To successfully adapt their HR strategies and operating models for a decarbonizing world, companies must ensure that the new approaches make sense for all parts of the organization.

As the global push to tackle climate change gathers pace, oil and gas companies are under pressure to rapidly transform and tap into new opportunities on the path to net zero. But they can’t ignore the needs of their traditional fossil fuel-based businesses if they are to fund new low-carbon investments and, at a time of geopolitical tensions and rising energy prices, provide a secure, accessible energy supply.

For oil and gas CEOs and HR leaders, that means reviewing and potentially changing operating models and people strategies in fundamental ways to ensure that they are fit for purpose across the whole organization but also reflect the different growth trajectories, ways of working, governance procedures, and skill requirements of each business area. Companies that fail to do this risk disrupting their traditional operations and losing out to more nimble, innovative low-carbon players.

In this evolving environment, companies must take into account the nuances, drivers, and challenges of each low-carbon business.

However, we believe companies need to go further. Each low-carbon business has its own nuances, drivers, and challenges. Companies must take these differences into account when adapting their models, procedures, and strategies for this evolving environment. To help achieve this, companies can categorize low-carbon businesses into broad groups—decarbonization value chains, renewables, or green innovation and venturing—based on how closely they resemble traditional oil and gas operations and how much innovation they require. (See the sidebar, “Low-Carbon Businesses Fall into Broad Groups.”)

Low-Carbon Businesses Fall into Broad Groups

Low-Carbon Businesses Fall into Broad Groups

- Decarbonization Value Chains. These value chains—such as those involving carbon capture, utilization, and storage (CCUS) or the production and transmission of biofuels and hydrogen—are closest to traditional, asset-heavy operations. They rely on emerging technologies that are not yet deployed at scale.

- Renewables. Businesses that involve the generation of renewable energy sources such as wind or solar are further away from companies’ traditional operations and require scale, cost efficiencies, and local knowledge to succeed. They are generally dependent on mature technologies that are already deployed in the market.

- Green Innovation and Venturing. These opportunities are the furthest from companies’ traditional business approaches and require completely different skills, capabilities, and operating models to identify and scale new, clean technologies.

From our work with major oil and gas players, we’ve identified six people-focused actions that companies should take to succeed in their chosen low-carbon fields while also ensuring their traditional operations are safe, efficient, and reliable.

Establish a Compelling and Inclusive Purpose Backed Up by Tangible Action

Effectively communicating a clear and compelling purpose—both across the organization and externally–is more important than ever for oil and gas companies as they navigate the energy transition. To transform, these companies must have an authentic and guiding purpose supported by tangible action, whether that’s expanding into a new low-carbon area or extracting oil and gas more sustainably. In the absence of demonstrated commitment, employees, customers, investors, and partners may become skeptical or disengaged, leading to higher attrition levels among both staff and contractors. This is an outcome companies can ill afford given current talent shortages. In its latest research, BCG BrightHouse estimates that companies with just such a purpose experience 8% less turnover.

To be truly compelling, the organization’s purpose must be inclusive and resonate with all staff. A purpose that focuses solely on sustainability goals without articulating a role for employees in traditional carbon-intensive businesses risks undervaluing their contribution and could create a divisive “us versus them” mentality within the organization. It could also undermine companies’ decarbonization efforts, as disenfranchised staff in traditional areas will be less willing to work toward achieving these plans.

ACWA Power provides a helpful example for oil and gas companies. The Saudi Arabia-based operator of power and water desalination plants is reducing its exposure to coal and nuclear generation and expanding into hydrogen and solar photovoltaic energy solutions. Its purpose is “reliably and responsibly delivering power and desalinated water at low cost.” This clearly captures the contribution of traditional and renewable energy businesses as well as the importance of security and sustainability.

Similarly, BP’s purpose—“reimagining energy for people and our planet”—is supported by its stated intention of “performing while transforming.” Together, these statements contain the what and how of BP’s transformation strategy. They also underline the significance to the company of both traditional and low-carbon businesses and, in doing so, help attract new employees.

Reset the Organization to Pursue Goals Collaboratively

Accessing new, low-carbon value pools requires collaboration both externally—with governments and communities—and internally. Often it is internal partnerships that prove most challenging. Unless the whole organization is aligned behind a single set of objectives, decarbonization initiatives risk being delayed or derailed.

Take the example of a company seeking to increase sales of aviation biofuels. This requires production, sales and marketing, trading, and external affairs teams to collaborate. External affairs staff may be incentivized to promote the decarbonization initiative with governments and investors. However, due to nascent customer demand, sales teams will likely be wary of engaging with airlines that seek long-term pricing before starting fuel trials. Low liquidity also makes it difficult to trade and price the new product. As a result, two key actors—trading and sales and marketing—are not incentivized to deliver the initiative.

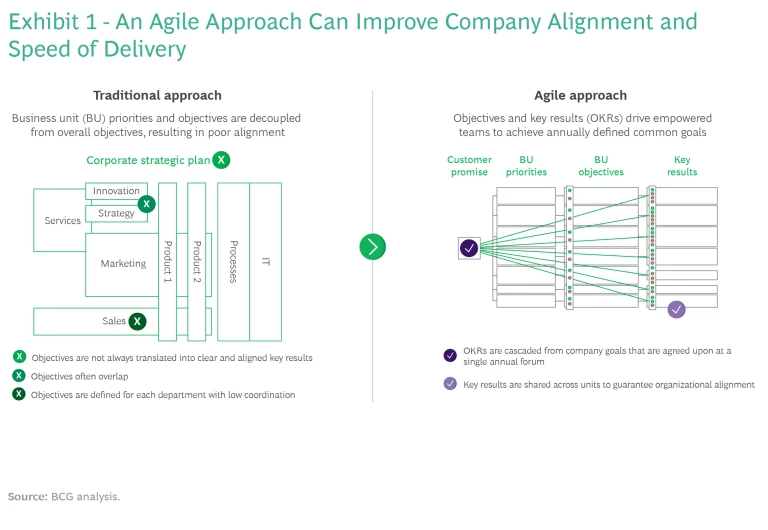

Over the long term, oil and gas companies can overcome these problems by creating a more decentralized, regionally based operating model that leverages local knowledge to support low-carbon opportunities. However, this is likely to involve significant restructuring. In the nearer term, companies can improve internal collaboration by adopting agile principles to align the organization behind its decarbonization goals. But this approach requires clear, bold commitment to new ways of working. Without adjusting all elements of their operating model, companies risk adding significant complexity.

Without adjusting all elements of their operating model, oil and gas companies risk adding significant complexity.

Introducing an agile approach involves establishing autonomous, cross-functional teams that are empowered to deliver on specific, measurable, outcome-based goals from end to end. Greater autonomy enables teams to respond more quickly to changing circumstances, which is essential in fast-paced, low-carbon businesses. At the same time, clear priorities and decision-making guidelines ensure delivery is consistent with the company’s strategy and purpose, resulting in improved alignment across the organization. We find that companies that successfully deploy enterprise agility can accelerate delivery by two to four times, enjoy a potential 15% to 25% reduction in development costs, and improve productivity velocity by up to four times. Furthermore, traditional and low-carbon businesses can benefit equally from deploying cross-functional teaming and agile governance.

One European energy retailer successfully deployed agile to improve speed to market and reduce costs. As a result of the changes it introduced, business unit (BU) heads now use an annual planning forum to agree on strategic priorities and set BU-level goals that clarify delivery responsibilities and help to ensure cross-organizational alignment. These goals are then cascaded into quarterly BU plans, and a small number of objectives and key results (OKRs) are established to track progress. (See Exhibit 1.) Cross-functional, autonomous teams are created to deliver outcomes in support of these goals quickly and effectively. In addition, some key OKRs—including both short- and long-term metrics—are shared between cross-functional teams to promote alignment across the business and incentivize growth behaviors. As a result, employees understand how their work contributes to long-term goals, including sustainability, and are empowered to achieve them. This approach has resulted in better customer service and 10% to 20% of OpEx savings. Oil and gas companies can learn from this example as they seek to align their own organizations behind strategic decarbonization goals and deliver their low-carbon commitments quickly.

Ensure Governance and Funding Models Are Fit for Purpose

To succeed in fast-paced, low-carbon businesses, companies must ensure they are not encumbered by legacy processes and structures designed for traditional oil and gas ventures. There are two potential solutions to this problem: establish new low-carbon divisions with their own procedures or adapt existing processes to make them fit for purpose for low-carbon opportunities

Creating a new division makes sense for green-venturing businesses that closely resemble startups and require a very different culture, way of working, and compensation structure from traditional businesses. Decarbonization value chains, by contrast, require an alternate approach. While they share many characteristics of other low-carbon areas (including a reliance on speed, higher growth rates, and lower returns than traditional businesses), they typically involve large-scale investments in transmission and generation assets and so have a similar risk profile to upstream or midstream oil and gas projects. Consequently, companies expanding into hydrogen or carbon capture, utilization, and storage (CCUS) should retain their integrated operating models and adapt existing processes.

The best solution for renewables is less clear. While they depend on fast decision making and local knowledge to succeed, renewables businesses can benefit from being part of larger, integrated businesses that contain adjacent low-carbon technologies—such as hydrogen and electric vehicles—and that have close proximity to customers. Companies that want to maximize these advantages and avoid significant restructuring costs should review and adapt existing processes to ensure decisions can be made quickly by those closest to the front line.

To support their new low-carbon businesses, companies can also amend their financial approaches so that low-carbon projects, which are often lower risk and lower return, aren’t passed over for vital funding. For example, they can update capital allocation rules to include sustainability parameters or introduce an internal carbon price to ensure they take emissions into account when making investment decisions. Finally, they can alter cost allocation models so that low-carbon businesses aren’t burdened by high organization-wide overheads.

To create processes that are effective across all its business areas, one European energy company is considering the following measures: moving to portfolio-based approvals that allow for greater individual project risk; pushing decision making lower down in the organization; and developing uniform approaches to project management and modularized design that can be approved and replicated quickly while maintaining standards. This approach can help oil and gas players improve their speed to market across both traditional and low-carbon businesses.

Use Skills-Based Mapping to Prepare for Evolving Capability Needs

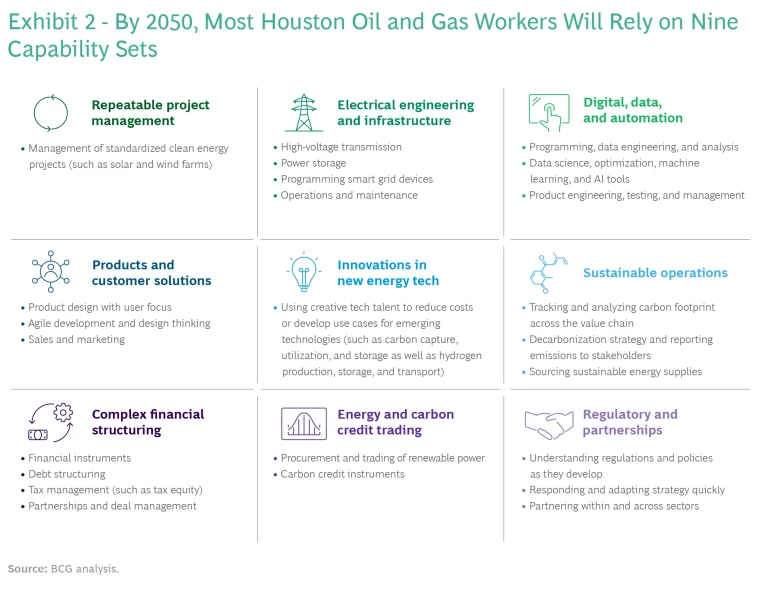

As strategies, technologies, and growth projections in traditional and low-carbon areas evolve, so too will companies’ need for new and established skills and capabilities. Maximizing value from existing oil and gas assets will require employees with strong digital skills, while growing low-carbon businesses will require workers with a higher degree of commercial, regulatory, and partnership knowledge, as well as new technical skills.

As strategies, technologies, and growth projections in traditional and low-carbon areas evolve, so too will companies’ need for new and established skills and capabilities.

In our work with the Greater Houston Partnership, an economic development organization, we found that by 2050, three-quarters of jobs among Houston-based oil and gas companies will fall into just nine leading-edge capability sets. (See Exhibit 2.) Positions involving manual labor, complex mechanical know-how, and deep oil and gas expertise will shrink to one-quarter of jobs from more than one-third in 2020. Roles involving existing capabilities in areas such as renewables, electrification, and digital, meanwhile, will increase from 63% to 71% of the total. The biggest jobs growth will be in capabilities that enable companies to expand in new technologies, like hydrogen and CCUS, and in carbon credit trading—though these will still make up a relatively small share.

To ensure they have the right mix of competences for the future, oil and gas companies will need to carry out a skills-based mapping exercise, starting with defining the expertise and capabilities needed to succeed in their chosen business areas, markets, and geographies. Only once that’s done should they consider which future capabilities can be developed in-house and which will need to be bought or borrowed from outside the company.

BCG took this approach when it supported a national government whose oil and gas sector is a major national economic contributor. To assess the impact of the energy transition on employment, we started by defining four scenarios that would shape the pace and nature of the transition and its effect on jobs in the sector. We then evaluated the impact of each scenario on 20 energy sectors, including traditional and low-carbon areas. Our analysis confirmed that while direct employment in traditional oil and gas activities may shrink by up to 75% by 2050, jobs in renewables and other decarbonization areas will increase—with an overall net positive effect of between 15% and 50%, depending on the scenario—driven in large part by the construction of new assets.

By analyzing the implications for individual occupations and skills clusters (and factoring in the impact of automation), we created a detailed picture of the energy transition’s effect on future skills requirements and identified specific skills gaps, as well as when and in which locations they would occur. This information will help the government make targeted educational and upskilling interventions.

While this example is on a national scale, oil and gas companies can repeat the exercise with their own strategic scenarios. By doing so, they will equip themselves with the necessary data to make early interventions in recruiting, compensation, learning and mobility and thereby attract and retain the right mix of skills in the right locations at the right time.

Invest in New Talent and Upskilling Existing Workers

Once an organization has defined the skills and capabilities it needs for the future, the next step is to develop a plan for attracting, motivating, and retaining that talent—including whether to buy or build. For low-carbon businesses, some renewable capabilities, like high-voltage power transmission and storage, sit outside traditional oil and gas activities and will need to be bought or borrowed through acquisitions and partnerships. However, other decarbonization capabilities, like steam methane reforming and gas transportation required for blue hydrogen production, are tangential to existing oil and gas skill sets and can often be developed more easily in house.

Savvy oil and gas companies are choosing to prioritize retaining and motivating workers in their traditional businesses. These employees are not only essential for optimizing carbon-intensive operations but are an important source of talent in low-carbon areas as well. Upskilling traditional workers so that they can make the transition to these new areas can generate significant value for companies. In addition to helping them avoid hiring and onboarding costs, company managers find that upskilled workers deployed in low-carbon fields are often highly motivated and productive.

A practical example is Norway’s Equinor, which operates in oil and gas, renewables, and low-carbon solutions, and that launched Reskill@Scale in 2021. According to a recent Equinor sustainability report, the program is designed to support the transfer of oil and gas workers to low-carbon and renewable areas through mentoring and training activities. Another company is planning to help traditional workers make the transition by establishing an internal careers service that will offer advice and match employees with relevant low-carbon positions, as well as hands-on training and job rotations supported by mentors and technical coaches. Such actions can be augmented by artificial intelligence tools that identify “best fit” future roles for staff based on existing skills profiles.

Shift the Emphasis of Support Functions Towards Evolving Business Needs

Navigating the energy transition will require oil and gas companies to invest in their support functions so they can successfully manage the challenges ahead. In the future, HR departments will be responsible for holistic skills-based mapping. They will also develop and manage upskilling programs and new career pathways for workers exchanging traditional jobs for low-carbon ones, while managing the exit of other employees. These enhanced responsibilities will involve identifying and accessing fresh talent pools, designing onboarding processes, managing new ways of working, and handling employee terms and conditions that will differ widely across the organization.

Meanwhile, finance, planning, and control functions will require fit-for-purpose capital allocation and control processes. And they will need to take a more active role in identifying potential acquisition targets and handling post-deal integration. To deliver this ambitious program of work, HR and finance departments will have to transition from support functions to strategic partners that are staffed with high-performing, innovative professionals focused on delivering strategic business needs.

One Europe-based international oil company is in the process of making these changes. The organization is planning to set up a corporate competency center staffed with highly skilled individuals who are tasked with supporting the energy transition. By outsourcing standard activities such as payroll and accounting, employees can concentrate on value-adding activities, such as workforce planning, skills programs on the people side and M&A sourcing and integration on the business side. They will foster the adoption of agile methodologies, working in cross-functional teams that assess the implications of evolving company strategy on business needs. At the same time, key functions, such as treasury and health and safety, will continue to operate as before, leveraging the expertise of dedicated, in-house teams while continuously improving processes and efficiency thanks to the implementation of new digital tools.

The energy transition poses multiple challenges for oil and gas companies. These include adapting to the varying growth trajectories and requirements of traditional and low-carbon areas and incorporating the nuances that characterize different types of business within those areas. But they must also rethink legacy models and approaches, attract and motivate new talent, encourage greater collaboration, invest in their support functions, and create a unifying purpose that resonates across the organization. While it is undoubtedly a complex task, we believe the industry has the human and financial capital to rise to the challenge. However, if it is to succeed in a sustainable, low-carbon future, it must first free itself from the innovator’s dilemma and put aside many of the structures and policies that have made it successful in the past.