Mergers often intensify the scrutiny of companies’ environmental, social, and governance (ESG) practices. Investors, customers, employees, the media, and government agencies all show a significant interest in the ESG implications of corporate integrations.

Many acquirers have responded by focusing on mitigating ESG risks during the post-merger integration (PMI) phase. However, beyond simply adopting a defensive stance, PMI offers opportunities for value creation by defining more ambitious ESG strategies, establishing new operating models, and embedding a sustainability-conscious culture in the combined organization.

To generate the most value, companies must seamlessly weave their ESG strategy into the entire PMI process and ensure that their targets and roadmaps are aligned. They must also enable value creation through the use of effective metrics and data, as well as appropriate reporting standards and governance practices. Integrating ESG approaches swiftly and proactively will enhance the likelihood that they will be effective and deliver a clear message about the merged entity’s commitment to advancing the ESG agenda.

Integrating ESG approaches swiftly and proactively will enhance the likelihood that they will be effective and deliver a clear message about the merged entity’s commitment to an ESG agenda.

Why ESG Matters in PMI

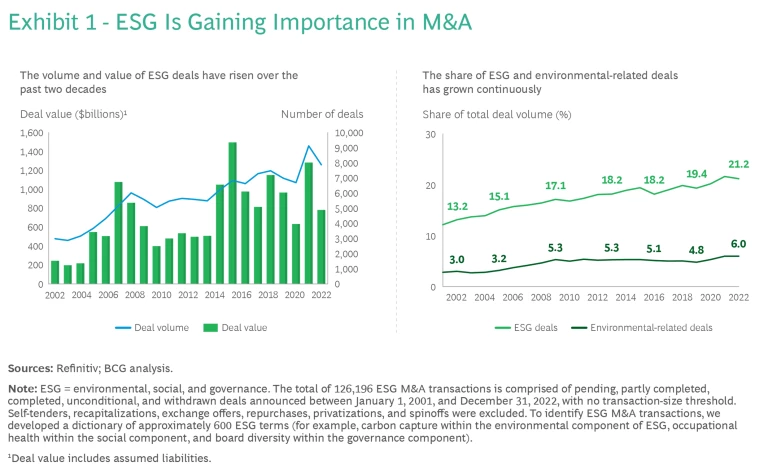

ESG dealmaking is on the rise. Our analysis identifies a clear upward trend over the past two decades. (See Exhibit 1.) The annual volume of ESG deals rose globally from approximately 5,700 in 2011 to an all-time high of approximately 9,200 in 2021—a 60% increase. Although deal volume fell slightly in 2022 in line with the global M&A market, growth remains strong in relative terms: the volume of ESG-related deals as a share of all deals rose from 12% in 2001 to 17% in 2011 and to 21% in 2022.

The trend reflects dealmakers’ recognition that promoting sustainability and social responsibility enhances shareholder value, with ESG frontrunners often surpassing their peers in profitability and market valuation. To pursue the opportunities, companies have started integrating ESG topics into the M&A process, from formulating a buy-side strategy aligned with an ESG agenda to applying an ESG lens in due diligence and valuation. In most cases, however, companies are not looking at ESG during the PMI process through the lens of value creation. Their focus instead remains on managing ESG risks, such as those tied to the acquired company’s sustainability or labor practices.

Promoting sustainability and social responsibility enhances shareholder value, with ESG frontrunners often surpassing their peers in profitability and market valuation.

While risk mitigation remains essential, companies should not overlook the importance of realizing ESG-related synergies and opportunities. PMI provides a unique opportunity to promote the ESG agenda and elevate related ambitions by taking the following steps:

- Adopt a more ambitious ESG strategy. Companies can scale up ESG ambitions by establishing new targets and roadmaps. They can capitalize on the existing best practices of both organizations to facilitate this process. Communicating these plans externally is crucial, especially as the combined organization builds momentum toward achieving its goals.

- Reevaluate the operating model. The combined organization can adopt best-in-class corporate governance and decisions processes to achieve its ESG objectives. It can also set up data-driven monitoring processes to track ESG progress and compliance.

- Strengthen the ESG culture. It is essential to craft and articulate a new ESG narrative that resonates with employees and helps attract and retain talent. The company also must embed ESG in the corporate culture, ensuring that ESG considerations become a fundamental part of how the combined organization operates.

PolyOne Corporation’s acquisition of Clariant Masterbach’s plastic-pigments units exemplifies how an effective PMI process can unlock the combined entity’s ESG potential while enhancing financial performance. (See “Case Study: PMI Improves ESG Scores and Financial Performance.”)

Case Study: PMI Improves ESG Scores and Financial Performance

In July 2020, concurrently with the transaction’s closing, the unified entity was rebranded as Avient Corporation. The company emphasized sustainability in its new mission statement: “At Avient, we create specialized and sustainable material solutions that transform customer challenges into opportunities, bringing new products to life for a better world.” The combined entity’s 2019 sustainability report, modeled after PolyOne’s 2018 sustainability reporting framework, focused on four priorities: people, planet, products, and performance.

The emphasis on sustainability during the integration enhanced the company’s ESG performance, as measured by third-party scoring systems. Avient’s score from CDP (formerly the Carbon Disclosure Project) rose from D in 2018 to B in 2021, indicating that the company addresses the environmental effects of its business and ensures good environmental management. The company’s ESG and environmental scores from Refinitiv also increased significantly.

The integration boosted financial performance as well. Avient increased its cost synergy target from $60 million to $85 million in December 2021, and the company’s two-year relative total shareholder return was 16%.

ESG Success Factors in PMI

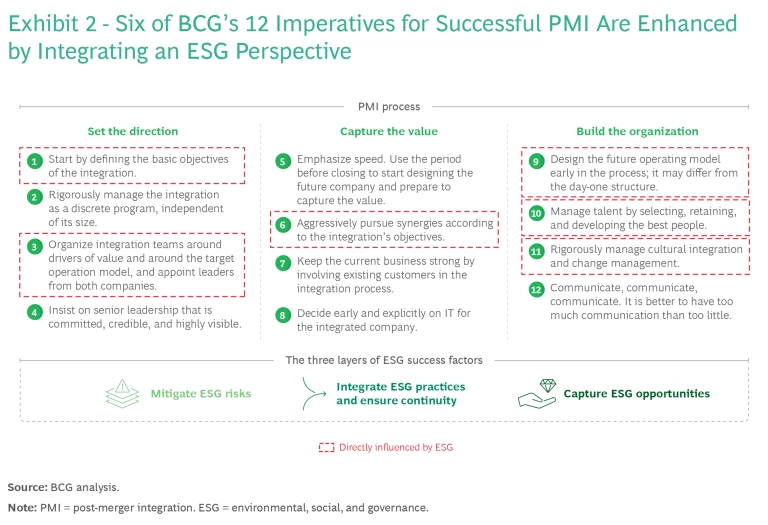

Six of BCG’s 12 imperatives for successful PMI can be enhanced by integrating an ESG perspective. (See Exhibit 2.) This results in three layers of ESG success factors during a PMI:

Mitigate ESG risks. Addressing ESG in PMI reduces risks by equipping the combined entity to anticipate and meet compliance requirements, reduce controversy and reputational concerns, secure scarce resources, and respond to demand shifts. Ultimately, ESG risk mitigation eases overall business risk.

Heightened regulatory standards pose a significant challenge. Regulators, particularly in Europe, are becoming more assertive. For instance, the EU’s Fit for 55 package sets new ESG performance standards that aim to cut greenhouse gas emissions by at least 55% by 2030, compared with 1990 levels. And the forthcoming EU Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards (ESRS) present new disclosure requirements. Global and regional regulatory landscapes will continue to evolve, making it imperative that risk mitigation in PMI includes consideration of the regulatory baseline as well as potential future developments.

Integrate ESG practices and ensure continuity. A key task during PMI is to converge and harmonize the organizations’ approaches to ESG disclosure and data collection, as there is often a lack of uniformity and consistency. For example, the acquiree’s ESG reporting system may need to be adjusted to accommodate the acquirer’s reporting needs. This requires creating a unified approach that combines the strengths and addresses the weaknesses of each company’s existing ESG practices, while still ensuring continuity.

Strong ESG practices, including effective reporting, are crucial for maintaining favorable ESG ratings and valuations. Rating agencies and investors are scrutinizing ESG disclosures more closely as their valuation models now incorporate this topic.

Capture ESG opportunities. The PMI process lays the foundation for delivering ESG synergies, which yield both quantifiable and non-quantifiable benefits. Quantifiable benefits primarily influence the bottom line in terms of recurring cost savings through process enhancements and efficiency gains. Applying an ESG lens when redefining the combined entity’s operating model encourages the new organization to adopt best-in-class corporate governance, new decision processes, and data-driven monitoring systems. Companies can capture additional revenue, too, with methods such as distributing their green products through their broader combined networks. Robust ESG performance can also help reduce the cost of capital and improve access to financing, thereby bolstering the company’s balance sheet and overall financial well-being.

Non-quantifiable benefits stem from the positive influence of ESG synergies on the equity story and total shareholder return (TSR), as investors appreciate the potential for long-term value creation. Moreover, articulating a compelling ESG narrative during PMI can enhance workforce productivity, customer loyalty, and community relations. It also aids in attracting and retaining talent by strengthening the corporate culture and satisfying the expectations of ESG-conscious workers.

Articulating a compelling ESG narrative during PMI can enhance workforce productivity, customer loyalty, and community relations.

Embed ESG Strategy and Enablers in PMI

To best take advantage of these success factors during PMI, companies need to define their ESG strategy and establish enablers.

Defining the ESG strategy before PMI rests on two pillars:

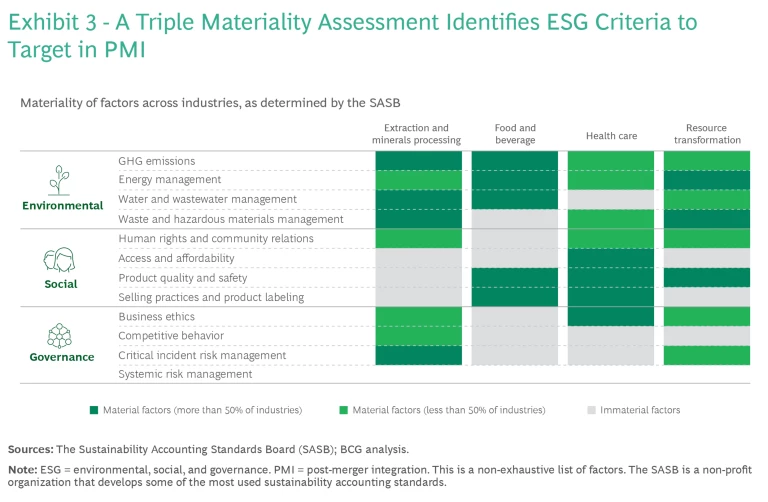

Materiality and Prioritization. Identify and prioritize ESG topics that may have a material financial or operational impact on the merged organization. These topics may be identified during the due diligence process or through a materiality assessment. A triple materiality assessment—encompassing the acquirer, acquiree, and the combined entity—is valuable for pinpointing the most impactful ESG criteria and harmonizing the priority topics. Materiality can be scored in terms of relevance to business success and importance for stakeholders. Third-party resources, such as the SASB’s analysis of materiality across industries, can provide a taxonomy of topics and support the assessment. (See Exhibit 3.)

To assist in setting priorities, establish a baseline for the combined organization’s most relevant ESG KPIs and benchmark performance against that of peers and best-in-class players. This will facilitate the creation of targets and a roadmap and aid in identifying ESG synergies.

Targets, Roadmap, and Synergies. Set and validate ESG targets, and devise an implementation roadmap for significant ESG topics, including alignment on objectives for net zero emissions. Establish a plan for addressing ESG risks and synergies. Also consider how to integrate the organizations’ renewed or new commitments and public pledges into communications. Doing this is especially critical if the acquirer and acquiree have previously announced different ambitions. In many cases, the PMI process will transform the combined entity’s ESG ambitions and how they should be communicated.

Setting climate goals is a specific ESG commitment that needs to be addressed during a PMI to manage stakeholders’ expectations and ensure clarity in communications. Revising climate commitments and communication strategies will require updating and revalidating the acquirer’s climate targets. Companies that seek revalidation of targets by the Science Based Targets initiative should anticipate that the process will take 6 to 12 months and plan accordingly.

Establishing ESG enablers before PMI also rests on two pillars:

Metrics, Reporting, and Rating. Address four key aspects to support decision making, and align the organization with sustainability goals and stakeholder expectations:

- Combine or build data capabilities and management. Design and set up an ESG data collection organization and processes across the value chain, and establish proper controls. This includes harmonizing the organizations’ ESG metrics (such as greenhouse gas footprint measurement, carbon pricing, and KPIs), data (including databases, systems, maintenance, and sourcing), and disclosure methodologies (from data collection to reporting).

- Adhere to external requirements. Prepare the combined entity to cater to the standards of customers, investors, regulators, and data raters, among others.

- Foster positive relationships with stakeholders. Take control of the narrative of how sustainability impacts your business, and actively engage investors, customers, and others on the key topics.

- Engage with the ecosystem. Establish a voice within the ESG community by interacting with data raters, industry coalitions, and sustainability consortiums.

By focusing on these aspects, even companies in hard-to-abate industries can elevate their ESG performance and ratings. For example, the Xella Group—a manufacturer and supplier of building and insulation materials—achieved a one percentage-point increase in its EBITDA margin, a top-tier ESG ranking within its sub-industry, and a 5% valuation boost.

Organization and Governance. A PMI is the right time to set up a best-in-class ESG organization. This should entail reconsidering the combined entity’s organizational structure and governance from an ESG perspective, focusing on committees and teams that are responsible for the steering, management, and execution of sustainability strategy. The integration process can lead to changes in the structure, content, and frequency of reporting on sustainability initiatives and performance. To inform this effort, work to gain a baseline understanding of both existing organizations’ ESG functions, capabilities, and responsibilities and how ESG is integrated into their cultures, practices, and communications.

Integrate ESG into Core PMI Processes

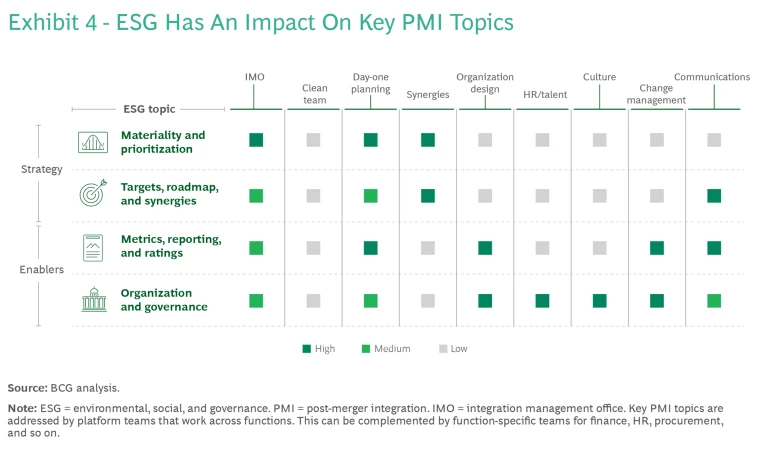

Addressing ESG topics alongside strategy and enablers requires adapting core PMI processes. (See Exhibit 4.) Two areas exemplify the impact this can have:

Integration Management Organization. This team manages the integration process, focusing on risk mitigation, business continuity, and value capture. Each of these dimensions is directly affected by ESG topics.

There are several ways to organize ESG initiatives in a PMI. They can be handled in the context of functional workstreams if they aren’t the focus of the integration or are well managed by the functions. However, a separate ESG workstream is advisable if a corporate function dedicated to ESG exists or is planned. Alternatively, if ESG is a key topic for the integration, with potential opportunities to capture value and mitigate risks, the best option is to establish an ESG-focused platform team within the integration management office.

Day-One Planning. The combined organization must be prepared to maintain ESG compliance from the first day of joint operations. In the short term, ESG topics could create risks and negatively impact staff engagement if not managed properly. To ensure a smooth transition on day one, companies must establish ESG priorities and a roadmap, communicate a renewed ESG narrative, and ensure functional integration.

As a catalyst for transformative change, PMI presents a valuable opportunity to promote the ESG agenda and elevate related ambitions. It provides an avenue for businesses to pursue a more ambitious ESG strategy by setting new targets, employing best practices, and communicating goals. The societal and financial rewards are well worth the effort. Now is the time to use PMI to capture the promising value of ESG.

The authors would like to thank Luis Arjona, Guillaume Cornet, Dominik Degen, and Maximilian Krebs for their contributions to this article.