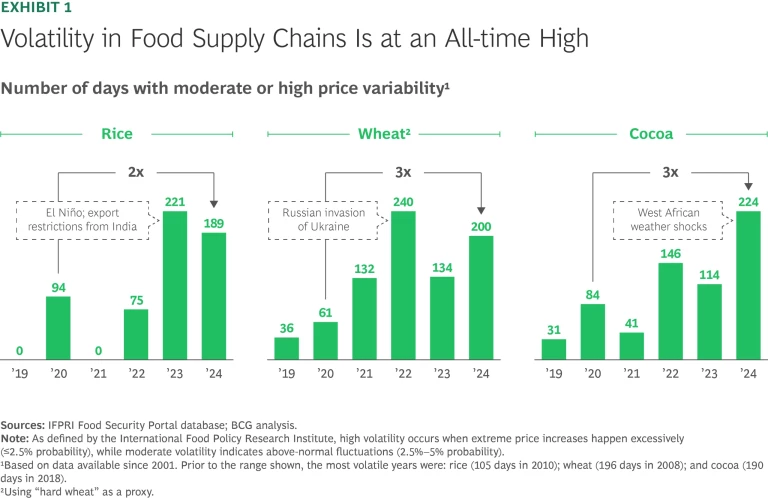

For agrifood decision makers, building the capabilities that can strengthen supply chain resilience is a priority. In major commodity markets such as wheat, maize, and rice, volatility is at its highest since the start of this century (see Exhibit 1). And while in the past, disruption took the form of single-event volatility, the growing frequency of climate-related events as well as increased geopolitical uncertainty, trade restrictions, and tariffs increases the likelihood of multilevel disruptions in existing agrifood production regions. These are far more complex to handle and demand an entirely new approach to supply chain resilience.

While the challenges look daunting, we see a number of pathways to resilience and opportunities for action that can enable agrifood businesses to withstand today’s disruptions while building competitive advantage for the long term. To understand the challenges and offer solutions, BCG and Quantis have modeled projected declines in global production of 15 crops by 2050 and set out a resilience-building roadmap.

Food Systems Face Increasing Challenges

Food systems are already struggling: one-third of all food produced globally is lost or wasted, while the World Health Organization estimates that one in 11 people globally faces food insecurity. Disruptions in agricultural production exacerbate this situation, rippling across communities, economies, and trade activity and reducing access to essential food supplies. As geopolitical instability intensifies, supplies of staple crops such as wheat can be disrupted; the war in Ukraine is a case in point. Meanwhile, as climate changes exacerbate both rising temperatures and the frequency of extreme weather events, unpredictable growing seasons may cause further disruption in existing agrifood production regions.

In West Africa, for example, erratic rainfall patterns and infestations such as swollen shoot and brown rot disease have pushed cocoa bean production levels downward in a region that produces more than 60% of the world’s supplies, most of which are exported to Europe and North America for processing and chocolate production. This has sent prices to their highest levels ever, hitting close to $13,000 per ton in December 2024—a 400% increase compared to the average over the last ten years.

For agrifood decision makers—both procurers of agrifood commodities and policymakers responsible for national food security—adapting to these increasing risks is essential for long-term stability and growth. This means assessing risk archetypes and identifying the crops most affected by climate events and the regions disproportionately affected by supply chain disruption.

Stay ahead with BCG insights on climate change and sustainability

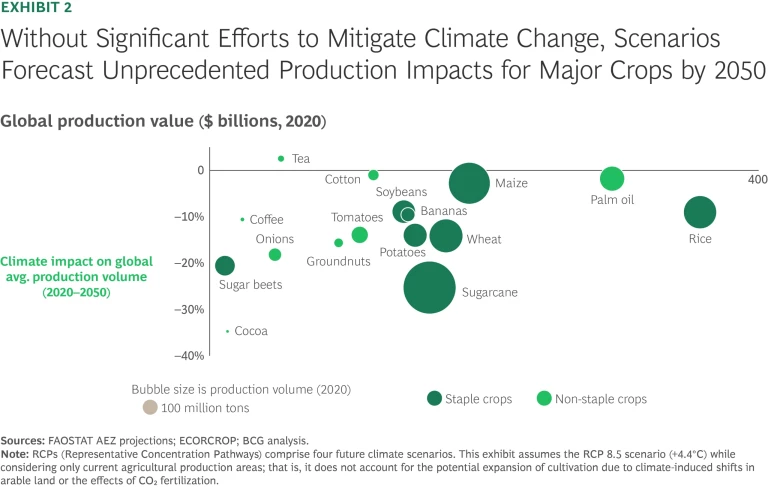

BCG and Quantis analysis sets out the scale of the challenges. We have modeled the impact of accelerating environmental stressors on 15 key crops: bananas, cocoa, coffee, cotton, groundnuts, maize, onions, palm oil, potatoes, rice, soybeans, sugar beets, sugarcane, tea, tomatoes, and wheat (we included cotton due to its importance to the apparel industry and as a rotation crop in sustainable agricultural practices). Together, these account for 65% of total global crop production and 70% of the world’s caloric intake.

To reduce the risk of disruption to the existing global food supply, investments can be made in sustainable and regenerative farming practices and the technologies—such as AI and predictive analytics—that support precision farming. Climate-resilient seeds and crop varieties can also be developed, along with alternative storage systems, diversified sourcing strategies, and optimized logistics. But while progress on these and other innovations have been made, a recent BCG report published in collaboration with World Economic Forum, shows that more needs to be done to scale sustainable food system solutions.

The Impact of Climate Change on Food Systems

Rising global temperatures, increasingly unpredictable growing seasons, and more frequent extreme weather events are already having a significant impact on agricultural productivity and commodity prices. This makes addressing global instability in agrifood supply chains essential. The first step is understanding the problem. The BCG and Quantis crop analysis has produced insights at three levels: global impact, country-level impact, and multilevel disruption.

Global Impact. Nationally and regionally, downward pressure on production volumes from extreme weather-related events translates into global impact. Our model estimates that production levels worldwide could decline up to 35% across staple and non-staple crops by 2050 (see Exhibit 2). Some land in northern latitudes is opening up in the warming world, and this might mitigate some of the forecasted supply shortages. However, the potential for poor soil quality, melting permafrost, lack of infrastructure, short growing seasons, and uncertain economic feasibility makes it unlikely that it can fully offset global supply risks.

Our model estimates that production levels worldwide could decline up to 35% across staple and non-staple crops by 2050.

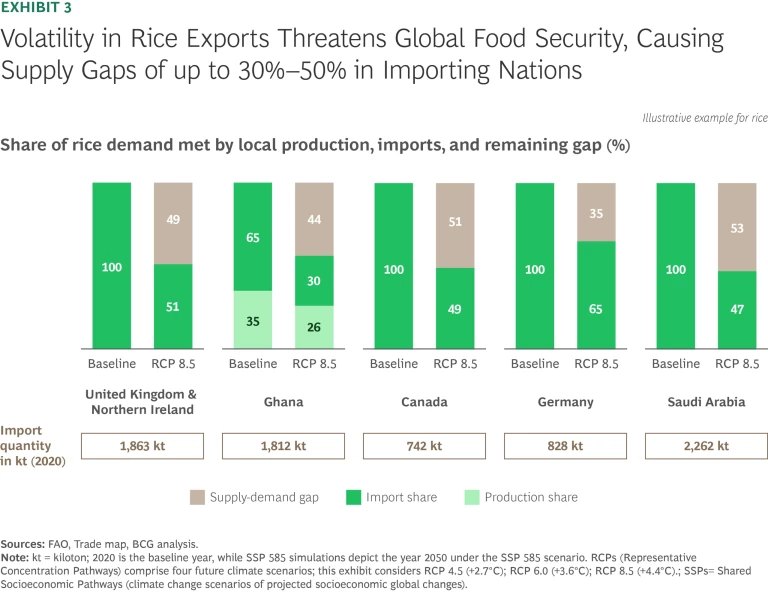

For most of the world’s staple and non-staple crops, the impact of falling production levels and soaring prices extends beyond individual farmers or the economies of producer nations. For example, global declines in rice production due to export bans can lead to supply gaps of 30% to 50%, impacting global food security (see Exhibit 3).

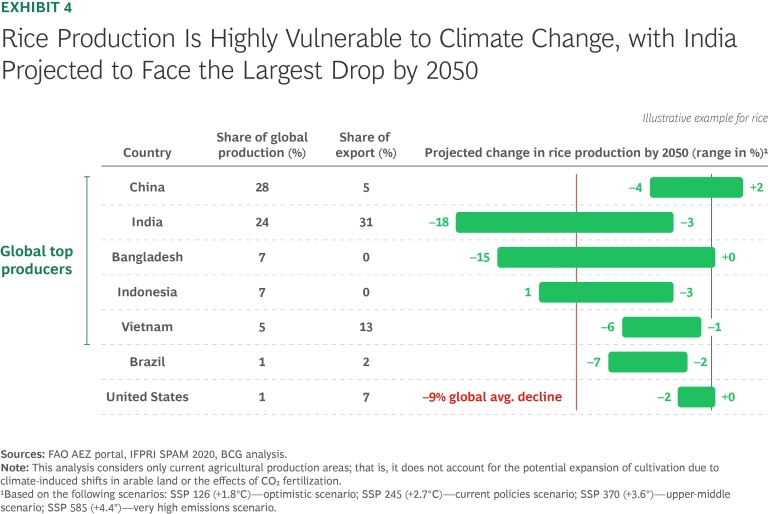

Country-Level Impact. For some of the countries that produce key agricultural commodities, the impact of changing conditions may be even more pronounced, significantly affecting the livelihoods of their farmers, economies, and food security. A good illustration is the impact of climate-driven stresses on the production of rice and the effect this has on regional economies.

In our model, global production volumes of rice—which makes up 22% of global caloric intake, surpassed only by wheat at 23%—are set to fall by 9% by 2050, with the top five producers experiencing a decline of 18% (see Exhibit 4). The greatest impact is expected to be in the three countries responsible for 40% of total global rice production: India (18% decline), Bangladesh (15% decline), and Indonesia (12% decline).

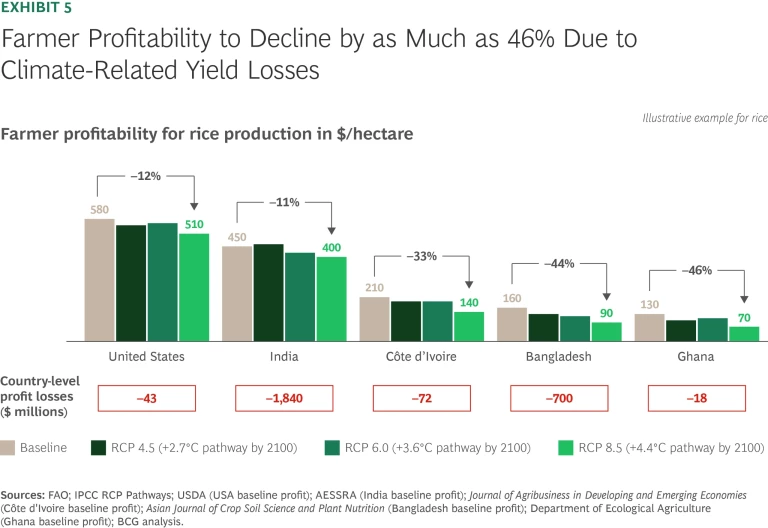

Climate-driven falls in rice production will hit the GDP of key rice-producing nations. Bangladesh and Vietnam face losses of up to $4 billion, while major economies such as India and China could lose $9 billion and $6 billion, respectively. Losses in national GDP mean losses for farmers, who are already struggling with falling profitability, volatile market prices, and limited bargaining power, which leave them without the financial resources to invest in adaptation and resilience levers (see Exhibit 5). They may end up trapped in cycles of debt, further threatening their financial stability.

Multilevel Disruption. The events driving agrifood supply chain risk no longer show up one at a time—they now arrive in crowds. In 2022, for example, multiple disruptions in existing agrifood production regions have put a severe strain on global supplies of sunflower oil, a critical commodity for many countries. First, the war in Ukraine dealt a significant blow to the supply chain, since Ukraine and Russia together account for more than 60% of global sunflower oil exports.

Meanwhile, climate-related events are causing severe disruptions in the production of substitute oil varieties. In Thailand, drought and plant disease have reduced palm oil production. Severe droughts in Brazil and Argentina, two of the world’s largest soybean producers, caused soybean oil production to fall 11% and 5%, respectively. And record-breaking heat waves in Canada, the world’s largest canola exporter, devastated rapeseed crops, leading to severe reductions in canola oil production. In 2022, such events threw the entire vegetable oil supply chain into crisis, pushing prices to historic highs.

As changes in weather and temperature put increasing pressure on all crops and geopolitical dynamics, trade restrictions, and tariffs continue to shift, procurement leaders and policymakers should expect such disruptions to happen more often. And while decision makers may be able to navigate individual, localized risks, the convergence of these factors can trigger a crisis that is extremely difficult to manage.

Understanding Agrifood Risk Archetypes

Rising unpredictability in crop production affects commodity prices, undermines procurement strategies that rely on stable supply flows, and increases food security risks. To help decision makers understand the complex nature of these challenges, we have identified four major risk archetypes.

Localized Risk and Volatility. In countries facing the greatest threats of adverse weather events and temperature extremes, the crops produced in those regions are at greater risk. As crop production fails, export bans become more likely. For example, in 2022 and 2023, the Indian government implemented trade restrictions on rice aimed at keeping domestic supplies high. Our model shows, for example, that global rice exports could drop by 54% by 2050 if India were to impose a full export ban as a response to drops in domestic production.

Concentrated Production. Some crop sourcing relies on a single dominant growing region, with limited at-scale alternatives, making supply diversification difficult. Expanding sourcing by developing new suppliers and cultivating alternative crops is one response, but requires major investments and extra lead time, since it can take years for some commodities to reach maturity. For example, in West Africa, which has for decades dominated cocoa production, disease pressures, rising temperatures, and extreme weather events have, since early 2024, caused a global shortage. Brazil’s ambitious plans to double domestic cocoa production by 2030 could provide an alternative, but this could require significant investments in areas such as educating farmers and building logistics and storage networks.

Single-Variant Trap. Heavy reliance on a single variant means that pest infestations, diseases, or climate-related challenges could cause large-scale crop failure. For example, the Cavendish banana, which accounts for 95% of all bananas sold commercially, is extremely vulnerable to disease because of its lack of genetic diversity. Significant funding is required to support genetic diversity programs, scale up regenerative agriculture, develop more resilient crop varieties, and revive past crop varieties that are preserved in seed banks.

Innovation Laggards. Some crops have limited ability to overcome environmental challenges due to lack of technological innovation or the biological advances that improve crop performance. In the case of potato cultivation, for example, genetic modifications that could reduce water consumption and exposure to drought are constrained by yield trade-offs and low public acceptance. Meanwhile, technology cannot battle the increased heat stress and fungal diseases that rising temperatures inflict on potato farmers.

Future-Proofing Agrifood Supply Chains

Given the consequences outlined in our scenarios, decision makers can achieve much by investing in preparation for a more uncertain future while also using these investments to secure long-term business success. Steps to build supply chain resilience include:

Driving Innovation. This includes investment in the development of high-yield resilient seeds and crop varieties, selective breeding techniques, biotechnology, and climate-adaptive crop management strategies. Innovation can also identify alternative crops that deliver yield stability under changing conditions and that, in the event of supply disruption, meet the same taste and quality standards as the original crop. Innovation in infrastructure and systems includes developing new post-harvest food-storage technologies and implementing food-processing methods that reduce waste.

Innovation can identify alternative crops that deliver yield stability under changing conditions.

Climate-Smart Farming. Sustainable farming practices and regenerative agriculture measures to improve soil health, such as crop rotation and organic fertilization, can have a positive impact on carbon, water, and biodiversity while building long-term resilience as well as increased economic security for famers and agribusinesses.

Building Predictive Al Capabilities. The combination of in-soil sensors, satellite imaging, AI, and machine learning enables farm-to-fork traceability and on-farm monitoring. These technologies also support precision agriculture, which cuts costs through more targeted application of inputs such as fertilizers and pesticides, as well as better predictions of climate shifts and severe weather events.

Diversifying the Portfolio. Reducing reliance on vulnerable crops and regions means expanding and adjusting sourcing strategies. One solution is to identify alternative or underrepresented crops (such as buckwheat, flax, and watermelon seed for use in snack production). Others include expanding supplier bases, identifying crops that can adapt to the climatic and soil conditions of alternative growing regions, and harnessing global trade networks to ensure supply continuity.

Optimizing Logistics. Investing in nearshoring or reshoring of food production shortens supply chains. Technologies such as climate-controlled storage and transport and modular, solar-powered cold rooms increase the efficiency of logistics infrastructure while reducing post-harvest losses.

Unlocking New Financing Sources. Since the solutions noted above require investment, unlocking transition financing and other forms of capital is essential to enable farmers and suppliers to adopt new technologies and farming practices and risk-mitigation strategies.

A Framework for Action

As global supply chain volatility increases, companies can no longer afford to take a reactive approach to managing risks, addressing disruptions only as they emerge. We see plenty of opportunities in positive actions to build the resilience necessary to withstand both sudden shocks and longer-term shifts. To do so, BCG and Quantis suggest a three-step framework.

Understand and prioritize risk exposure. A resilient agrifood supply chain starts with a comprehensive understanding of risks—whether climate-related or geopolitical—and their impact on key agricultural inputs. Decision makers can map their agricultural input sources and then use climate modeling to identify vulnerabilities and define strategic actions. This is not a one-time exercise. Risk assessments can be embedded into everyday procurement decisions and revisited frequently to account for shifting conditions. This involves:

- Mapping existing agricultural input sources and, for example, using climate modeling to assess both climate (physical and transition) and geopolitical risks per crop and region

- Defining the right approach—maintaining current crop selection or diversifying or expanding—for each of the key input regions

- Prioritizing action based on which supply chains, sourcing locations, or commodities require immediate action versus longer-term strategic shifts

A resilient agrifood supply chain starts with a comprehensive understanding of risks—whether climate-related or geopolitical—and their impact on key agricultural inputs.

Develop a long-term action plan. Once risks are understood and prioritized, the next step is to develop a strategy for building resilience over the long term.

For procurement leaders, strategic actions include:

- Deepening partnerships with farmers and suppliers to create more stable, sustainable supply chains through; for example, through long-term supplier contracts that give farmers the financial stability needed to scale up regenerative farming practices or engage in backward integration (a form of vertical integration that includes merging with or acquiring suppliers) as a way of securing supply

- Embarking on joint value chain projects that might be supported through co-financing initiatives

- Expanding financial hedging capabilities to mitigate price fluctuations and ensure cost predictability in sourcing strategies

For policymakers, strategic actions include:

- Supporting regenerative farming by offering subsidies and ecosystem service payments

- Encouraging investment in sustainable practices, supply chain infrastructure, and advanced technologies such as AI, satellite imaging, and soil sensors

Establish a control tower to manage short-term risk. Even with long-term resilience measures in place, procurement leaders can also prepare for near-term disruptions to existing agrifood production regions. A climate risk control tower—a centralized digital tool that integrates real-time environmental, supply chain, and market data—provides actionable insights to guide decision making. Designed around key use cases, such a system helps answer critical questions such as:

- Is my upcoming harvest sufficient, or should I find an alternative supplier?

- If I need an alternative supplier, which regions have the lowest risk exposure?

- Should I secure future contracts now, or will market conditions improve?

Will logistical disruptions impact inbound supply, and should I adjust transportation routes?

Building Resilience to Gain Competitive Edge

Volatility is here to stay. And given the scale of the challenges, doing nothing is not an option. Building resilience does not happen overnight. Funding will be needed to implement new systems and technologies. Key stakeholders can work closely with policymakers to drive change.

However, while the task may look daunting, acting now makes it possible to weather the storms that are inevitable in the coming years. In the short term, this means, for example, that retailers could experience fewer stock-outs, customers could experience fewer price fluctuations, and consumer packaged goods companies could experience fewer production disruptions.

In the long term, by taking a structured, predictive approach to risk management, decision makers can also lay the foundations for sustainable profitability. This could safeguard the incomes farmers rely on while enabling policymakers to contribute to the security of the global food system. And it could help companies to gain competitive advantage and build a business that has the potential to thrive in the long term.

The authors thank Arshita Raju, Rachel Ross, Minjon van der Weck, Géraldine Noé, John Willard, David Potere, Maryama Hmaidi, Said Ettousy, and Ali Ziat for their contributions to this article.

This content was developed in collaboration with Quantis. Quantis, a BCG company, is a global sustainability consultancy pioneering approaches to solve critical environmental challenges.