This article is a collaboration between BCG and SAP.

Finance functions can use a virtual representation of key metrics to facilitate analyses of granular data and improve decision making at the enterprise level.

Finance functions must fulfill new management requirements arising from digitization, advanced business models, changing expectations and regulations, and nontraditional value drivers. But they often lack access to the data needed to make rapid and precise decisions in the evolving environment. Existing data typically does not span the entire product lifetime, provide detailed information down to the product level, or allow for the correlation of financial and nonfinancial metrics.

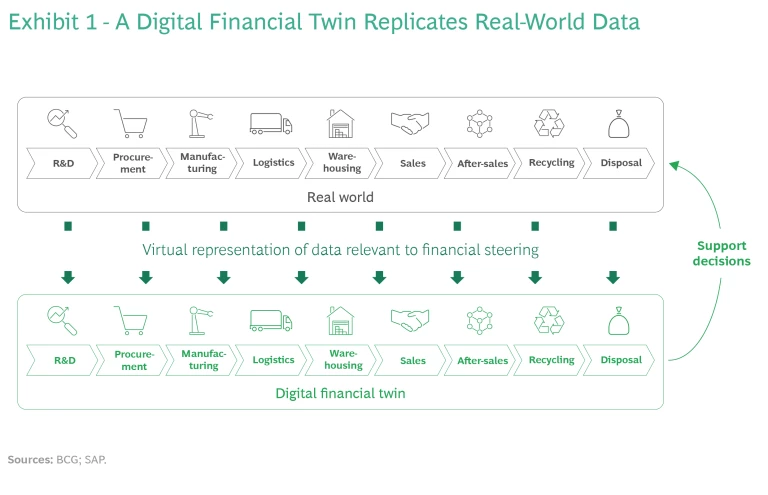

A concept called the “digital financial twin” offers a solution. The twin is a digital representation of financial and selected nonfinancial metrics, including those measuring relationships, structures, and processes across the entire product lifetime and value chain. (See Exhibit 1.) It precisely allocates these metrics to products, services, suppliers, customers, and employees. Production and supply chain functions are already using digital twins to gain transparency into granular, real-time operational data. By implementing a similar capability, finance functions can facilitate comparisons of granular data across functions and boost the efficiency and quality of decision making at the enterprise level.

The time is right to establish the technical and organizational prerequisites. Many companies need to upgrade or replace their enterprise resource planning (ERP) systems and better integrate automation and human decision making into their finance functions. By implementing a scalable system landscape based on a modern IT architecture and zeroing in on the fundamental problems to solve with data analyses, companies can lay the foundation for creating and using a digital financial twin.

Data Availability Hasn’t Kept Pace with Evolving Requirements

Several developments in the business environment are increasing the complexity of financial management, creating the need for more extensive and precise data.

The Real-Time Economy. Digitization has led to ever-shorter product development cycles in various industries, including automotive, technology, and life sciences. To adapt to digital business models and greater volatility, companies must make decisions quickly and implement them effectively. Finance professionals need transparent access to data and KPIs and often require real-time analyses and recommendations in order to take appropriate action.

Greater Individualization. Customers increasingly demand individualized product and service offerings. Most companies do not have the detailed information required for individualization because the manual workloads and costs necessary to obtain and process it are prohibitively high.

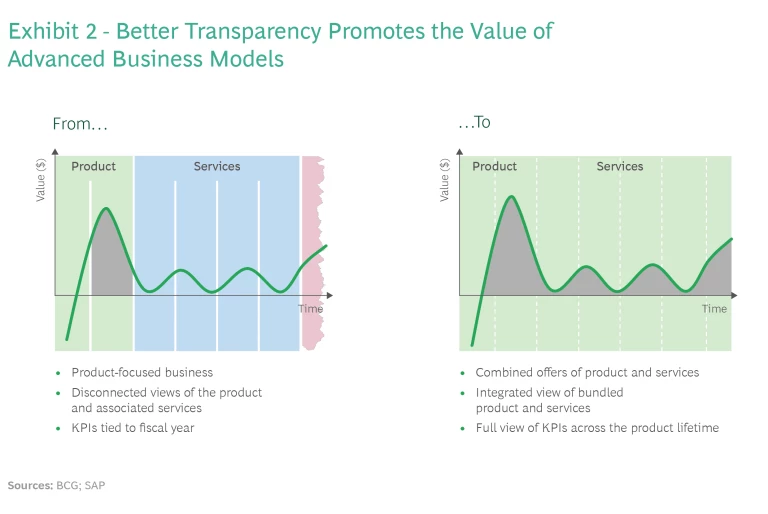

Combined Product and Service Offerings. Companies are combining product and service offerings to generate additional revenues and profits over the product lifetime. But the financial metrics available for a particular product usually cover only short periods. SAP has observed that companies struggle to design the best combinations of product and service offerings and to set optimal prices because they are unable to consider a product’s entire lifetime when forecasting revenues and margins.

Expanded Scope of Value Creation. Traditional financial indicators (such as sales, costs, margins, and operating assets) are no longer the only decisive factors in measuring a company's success at creating value. Nonfinancial dimensions, such as environmental, social, and governance (ESG) factors, are gaining importance owing to regulatory and legislative developments and new societal demands. For example, governments assess a company’s ecological footprint for regulatory compliance, investors consider it in valuations, and consumers consider it in purchasing decisions. Today, most companies are not able to correlate nonfinancial information with financial information. As a result, they struggle to make data-based tradeoff decisions—such as the effect of specific emission reduction goals on the profitability of different products. Many companies also lack sufficient transparency at a granular level to make proper ESG disclosures to external stakeholders.

How Does a Digital Financial Twin Address the Challenges?

A digital financial twin helps companies meet the management requirements arising from these developments. A twin precisely allocates financial and nonfinancial information to products, sections of the value chain, or organizational units (including divisions, customer segments, and markets). This allocation is made possible, first, by the expansion of classification attributes for data and, second, by the availability of modern in-memory databases that combine such attributes to aggregate data in real time.

These capabilities allow a digital financial twin to provide four key benefits:

- Detailed control information down to the individual product level

- Transparency into value contributions over the entire product or customer lifetime

- Integration of nonfinancial information with traditional financial metrics

- Information availability in (near) real time

A digital twin precisely allocates financial and nonfinancial information to products, sections of the value chain, or organizational units.

Detailed Product-Specific Information. Today, it's generally not possible to manage a business on a product-specific basis. Many companies struggle to present a comprehensible profit and loss statement for each product and product variant along the value chain.

A digital financial twin enables companies to analyze profitability at the individual product level. In the automotive industry, for example, a company could determine the value contributions of specific equipment by vehicle identification number. This allows it to optimize decisions on product variants (for example, components modified to reduce emissions) with full transparency into the associated costs and investments (such as those related to materials, production capacity, subsidies, and customs duties).

Transparency into Value Contributions. The digital twin's precise attribution of revenues and costs to products and customers across different periods promotes unprecedented transparency. It can determine value contributions over the entire product (or customer) lifetime and simulate different scenarios. (See Exhibit 2). The company gains support for short-term controlling measures as well as long-term, strategic financial decisions.

On the revenue side, the digital twin helps to set prices based on lifetime profitability. An automotive OEM, for example, could optimize the initial prices of vehicles by taking into consideration forecasts of sales of in-car services, which customers have the option to activate after purchasing the vehicle. On the expense side, transparency into total product costs informs decisions about design and production. Decisions can also consider warranty or recycling costs.

Integration of Nonfinancial Information. By attributing relevant characteristics along the value chain, the digital financial twin enables companies to compare financial KPIs (such as profitability) and nonfinancial KPIs (such as CO2 emissions) over the entire product lifetime. Going forward, the twin can aggregate data from traditional financial statements with data from “transactional carbon-accounting statements” currently under development. This transparency supports making tradeoffs across product lifetimes to optimize the company's ecological footprint and other ESG factors. It also enables effective reporting to external stakeholders.

Information Availability in (Near) Real Time. Companies can apply the automated aggregation of transaction data in the digital financial twin to increase their competitiveness. For example, information aggregated at an early stage of the product, service, or customer lifetime enables rapid operational, tactical, and strategic decision making and any necessary course corrections.

What Are the Prerequisites and Implementation Path?

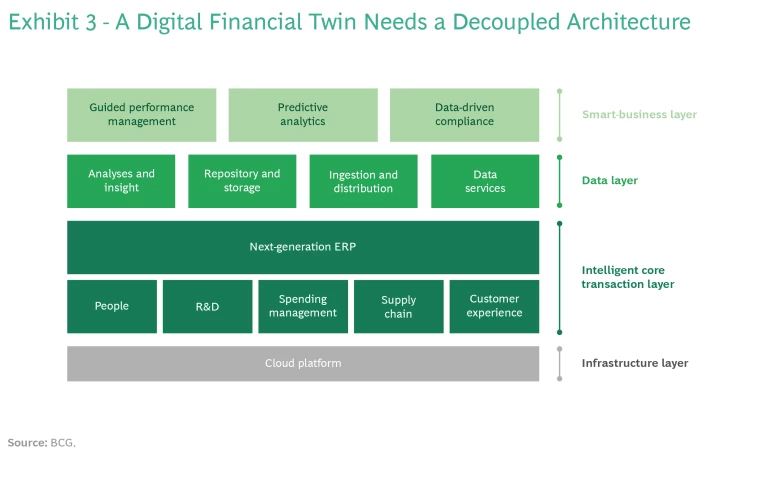

The basic technical requirement for introducing a digital financial twin is a scalable system landscape (next-generation ERP and data layer) based on modern cloud-based architecture. Companies can transition to this landscape by building a data and digital platform that decouples the data layer from the next-generation ERP and any existing legacy systems. (See Exhibit 3.) The system landscape enables the nearly real-time aggregation of transaction data, including all attributes (such as purchase price and date) relevant for financial steering, in an integrated platform. This data includes profit and loss KPIs (such as total revenue and gross margin), balance sheet KPIs (such as working capital, return on equity, or return on investment), warranty costs, CO2 emissions, and supplier information.

Other prerequisites include sufficient and scalable storage and computing capacity, authorization and security protocols, secure data storage, and data processing logic. These enablers provide the basis for capabilities such as parallel valuation, controlling at the individual product level, and product lifetime planning, simulation, and reporting.

The basic technical requirement for introducing a digital financial twin is a scalable system landscape (next-generation ERP and data layer) based on modern cloud-based architecture.

The typical implementation path involves adapting the financial steering approach to the new capabilities and anchoring the digital twin in processes and throughout the organization.

Evolve the steering approach. First, define an approach to the planning, steering, and financial control of the enterprise that allows the company to apply the capabilities of a digital financial twin. The answers to several questions will point to the most fundamental requirements:

- What are the company’s most important strategic and operational questions and the corresponding tradeoff discussions?

- How can the increased granularity of financial information and the greater flexibility of steering dimensions (such as product, customer, supplier, and channel) help to improve these strategic decisions?

- Which nonfinancial control variables (for example, CO2 emissions and other ESG parameters) do we need to integrate into decision making?

- How can we use the faster availability of financial information to enable more agile decision making?

- How do we design data governance and ownership to ensure maximum transparency for all relevant stakeholders?

Design the technical implementation. When creating the technical prerequisites, adapt the financial data model. Consider all attributes relevant to the steering approach (such as financial and logistics KPIs with integrated ESG attributes). However, it isn't necessary to fully harmonize the data models of other units and functional areas. To keep the data maintenance effort low, automate the attribution of each transaction to the fullest extent possible.

Optimize or introduce a next-generation ERP system to enable the consolidation of transactions, tagged with all attributes that could be relevant for steering. The system allows for the flexible structuring of steering information along any of these attributes. The goal is to maximize transparency for decision makers, enabling them to, for example, drill down from high-level KPIs to granular information and even restructure historical data. To create further transparency and enable timely support for decisions, install high-performance planning, simulation, and reporting applications with machine learning and predictive capabilities. Finally, present the information in dashboards specific to a user’s decision support needs.

Anchor in processes and throughout the organization. To realize the benefits of a digital financial twin, companies must adjust accounting standards and processes as well as downstream consolidation and reporting processes. They must also train employees to use these processes properly. In complex cases, it is valuable to adjust the setup of existing centers of excellence for accounting or reporting or to establish new ones. For example, some companies have set up dedicated ESG accounting teams to ensure that relevant data is available.

Devote sufficient attention and resources to change management. Managing the changes well will play a major role in successfully anchoring the digital financial twin in processes and throughout the organization. It's crucial to convince employees of the overarching benefits of the concept, considering that implementation requires additional work for at least some people in operational roles. Ensuring the quality of data input when booking new transactions is especially critical. For instance, to support decision making on CO2 emissions along the entire value chain of a specific product (such as a car model), accountants need to enter the relevant data and attributes when posting transactions.

The No-Regrets First Steps

Although implementation is extensive and complex, companies can take the first steps without incurring many risks. There are several no-regrets actions.

Assess the future viability of ERP capabilities. For most companies, data storage and processing and increasingly rapid analyses have become sources of competitive differentiation. This makes it valuable to check the existing ERP and data warehouse architecture for future viability and adapt them if necessary. At the same time, companies can examine whether their current capabilities will allow them to implement a digital financial twin.

Decouple data from old, inflexible legacy core systems. Decoupling data onto a suitable platform allows the finance function, rather than the IT function, to control the data. This enables the finance function to prioritize and implement use cases for the digital twin even as the company upgrades the core ERP and noncore platforms. Finance can roll out new use cases independently of the pace of the upgrades and test new digital services while the upgrades proceed. As the core ERP upgrade progresses, new capabilities of the digital twin can be integrated into these use cases and digital services. Decoupling also means that the full harmonization of data in legacy systems, while helpful, is not a prerequisite to initiating the rollout of digital use cases.

Integrate business transformation into the upcoming ERP upgrade or replacement. Companies can use the upgrade or fundamental rebuilding of their ERP system not only for IT modernization, but also to change the steering logic, processes, reporting, data sources, data model, and booking approach (including attribution of data). These changes will unlock a digital twin’s transformative potential.

To win in today’s complex environment, companies must utilize large volumes of data to inform decision making. The ability to automate the management of this data will be crucial to realizing its value fully. A digital financial twin enables effective automated management through consistent attribution, fast data flow without information loss, and powerful cloud-based applications, such as dashboards for real-time simulations of complex scenarios. By using a digital twin to make decisions faster and gain better visibility into value contributions and ESG impacts, finance functions can help their companies achieve a decisive competitive advantage.