Over the past decade, much of the aluminum industry—particularly upstream and midstream

A Lost Decade for Producers

Aluminum producers have enjoyed a tailwind of healthy global demand over the past decade. Demand for primary and secondary aluminum grew at a 6.5% compound annual growth rate (CAGR) from 2009 to 2019. By sector, the strongest drivers of demand were consumer durables and transportation. By country or region, the strongest demand came from China: demand grew at an 8.2% CAGR (versus 5.1% for the rest of the world). China accounted for 57% of global incremental demand.

Most of the industry’s producers, however, failed to translate this demand into higher prices and increased profitability. Aluminum prices have never exceeded pre-2008 crisis levels and were essentially flat through the mining “supercycle” that greatly benefited producers of other metals. Compounded by the high capital intensity of aluminum

Much of the disconnect between demand, prices, and profitability is attributable to increased production by Chinese producers. Indeed, Chinese players boosted global production significantly and captured a progressively larger part of it. Between 2009 and 2019, global primary aluminum production rose from 37 million tons to 64 million tons; Chinese producers’ share rose from 37% to 57%. Chinese players also lowered their cash costs relative to those of the industry’s other producers. As a result, Chinese players captured an even greater share of industry rent (the space between market prices and the supply curve) for smelting—their share rose from less than 30% in 2009 to more than 60% in 2019, while the rent captured by non-Chinese producers declined by more than half.

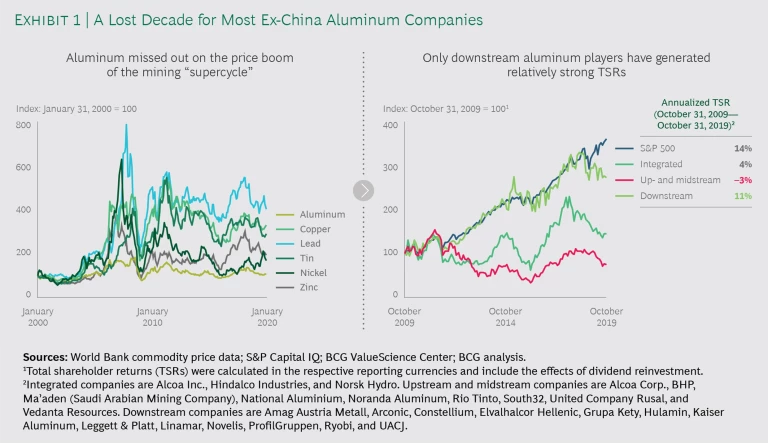

This combination of factors weighed heavily on ex-China producers’ total shareholder returns (TSRs). (See Exhibit 1.) Industry TSR for major global upstream and midstream players was -3% versus 14% for the S&P 500. Integrated players fared a bit better, with a TSR of 4%; downstream players fared substantially better, with a TSR of 11%. For ex-China upstream and midstream companies, it was a decade best forgotten.

Opportunities to Improve Returns Include Green Solutions

Three developments on the horizon are poised to change the industry’s competitive dynamics. Two of the three have an important common denominator—a move toward environmental considerations. The developments poised to change aluminum’s competitive landscape are: 1) a growing focus among investors, customers, governments, and society on sustainability; 2) the strong likelihood of the near-term introduction of a carbon-taxation scheme by European governments—and, possibly, the US government; and 3) a set of changes in global trade patterns now accelerating in response COVID-19.

1. When companies go green, investors take note. Across industries, investors are increasingly rewarding companies that have the “greenest” operational profiles; aluminum companies will have to adjust accordingly. To maintain the industry’s social license to operate, producers will have to act on three fronts.

The first is emissions reduction. The industry accounts for 2% of global CO2 emissions but has a ready means to reduce this impact: utilize cleaner sources of power generation. Smelters (which account for the bulk of the industry’s emissions) using hydroelectric power, specifically, emit roughly six times less CO2 per ton of production than those supplied by coal-based power.

The industry accounts for 2% of global CO2 emissions but has a ready means to reduce this impact: utilize cleaner sources of power generation.

The second front is the industry’s impact on communities and the environment. Alumina refineries’ toxic “red mud” waste stream creates an ever-increasing environmental liability. Accidents in mines and refineries that have societal effects will be less and less tolerated by a world that has seen collapses of tailings dams cause hundreds of fatalities, destroying both livelihoods and environmental ecosystems.

The third front, closely related to the first, is growing consumer demand for “green aluminum.” This is aluminum produced in smelters powered by renewable or non-CO2-emitting energy sources, such as hydroelectric, geothermal, or nuclear. Coal-based production, which makes up 90% of Chinese production, currently accounts for 62% of global production and has led the industry’s supply growth over the last two decades. As a consequence, global average CO2 emissions from aluminum production have actually increased to 8.5 tons per ton of primary aluminum produced in 2019—up by nearly 15% since 2009. (This only includes emissions from power generated for use in smelting. It neglects direct CO2 emissions in smelting and emissions produced in mining and refining.) Thus the industry is becoming more polluting at a time when the world requires precisely the opposite.

While the transition to cleaner power places no technical demands on the smelting process itself, producers that make the transition face the same hurdles, including limited access to clean power and potentially higher costs, as those from other industries that are shifting to cleaner power generation.

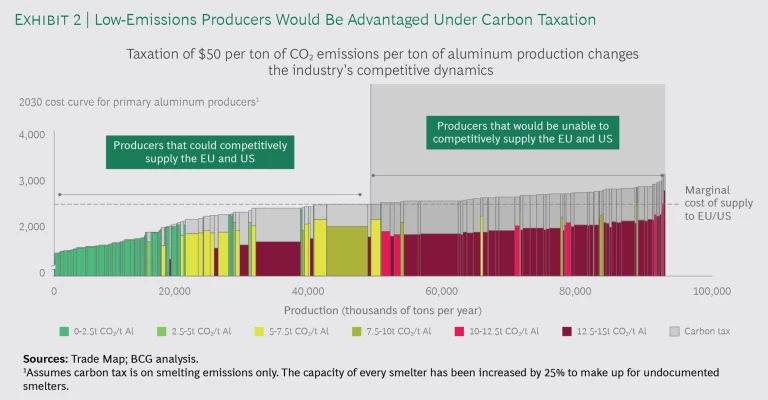

The introduction of carbon taxes, including carbon border taxes on imports, would have a material impact on the global supply curve of producers selling in those regions.

2. Governments are leaning toward carbon-taxation schemes. The second development poised to change the industry’s competitive terrain is the strong likelihood of the near-term introduction of a carbon-taxation scheme by European governments (and, possibly, the US government). The introduction of carbon taxes, including carbon border taxes on imports, would have a material impact on the global supply curve of producers selling in those regions, to the decided advantage of low-emissions producers. (See Exhibit 2.) A $50 tax per ton of CO2 emitted per ton of aluminum produced would raise the per-ton costs of a hydroelectric-based producer by $100 to $150; the costs of a coal-based producer would rise by approximately $800. No high-emissions producer trying to sell into countries with such taxes would be competitive. Local demand in the US and EU would continue to be met by local low-emissions producers (for example, ones from Canada and the Nordic region). High-emissions producers would increasingly cede ground to low-emissions producers from other countries, such as Russia and Malaysia.

Imposing such taxes would have other effects as well. Chinese producers of aluminum-intensive products (such as aluminum car wheels and household aluminum foil) would shift their focus away from the EU and US toward the rest of the world, as would high-emissions producers from other countries, such as India and Australia. Unless forced to shut down by the emergence of new, low-emissions capacity, high-emissions EU and US producers would push global aluminum prices higher. Low-emissions producers would see a sizable boost in profitability from the combination of higher prices and the relatively small boost in emissions-tax-related costs.

Low-emissions EU and US-based producers will be able to claim or reclaim substantial amounts of demand in their home markets.

The net effects of these developments stand to reshape the industry. As companies take steps to maintain their social license to operate, they will incur new expenses. The industry’s competitive balance will change significantly. Low-emissions producers, irrespective of the country they are domiciled in, will see sizable benefits to their business. Low-emissions EU and US-based producers will be able to claim or reclaim substantial amounts of demand in their home markets. Chinese downstream producers will shift their focus to finding new export destinations where they can maintain a cost advantage unencumbered by carbon taxes—at least temporarily. China’s recently announced ambition to reach carbon neutrality by 2060 will require significantly decarbonizing its power supply and operations.

3. Global trade patterns are shifting. The third factor that stands to alter the industry’s competitive dynamics is a set of changes in global trade patterns. COVID-19 has destabilized economies, exacerbated existing geopolitical frictions, and intensified a general move away from free trade among nations. It has also strengthened many companies’ growing resolve to make their supply chains more resilient and less vulnerable to shocks and interruptions. For example, BCG projects that in 2023, two-way trade between the US and China will have shrunk by around 15%, or about $128 billion, from 2019 levels. Trade between Southeast Asia and the European Union, in contrast, will have increased by around $22 billion.

A major effect of these dynamics is the likelihood of increased relocation and reshoring of manufacturing capacity, including among aluminum producers and users. (Changes in government industrial policy or incentives might intensify or accelerate such relocation.) This would ultimately change global patterns of demand for aluminum significantly, with demand increasingly met, most likely, by local or regional suppliers. For some aluminum companies, this will result in a windfall, while others could see a sizable setback.

Critical Actions for Stakeholders

To help the industry return to and remain at a point where it can create value sustainably, producers and industry stakeholders can take a range of actions.

Industry players should intensify the pursuit and use of low-carbon energy supply, partner with forward-thinking customers to jointly develop or advance new applications where green aluminum is advantaged, and boost their recycling efforts and efforts to develop closed-loop solutions. They should also explore industry collaboration to fund and further accelerate innovation that could spur greener production methods (e.g. inert anode, red mud reuse), and explore industry consolidation to build scale, fund innovation, and lower costs more quickly. And they should consider ways in which greater use of digital tools and technologies might lead to more sustainable operations.

Governments should assess the true effects of carbon taxation on domestic players. They should study opportunities to reinvest the proceeds from taxation in new low-carbon energy sources and sustain- ability measures for the industry; foster overcompliance with environmental, social, and governance (ESG) standards among industry players while working to push standards higher; and determine whether aluminum is a strategic industry worthy of support. They can also consider measures to ensure the availability of aluminum supply amid the new dynamics of globalization.

Investors should identify companies poised for greatest success, including those likeliest to exploit new sources of demand for green aluminum or lower their emissions in the new environment. They can also identify companies at elevated risk of supplier or financial risk, supply-chain disruption, or failure to meet rising ESG standards.

Customers can partner with aluminum players to advance innovation, R&D, and product development, and determine whether an alternate balance between primary and secondary production in product development might lower emissions; identify and quantify supplier-network risks; and build access to low-cost, low-ESG-footprint aluminum in anticipation of changing end-user demands. They also need to continue raising the company’s ESG performance to build or enhance a sustainability-based advantage.

After an extended period in the doldrums, much of the aluminum industry is about to see a set of momentous changes in business context, opening for some the potential for higher revenues, profitability, and TSRs. This is largely the result of forces beyond the industry’s influence. But the industry, supported by stakeholders, has much it can do unilaterally to ensure that it returns to the point at which it can once again sustainably create value—not just for investors but also for communities, employees, and customers.