Industrial products companies’ initial forays into digital services didn’t go exactly as planned. Many had high expectations that expanding into digital would help them expand services, the most profitable part of their business, and lead to new sources of revenue, leaner field operations, and more targeted sales. But making digital happen was harder than they anticipated. Companies quickly realized that they lacked the foundational digital platforms and systems on which to build other applications in a scalable, competitive way, whether those applications were for new services, a more efficient way to manage their operations, or deeper insight into pricing and selling of services.

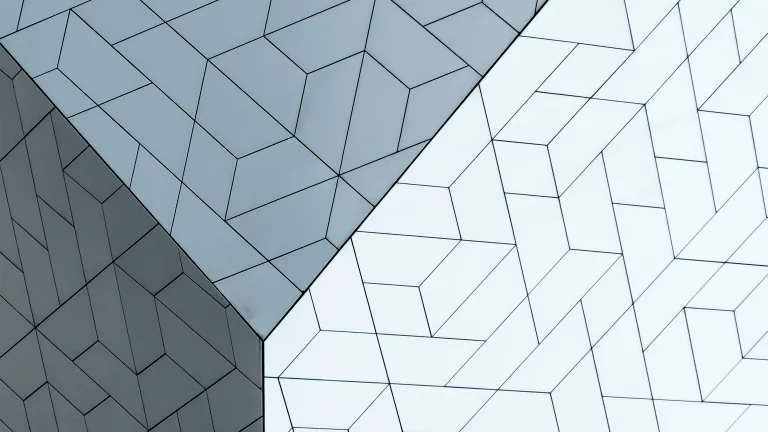

The realization led industrial products makers to rebalance their efforts to focus on establishing the core data platforms and systems that serve as the underpinnings of other digital services. The adjustment they made is clear from BCG’s ongoing benchmarking survey of industrial products makers’ digital services strategies. In 2016, these “enabler” technologies had yet to appear on anyone’s radar. In 2020, they account for four of the participating companies’ top ten priorities.

Among the latest benchmarking company group, enabler technologies remain relatively immature. At many companies, projects are still in the pilot phase. To get the most out of their efforts, companies must work on a limited number of scalable pilots at a time, and prioritize those with the clearest potential to make or save money before moving on to the next opportunities.

Why Initial Digital Services Didn’t Take Off

BCG began benchmarking industrial products companies in order to understand their use of digitization to Changing the Game in Industrial Goods Through Digital Services. The benchmark group includes dozens of companies and business units of larger corporations, all of which manufacture heavy industrial equipment or the components that go into it. Whether they are standalone companies or business units of larger entities, all of them have a global presence, with an average annual revenue of about $3 billion.

Digitization allows these companies to do three things: create revenue streams from new services and business models, sell more of their existing services, and make operations more efficient. In 2016, when BCG first polled benchmark companies, using digital to launch new services accounted for three of the top four use cases and four of the top ten. (See Exhibit 1.)

Initially, companies believed that predictive maintenance and remote monitoring and diagnostics for field service technicians would be the cases most relevant to their business. Predictive maintenance is a natural first pick because if industrial products suppliers know when equipment needs to be serviced, they can fix it before it breaks and avoid the costs associated with equipment downtime and last-minute repairs.

Remote monitoring and diagnostics for field service technicians is also an attractive initial use of digital because of the nature of the business. Many industrial goods makers have large contingents of technicians who work on customer equipment. If companies can remotely monitor how equipment is running, they can gather the data they need to identify problems in real time and dispatch technicians with the appropriate knowledge and spare parts. Companies can also use remote monitoring to collect the data needed to improve shift scheduling and workforce planning.

But launching those services was more technically challenging than companies anticipated. One of the most visible obstacles was lack of connectivity between companies and their installed base of equipment, which made it virtually impossible to offer services that relied on such connections. Some new services don’t work without a critical mass of connected equipment. Consider predictive maintenance. Without a large installed base of connected equipment, algorithms that forecast maintenance needs don’t have enough operating data to draw from. It’s also difficult and expensive to retrofit legacy equipment with sensors and to connect those sensors to industrial products manufacturers’ data systems. What’s more, for competitive, privacy, and security reasons, customers shy away from adopting new services that require them to share data about their operations.

In addition to their lack of foundational systems, many manufacturers did not have a clear understanding of the value that customers would derive. Because of that, the companies could not adequately articulate the new offerings’ value proposition, and without clear reasons, customers were reluctant to commit.

The 2020 Benchmark Findings: Companies Rebalance

The 2020 benchmarking survey makes it clear not only that industrial products companies have reprioritized toward enabler technologies but also that they continue to be slow in connecting with their entire equipment base and in moving digital services applications out of the pilot stage. That’s a problem. But it’s also an opportunity. It means that for this industry the journey to digital is still in its early days. Companies that get it right still have the chance to succeed ahead of the competition.

Enablers are the key. Enabler technologies are the digital platforms and systems through which information flows. They include the embedded sensors and other devices that collect the data, the networks that move the data, and the software applications and other technologies that ensure that the data being collected is accurate, secure, and sharable.

In the 2020 benchmarking survey, companies included four enabler technologies among the ten applications of digital services that they believe are most relevant to their business:

- Data management systems. Data management systems store and share data in a way that is efficient and scalable, with the appropriate levels of security and reliability. They are centrally governed and provide a single point of reference for each piece of information. In the 2020 benchmarking survey, companies ranked data management systems as the digital element most relevant to their business.

- Smart equipment. Smart equipment includes sensors that measure basic parameters such as pressure, rotation, and vibration—information that serves as the basis for equipment monitoring and other services. Smart equipment also includes the retrofit kits that are used to bring older products online. This equipment uses edge analytics to process information that the devices gather. It either reacts autonomously or sends only the relevant information, thus saving time and bandwidth. Benchmark companies pegged smart equipment as the second most relevant digital service for their business.

- IoT backbone architecture. IoT backbone systems are the conduits that allow data from devices and controls to seamlessly integrate with cloud systems and with a company’s applications and interfaces. Companies ranked IoT backbone architecture sixth among the top ten digital services applications.

- Equipment connectivity. This enabler technology transmits data in real time and reacts to actions from a company’s systems, such as requests for information. Equipment connectivity ranked eighth among the top ten applications of digital services.

As the name implies, enabler technologies don’t create value on their own. Rather, they lay the groundwork for value that is created by other applications and services. Enablers also have a multiplier effect, allowing companies to introduce multiple value-added initiatives simultaneously and efficiently.

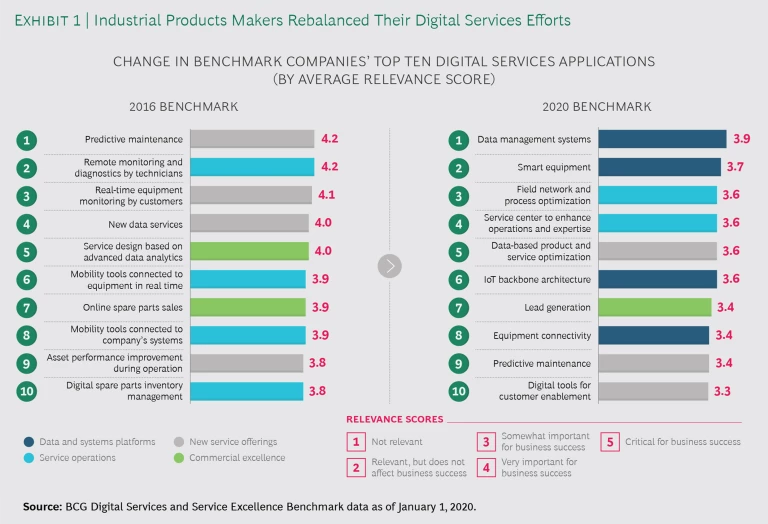

Connecting new and existing equipment remains a major challenge. Connectivity is a key enabler of digital services. If equipment is connected, companies can collect the data that they need to improve service and sales operations and offer new services. Nevertheless, industrial goods companies’ connections with their new equipment and installed base remain limited.

Among companies in the 2020 survey, 78% have connections of some kind with their installed base of equipment. (See Exhibit 2.) However, the average penetration rate is just 13%.

The picture is brighter—though not much—for new equipment. Although fewer benchmark companies (65%) have remote connections with the new equipment, the average penetration rate (31%) is much higher than it is with the installed base.

Increasing connectivity isn’t just a technical challenge. As noted earlier, customers are generally not willing to share data about their business and operations—even with a trusted business partner—unless there’s a convincing value proposition attached to it. They might be more willing to share, for example, if doing so could improve their equipment utilization rates or decrease their operating costs. Customers also balk at sharing data out of concern that it could weaken their competitive edge or make them more vulnerable to a security breach.

Some industrial goods companies offer incentives to help customers overcome their reluctance to connect new or previously installed equipment. One US heavy-machine manufacturer took a two-pronged approach to encourage customers to connect to its data platform, an integral step toward collecting the data that it needed to create new services. First, the company sold all new equipment with built-in sensors and telematics at no extra charge. Second, for customers with existing equipment, the company offered two options: customers could get free kits to retrofit existing machinery with sensors and other connectivity equipment themselves, or they could pay a small fee to have the company do the installation.

But providing customers with the ability to connect wasn’t enough. The company also needed to give them a reason to connect. It engaged with customers to understand how it could better support their business operations. Then it used customers’ feedback to design an application suite. By offering the support that customers wanted, connecting their equipment became a win-win. Over a three-year period, the manufacturer doubled the number of units connected to its data platform to 1 million, about half of its total assets in the field. The level of connectivity paved the way for the company to offer new data-based services, which helped it be more effective in selling and executing services.

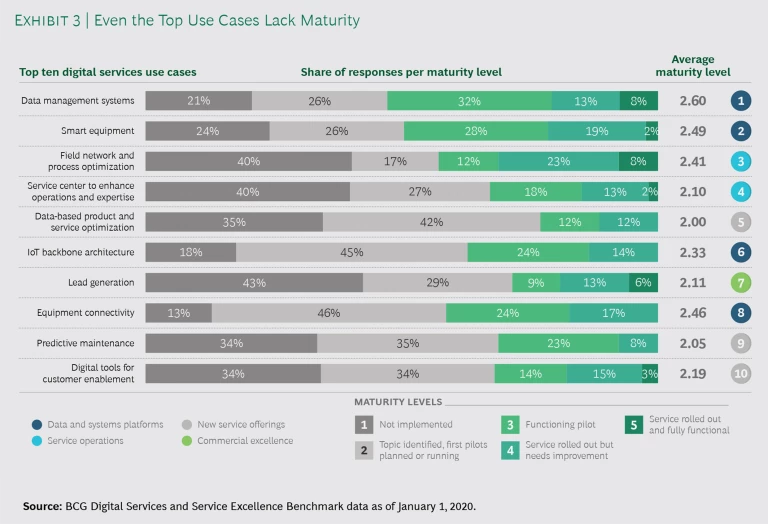

Even work on the most mature digital services is just getting started. If companies believe that data management systems and smart equipment are the digital services enablers that are most relevant to their businesses, it’s easy to understand why work to launch them is further along than other efforts. But that’s not saying much. Only about half of the benchmark companies have created a functional pilot for either of the top enablers, rolled out an initial service that could use some additional work, or have a fully functioning service up and running. (See Exhibit 3.) Some companies are even further behind—24% report that they have not begun to implement any kind of smart equipment pilot, and 21% report that they have yet to implement a data management pilot.

Work on other enabler technologies has been even slower. For example, no benchmark companies have rolled out fully functional IoT backbone architecture or equipment connectivity enablers.

Even so, work on enabler technologies has progressed faster than work on the other digital services identified as top use cases. That makes sense because companies can’t begin to offer those services until the foundational enabler technologies are in place. In the areas of predictive maintenance systems and customer enablement alone, nearly 70% of the benchmark companies have not implemented a pilot.

It’s evident from the benchmark data that companies are working on many pilots at once, rather than concentrating resources on a smaller number of initiatives. That could help explain why so few fully functional applications have been rolled out. Companies may be unsure which use cases will provide the most value, so they have spread resources across many projects instead of going all in with just a few.

Bringing Enabler Technologies and Digital Use Cases to Life

Digital services hold significant promise for industrial goods companies to Creating Value for Machinery Companies Through Services. On the basis of their customers’ pain points and how solving those points could create internal value, companies must decide which digital services to launch first, and then develop an attractive value proposition.

Make the value proposition clear and simple. To overcome customers’ reluctance to share data, spell out in as much detail as possible and quantify how a new offering can help solve their problems.

Launch enabler technologies to support initial use cases. Avoid generic platform building. Use top-priority use cases as a starting point to implement basic enabler technologies in an efficient, scalable way. Once those value drivers have been identified, avoid distraction by limiting the number of use cases that are pursued at any one time.

Adopt a minimum viable product (MVP) mindset. Take a page from agile ways of working. Start by creating MVPs that can be tweaked and improved in response to customer feedback.

Dedicate resources. It’s not enough to identify which digital service use cases would be best to pilot first. For pilots to have the best chance of succeeding, they must have adequate financial and human resources attached to them.

When industrial products companies realized that insufficient infrastructure and connectivity would make it difficult to launch digital services, they reprioritized their efforts toward building out the relevant foundational systems and platforms. But progress has been slow, too slow. That gives fast movers a chance to move ahead of their competitors. To do that and realize the full value that digital services can bring to their businesses, they must double down on moving enabler technologies from pilots to functioning applications.