The technology is breaking down the industry's historically high barriers to entry. Building AI-ready organizations has to be at the top of the executive agenda.

AI is transforming business and society with algorithms that improve operations, enable the metaverse, and alter the ways companies interact with individual consumers. This transformation places insurance companies at a crossroads: they can either make a serious commitment to AI—or ignore this impending change and risk losing the ability to compete with their peers.

An insurer’s ability to optimize sales, distribution, pricing, and claims management will be vastly improved if it can use AI to collect, analyze, and embed data-driven insights into its core processes. Still, it gives rise to a conundrum: AI can transform the insurance industry, but, to do so, it needs data—which is exactly what insurers often lack.

The imperative for insurance CEOs is clear: it’s time to build AI-ready organizations.

The Changing Nature of Data

Insurers have infrequent interactions with their customers and thus have limited data on which to base their underwriting, pricing, and claims decisions. More-AI-oriented industry players, such as insurtechs, have gotten around this by putting digital and data at the core of their business models. These startups, run by digital natives, have had early success in some markets, such as auto and home insurance. The amount of money flowing their way suggests that they have the confidence of investors, who clearly believe in AI’s ability to disrupt the industry and capture a fair share of its profit pools.

Insurers can and must change.

Insurers hail from a tradition steeped in data of a different sort: historical and static data that comes from claims databases and underwriting questionnaires. But insurers can and must change. First, they can begin to access larger volumes of customer data by positioning themselves as members of a consumer-information ecosystem. They can form partnerships with customer-facing entities—such as home-inspection companies, smart-home-device manufactures, OEMs, travel agencies, and other organizations—and work with them to build more comprehensive customer data profiles. Where outright data sharing is not possible because of privacy laws, approaches such as federated learning can assist by effectively enriching AI models without an actual exchange of data. Second, insurers can access more customer data by developing new ways to increase their interactions with existing customers, by using rate-pricing guides or calculators on their apps and websites, for example. Both approaches can provide insurers with the information they need to effectively implement AI. Some insurers have already started down this path and are seeing positive results.

Investing with Persistence from the Top

BCG research suggests that the percentage of insurance companies that have reported a significant financial impact (with at least 1% growth to their EBIT margins) from their AI investments has doubled from 10% to 20%. This impact has remained at 10% for other industries. To quickly integrate AI into their operations, successful insurers are taking a product mindset. They identify the area in which they want to excel, then relentlessly innovate, deploy, and improve AI solutions using a mix of in-house talent and external entities, including insurtechs, AI-transformation powerhouses, and academic institutions.

AI transformations are most successful when they are led by CEOs.

Taking these steps gives insurers a critical first mover’s benefit: gathering new talent, data, and insights reduces the cost of using AI to create competitive advantage in key areas such as distribution and claims. But, despite the AI-driven success of individual insurers, the industry at large continues to lag far behind in AI spending. The energy market, for example, is expected to invest nearly $8 billion in AI by 2024. The automotive market, including hardware, software, and services, will reach $27 billion by 2025. AI in the health care market was at $8 billion in 2020 and is expected to reach $194 billion by 2030.

In our experience, AI transformations are most successful when they are led by CEOs. Those efforts led by other executives—or anyone who must pay closer attention to short-term KPIs—are, on average, about half as likely to succeed. This is because AI transformation is not just a matter of installing new technology. It requires companies to develop the right talent base and operating models; ensure effective data strategy and governance; and build the necessary digital, data, and analytics platforms. CEOs cannot afford to delegate these responsibilities.

At the same time, CEOs must realize that AI transformation requires an investment of tens or hundreds of millions of dollars over multiple years to be successful—and that, because of the time it takes to develop new sources of customer data, it may take even more time to realize the full value of their AI spending. But the reward will be worth the wait, as evidence suggests that these investments will be returned many times over. CEOs must therefore be ready to play the long game. They must also act decisively—and quickly—to start building the AI capabilities they will need to stay competitive.

What’s Holding Back the Industry?

With such a clear need for urgency, one must ask: “Why so little investment in AI?”

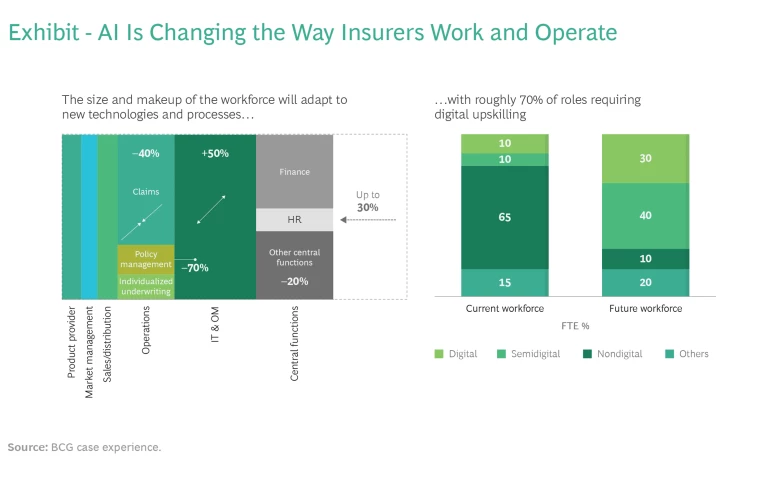

Many insurance executives are worried about the impact an AI transformation will have on their workforces—that robots will replace humans. It is true that AI will result in cutbacks in some areas. Recent BCG research suggests that policy management positions will shrink by 70% and claims by 40%. But, at the same time, tech departments will grow by 50%. Actuaries won't disappear, but as AI matures and insurers gain access to new information (through data-sharing partnerships and other methods), data scientists will be able to do a surprising amount of the work that actuaries do today. Rather than being replaced, many roles will be upskilled to accommodate new technologies—as well as new ways of working and processes that emerge as a result. (See the Exhibit.)

Insurance companies have been reluctant to adopt AI for other reasons as well. Companies that have at least dipped their toes into the technology tend to use it to address narrow topics rather than high-value problems. When these companies do not see sufficient returns on their AI investments, they may be hesitant to dedicate enough money, time, and senior-management attention to generate significant financial benefits. Short-term thinking and looking for quick wins do not give AI solutions adequate time to learn and prove their value.

Many insurers do not have the right operating models or mindset to successfully adopt AI. They tend to be too cautious—too unwilling to accept technical, operational, and business risks. Despite (or perhaps because of) its focus on assessing and pricing risk, the insurance industry is itself risk-averse. Many think that the current market disruptions represent just a moment in time and that insurers can soon return to the old ways of using historical data to predict future trends and set prices. But data-driven decision making is coming, however slowly, to the industry. If CEOs want their companies to survive, they must act now to light a fire under their executives and commence the AI-transformation process.

It is true that insurance companies have long benefited from the high barriers to entry afforded by their control of historical loss and claims data. But insurtechs have overcome these barriers by using external data, especially data that comes from high-frequency or live feeds. One such startup, Tractable, now gathers terabytes of car crash and repair-cost images to manage claims. Tractable has become a leading force in the auto insurance market, and there is no guarantee that the company will limit itself to this sector when so many other insurance verticals are ripe for the picking.

AI Transformation Is About People, Not Technology

AI transformation is not simple, but a look at successful adopters suggests some best practices. First, insurers would be wise to choose one foothold, a dimension within the value chain where they think they can reap big rewards. They might focus their investments to create AI-supported advisors to boost the efficiency of their customer service desks, for example. They could leverage AI to master claims settlements by excelling in payout optimization and customer satisfaction—or to lead on pricing and underwriting and beat the competition on risk selection.

As companies invest in AI, they will be well-served to follow the 10-20-70 principle. According to this principle, insurers would, in the long run, direct 10% of their efforts toward extracting value from algorithms, particularly those that power predictive or prescriptive models. They would direct the next 20% to acquire or build the technology that enables them to capture, store, deliver, analyze, and visualize internal and external data. From there, they can take recommended actions—regarding personalized offers, push notifications, and more—in real time. The remaining 70% would be invested in business processes and people. Our experience suggests that investing in cutting-edge technologies and algorithms is not sufficient for obtaining major business advantages. Companies must take the time to rewire decision making and operations to extract maximum value and invest in human capabilities to make operational and organizational changes stick.

Insurers will improve their chances of success by making sure their CEOs and C-suites support building strong data governance that ensures the integrity and quality of data for all use cases. They will also benefit by transforming decision-making processes, moving from intuition and historical data to new processes that rely on real-time data and AI modeling. And when they plan customer-facing initiatives, insurers will improve their customer knowledge by committing to capture and track the right data from the beginning.

The AI-transformation process also presents a unique opportunity for senior management to institute new ways of working—to create cross-functional teams that leverage data and analytics in addition to a rapidly moving, agile test-and-learn approach. They should delve as deeply as possible into a significant problem, work iteratively, and then embed the resulting AI-based solution into the company's overall processes. When that process is complete, they can then apply the lessons learned as they move quickly to the next major problem.

What Success Looks Like

Clearly, insurers that invest significantly in AI are seeing the benefits, such as increasing net new business by 20% to 25% and reducing loss ratios by 2 to 3 percentage points, thanks to improved underwriting and claims excellence. The most digitally mature companies already outperform their peers, particularly in the areas of revenue growth, enterprise value, and gaining ROI from digital projects. But success comes from a mix of technology and humans. Companies succeed when they combine new technology with human capabilities to transform operations, improve customer experiences and relationships, and develop new offers and businesses. By following the footsteps of their digitally mature peers, and making a fast and firm commitment to long-term investment in AI at scale, insurance CEOs can position their companies to compete successfully in the digital future.

Companies succeed when they combine new technology with human capabilities to transform operations, improve customer experiences and relationships, and develop new offers and businesses.

Insurance CEOs have a straightforward, but fast-approaching, choice ahead of them: make the necessary investments in AI—or fall behind in the marketplace to those who do.