Generative AI (GenAI) is a rapidly evolving technology, but one thing is already clear: it has the potential to transform the pharmaceutical industry. The challenge is to figure out how to capitalize on this potential to maximize value. BCG has developed a six-part framework for helping organizations implement GenAI to create real value along the entire value chain—potential, platform, partnership, process, policy, and people. All six aspects are important, but in this joint publication with Microsoft, we focus on the first three elements, which present the most immediate priorities for pharmaceutical firms:

- Potential. Assess the range of possible options, and identify readily available use cases that have the greatest probable value and feasibility.

- Platform. Establish the necessary data infrastructure, including governance that incorporates the principles of responsible AI.

- Partnership. Build capabilities quickly by working with partners that can provide timely access to the latest technology platforms, tools, services, and strategy expertise.

BCG and Microsoft complemented the study with a survey targeting leading digital senior executives at 15 of the biggest global pharmaceutical firms. The results confirmed the firms’ strong interest in GenAI use cases but also reinforced the importance of making smart portfolio choices from the start.

Having undertaken digital transformations in the past, executives recognize the importance of creating options throughout the value chain, structuring the early stages to generate quick wins, and building momentum across the enterprise for long-term value creation. By focusing on the three elements we have identified, pharmaceutical companies can begin implementing GenAI technology responsibly—and capturing its benefits—at all stages of the transformation journey.

Practical Solutions to Current Challenges

Pharmaceutical firms face significant challenges along the value chain. R&D investments are huge and intrinsically risky, and R&D processes remain inherently inefficient. Commercial functions struggle to provide targeted information to core stakeholders so that the right patients get the right treatment at the right time. GenAI offers potential solutions to many of these issues, giving firms access to new data pools and promising techniques to process and analyze that data in ways that get new products to market faster.

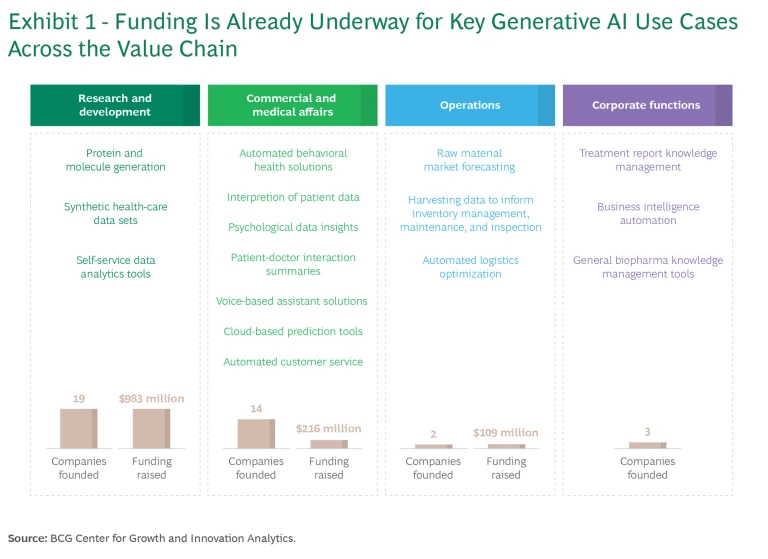

The market for GenAI solutions in health care is growing rapidly. (See Exhibit 1.) A recent BCG analysis projects that the GenAI market in health care will grow at a compound annual rate of 85%, from its current valuation of roughly $1 billion to $22 billion by the end of 2027.

New offerings can benefit virtually every aspect of the organization—improving the performance of business roles and functions, and boosting efficiency and productivity in everything from R&D to commercial activities. Already, 90% of survey respondents say that their organization has begun developing GenAI capabilities.

Three Priorities to Unlock Value

Leadership teams at pharmaceutical companies face various critical choices on how best to start applying GenAI in order to maximize its value potential across the enterprise. Our experience working with clients suggests that they can make the fastest progress by focusing on potential, platform, and partnership.

Potential

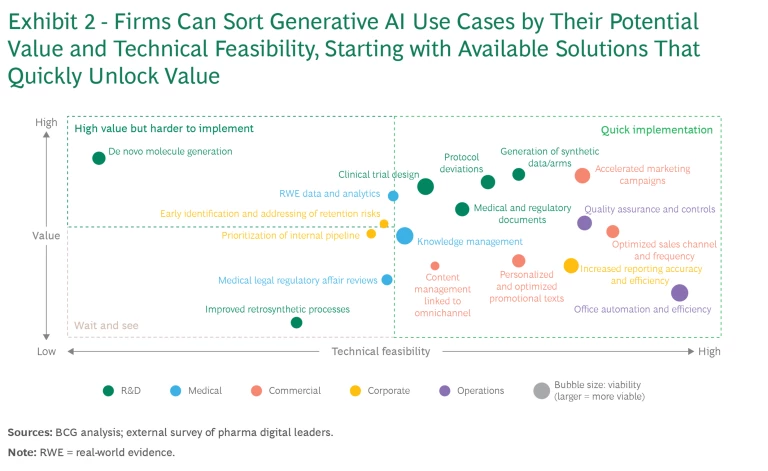

Rather than simply experimenting, firms need to identify their biggest challenges and opportunities along the value chain, consider GenAI solutions, and assess those options in terms of value and technical feasibility.

Regarding value assessment, pharmaceutical firms have several options:

- Conduct A/B testing. For example, compare the cost of traditional lab benchwork to the cost of a digitally simulated, in silico process to reach the same outcome.

- Model the cost savings of using GenAI in areas such as shortening the R&D timeline for new products, increasing efficiency in recurring administrative processes, and improving the quality management of manufacturing operations.

- Assess synergies through new ways of working, such as by empowering commercial teams with new insights about customers or market segments.

Exhibit 2 shows a portfolio of GenAI solutions sorted by potential value and technical feasibility. This type of ranking enables leadership teams to identify and prioritize a few straightforward, quick-to-implement use cases—such as in support functions or commercial operations—to expand their capabilities and build momentum. Then they can shift to more advanced applications, such as in R&D, that have high potential value but are more complex.

With a portfolio of GenAI projects in hand, companies can begin implementing them, while also developing a suitable foundation of technology, capabilities, and culture. A best practice among leading organizations is to designate a central team to coordinate all of the company’s GenAI efforts. The team should have a mix of data science, AI, and pharmaceutical expertise.

Striking the right balance of internal expertise and external strategic and technical know-how is critical. “Our biggest success in terms of digital maturity has been upskilling our talent,” one pharmaceutical executive told us. “We’ve set up digital centers of excellence in several countries with digital, data, IT, AI, and cloud experts.” Another success factor is to foster a strong innovation culture, reducing internal resistance and setting appropriate governance so that project teams have a clear mandate to experiment and test new ideas and applications.

Determining and putting in place the best funding model is another priority. The value of GenAI is clear, but as one digital leader in pharma noted, “It’s challenging to prioritize AI initiatives over existing initiatives.” Rather than asking individual business units and functions to fund their own GenAI projects, companies should adopt a medium- to long-term centralized approach, akin to a center of excellence. Over time, as their capabilities mature and as projects begin to yield value, companies can transition initiatives to department budgets.

Platform

The second major priority that pharmaceutical firms should focus on involves building a suitable platform, with special attention to cloud, data, and AI infrastructure. A worrisome finding from our survey: only 55% of pharmaceutical firms report having the data maturity and expertise needed to build a meaningful GenAI capability in the short term. The quality and quantity of data that companies use to train their AI models will significantly influence the models’ performance and capability. Data not only shapes the accuracy of a model’s predictions, but also determines its ability to produce novel content. Further, by rapidly infusing AI in all layers of the tech stack, a company can make virtually every employee and business process more productive.

Today, the availability of end-to-end, unified data analytics platforms means that companies no longer need to invest time and capital in stitching together a complex set of disconnected, multimodal health data sources into a single enterprise data lake. For example, Northwestern Medicine, an academic health system in Chicago, recently implemented an integrated platform to collect clinical data from an array of sources, meet regulatory mandates for information exchange, and unlock insights with data and AI.

Pharmaceutical companies can use a similar approach, leveraging integrated platforms with unified architectures that enable a developer to extract insights from data and present it to business users. This will allow them to use GenAI in applications along the entire value chain, from R&D to commercial functions.

Meanwhile, assessing best technology solutions remains an iterative process, especially as GenAI techniques continue to evolve. For example, retrieval augmentation generation is a new architecture that augments the capabilities of a large language model (LLM) such as ChatGPT with an information retrieval system that provides the data. Similarly, prompt engineering (which involves designing the prompts for LLMs) and fine-tuning models are continually evolving.

Governance centered on the principles of data security, privacy, compliance, and responsible AI is critical to ensure that new initiatives align with the company’s core values and ethics. AI-mature pharmaceutical companies were three times as likely as others to identify responsible AI as a key criterion to meet in adopting GenAI. It is important to address this with a clear, forward-looking perspective that factors in the following principles:

- Fairness, to guard against biases in training data

- Reliability and safety, to ensure that results and outputs (such as patient chart summaries) are accurate

- Privacy and security, to prevent disclosures of patient data

- Inclusiveness, to ensure accessibility and sensitivity to all population segments

- Transparency, to confirm that clinical information comes from verifiable sources and is auditable

- Accountability, so that firms comply with legal and regulatory requirements

Partnership

The third element is perhaps the most important in implementing GenAI. Pharmaceutical companies can jump-start their journey by partnering with other entities that have strategic and technical expertise.

Talent with strong digital and AI skills is in high demand across all industries. Although pharmaceutical companies are increasingly able to test initial proofs of concept and pilots, the costs of training AI models, building end-to-end data systems, and fully integrating use cases can be steep. Tapping into external expertise and resources and building strategic partnerships early on can lead to much faster progress in building AI capabilities and creating value.

Earlier struggles with digital transformations show the value of such partnerships, as firms that tried to rely solely on internal expertise—or build new capabilities in-house—fell behind. These organizations tied up valuable resources and failed to stay current with ongoing changes in technology. Pharmaceutical companies should learn from these experiences and accelerate their adoption of GenAI by partnering with innovative firms that already have capabilities and solutions in place.

Critically, strategic partnerships can help companies move beyond the pilot stage and scale successful AI use cases—projects that require deep data science expertise as well as pharmaceutical know-how. By adopting a holistic approach, companies can identify new business models and revenue streams to create a lasting competitive advantage from the technology. Longer term, partnerships can grow to include other participants, producing network effects and creating value-generating ecosystems for all participants.

As one executive said, “Pharma companies will need partners for data, expertise, and tooling.” Another expressed a similar sentiment: “All-internal development is a risky and expensive strategy. We’ve learned that a blend of internal knowledge and a capable partner network strategy is key to succeed.”

Every element of the six-part framework that BCG has developed for GenAI is important, but potential, platform, and partnership are the biggest priorities for pharmaceutical companies. By focusing on these three—combining strong technology capabilities and a strategic business partnership—firms can capitalize on GenAI in a systematic manner that balances investment, risk, and value. GenAI is no longer an option but a strategic imperative. Companies that seize the initiative and build on a partnership-enabled foundation will give themselves a clear edge over the competition.