The following is an excerpt focused on reimagining the service station from the report A New Era for Fuel Retailers. Please download the PDF for the full report.

Digital, EVs and alternative fuels, new mobility models, changing customer habits: to thrive amid these new challenges, fuel retailers must create new value pools.

For fuel retailers, the uncertainty and volatility triggered by recent geopolitical events are only the latest disruptive forces upending the industry. As we observed in our 2019 report “Is There a Future for Service Stations?,” digital, EV and other alternative fuels, the rise of advanced mobility modes, and rapidly changing customer habits have created huge challenges for the traditional fuel retail business. COVID-19 hammered fuel volumes even further. Yet the explosion the pandemic sparked in e-commerce highlighted a promising opportunity: operators that had a robust retail business saw that in-store sales and online offers helped offset declines in gasoline and diesel sales volumes. Retail, they realized, is a matter of business resiliency.

Collectively, these developments point to the need for fuel retailers to reorient themselves: away from fossil fuel and toward alternatives and away from the vehicle and toward the customer. They need to stop selling more of the same and start selling more to the same (and to the new). And though the pressures today remain as urgent as they were a few years ago, fuel retailers now can choose from among a plethora of options, rather than following a narrow path.

For oil and gas companies, the case for action is particularly strong. Fuel retail has become a more crucial gateway to diversification than ever. Beyond affording them a means for growing non-fuel revenues, it also offers companies a way to pursue their sustainability objectives by marketing sustainable products and services, such as electric charging points and alternative fuels, to their customers. Because the fuel retail business has lower cyclicality than other businesses in the value chain (such as upstream and refining), it helps reduce the volatility of the overall portfolio. Finally, service stations are instrumental in repositioning an oil company’s brand and supporting the energy transition that must take place.

Many innovative fuel retailers have already embarked on the journey to transform their businesses, moving decisively to secure their existing sources of value while developing new value pools. Their abundant assets—established presence and networks, customer touchpoints, loyalty programs, real estate, the volume of transactions, and the data these assets generate—put them at an advantage.

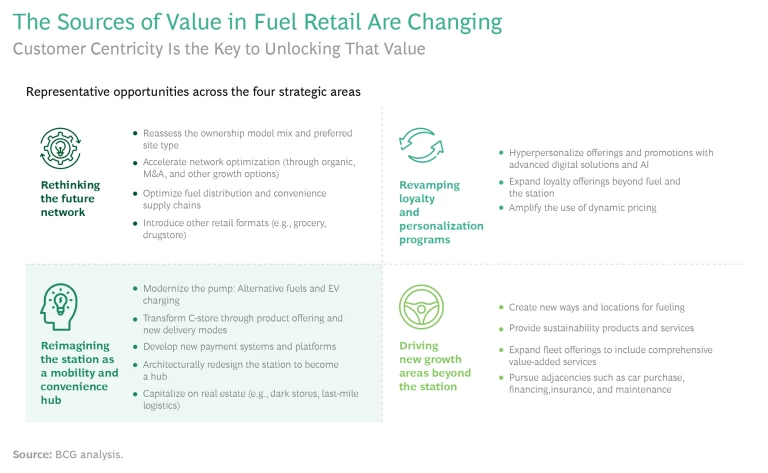

No single stratagem will be sufficient to overcome the forces of disruption. To stake out a profitable future, fuel retailers must adopt a customer-centric model. Doing so entails taking action in four areas: rethinking their future network, reimagining the station as a mobility and convenience hub, revamping their loyalty and personalization programs, and driving new growth areas beyond the service station. (See the exhibit.)

Our full report (downloadable below) details this four-pronged strategy. In this article, we focus on reimagining the station as a mobility and convenience hub. To accomplish this, fuel retailers can exploit three promising opportunities onsite: modernizing the pump, transforming the C-store, and capitalizing on their real estate (and strategic locations) to become a services hub.

Modernizing the Pump

Companies can modernize their pump offerings with alternative fuels and EV charging stations to serve the growing base of alternative-powered vehicles.

Sustainable Fuels. Offering alternative fuels—namely, biofuels and hydrogen for passenger fleets, heavy-equipment operators, and some B2C customers—is becoming essential. Worldwide demand for biofuels was already growing sharply three years ago and, led by Asia and America, is expected to keep growing across all regions (at around CAGR +4%). Demand is forecast to hit 223 million tons of oil equivalent (Mtoe) by 2040—an increase of 89 Mtoe over 2018 levels—as regulatory targets encouraging the use of oil substitutes in transportation are raised.

It makes sense for retailers to promote renewable fuels as the answer for decarbonizing heavy transport over the next ten years. The market is expanding at an unprecedented pace; indeed, renewable diesel is becoming price competitive with traditional diesel. In California, for example, it has at times commanded a cheaper price at the pump. Moreover, renewable diesel has strong regulatory support, thanks to EU directives; low-carbon fuel standards in California, Washington state, and Canada; and the renewable identification number (RIN) program in the US EPA’s renewables tracking program. It is the fuel of choice for fleets that are decarbonizing. And suppliers are actively building their footprint; after Neste and Valero led the way, many majors are getting involved.

Longer-term, of all the options, we are optimistic that hydrogen could be the most widely adopted alternative fuel for long-distance heavy-duty trucks (those covering more than 400 km per trip), given the range limitations of battery-powered vehicles. To establish a position and comfortably meet demand, companies would need to have a critical mass of stations offering hydrogen by 2030. The best way to meet this opportunity will be through partnerships across the chain of generation, distribution, and storage—especially OEMs and fleets. For example, TotalEnergies and Hyzon Motors (a leading supplier of hydrogen-fuel-cell-powered trucks) have agreed to develop hydrogen refueling and vehicle supplies for long-haul customers.

EV Charging. Burgeoning demand for charging points represents a prime opportunity for fuel retailers, which have the advantage of an established network of stations and space. They can serve longer-distance drivers, both commercial and consumer. Aral, for example, has announced plans to expand its high-powered charging network in Germany, installing 500 charging points with up to 350 kW at more than 120 stations. As battery technology advances and battery recharging times shrink—specifically, down to five to ten minutes—EV use could truly take off, even in urban locales where access to private parking and charging is limited. (At present, most charging must take place at home or work.)

The EV fleet market is growing rapidly. Fleets with regulatory exposure and those serving high-end customers will be the fastest to electrify—and securing first-mover advantage and maintaining pace are important. A fleet-charging ecosystem is emerging with strong links to telematics and planning and dispatching. B2B charging for fleet customers is likely to become highly competitive, especially among operators and equipment suppliers.

To succeed, companies will have to serve complex customer needs by providing high-quality end-to-end service, tailored solutions, and the ability to integrate fleet management with site energy management capabilities. As with green fuels, partnerships will be key, particularly in the early phases of market development. Scania, for example, has joined with the French multinational utility company ENGIE and its subsidiary EVBox to provide charging solutions. Partnering with logistics hub providers is another potential means of market entry for OEMs.

Many companies are also installing charging points outside of service stations. With its 2018 acquisition of Chargemaster (recently renamed BP Pulse), BP became an early entrant into the EV charging market. BP Pulse provides residential, business, and public charging points and operates the UK’s biggest rapid public charging network. Through its large ecosystem of partners (including Ionity, ubitricity, and Fastned), Shell Recharge offers drivers access to a network of 275,000 public charging points in 33 countries across Europe. It also markets home-charging solutions in the UK, France, Germany, and the Netherlands and develops dedicated charging solutions for B2B customers, including car manufacturers, leasing companies, professional fleets, and hospitality and retail companies.

In providing EV charging, companies will need to strike advantageous agreements with utility partners—agreements that secure electricity at desirable sites (including outside their stations) and at a favorable cost, ensure uninterrupted access, and enable retailers to grow their network strategically. Some providers are devising creative approaches. For example, a retailer could expand its services to include charge point installation and management for business and residential customers; or, like the UK’s Gridserve, create its own grid, powering EVs through its own solar panel farms; or partner with clean-energy providers.

Transforming the C-Store

Once seen as a place to grab cigarettes or a quick bite or coffee while on the go, the convenience store (C-store) needs a rethink, thanks to new trends and changing consumer demographics. Where convenience drove baby boomers, sustainability will increasingly motivate the buying decisions of generations X, Y, and Z. Where purchasing used to be in-person only, consumers increasingly order online. Where loyalty once sprang from a relationship with the service station owner, personalization (or rather, hyper-personalization) in the future will be AI-driven. But simply acquiring or converting sites in itself isn’t enough. To grow their C-store revenues, retailers need to create a compelling and consistent brand experience. Here are four broad options to explore:

- Develop franchising offers for the dealer network. Such a move can take many forms, blurring C-stores with other retail formats such as grocery stores, drugstores, deep discounters, and quick-service restaurants. An even faster route is to establish joint ventures with existing convenience store companies, such as BP and M&S food stores in the UK; Esso and Tesco Express; and Mexico’s OXXO (owned by FEMSA) and Raizen of Brazil.

- Build your own convenience brand. Having an attractive convenience offering promotes differentiation and increases share of wallet. According to our survey, companies differentiate themselves in any number of ways, most commonly through friendliness, cleanliness, fuel pricing, speed and ease of transactions, and positive brand perception. A successful customer offering should include a market-leading fresh food offer—ideally, food-for-now and food-for-later selections. Leading international C-stores such as Wawa and Carrefour City allocate 40% to 50% of store space to such products. Above all, they should make shopping a fast, easy, and digitally enabled experience featuring ordering apps, cashless stores, and whole-basket scanning as well as unmanned, self-service stores. Perhaps the most compelling technological innovation for brick-and-mortar C-stores would be to emulate the Amazon Go model, which uses sensor and scanning technologies to eliminate checkout altogether.

- Curate the product assortment. Retailers should be deliberate and rigorous in their assortment choices, matching breadth and depth to demand and demographics. Stores need to analyze SKU performance on a regular basis, weeding out slow-moving products and replacing them with relevant, attractive, and trending items. These choices will be guided by a robust data-gathering and analytics program.

- Offer delivery. With the explosion of e-commerce in the past two years, delivery has grown increasingly important. For example, 7-Now, launched in 2018 by 7-Eleven (a global convenience operator and the largest convenience chain in the US and Canada) promises 30-minute order delivery from a selection of more than 3,000 items, using its popular loyalty program. Customers can choose door-to-door delivery or order pickup at the company’s broad network of franchisees and company-owned stores.

To support these enhancements to the customer offering and experience and improve site efficiencies and C-store performance, companies will need to beef up and augment core capabilities and practices. They’ll need to examine their processes for wetstock monitoring, fuel logistics, supply and inventory management, and performance monitoring. They’ll need to install the latest payment systems, both point-of-sale and indoor and outdoor systems. Finally, they’ll need to digitally integrate site operations with company enterprise resource planning systems and the cloud in order to monitor and continuously improve performance.

Becoming a Services and Logistics Hub

Another creative approach retailers might take involves transforming their sites into services and logistics hubs. Essentially, this means making the most of their real estate by leveraging it for other businesses, particularly those for which low-cost space and proximity to transportation or customer hubs matter more than attractive retail storefronts. (This could mean leasing it to others or building these new businesses themselves.) Possibilities include dark stores and kitchens and last-mile logistics hubs (sorting, delivery, and transfer points, as well as lockers for customer pickup). But there is no limit to the kinds of offerings; for example, any convenience that might be attractive to commuters, truckers, or long-distance travelers while charging their EV or taking a travel break is a potential candidate—even salon services.

Dark Stores. Companies can rent space to businesses that are not designed for serving retail customers onsite. Such businesses do not need a classic retail storefront; instead, they are optimized to produce a product for takeout or delivery. Among the most promising type of dark store for fuel retailers are “dark kitchens” (also known as “cloud kitchens”)—commercial meal-preparation facilities for multiple food and beverage or restaurant brands. Cloud kitchens are optimized for the preparation of delivered food (although some offer takeout), so they can be located in lower-rent locations near transportation links. They specialize in high-efficiency, high-speed cooking processes and, as data-driven businesses, are able to change menus and operations to adapt quickly to changing market trends. Retailers can monetize their existing kitchen space (or overhaul it or even create one) to set up these facilities.

Thailand’s PTT OR (Oil Retail) is one such example. In March 2021, the company partnered with Line Man Kitchen, a food delivery startup, to fulfill its ambition of “retailing beyond fuel.” Line Man serves multiple restaurants from a single location and offers delivery and pickup options. Beyond fuel customers, this service attracts a new customer segment: those looking for takeout or food delivery to home or office.

Dark kitchens that provide attractive, cost-effective, and competitive food services serve other sectors, but their innovative formula complements fuel retailers’ advantages: their extensive network, convenient locations, and, in many cases, space. More broadly, they potentially share synergies with C-stores—not simply as a behind-the-scenes provider, but also as a partner with the power to draw customers to service stations.

Last-Mile Logistics. Station networks confer several advantages on co-located businesses, among them a wide footprint, presence in strategic locations (often close to other transport links), and typically available space. These features suggest a no-regrets opportunity for retailers to turn their sites into logistics hubs such as processing and transfer facilities for the carriers or lockers for customers. The growth of e-commerce suggests that the demand for logistics services will only grow.

Petronas, Malaysia’s state-owned oil and gas company, is now reaping advantage from its extensive network with its wholly owned subsidiary, Setel Express. Founded in 2020, the company serves B2B customers—retailers and merchants offering parcel delivery to their customers. It provides pickup and door-to-door delivery as well as services at its hubs, located in Petronas service stations.

While the current industry volatility and uncertainty about geopolitical impacts are naturally concerning, fuel retailers must begin preparing for the long term—and a different future. Fuel retail will be a pivotal source of growth in the coming years, but as the demand for traditional fuel declines, fuel retailers will need to diversify.

A differentiated retail offer is vital. Exploiting non-fuel value pools is another important path to diversification and financial sustainability. Beyond extracting the most from their traditional core business, fuel retailers will need to make ambitious moves into some of the many promising new businesses as they adapt the service station to support new vehicle types, capitalize on their real estate, and zero in on sustainable practices.

By reducing their dependence on hydrocarbons, operators can reduce the volatility of their traditional businesses and position the fuel retail business for long-term success.