The role of the relationship manager is changing. RMs are harnessing the power of data and advanced analytics to attract more new business and deliver more value to clients.

In most commercial banks, relationship managers (RMs) have built their client portfolios the old-fashioned way. They cultivate relationships with business leaders, supported by traditional middle- and back-office services. But increasingly, many banks are seeking to stay competitive by transforming their business development practices. They are placing analytics and digital at the top of their strategic agendas.

Still, many have yet to gain full value from their most precious data asset: their clients’ daily transactions. The institutions that have made progress are what BCG calls bionic banks. They have mastered the integration of advanced technology with human ways of working.

A bionic bank uses technologically enabled solutions to gather a broad variety of data about clients’ transactions and behavior. And it gives RMs access to advanced analytics tools so they can distill that data for their sales teams daily, providing insights into clients’ current needs and future ones.

By using these insights to guide the efforts of their sales teams, RMs can not only increase their bank’s bottom line by 10% to 15% but also solidify their role as a client whisperer—someone who understands clients’ needs and background well enough to gain their full loyalty and trust.

The Power of Data-Driven Insights

The job of a commercial RM is complicated. Finding new clients and anticipating their needs are very important parts of it. But the most profitable aspect of the RM role involves existing clients: continuously engaging with them, developing and personalizing new solutions for them, and managing and pricing those services correctly.

Advanced analytics tools can help RMs uncover opportunities and warn them of potential portfolio risks.

A bionic approach to relationship management helps RMs work more successfully with their clients. Using advanced data and analytics tools, RMs can uncover timely, accurate, data-driven insights about clients’ behavior that may signal opportunities for them. These analytics tools can also warn RMs of potential portfolio risks, including indicators of client attrition or credit deterioration and relevant changes in client behavior. RMs can then be proactive in several areas:

- Customized Solutions. Timely reporting of transaction data gives RMs insights into clients’ evolving needs, which may provide cross-selling or upselling opportunities. More important, these insights can give RMs a deeper understanding of their clients’ operations and a chance to offer a well-tailored portfolio of multiple products and services. By anticipating clients’ needs, RMs can deepen their relationships, gain a reputation for continuous innovation, and expand the share of wallet.

- Client Retention. Signaling when clients start exhibiting behaviors that are linked to attrition is invaluable. The earlier the warning, the more opportunities that an RM has to credibly connect with existing clients and address the root causes.

- Risk Monitoring. Alerting RMs in real time of potential changes in a client’s risk profile enables them to intervene. By taking steps early, such as steering a credit review process, RMs can help clients keep risk in check.

- Automation of Routine Decisions. Streamlining the credit application process not only saves RMs time but also lets them focus on situations that require their assessment of the appropriate limits.

- Pricing Strategy. Recommending pricing for new solutions and adjusting existing prices given each client’s price sensitivity and behavior can complement the RM’s gut feeling. Analytics that draw on data from other comparable deals negotiated by the bank also helps the RM gauge pricing.

- Lead Generation. Identifying prospective clients for RMs can speed the new business process. RMs benefit from insights into the possible solutions to offer, the connections between a prospect and other bank clients (existing and potential ones), conversational suggestions, and the competitive landscape of a prospect’s industry.

Taking the bionic approach to relationship management helps commercial banks establish leadership positions in their markets. It’s particularly apt for small business clients and midmarket companies (typically, those with annual revenues of $250 million or less). With the right implementation of data-driven tools and approaches, commercial banks can significantly grow their revenues by about 20% to 35% within two to three years.

Urgency and Pressure

Many banking leaders are aware of the potential value of the bionic approach, but few seem to feel a sense of urgency about adopting it, and time is running out. Growth in the commercial banking industry has become more difficult, challenging the economics. Although most banks have kept their heads above water during the pandemic and generated positive value, they need to grow faster and faster every year just to stay in the same competitive position. And the need to diversify revenue sources and generate fee income have taken on renewed importance.

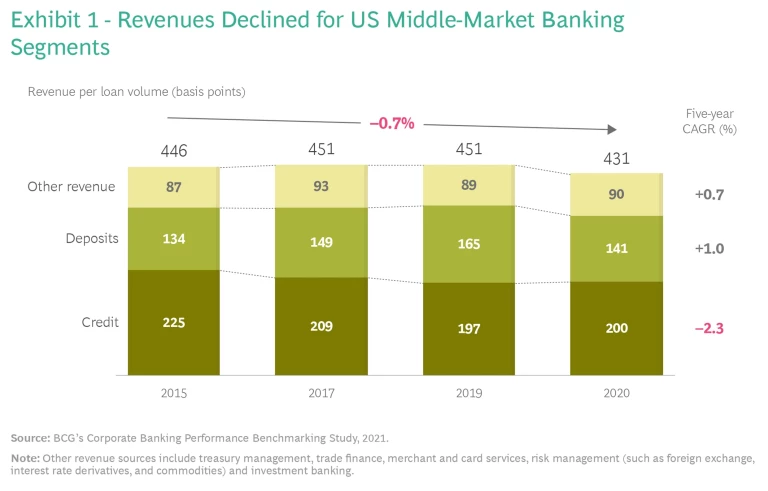

There are several different sources of pressure. One is general economic uncertainty, exacerbated by the pandemic. For example, the current low interest-rate environment and the low demand for loans is constraining the financial services industry, most notably in the US. Revenues in core US commercial-banking middle-market segments ultimately declined from 2015 through 2020 by about 4% in five-year CAGR each year. (See Exhibit 1.) While revenue from fee-based cross-selling has grown by as much as 1% per year, it is largely offset by the effect of compressed loan margins, which are responsible for up to 2% annual reductions in CAGR. And there has been barely any growth from noncredit products, such as deposits, treasury management, trade finance, merchant and card services, risk management, and investment banking.

Another source of pressure are indirect costs. They grew 2% per year from 2015 through 2019. These include general overhead and uncontrollable costs such as those for regulatory compliance. Many banks have responded by cutting where they can: closing branches and reducing front-office head count. They have also upgraded their technology and started digital initiatives, with the goal of reducing costs in the long run, even if it means higher upfront expenses.

In addition, commercial banks are feeling increased pressure from outsiders. Digital challengers such as fintech firms and nonbank lenders are entering the banking space. They serve the market in creative ways, chipping away at profit pools once well protected by traditional banks. They also have more facility with new technologies and advanced analytics than most banks do. This enables them to scale quickly and set new standards for excellence for clients and employees.

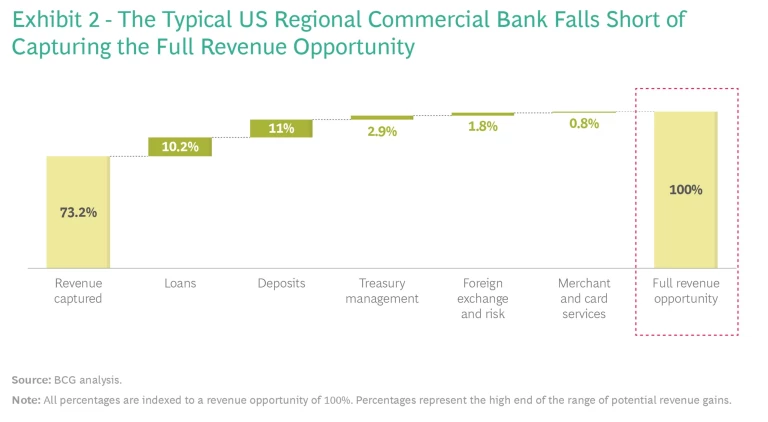

Perhaps the greatest sources of pressure are the banks themselves. Many established practices and habits, so ingrained that they are nearly invisible, have made it difficult to grow. For example, although RMs universally recognize the need to cultivate existing clients, when an opportunity for a new client presents itself, it tends to seem more urgent. This is one reason why we see, for instance, US banks capturing only about 70% of their clients’ potential banking wallet and losing about 10% of their clients each year to attrition. (See Exhibit 2.)

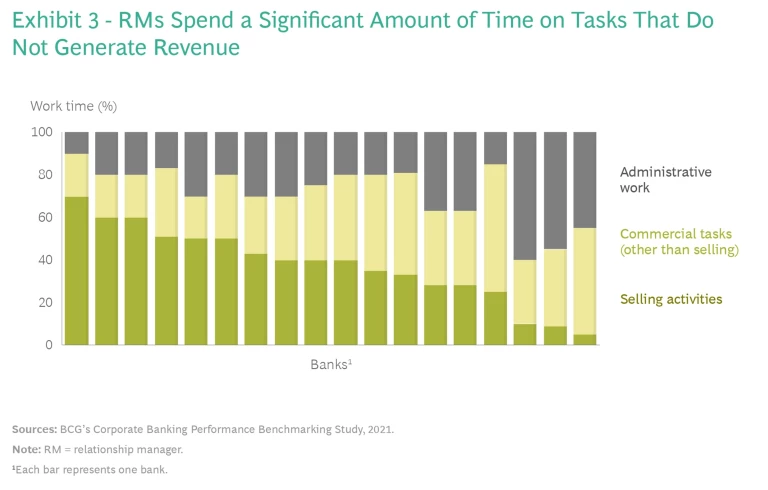

Other counterproductive commercial-banking habits include operating with a one-size-fits-all credit process, having RMs monitor simple credit cases at length, and allowing an RM’s time to be highly fragmented across various sales and relationship management activities. For example, RMs in US commercial banks often can spend up to 60% of their time on internally facing administrative tasks. (See Exhibit 3.) Activities such as assembling information from different sources of data, or keeping up with administrative reminders, have little to no impact on client satisfaction or revenue generation. With more and more clients to manage, and more data available for analysis, it’s more important than ever that sales teams receive the most relevant, up-to-date information on their clients as seamlessly and automatically as possible.

Crossing the Bionic Threshold

To address these challenges in a holistic way, banks need to integrate technological advances with changes in everyday activity. RMs, in particular, can make the most of data-driven insights by incorporating them into their routine practices. Our research has found that only 30% of the impact from the bionic approach comes from analytics (including algorithms and data engineering) and technology (including data and computation platforms as well as visualization tools). Seventy percent of the impact is due to shifts in RMs’ behavior as well as that of other employees throughout the bank. These shifts include designing new business processes, embedding the data-driven operating model in those processes, and changing the way people work.

RMs can make the most of data-driven insights by incorporating them into their routine practices.

This is the kind of change that a bank can’t get from the top-down implementation of a massive platform or from the isolated introduction of new tools. It ideally takes place in an almost viral fashion, spreading through the bank from one sales team to another. The job of senior management is to create the conditions that lead RMs to adopt organizational and individual changes and set an example for others. To create these conditions, five elements need to come together:

- Data. Banks track many activities that are relative to their clients, without compromising private information. In commercial banking, tracking could include transactions in operating accounts, payments and receivables, card usage, merchant-acquiring transactions, trade and international activities, credit utilization, and client data collected during underwriting. This data, when integrated and interpreted correctly, can present a more accurate and timely read of a client’s business needs and challenges than most quarterly financial reports do.

- Analytics. Making sense of all available data requires advanced analytics techniques (such as machine learning) and algorithms that are fit for purpose. Optimally, banks should use predictive analytics in order to recognize patterns that could lead to high risk or great opportunity. They should also study client behavior over time to discern changes in similar patterns of client activity. However, advanced analytics by itself is typically not enough. Successful analytics typically complements algorithms with deep business knowledge codified as business rules.

- Actions. The outcome of the analysis needs to be translated to actionable recommendations for RMs and sales teams. The goal is not to replace human intelligence or gut feel but to augment it with ideas, product suggestions, meaningful correlations, and other bodies of information that enhance an RM’s client judgment.

- Delivery. A well-designed, fit-for-purpose digital interface for RMs and sales teams is needed to unlock the value of advanced analytics. Digital tools, processing the output of analytics models, can give RMs a more comprehensive view of a client’s business and enable them to complete call preparations in less than one-third of the time previously required. Online dashboards can be prepopulated with suggestions and starting points for offerings as well as with workflow guidance to increase collaboration across sales teams. Other features can help RMs prioritize their activities and efforts for the week or offer advice for clients given what businesses in similar circumstances have done. A well-thought-out digital tool starts by fully understanding the target users and their day-to-day activities. Some banks conduct ethnographic-style research to understand how their RMs work. Then the bank tailors the user experience to the RMs.

- Measurement. Once these elements are deployed, management teams need to hold the RMs and sales teams accountable. RMs need to track the results of their new data-driven efforts and use that new information to continue refining and improving their approaches.

These five elements need to be supported by two more:

- An Operating Model. Implementing a data-driven operating model typically leads to changes in sales processes and workflow. There may be a significant shift toward more frequent and targeted collaboration between RMs and product specialists. The bank’s competitive advantage will come less from individual star RMs who outsmart their counterparts at the bank next door and more from the combined effort of sales teams that act together given accurate and timely insights about their clients.

- Enablement. For these elements to generate results, sales teams must embed them in day-to-day sales activities. Therefore, it is crucial to ensure that teams are thoroughly supported until this new way of working becomes second nature. Support for RMs ideally includes hands-on training, a central team that is ready to help troubleshoot issues and answer questions, a forum in which RMs can share experiences and success stories, and a committed leadership team that can coach sales teams and help them navigate the change.

Back to Basics

Much of the analytics technology involved in this bionic approach is new. AI, for example, may seem unfamiliar at first. But according to banks that have adopted the bionic approach, the changes seem very natural before long. In a sense, this approach brings banking back to its roots: to a world in which each client’s situation is more manageable because more is known about it. The banker is a provider not only of funds but also of perspective. RMs have the time to build the judgment that makes each exchange worthwhile.

RMs who are learning to operate with these new tools will find that much of the tedium and minutiae of their role will fall away, erased by the seamless infrastructure that is created. And in their place will be the opportunity to engage with entrepreneurs and business leaders, develop working relationships with them, and help them realize their ambitions—which are most likely the reasons RMs went into banking in the first place.