The investment category owner is the key to success for any zero-based program. It’s also a proving ground for the next generation of company leaders.

Leaders understand that any successful transformation depends almost entirely on effective change management. The most impeccably designed program isn’t worth much without the right leaders in place to rally people around it, make it happen, and keep it front and center.

So it is with zero-based budgeting (ZBB), the transformation that involves challenging how resources are spent and reallocating them to advance the company’s growth and innovation agenda. Like any transformation, the success of a ZBB program hinges on the team behind it—a team that must be fully involved at all stages to make ZBB an organic process engendered by mindset, rather than a program imposed by fiat. ZBB thrives when its rationale is clear and the organization is on board with the strategy. In a previous article, we explored the context levers companies employ to shape their environment and in turn, the behaviors and mindset that make ZBB work. By far, the most important factor is the investment category owner (ICO).

Each ICO (formerly called cost category owner) manages a dedicated cost category across the enterprise. ICOs challenge existing costs to ensure they are based on the right drivers. They also help budget owners strike a balance between efficiency and effectiveness in supporting the overall business strategy.

In every aspect of a ZBB program, ICOs apply their fresh perspective to challenge the status quo, working with teams to uncover opportunities for mining value, holding budget owners accountable, and fostering the right mindset. In this article, we explore the role of the ICO, demonstrating how it gives ZBB traction and sustainability and can serve as a proving ground for up-and-coming leaders.

Who and What Is an ICO?

The most successful ZBB efforts create new roles, responsibilities, and processes to foster a culture of cost consciousness. The ICO role is not only central to the ZBB program in operational terms, it is also the standard bearer—the catalyst—for change management.

But it’s a role that is often misunderstood at first. ICOs sustain ZBB momentum to ensure the budget is continuously refined and to align it with overall company strategy. They are charged with lending an outside-in perspective, a nontraditional way of viewing costs—one based on the spending source, not on whose P&L gets hit. Thus, ICOs advance the significant mindset shift that is so central to ZBB.

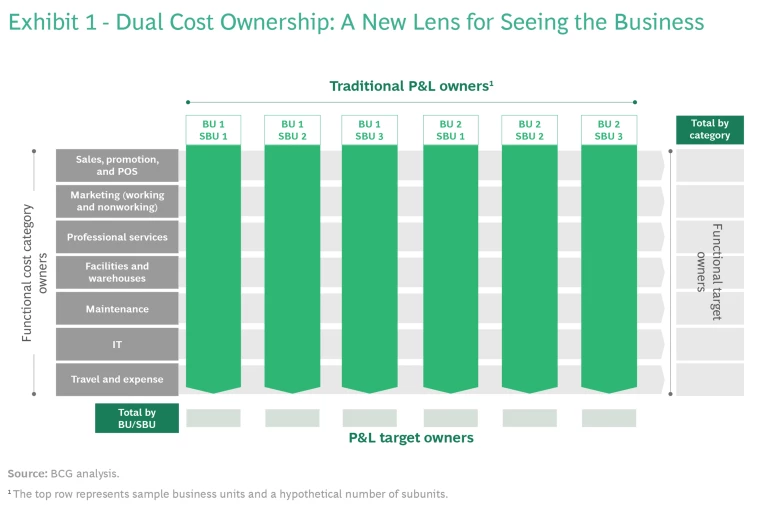

With the ICO role, companies effectively create dual ownership of a cost category. (See Exhibit 1.) ICOs do not have actual P&L responsibility; that remains with regional, functional, and business unit leaders. ICOs are thus able to see the business through a new lens. Their objectivity enables them to challenge current spending and assumptions, holding P&L owners accountable and collaborating with others across the business to develop hypotheses about value levers. For the first time, someone is in a position to question why the spend is as it is. ICOs can foster a broad-minded view of investment opportunities and in this way—over time—companies can validate, prioritize, and implement them.

ICOs help instill an owner-operator mindset, in which budget owners treat their budgets as if they were made up of their own money. At the same time, ICOs promote an open, no-blame culture, attributing past inefficiencies to systemic factors. By reinforcing the no-blame and ownership mindsets—along with data-driven decision making—ICOs help cultivate the transparency that is the cornerstone of ZBB success.

When given the latitude to fully embrace the position, an ICO is not only a change agent but also becomes a thought partner.

Who a company chooses to be in the ICO role is arguably the most critical determinant of ZBB success. ICOs should be executives, ideally one level below the C-suite. As experienced senior leaders, they will have the wherewithal to zero in on value initiatives. They should be rising stars in the organization, with the authority and the leadership to conduct workshops and oversee ongoing implementation. Beyond carrying out their existing responsibilities, they promote change and fuel the desire in others to make a visible difference. Generally, the ICO assignment has an 18- to 24-month term (in any case, no less than 12 months), which allows for continuity and clearly signals that it is more than a short-term project role. ICOs may also be responsible for training their replacement, which will ensure a seamless transition when they pass the baton.

A person’s willingness to step into this nontraditional role and take a “horizontal” view of the P&L demonstrates seriousness and a commitment to value and to realizing enterprise goals. When given the latitude to fully embrace this position, the individual is not only a change agent but also becomes a thought partner. Success as an ICO can thus advance and accelerate one’s career. For example, after serving as ICO for her company’s sales category, one ICO we know was asked to lead a major enterprise-wide strategic initiative sponsored by the CFO.

The ICO and the ZBB Journey

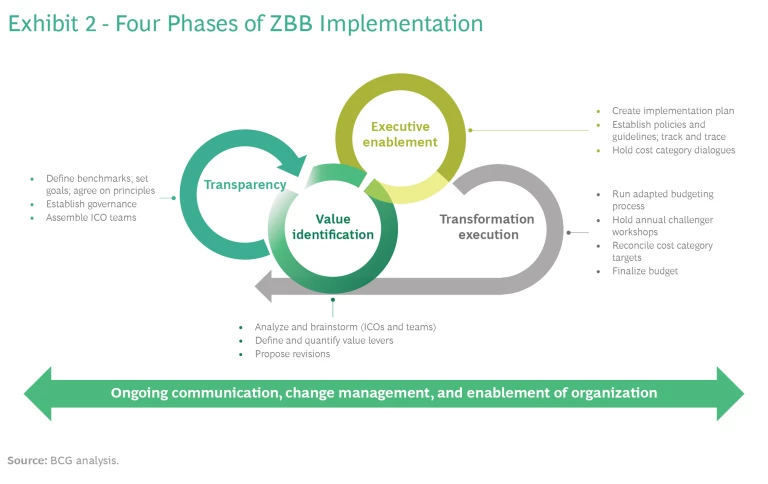

With ICOs spearheading the ZBB effort, companies can lay the foundation for their new culture of cost consciousness through four phases of implementation: transparency, value identification, execution enablement, and transformation execution. (See Exhibit 2.)

Transparency. In this initial phase of ZBB implementation, the company takes a bottom-up, granular look at expenses at all levels to get an in-depth understanding of its spend. With the help of internal and external benchmarks, leaders first define the overall objectives for the budget, agree on the principles for reinvestment, and establish a ZBB governance structure. Leaders then appoint ICOs and help them and their teams get to work.

As we’ve described elsewhere, ICOs are responsible for a functional category of spend, both baseline and investment or savings opportunities, across the business. These categories include, for example, costs associated with sales, promotion, and point-of-sale; marketing (working and nonworking); professional services; facilities and warehouses; maintenance; IT; and travel and expense. In addition, the ICO structure can be set up to assess the design of the overall organization in order to optimize roles, responsibilities, and people costs.

ICOs begin by studying baseline spend data, supplementing their research with operational category data and benchmarks. This deepens their understanding of past decisions and of current spending practices from region to region. It also allows them to see how the company compares to other companies, often uncovering useful practices that might be worth adopting. At the end of this phase, an executive steering committee typically sets category-level targets to which the ICOs are held accountable.

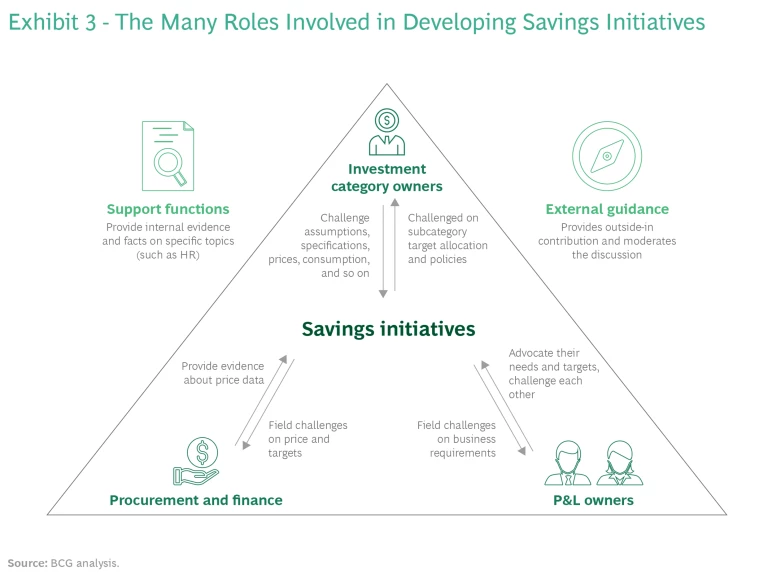

Value Identification. In this phase, ICOs lead the charge to identify sources of value that will help meet category-level targets. ICOs work jointly with cross-functional teams (whether from multiple levels or across units or regions) to define value initiatives, based on the top-down category targets set by the executive steering committee.

Working in agile sprints, the teams brainstorm ideas and evaluate the size of each potential opportunity. ICOs then lead workshops to identify value levers. For example, in a sales workshop, they might propose that point-of-sales materials be branded to provide sales lift; in IT, they might propose eliminating landlines; in working marketing, they might redirect spending from traditional channels to digital channels. ICOs and the teams validate these ideas through operational analysis, prioritizing ideas according to their potential value and feasibility. In such an environment, team members are more inclined to share ideas about what could be done better. By having cross-functional representation in workshops, stakeholders from different functions of the company can pinpoint duplicative efforts and seek opportunities for joint efforts wherever possible.

Once these ideas are vetted and prioritized by ICOs and the cross-functional working team, ICOs present them to the steering committee to help refine and prioritize them. Out of this comes a list of initiatives and the detailed savings they will deliver, by category, and those initiatives are then cascaded to P&L owners. Such an integrated approach is fundamental for building efficient, effective initiatives that will get traction enterprise-wide. (See Exhibit 3.)

Execution Enablement. In this phase, ICOs lead the working team to define an implementation plan for the approved initiatives. Policies and guidelines, along with a track-and-trace system, are put in place. Then teams prepare the initial budget overlay, integrating initiatives created according to ZBB investment categories into the actual P&L line items in the company’s budget. Following this, the teams host initial first cost category dialogues with senior leaders, where they introduce (or adapt) processes to ensure initiative activities are visible and trackable.

ICOs see to it that P&L owners understand what they are accountable for and then hold them to it. ICOs adhere to the goal of continuous improvement, ensuring that the changes adopted by the program stick and that attention to spend optimization is unwavering. That means they remain engaged with P&L owners throughout execution. In the process, and throughout this collaborative relationship, ICOs reinforce the new cost consciousness and ensure that the value they’ve identified is realized.

When necessary, ICOs escalate issues. Collectively, they have their fingers on the pulse of global category budgets and are well-positioned to surface new ideas for category savings.

ICOs, then, play a tremendous role in managing the ongoing ZBB effort; in that respect, they are the ongoing face of change. They advance change management, seek further budget opportunities, and share lessons across the company. For example, they might host additional “challenger workshops” for all investment category teams to uncover additional ways to optimize their spend and help accelerate transformation. Through monthly reports they monitor category-level savings and operational KPIs across the organization, check in with initiative owners regularly to ensure they aren’t hitting any roadblocks, and update the steering committee about progress. Through the monthly cost-category performance reviews, the steering committee reinforces ICOs’ power to hold P&L owners accountable and keep pursuing improvement and cost innovation.

Transformation Execution. Here, the company implements the new adapted budgeting process. Teams reconcile cost category goals and finalize the budget. ICOs keep the cycle in motion: they ensure that key activities are revisited throughout the year, including annual challenger workshops. They might hold additional value identification workshops or propose new initiatives to the steering committee. That triggers another round of target setting and initiates the budgeting process anew.

After going through a full cycle of these phases, a company can revisit some or all of them as needed. In this way, it maintains the rigor required for managing the cost base as well as for identifying opportunities to redirect spending to where it counts most. Budgeting is no longer a static effort that’s largely set in stone until the next year. Through this ongoing reworking and refinement, the organization gains ZBB muscle memory and reinforces the value mindset.

A Showcase for High-Potential Talent

Beyond advancing resource allocation to best serve the company’s strategic goals, the ICO role provides important human capital benefits.

For those who take on the role, being an ICO is akin to taking a crash course in general management. Serving as an ICO affords opportunities that rarely arise in business-as-usual mode. The monthly steering committee sessions, for example, give ICOs greater exposure to the full C-suite team than they could ever get in their day-to-day work. Moreover, we often hear that they regard their participation with pride. It’s not uncommon for an ICO to acknowledge the experience and visibility gained as contributing to a promotion or a new role. (See “Serving as an ICO: A Firsthand Account.”)

Serving as an ICO: A Firsthand Account

Initially, I thought of ZBB as more of a cost takeout, where we’d commit to measures like sharing mid-priced hotel rooms while traveling. So when our CEO asked me to serve as an ICO, I was pleasantly surprised to learn that ZBB was more of an investment program, directly supporting our company’s long-term growth strategy. We were breaking away from the cycle of simply approving budgets based on applying an inflation factor to the prior year’s budgets and moving toward a more holistic view of our spending.

I’m on the company’s legal team and was asked to be the ICO of a marketing category. All ten of us ICOs were made responsible for a spend category not directly tied to our day job. This would enable us to be more objective (and less reluctant) about proposing changes, while giving us a chance to learn about a different aspect of the business.

A 20% Redirect Boosts Company Brand

Once our baselines were locked and category spend was finalized, the heavy lifting began. I pushed our working team to consider big changes to make sure spend was being allocated to high-value activities. My first big lesson—admittedly a shock—was discovering that we weren’t always measuring return on our marketing spend. We had no way of knowing definitively which of the marketing efforts were working. Taking a more returns-based approach to our spend became a priority to me.

We got to work, and before long, our category team had identified ways to redirect more than 20% of our marketing spend to activities that would generate sales and profit. Specifically, we could shift away from traditional media and toward digital marketing and cut spending on events and sponsorships that did little to further our brand positioning. This effort was a big win for the team. It was a validation not only of our teamwork, but also of the ICO’s pivotal role and of our ZBB program overall.

Advancing the Company’s Digital Efforts

It’s exciting to see that through our ZBB efforts the company has been able to invest more heavily in our digital agenda and expand our e-commerce and social media capabilities. As someone helping to ingrain the new mindset, I’ve been active in our company’s ZBB communications, participating in video updates and a SharePoint series to spread awareness.

After 18 months as an ICO, I’ll likely rotate out of my role. Apart from the learning and development opportunity, being an ICO has helped me gain a more holistic view of how the company operates than I ever had from where I sat functionally in our organization. I’ve been able to deepen my relationships with our C-suite and other ICOs and in the process become more effective in my day job. And I’ve had an opportunity to help shape the company’s culture. In passing the baton, I’ll be giving someone else what is in effect a graduate training opportunity.

For the company itself, the ICO role offers a mechanism for putting high performers to the test, allowing them to showcase their leadership skills—including their change management capabilities—in a new and different light.

In every phase of the ZBB journey, the ICO plays a pivotal role. Companies that choose their ICOs carefully and enable them fully are not only setting their programs up for success and seeding culture change, they are also developing the next generation of leadership talent. The visibility they offer to these up-and-coming leaders in turn promotes the ICO role, adding allure to the program that will help attract future rising stars.