The milestone that most observers use to measure the progress of quantum computing is known as quantum advantage—the point when a quantum machine outperforms the most powerful classical computer possible on a task of practical use and relevance. It’s a high standard and one that’s open to interpretation. More important, it doesn’t address the fundamental question that buyers of IT ask: Can quantum computing solve problems for the business faster or more efficiently than the tools it currently uses?

To gauge the progress of quantum computers toward practical usefulness, we are tracking the development of what we call enterprise-grade quantum computing. This milestone marks the point at which businesses determine that quantum computers provide enough of an edge over their existing tools that companies are willing to use them to solve real business problems.

The Future Is Taking Shape

Enterprise-grade quantum computing is coming into sight. IBM has improved machine learning for fraud detection, reducing false negatives by 5%, compared with the results from a classical-only model. QC Ware and Goldman Sachs have outperformed classical computers on Monte Carlo simulations, a widely used technique in option pricing and risk management. Crédit Agricole has teamed up with Pasqal and Multiverse Computing to predict deteriorating credit scores with the same level of precision and recall as the bank’s classical random forest model with 96% fewer initial classifiers.

Small steps forward, achieved in laboratory circumstances. But they point clearly toward real business usage. Assuming that quantum computing hardware companies continue to deliver on their technology-development roadmaps (which they have been doing for the past several years) and that software continues to make better use of the hardware, these milestones signal that enterprise-grade quantum computing can be generating business value by 2025.

This is good news for users and for hardware and software providers, but it is also a warning sign for those potential businesses that have yet to start building capabilities. A dearth of capacity and talent will quickly separate winners and losers. Companies that have not invested in use case development and partnerships with providers are likely to find themselves locked out. To make sure their companies are on the right side of this divide, CEOs need to plan for an enterprise-grade quantum computing future now.

Rising Demand

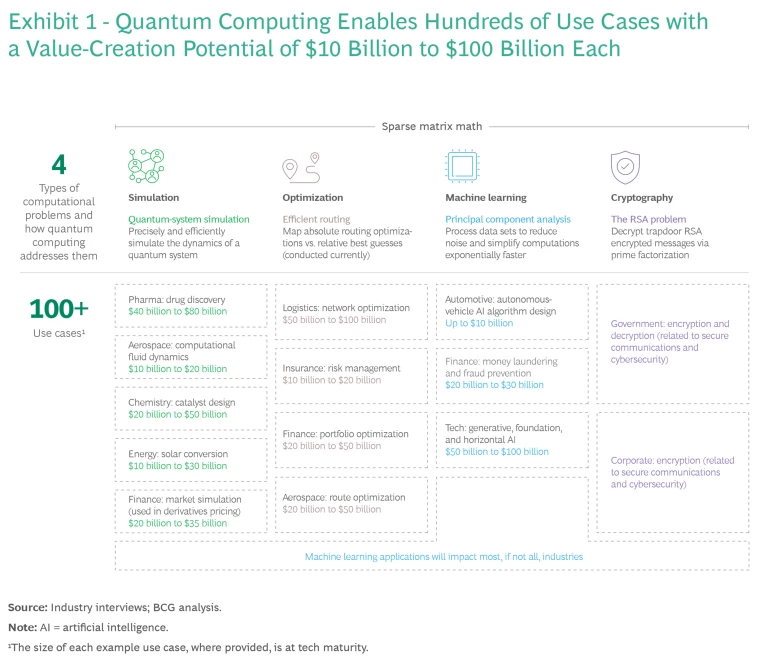

While the physics behind quantum computing are mystifyingly complex, the potential business impact is plain to see. It all comes from a single quantum-advantaged mathematical function, known as sparse matrix math, which unlocks four types of computational problems that have confounded traditional machines. (See Exhibit 1.)

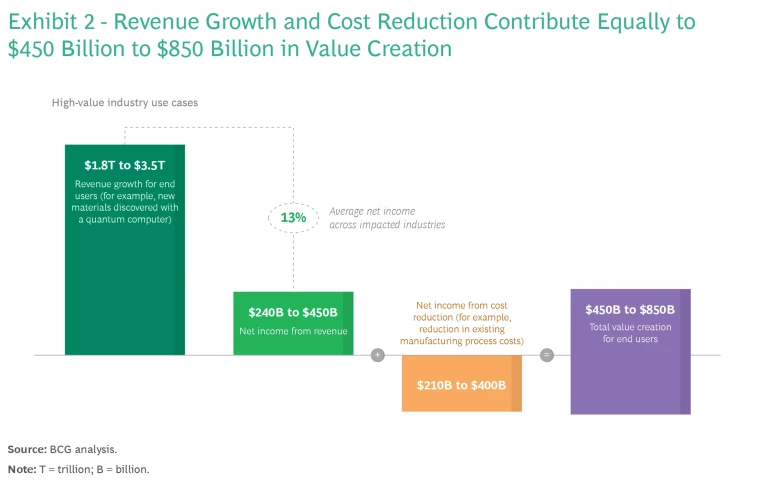

This progress has led to more than 100 use cases in multiple industries that can create enormous value. We have estimated that at maturity (projected to be around 2035), the technology can create $450 billion to $850 billion in net income for end users through a combination of new revenue generation and cost savings. (See Exhibit 2.)

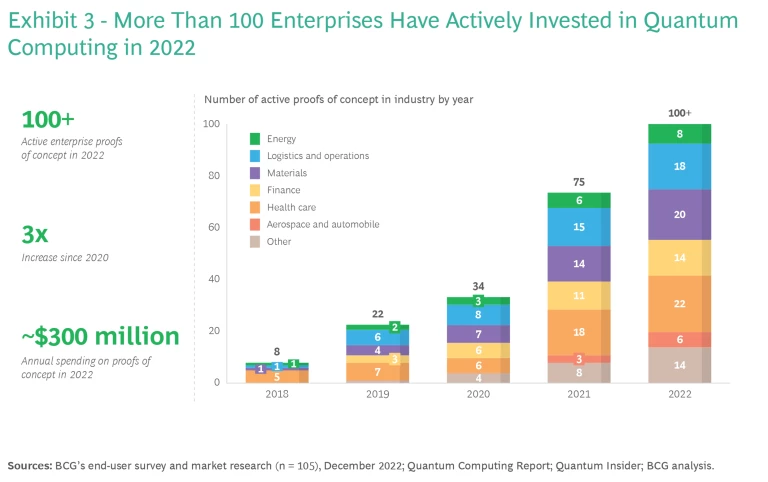

This prospect has venture and corporate investors piling in, identifying use cases, partnering with vendors, and building internal capabilities. Venture capital investing doubled over the past three years to almost $1.6 billion in 2022. Corporate use case activity tripled over the same period with more than 100 enterprise proofs of concept active in 2022 in such industries as automotive, energy, health care, and finance. (See Exhibit 3.)

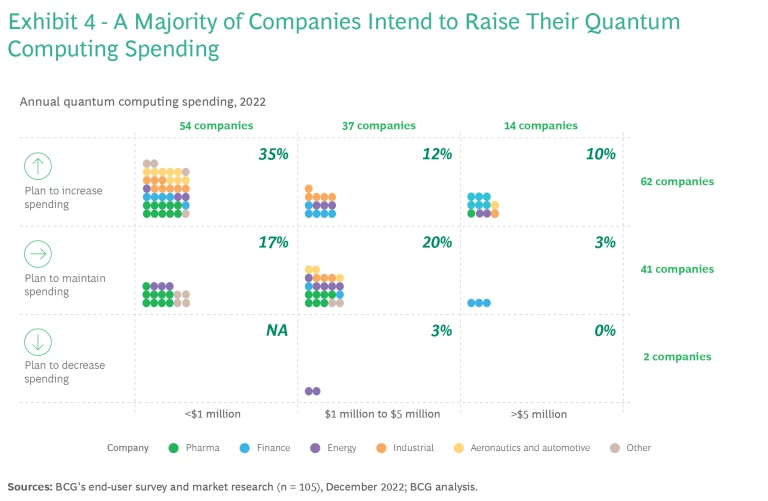

Users are not only investing in greater numbers, but the investments themselves are growing in size and significance. The global quantum-computing market totaled about $614 million in 2022, according to Hyperion Research, which expects spending to continue to grow at more than 25% a year, reaching roughly $1.2 billion in 2025. Half of the companies that BCG recently surveyed spend more than $1 million annually, and 70% of these businesses have been investing for more than three years. The $1 million mark is important because those spending above this level are three times as likely to have C-suite attention and sponsorship and twice as likely to have a strategy to protect their intellectual property (IP) and develop their internal capabilities. They also spend twice as much on hardware.

Our survey found limited buyer’s remorse among those investing in quantum computing: nearly all users plan to maintain or increase spending in the coming years. Some aggressive early adopters (those spending $5 million or more annually) are eager to double down and extend their competitive advantage: 80% of these companies plan to increase spending year over year. (See Exhibit 4.)

Winner Takes Most

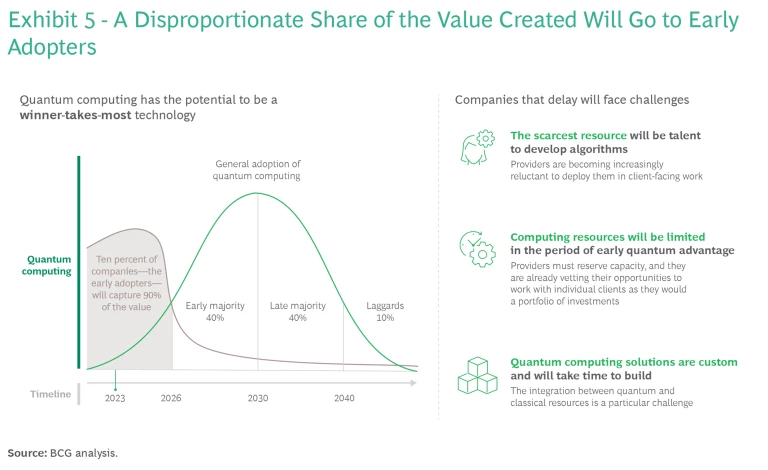

Behind the aggressive posture lies the understanding that, thanks to a confluence of factors, quantum computing in most industries is likely to be a winner-take-most technology, and a disproportionate share of the value created (we estimate as much as 90%) will go to early adopters. (See Exhibit 5.) The key factors that will confound companies trying to play catch-up are:

- Limited computing resources and the time it takes to develop quantum computing use cases. Quantum computing solutions are tailor-made. The integration between quantum and classical resources is a particular challenge. In the period of early quantum advantage, as the technology continues to develop, it will be critical for providers to reserve capacity. Users should not assume that they will have the ability to simply choose the provider with the most-promising technology or best fit. Providers are already vetting their opportunities to work with individual clients as they would a portfolio of investments.

- A scarcity of algorithm-development talent. Some providers already have most of their highest-skilled developers committed for multiple years working with early adopters in finance, pharma, and industrial goods.

- The difficulty of locking up IP. Even companies with a successful use case will be challenged to protect the relevant IP.

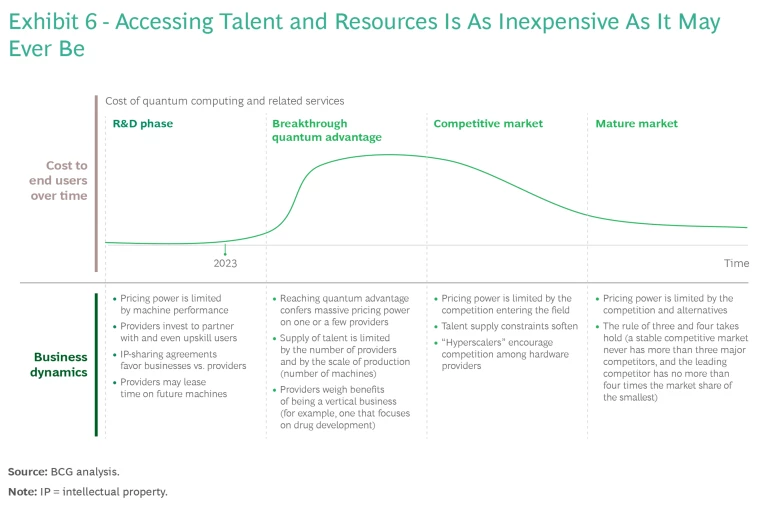

In all likelihood, gaining access to quantum computing talent and resources right now is as inexpensive as it may ever be (which still doesn’t make it easy). (See Exhibit 6.)

We are now approaching the end of an R&D phase in which vendor pricing power is limited by machine performance. Vendors need to partner with and even train companies’ end users, which makes IP-sharing terms favorable to businesses. Once breakthrough quantum advantage is reached, likely by a single vendor, supply will be so limited that the successful provider will have monopoly pricing power and command over top talent. It will be difficult to impossible for those without existing partnerships to gain access to a machine. By the time competition breaks through and supply stabilizes (and the rule of three and four takes hold), it will be too late for many: those with pre-established access will have developed large and largely unassailable IP advantages. The time frame is expected to be significant. One vendor told us that it may be two years before a second machine comes online after the first one.

What to Do Now

How should companies get started? The first step is to assess the potential for quantum computing to create business value in their sector, how competitors are approaching the technology, and what it would take to build a capability. Some sectors are already well down the road. Financial institutions have identified more than a dozen use cases leveraging quantum computing’s facility for optimization, machine learning, and pricing and simulation. More than 12 institutions are active in the ecosystem, experimenting in such areas as portfolio selection, allocation, and optimization, as well as derivatives pricing. Meanwhile, eight of the top ten biopharma companies are piloting quantum computing, and five have partnered with quantum providers.

Building a capability is a three-stage journey: identifying the right use cases, selecting the right vendors and partners, and developing a management system for incubating the technology that balances driving near-term business value with the prospects for long-term quantum advantage. It’s important at the outset to articulate the use cases and their value for the company, as well as clarify the challenges involved in managing expectations. Most companies set up a team visible to senior management with a recognized leader. They seek to invest in ecosystem partnerships and ventures, targeting high-potential use cases. Near-term applications require the seamless integration of the technology with existing workflows. Initial vendor relationships will be partnerships based on transactions, but companies should seek to cultivate relationships and trust early to become the vendor and partner of choice. The biggest challenge may be talent, given the supply constraints. Companies need a comprehensive talent strategy that encompasses the recruitment or development of quantum-aware leaders, quantum-literate operators, and quantum-expert executors. Building in-house talent will take time, so it is best to start as soon as possible.

Press reports in recent months have questioned the time frame for achieving practical quantum computing and again raised the prospect of a “quantum winter,” when doubts overtake optimism about the progress of quantum computing. Such questions seem to be having little impact on enterprise adoption, however, which has only accelerated in recent months. Businesses have been responding to the progress of the technology over the past three years. They are not waiting for full fault tolerance or an advantage over the best theoretical alternative. Instead, they are investing today with the providers that best position them to deliver value while building toward competitive advantage tomorrow. Enterprise-grade quantum computing appears to be right around the corner. Winners will already be deep into the game when it arrives.