Knowing your customers—and meeting their requirements—has never been more important for fuel retailers. With demand for fuel set to decline over time, future profitability will increasingly depend on the ability to attract greater consumer spending on nonfuel items. Getting the convenience retail offering right is essential if service stations are to make the most of their locations and capture a greater share of wallet in the face of stiff competition.

Stay ahead with BCG insights on energy

Five Consumer Insights

To better understand the behaviors and preferences of those who shop at service station convenience stores, we recently surveyed consumers across six markets: Australia, Canada, France, Germany, the UK, and the US. Five insights emerged.

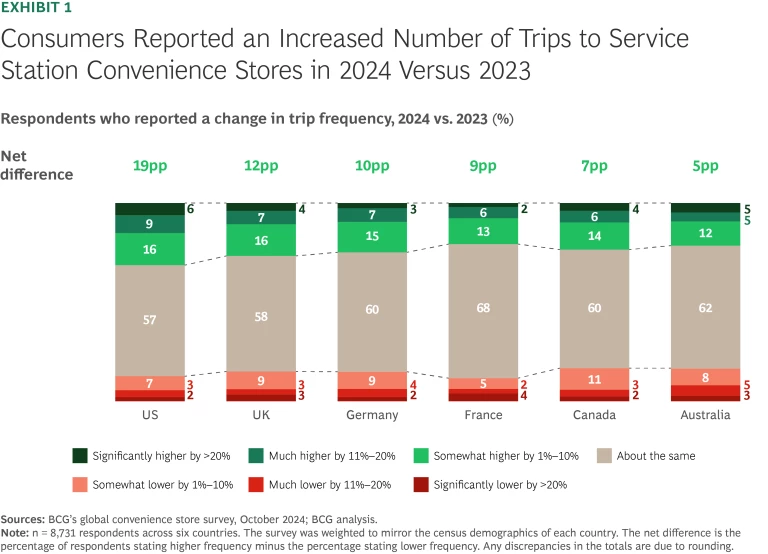

Trip frequency is increasing. In every market we surveyed, consumers reported an increase in the number of trips they made to service station convenience stores in 2024 compared with the number they took in 2023. The net difference between the percentage of consumers who said they took more trips and the percentage who said they took fewer trips ranged from 19 percentage points in the US to 5 percentage points in Australia. (See Exhibit 1.)

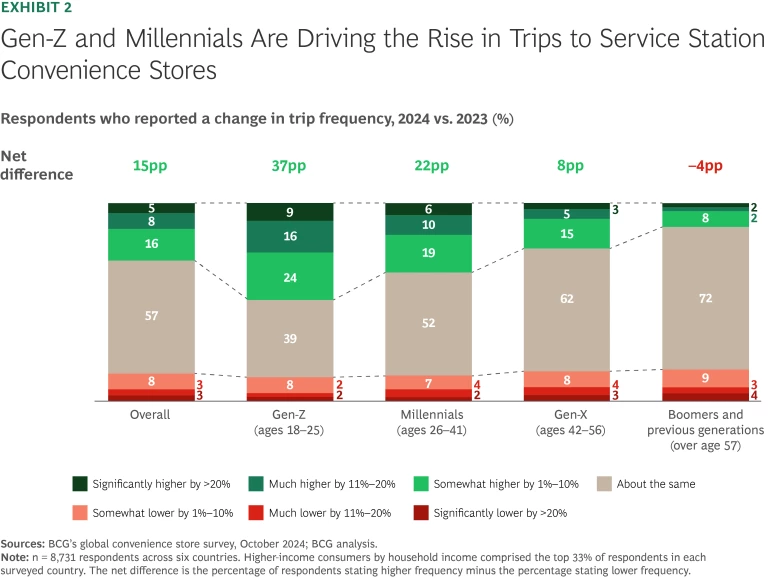

Across all markets, younger consumers—particularly Gen-Zers and Millennials—are driving the rise in trip frequency. (See Exhibit 2.) Our survey also showed that higher-income consumers increased their trip frequency the most in all markets with the exception of Canada, where middle-income consumers did so.

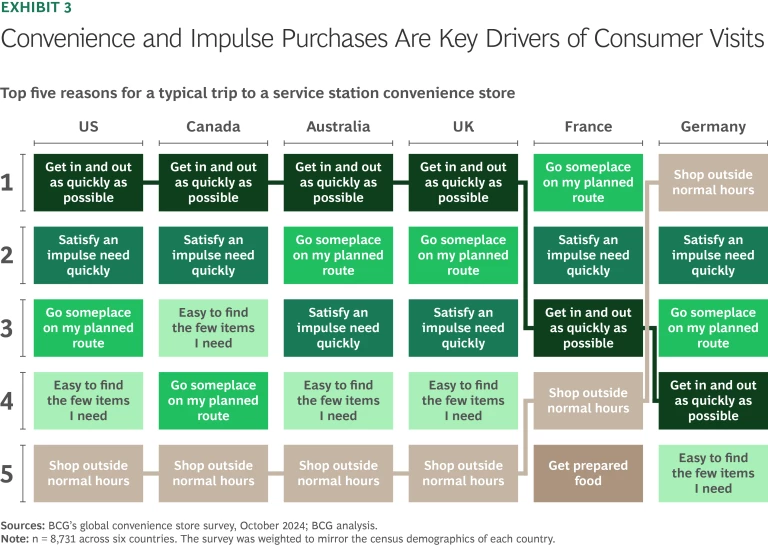

Convenience and impulse buys remain key trip reasons. We found that the most common reasons for visiting a service station convenience store in 2024 were surprisingly similar across all six markets. While there were subtle differences in their relative importance from one market to the next, the top five reasons for a typical visit were: get in and out as quickly as possible, go someplace on my planned route, shop outside normal hours, easy to find the few items I need, and satisfy an impulse need quickly. (See Exhibit 3.) These findings paint a picture of a consumer who values convenience-based factors and the ability to make an impulse purchase.

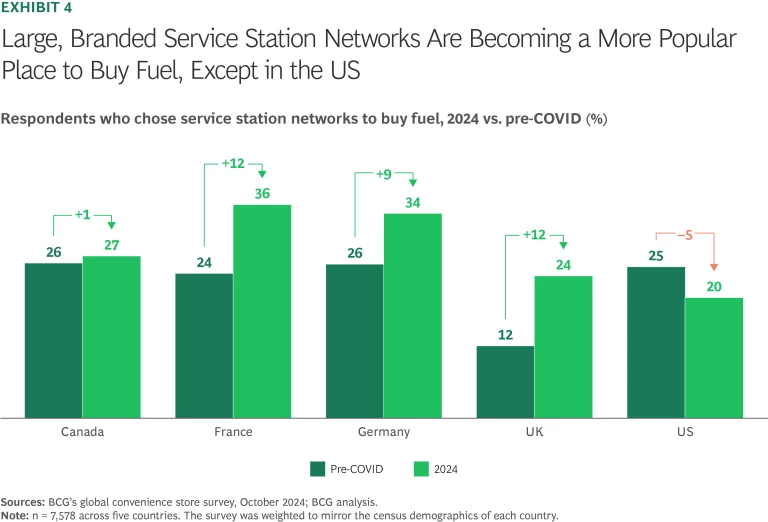

Branded service stations are winning more hearts and minds. When we asked survey participants about their preferred place to buy fuel, a mixed picture emerged. On the one hand, large, branded service stations gained popularity in 2024 over pre-COVID times in all markets except the US. This suggests that these service stations are winning more consumers’ hearts and minds. (See Exhibit 4.) On the other hand, branded service stations were still not the most popular place to buy fuel in France, the UK, and the US in 2024. In these markets, supermarket chains and traditional convenience store chains selling fuels came out on top. But large service station networks were respondents’ preferred place for purchasing fuel in Germany, Canada, and Australia.

Food and beverages are becoming more important in the eyes of the customer. While refueling remains the top reason to shop at a service station convenience store across markets, more consumers are visiting to purchase food and beverages. Compared with the pre-COVID era, consumers also increasingly value the selection, prices, and healthiness of food and beverages when choosing among convenience store brands.

Electric-vehicle and commercial drivers stay longer and spend more. While the majority of survey respondents drive private vehicles powered by internal combustion engines, we focused on two groups—drivers of electric vehicles (EVs) and commercial vehicles—to see how their behavior compared with that of other consumers. Both groups are growing in importance as demand increases for EVs as well as for logistics and last-mile delivery services.

EV drivers who visit service station convenience stores do so more often, on average, than non-EV drivers. They also spend more time in stores and purchase more nonfuel items, our survey finds. The same pattern emerged when we compared the behaviors of commercial drivers with those of other consumers. In addition, EV and commercial drivers increasingly value product range, convenience, and speed of service over price.

How to Win Share of Wallet

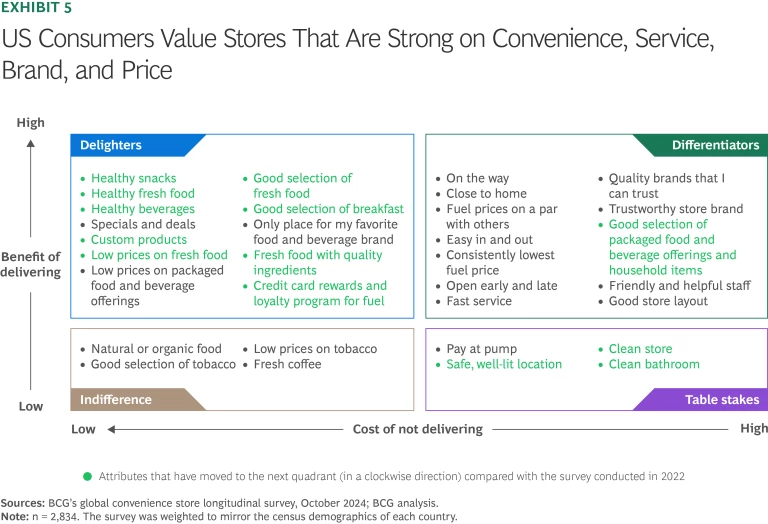

From the survey results, we created a picture of the differentiating factors that attracted consumers in our six markets. These attributes have the potential to translate into a greater share of wallet for those service stations that deliver them, regardless of market location.

Several attributes that were highly valued by consumers will come as no surprise to oil companies and service station operators. For example, respondents in all markets cited convenience factors (such as being located close to home, on the way, and being open early in the morning and late at night) together with low fuel prices as key differentiators.

But our survey also revealed the critical areas that service stations need to focus on to win share of wallet. These include building strong brand values of quality and trust by investing in the brand, improving store layouts so that it’s easier for consumers to get in and out, and paying attention to the basics—cleanliness, good lighting to promote safety, and friendly staff.

We also discovered attributes that consumers didn’t demand from service stations but were delighted when they were present. These “delighters” nurture greater consumer loyalty and can become differentiating factors over time. In the US, for example, having a good selection of packaged food and beverages and household items has migrated from being a delighter to a differentiator since 2022. (See Exhibit 5.)

Action Steps for Fuel Retailers

Convenience retailing is becoming increasingly important to the lives of consumers—and it’s critical for service stations’ long-term viability. With fuel demand set to decline, the clock is ticking for service stations to build strong, competitive convenience businesses. But to tap this vital source of revenue, oil companies and service stations operators must have their finger on the pulse of consumer behaviors and preferences.

Our survey results clearly indicate a shift in consumer priorities and the growing importance of specific customer groups, including EV and commercial drivers and younger consumers. Leading fuel retailers are already acting to enhance their right to win not only against their peers but also critically against fast-food and pure-play convenience companies. The winners will be those players that:

- Reassess their current brand position in the market and adopt proactive measures to build a brand that customers trust.

- Ramp up the quality of their customer value proposition by making focused investments to deliver a uniquely friendly, personalized, and seamless experience (both online and in store).

- Leverage data analytics capabilities to understand evolving customer preferences and act with agility to adjust their offering ahead of the competition.

In a crowded marketplace, taking these steps can help fuel retailers come out on top.