The era of “growth at all costs” is over for subscription media companies. Customer growth has slowed, acquisition costs have risen, and churn is way up. These changes impact direct-to-consumer businesses across video streaming, audio, gaming, and publishing. Traditional media companies still transitioning to these models have been especially challenged, since they’re confronting these issues while also trying to keep up with digital native companies that pioneered many of today’s subscription marketing approaches.

Shifting priorities on Wall Street have only added to the pressure. Impatient with heavy losses in new digital subscription business models, investors are increasingly rewarding profits, not just unit growth. Valuations for many media subscription businesses are down substantially, with seven of the top ten streaming media companies in the US underperforming the S&P 500 index by 41% from September 2021 to September 2023.

Media and entertainment leaders know it’s time to pivot. Instead of organizing around revenue growth at all costs, they need to optimize for profitable growth.

Some high-performing businesses have already begun this transition, and they are incorporating precision analytics and artificial intelligence (AI) into their marketing capabilities to improve unit economics. BCG found that these businesses are more successful at identifying—and retaining—high-value customers, with churn rates that are 30% lower than the average. They also excel at marketing efficiency, with nearly 50% breaking even on customer acquisition costs (CAC) within a year, versus the more typical three-to-five-year payback period.

Instead of organizing around revenue growth at all costs, media and entertainment leaders must optimize for profitable growth.

What these companies are doing well, others can emulate, and they don’t need to bite off sweeping changes to do so. Our research and client experience show that targeted shifts can yield significant results, and gains can compound over time as companies expand their capabilities.

Current Unit Economics Are Not Sustainable

Since 2016, the number of video-on-demand services with more than 1 million subscribers globally has quadrupled, from 28 in 2016 to 120 in 2022. During most of that time, subscriber growth also soared. But that’s changed: the top ten biggest streaming platforms saw average acquisition plummet from 51% year-over-year growth in 2020 down to single digits in 2023.

To attract and retain customers in this saturated market, some media companies have leaned hard into content, significantly ratcheting up spending on production and licensing. In 2022 alone, spending on original content jumped by 45%. But this surge has driven down margins and further pressured unit economics. In response, some companies have recently begun to rein in content spending, but there can be peril in that path, too, since cutting quality programming will give customers less reason to stick around and may increase churn.

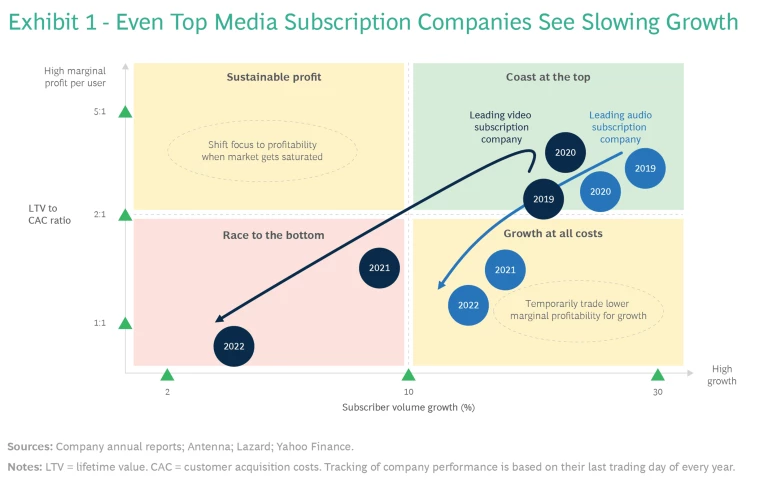

All of these pressures have taken a toll on performance. Across the subscription media environment, customer lifetime value (LTV) is shrinking, and CAC is rising. That’s true even for the most sophisticated digital native marketers. For example, one leading music subscription company’s LTV to CAC ratio fell from 2.6 to 1.1 between 2019 and 2022, and a leading global video subscription company’s ratio dropped from 2.1 to 0.6 over that same period. (See Exhibit 1.) The decline in LTV has been especially jarring for established players. Switching to direct-to-consumer business models often means trading “analog dollars for digital pennies.” One big satellite subscription service was surprised to discover that their new digital streaming service delivered only a quarter of the LTV of their traditional satellite offering.

There Are Pain Points Across the Funnel

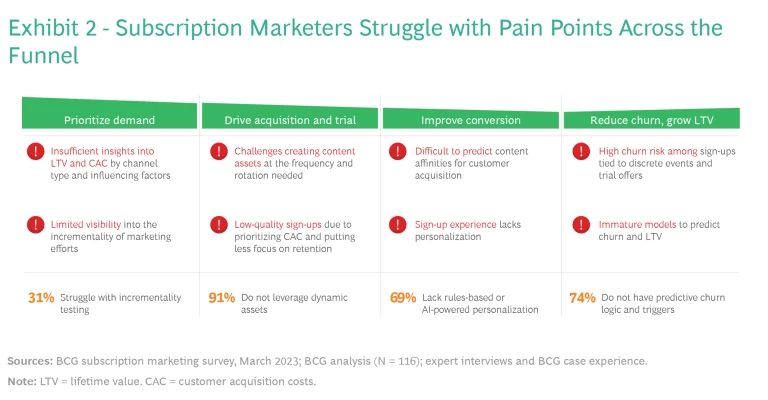

We surveyed more than 100 senior leaders in video, audio, publishing, and gaming. Their answers reveal widespread acknowledgement of common challenges across the marketing funnel. (See Exhibit 2.) Some examples:

“We aren’t sure what parts of our media spend are working.” Close to one-third (31%) of executives said their organizations struggle to perform incrementality testing. This type of analysis measures how many customers a company acquired as a direct result of a marketing initiative versus organic awareness, and it’s an essential method for gauging marketing effectiveness. Without it, marketers end up aiming their media spend broadly to achieve high reach, with many of those impressions wasted. As one marketing executive said, “Often we don’t have a great view on how external factors like big sporting events play into tolerable CACs.”

“We’re optimizing for the wrong thing.” Marketers at many subscription companies continue to be heavily focused on decreasing cost per acquisition (CPA) at the “last touch”: the last paid media advertisement a customer sees before converting. This approach seems logical, but it doesn’t distinguish between higher- and lower-quality customers and can lead to suboptimal spending. One streaming service increased spending in a lower-funnel affiliate media channel by more than 40% based on last touch CPA data, only to find that the customers it acquired had the highest churn rate of any channel. The investment looked good on a CPA basis but resulted in significant negative marketing ROI for the company.

“We struggle to get the right message to the right person.” In the complex, fragmented digital landscape, creative execution is becoming more difficult. Companies know they need to produce marketing content that feels “in the moment” and highly tailored to specific contexts and audience preferences. But 91% of those we surveyed said their organizations can’t generate creative assets dynamically.

“We often lose customers at the point of conversion.” One-size-fits-all registration processes and cumbersome setups are a known customer turnoff. But nearly 70% of executives said their companies have not yet adopted measures to streamline the “buy flow” process. Driving away potential subscribers at the point of conversion is especially costly, since this point in the journey comes after all the acquisition expense has been invested.

“We can’t predict churn early enough to do something about it.” Roughly 75% of executives say that their companies still don’t have fully predictive churn logic and triggers. Despite years of investment, retention models are still far too immature within the organization. Mitigation tactics also need to be more varied. As one marketing executive said, “retention tactics tied to predictive churn models rarely extend beyond email.”

What Successful Media Companies Do Differently

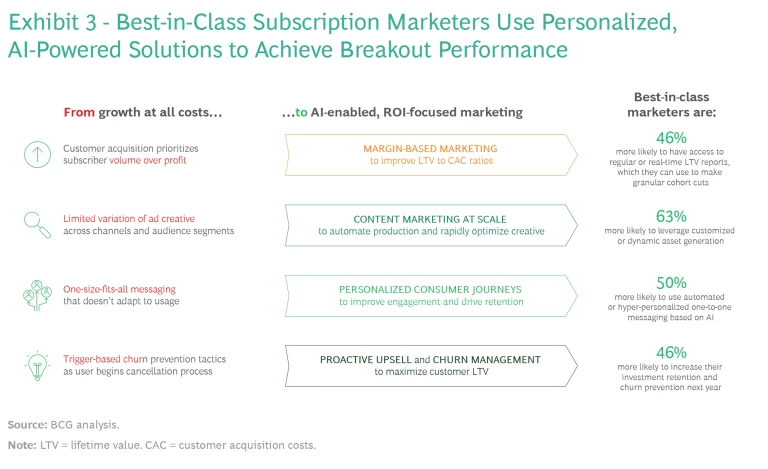

Our analysis surfaced a subset of companies that have overcome these pain points. Compared with the rest of our sample, these businesses enjoy the highest rates of marketing efficiency and lowest rates of churn. They offer different subscription services, but a common theme among them is better mastery of data and more widespread use of precision marketing and AI. Here are some of the practices that set best-in-class players apart. (See Exhibit 3.)

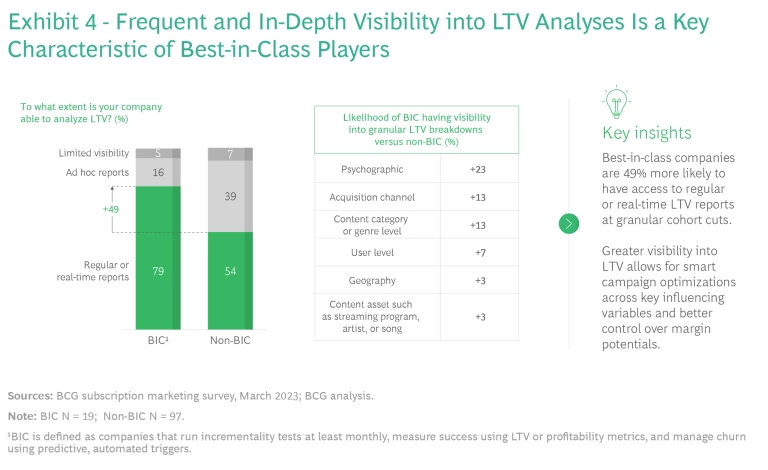

They turn up the incremental LTV dial. Best-in-class marketers are more likely than their peers to employ “margin-based marketing” tactics that use incrementality testing to allocate investment toward high-value audiences. These capabilities make them more effective at discerning “high-quality” customers who are likely to earn their CAC from “lower-value” customers who are likely to churn once their initial need or trial period comes to an end. Best-in-class companies are 49% more likely to make granular LTV cohort cuts on a regular or real-time basis, giving them greater insight into the psychographic characteristics of high-value audiences and the channels and content that are most appealing to them. (See Exhibit 4.) Such techniques helped one leading audio subscription provider determine that customers acquired through social audiences had more than five times higher LTV than those acquired through affiliate channels.

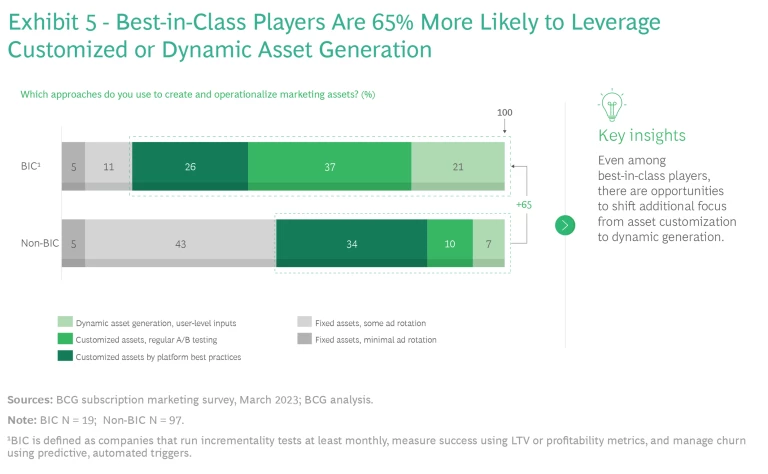

They invest in content marketing at scale. More than 80% of best-in-class marketers employ some form of customized or dynamic asset generation using AI and automation. (See Exhibit 5.) Rather than spending significant time researching and crafting a handful of advertisements with little variation across channels, AI enables rapid large-scale production of text, images, and video that can be tested in near real time across channels. This test-and-learn approach to creative production can increase marketing effectiveness significantly with the added benefit that ads can be refreshed more frequently to enable topical and hyper-localized context. One top video streaming service, for example, auto generates 80 trailer cuts for each of its top 100 titles using a proprietary algorithm that delivers customized creative across thousands of audience permutations on Facebook and YouTube. This process is repeated monthly as new content becomes available. Generative AI could supercharge at-scale content marketing even further. A BCG survey found that more than 70% of chief marketing officers are experimenting with Gen AI, and insight generation and marketing creative are among the most popular use cases.

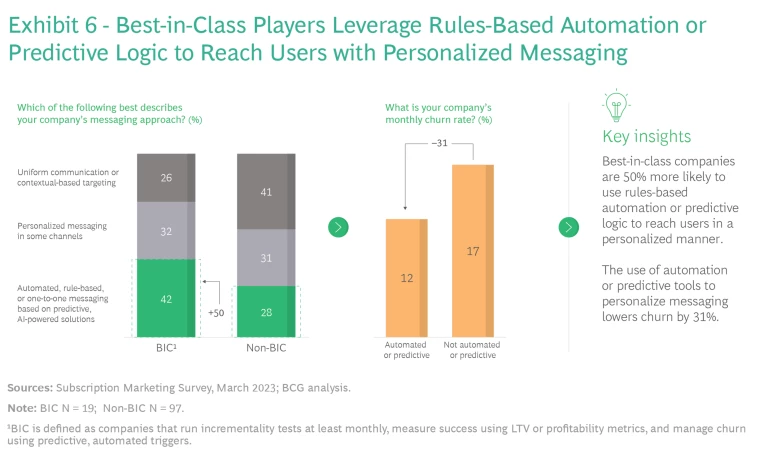

They personalize sign-up experiences. While most subscription companies use content-recommendation engines to serve existing customers, few use them to acquire, reactivate, and retain subscribers. This is where best-in-class players shine. These companies are 50% more likely to use automated or hyper-personalized one-to-one messaging to hook new users with relevant content, maintain consumer interest throughout the sign-up process, and make finding desired content easy after onboarding. (See Exhibit 6.) Developing this capability takes initial investment: companies need to build a data platform that can provide a single view of the customer across journeys and touchpoints and design individualized marketing campaigns, landing pages, and customer communications. But the payoff can be significant. For example, one major global entertainment company increased average order value by 10% and doubled the rate of email subscriber opt-ins by deploying one-to-one product recommendations and personalized messaging across their e-commerce website, email marketing, and paid advertising campaigns.

They adopt proactive, LTV-based churn management. Best-in-class companies go beyond classic churn risk measures such as “attempts to cancel” and “calls to customer service centers.” They look at usage behavior, competitive offers, service outages, activation issues, and a host of other factors to discern signals that could lead to customer disaffection. And more than a third plan to invest significantly in retention and churn prevention over the next two years, a difference of 46% above their peers. Having identified key signals, they then triage churn risk using rules-based automation or predictive logic, dialing retention investment up or down based on the LTV of individual cohorts. For example, a North American telecommunications operator reduced churn by 15% to 20% by aggregating customer and market data from 17 different sources and pulling it into a cloud-based platform that featured a predictive churn model, segmented cohorts by LTV, and customer-level mitigation tactics.

Building a Best-in-Class Precision Marketing Engine

Change can be overwhelming. But the most common mistake we see marketers make is to assume that gaining a material improvement in performance requires tens of millions of dollars in investment and years of convulsive change.

Going from “rest of class” to “best in class” doesn’t require a complete overhaul. What success does require is the commitment to act now and the willingness to do things differently.

The reality is that going from “rest of class” to “best in class” doesn’t require a complete overhaul. We’ve seen targeted interventions that focus on specific pain points deliver concrete returns, often within months. What success does require is the commitment to act now and the willingness to do things differently. Here’s how to start that journey.

- Know what you’re up against. Leaders need a precise understanding of their marketing economics and customer intelligence capabilities. But many are several levels removed from the teams that manage customer acquisition and retention. To close the insight gap, sit down with your head of marketing and ask them to detail the LTV of your customer segments by channel and audience. Find out how much you’re spending to acquire different customers and how profitable each cohort is. Determine how marketers are measuring ROI, for example. Ask how frequently they’re deploying incrementality testing, holdout testing, and other margin-based marketing methods, and learn what actions they’re taking in response to this data. Getting a detailed understanding of the state of play can help leaders identify a menu of options to pursue, including the “low-hanging fruit” they can target immediately.

- Move fast, run tests, refine continually. Companies cannot afford to hold out for perfection. Using the analysis outlined in the previous step, leaders should prioritize one or two use cases and move forward decisively with a test-and-learn agenda. Assembling cross-functional teams is essential. Marketers should cluster relevant skill sets into small, project-based groups and roll out multiple experiments in tandem, testing them in real time or near real time to determine which approaches deliver the best margin-based returns. In our experience, companies that adopt a “sprint to value” mindset generate bigger and faster performance improvements. Focused interventions provide important proof that material changes can happen, giving the organization confidence to take on more ambitious “higher-hanging fruit.”

- Develop longer-term improvements in parallel. Most businesses will need to strengthen their data infrastructure, acquire bedrock AI applications, and integrate precision marketing processes. These efforts take time, but leaders should not wait for them to be cemented before moving forward. Instead, they should use what they’ve learned from rapid tests to prioritize which areas to improve next. With the right orchestration, they can manage short-term initiatives and longer-term improvements in parallel and fund the journey as they go, acquiring the tools and capabilities they need to support their initial set of use cases and building upon them in a steady, concerted fashion.

The end of “growth at all costs” in subscription media may be just the nudge that good players need to become even better. The precision marketing approaches adopted by digital natives are available to all—but they require a mindset shift, more integrated ways of working, and deeper investment in in-house capabilities. With focus, rigor, and a willingness to put aside underperforming practices, traditional media companies can shift to a new era of profitable growth.