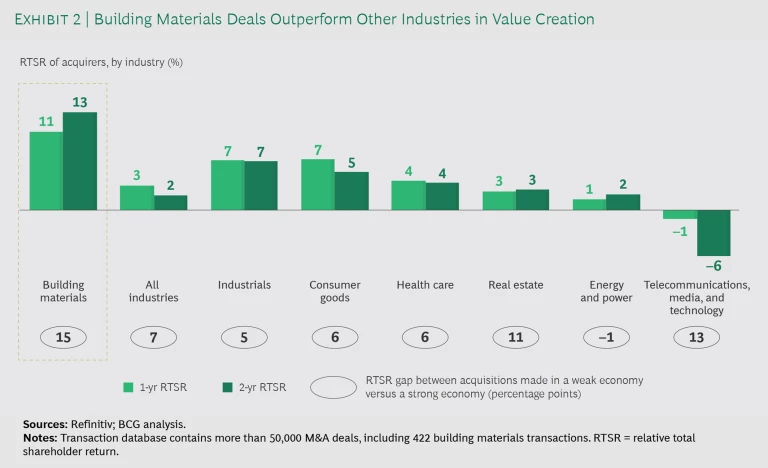

Building materials companies outperform other industries when it comes to creating value from acquisitions. (See Exhibit 2.) For these companies, relative total shareholder return (RTSR) is 11% one year after an acquisition and 13% in two years. These returns significantly exceed those observed in other industries.

Building materials companies also stand out for their success in creating value through M&A during an economic downturn. Historically, downturns are a good time for dealmaking. BCG research has found that, across industries, deals made in a weak economy outperform those made in a strong economy (one-year RTSR of 6.4% in a weak economy versus –0.6% in a strong economy). In the building materials industry, the weak-economy advantage is even more pronounced, with acquisitions made during a downturn significantly outperforming those concluded during a strong economy. RTSR is 15 percentage points higher for weak-economy deals, which is larger than in all other major industries.

Relative total shareholder return in building materials M&A significantly exceeds that observed in other industries.

The significant weak-economy advantage could be attributable to the relatively cyclical nature of the building materials industry, as the performance of many segments depends on the strength of construction activity.

The Elements of a Successful Strategy

Clearly, M&A offers attractive opportunities for building materials players. In particular, the current downturn could create an opportunity for these players to make selective acquisitions, as well as to gain experience that will enhance their dealmaking capabilities in the years ahead. But they will need to navigate a market dominated by small deals and vie with very active PE competitors.

The current downturn could create an opportunity for building materials players to make selective acquisitions and enhance their dealmaking capabilities.

To succeed, a company needs a carefully considered M&A strategy that guides how it will identify pockets of value in the industry, effectively search for targets in those areas, and plan for value creation and integration.

Identify where to play. The building materials industry is broad and diverse, comprising a wide variety of segments that have different market dynamics with respect to growth, profitability, and capital intensity, among other characteristics. This makes it critically important for companies to identify which segments to focus on for M&A. Segments adjacent to a company’s core business may offer particularly attractive buying opportunities by enabling the company to achieve commercial synergies or create integrated product offerings. However, given the fragmented market and prevalence of small deals, driving meaningful growth through M&A may require companies to make multiple acquisitions (a “string of pearls” approach) that consolidate smaller businesses around an initial “platform” acquisition.

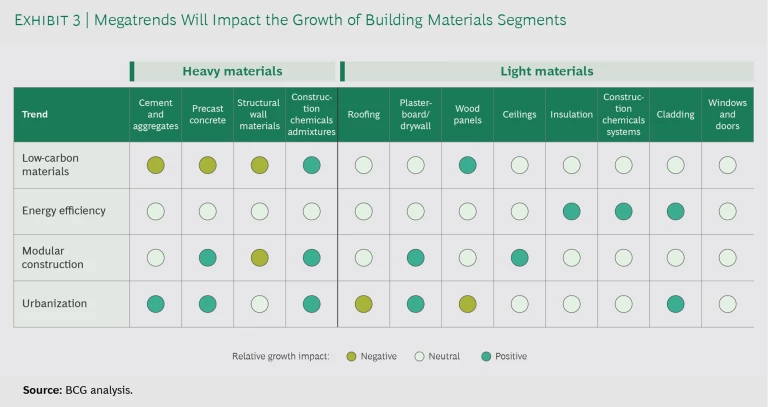

When considering the role of M&A in driving long-term growth and value creation, building materials companies should also assess the impact of four key megatrends that are driving very different growth profiles across industry segments.

- The Shift to Low-Carbon Materials. To reduce CO2 emissions, the industry is shifting away from nonrenewable and carbon-intensive materials and toward sustainable resources. This trend is also expected to become an increasingly important driver of M&A in this sector as companies seek to revamp their portfolio of activities and invest in technologies to mitigate the carbon impact of their operations.

- Demand for Energy-Efficient Buildings. To reduce costs as well as their CO2 footprint, businesses and consumers are increasingly demanding that buildings be designed for greater energy efficiency. This is creating tailwinds for growth in subsegments like insulation and exterior cladding.

- Increased Use of Modular Construction. Constructing buildings and homes with prefabricated materials reduces construction time and labor requirements. This trend is driving demand for new integrated product offerings.

- Urbanization. The shift in population from rural to urban areas is creating greater demand for high-rise residential buildings and multifamily homes, which typically use different construction materials than traditional residential buildings.

These megatrends will affect the growth trajectory of building materials segments in different ways. (See Exhibit 3.)

Set up a continuous and comprehensive target search. A company should establish search parameters that allow it to pursue targets in the most attractive value pockets. Because small building materials companies frequently come to market, it needs a continuous search process that comprehensively scans for attractive acquisitions. The company should make scouting part of the organization’s DNA by motivating people in the field to be on the lookout for potential targets. Regional commercial and sales teams are especially well placed to spot opportunities because of their familiarity with local market dynamics, including the capabilities of the local players. M&A teams should engage with these teams to tap into their insights.

A company should establish a search process that comprehensively scans for attractive acquisitions.

Define clear plans for value creation and integration. When pursuing a target, a company should already have a clear plan for creating value and integrating the assets. In the building materials arena, there are two common value creation strategies.

- Buy, Improve, and Sell. The buyer takes a transaction-by-transaction approach in which its value creation plan is based on acquiring and improving the asset and then selling it. PE firms have used this approach successfully by taking advantage of the local focus of many small building materials companies and the prevalence of family-owned businesses. This has allowed PE buyers to achieve strong returns on investment by professionalizing businesses—even within a three- to five-year time frame.

- Buy and Build. The buyer makes a series of acquisitions with the goal of consolidating a particular segment (for example, making an initial platform acquisition in a fragmented segment and adding bolt-on acquisitions that consolidate local players) or growing geographically (for example, buying a target to gain access to a new customer base for the company’s existing products). For instance, an established player might integrate the acquired businesses into its legacy portfolio.

Building materials companies can learn from PE firms’ success in deploying both of these strategies. Lone Star Funds provides a case in point—the company has used the buy, improve, and sell approach in numerous acquisitions over the past decade. In 2013, for instance, it acquired Continental Building Products, a maker of gypsum boards, for $600 million. The company was later taken public, allowing Lone Star to sell down its stake. Saint-Gobain acquired the company in 2020 for $1.4 billion.

In contrast, Clayton, Dubilier & Rice used the buy-and-build approach to acquire and then merge several companies over more than ten years to create Cornerstone Building Brands. The company is now the largest manufacturer of exterior building products in the North America. StellaGroup, backed by PAI Partners, acquired CRH’s shutters and awnings business in 2019. The acquisition allowed StellaGroup to grow its existing sun protection and closure system business, which was already the market leader in France, into a pan-European leader.

Building materials players have an outstanding track record when it comes to creating value from M&A, and deals made during downturns have achieved especially strong returns. Importantly, though, most companies will not be able to create value using the “one and done” approach of making a single large acquisition. Instead, they need to apply an industrialized approach to make a series of smaller acquisitions. The downturn provides an excellent chance to refine this approach and build the related capabilities. By taking advantage of this opportunity, building materials companies can set themselves up for above-average returns in the future.