For many years, companies operated their global supply chains on the assumption that minimizing cost was synonymous with competitiveness. But five years of cascading disruptions—including a pandemic, climate shocks, and dramatic shifts in trade policies—have shattered that logic and prompted companies to focus on making their supply chains more resilient, even if doing so means taking on higher costs and greater complexity.

Now, a new imperative faces companies: to make their supply chains resilient in a financially sustainable way. We call this new operating model the "cost of resilience” mindset. It’s about striking the right balance between cost competitiveness and agility—building manufacturing and sourcing networks that can flex in the face of disruption without eroding margin or market share.

Four megatrends are accelerating and shaping this transition: the rise of economic statecraft, heightening climate risk, wider adoption of robotics, and intensifying competition for manufacturing and supply chain talent.

Companies across a range of industrial sectors are responding to the challenge with various strategies. For example, in place of single, world-spanning supply chains that serve all markets, they are developing multiple regional—and in some cases local—supply chains. They are introducing additional redundancy to their sourcing networks, directly or through supply chain brokers—intermediaries that can shift sourcing within their own global networks. At the same time, they are searching for new ways to achieve scale, such as by pooling their capital investments in joint ventures or by working with contract manufacturers.

Successfully achieving resilience and cost efficiency in this unpredictable era entails gaining new capabilities and incorporating a greater range of factors into strategic decision making. Most companies will need to upgrade their ability to anticipate and manage geopolitical risks. To accomplish this, they should accelerate their adoption of advanced robotics in both high-cost economies and emerging markets, factor in risks associated with climate change and natural disasters, and focus more on securing blue-collar, white-collar, and digital talent.

Behind the Shift to a Cost-of-Resilience Mindset

For decades, "cost is king" was the mantra of global supply-chain management. Efficiency, consolidation, large scale, and just-in-time delivery reigned. Manufacturers in many sectors shifted production from high-cost economies to nations where labor, land, and other essentials cost less, under terms negotiated in multilateral trade deals and mediated by the World Trade Organization. To achieve economies of scale, companies typically concentrated production in a few massive factories in countries such as China, which emerged as the workshop of the world.

The COVID-19 pandemic exposed the disadvantages of overconcentration and the cost-is-king mindset. Factory shutdowns in China and elsewhere abruptly halted flows of goods and critical components, resulting in shortages, stranded assets, soaring prices, and lost market share.

“Resilience at all costs” became the new creed. The older obsessions with leanness and efficiencies of scale gave way to a focus on building more globally dispersed supply chains closer to end markets, adding redundancy, and keeping more inventory. Efforts by companies to reshore some production to North America, supported by US incentives and trade policies, greatly accelerated. For example, foreign auto companies in the electric vehicle (EV) segment invested more than $35 billion in the US from 2021 through 2024.

Many companies, however, soon found that resilience at all costs was financially unsustainable. Sharp US tariff increases on goods from nations that had benefited from relatively free trade have been the tipping point. BCG estimates that at least 20% to 30% of EBIT margins for companies across all manufacturing sectors are at risk from higher tariffs. At the same time, geopolitical tensions and frequently shifting trade policies mean that maintaining resilience remains important.

Four megatrends will exert pressure on companies to find a better balance between cost and resilience:

Megatrend 1: The Rise of Economic Statecraft

The expanding scale and scope of tariffs are the clearest manifestations of the trend. For example, on April 2, 2025, the US introduced a 10% baseline tariff on goods from all nations and additional tariffs of up to 50% on imports from dozens of countries. At one point, US tariffs on Chinese goods reached 145% before the US government paused them for 90 days. China, Canada, the EU, and other trading partners subsequently retaliated or have prepared to do so. The flow of exports from China to the US sharply contracted. As of this writing, many of these tariff increases are being litigated in courts and remain the subject of negotiations between the US and its trading partners.

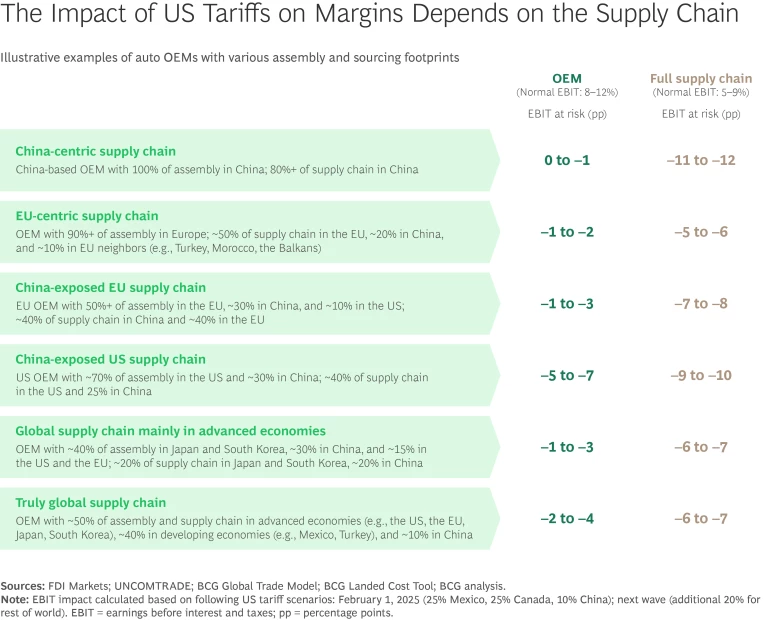

The US tariffs will have a material impact on OEMs and their suppliers because they affect goods shipped to the US, imported components used in US manufacturing, and goods shipped to other nations that are subject to retaliatory tariffs.

Risk exposure is closely tied to manufacturers’ dependence on the US market for sales and on China for supplies. The impact on automakers and their supply chains is particularly pronounced. US OEMs that rely on China for a significant portion of their parts sourcing, for instance, could see a 5- to 7-percentage-point drop in their margins—a decline of up to 75%. Percentage-point drops in margins would reach double digits across the full supply chain serving those OEMs. In contrast, for OEMs with more global supply chains the risk to EBIT margins is 1 to 3 percentage points, while for their supply chains the risk is 6 to 7 percentage points. (See the exhibit.)

Policymakers also employ other economic statecraft tools to transform supply chains. Nations are offering giga-incentives—typically involving more than $5 billion—to promote high-priority domestic industries. Such incentives have driven an eightfold increase in foreign direct investment (FDI) in US semiconductor manufacturing over the past four years, compared with 2017 through 2020, and a sixtyfold FDI increase in Poland’s semiconductor sector. Nations are forming alliances to accelerate development of strategic sectors such as critical minerals and lithium-ion batteries. They are also taking more defensive actions in key sectors. For example, citing national security concerns, policymakers in the US, China, and South Korea are screening inbound and outbound FDI in sectors such as AI, chips, and quantum computing.

Megatrend 2: Climate-Related Events as Strategic Risks

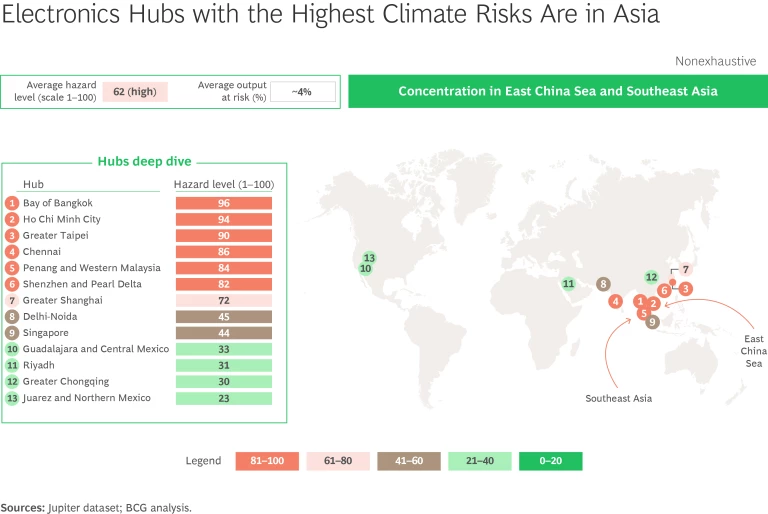

A BCG assessment found that 19 of the world’s 30 top ports, representing 35% of global throughput, face high risk from extreme weather and rising sea levels. Most of these ports are in Asia-Pacific. The port in Shenzhen, China, which handles around 30 million 20-foot equivalent tons of cargo annually, is most exposed to flooding and storms. Major ports in Europe and North America are relatively less exposed.

We studied the world’s 50 biggest manufacturing hubs for a range of sectors and concluded that climate-related events threaten around 8% of their output. East Asia is home to 10 of the 3 highest-risk sites. (See the exhibit.) In several of them, 20% of output and 10% of capital investment are at risk. Consumer electronic manufacturing is the most vulnerable sector, with 6 of 13 major hubs at high risk. Manufacturing hubs in Malaysia and Taiwan that account for around 40% of semiconductor production are also highly exposed to extreme weather and rising sea levels. Medtech manufacturing, by contrast, is among the most resilient sectors, mainly because eight of the top ten hubs are in low-risk locations such as Zurich, Boston, and San Juan, Puerto Rico, and because of the industry’s low-volume, high-precision, geographically distributed production model.

Megatrend 3: Mounting Manufacturing Talent Bottlenecks

These trends are reshaping supply chains as countries pursue sharply divergent policies toward immigration. While nations such as the US are becoming more restrictive, Canada, the EU, Saudi Arabia, the UAE, and others are opening immigration pathways—especially in science and key technologies—to position themselves as innovation hubs. Among other things, these nations are reforming their visa policies, investing more in recruitment, and forming government-to-government mobility partnerships to secure pipelines of workers. Italy’s Piano Mattei program, for example, is developing partnerships with African nations, supporting training and upskilling in Africa, and granting work visas for program graduates to work in Italian factories. After a few years, they return to their home countries, bringing with them best practices that are valuable for African manufacturers.

To recruit and retain global talent, companies must understand and appeal to these workers’ specific needs. BCG research has found that digital talent, which is in great demand but scarce, tends to gravitate toward cities with strong technology ecosystems and a high quality of life. More companies, therefore, are relocating R&D or even their headquarters to such hubs. But digital talent is very picky, often preferring to work for companies that are digital natives. In response, some companies are rebranding themselves to increase their appeal to digital talent. For example, to better compete for digital talent with EV companies such as Tesla and BYD, legacy automotive OEMs are positioning themselves as technologically forward-looking and stress ways of working that resemble those in the tech world in their recruiting outreach.

In contrast, white-collar workers who are critical to operations, such as engineers and process managers, tend to follow shifts in manufacturing locations. Mobility barriers, such as visa hurdles, can be major constraints on their ability to relocate.

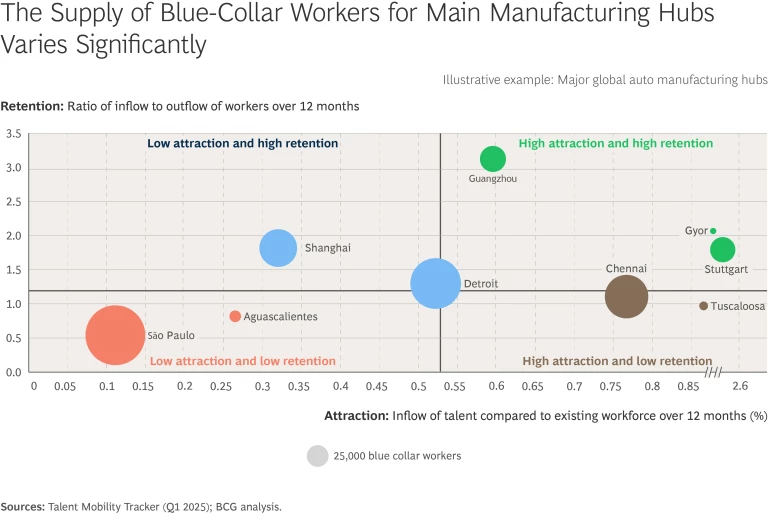

Global competition for blue-collar workers, whom companies now view as critical enablers of industrial strategies, is heating up as well. Aging populations and restrictions on immigration are creating scarcity in Global North industrial centers, and pools of blue-collar workers are also shrinking in many emerging markets in the face of rapid industrialization and inadequate training pipelines. Although recruitment and retention remain strong in auto factories in cities such as Guangzhou, Stuttgart, and Chennai, for example, they are more challenging in São Paulo and Aguascalientes, Mexico. (See the exhibit.) Labor pressures are especially intense in Mexico’s automotive sector in the wake of a $15 billion increase in EV FDI from 2021 through 2024, compared with the previous four years. As a result, manufacturers are starting to shift to less-saturated alternative sites in Central America, such as El Salvador.

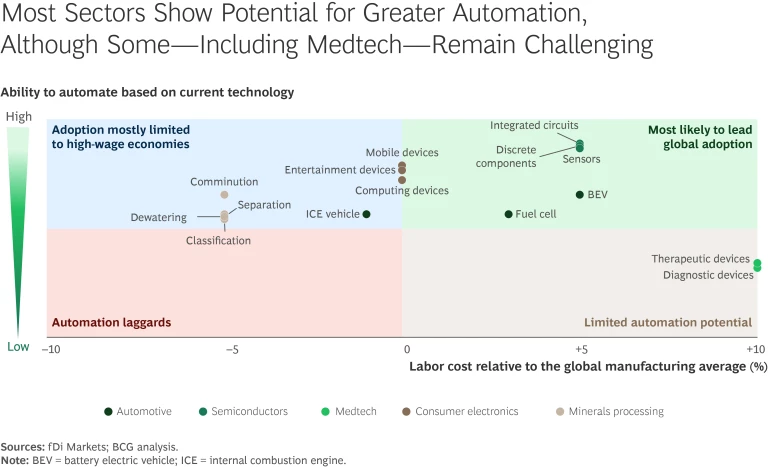

Megatrend 4: Adoption of Advanced Robotics

The automotive sector is the biggest user of robotics. There, the ratio of robots per 1,000 employees is six times the average of other manufacturing industries. From 2020 through 2022, installations rose by 47% in the US and by 26% in China. Consumer electronics and capital-intensive sectors such as metals and machinery are scaling up rapidly, particularly in South Korea and Japan.

Strategies for Building Cost-Effective and Resilient Supply Chains

Exactly how geopolitics will reshape the business landscape remains unclear. Businesses must therefore prepare their supply chains for a range of scenarios. Economic statecraft, climate-related events, technological advances, and competition for talent are likely to influence the reconfiguration of global supply chains for years to come.

To improve their resilience, many companies are diversifying their manufacturing and sourcing footprints by developing more geographic options. Manufacturers should focus on countries that have low costs and are geopolitically neutral—characteristics that can result in access to more markets.

Geographic diversification alone won’t be enough to withstand the consequences of megatrends on supply chains, however. Companies may also need to split capacity across more factories within a country for specific SKUs and to source components from multiple suppliers. Indeed, dual sourcing is becoming the minimum viable standard. Some automotive and medtech companies have already advanced well along this path, lining up more backup suppliers across more component families. We expect this trend to accelerate as tariffs continue to shift.

In particular, we expect to see increased reliance on supply chain brokers. These are typically large, sophisticated multinational corporations well established in both the West and the East. Several major suppliers of automotive and electronic components serve this role. They have factories in many countries, giving them great flexibility to control cost—something Chinese firms have struggled to replicate, particularly in North America. This model gained traction during the COVID-19 pandemic and has since become quite attractive to OEMs.

All of this diversification could require more redundancies in supply chains, depending on how geopolitics and the future business landscape evolve. For example, in a bipolar world in which a US-led Western bloc competes with a bloc aligned with China and its allies, remaining neutral won’t suffice. Companies may need duplicate supply chains, particularly in strategic sectors such as semiconductors and critical minerals.

On the other hand, if the world becomes more multipolar, businesses will probably have to go beyond duplication and develop more regionalized supply chains. In large, particularly sensitive markets, companies may even need dedicated local-for-local structures. In such a world, nonaligned nations in the Global South are likely to participate in several distinct regional chains. Vietnam, for instance, could contribute to different production networks dedicated to customers in the US, the EU, China, and Southeast Asia.

Each of these pathways could result in higher costs and less efficiency. Companies that best manage the cost of resilience, therefore, will have a competitive edge.

Shared production capacity is becoming a critical enabler. For many companies, making big capital investments in multiple regional greenfield factories is uneconomical, time-consuming, and excessively risky—particularly in an environment in which tariffs, trade policies, and industrial incentives continue to change rapidly and unpredictably.

One approach to shared capacity involves relying more on contract manufacturers, much as the electronics and pharmaceutical industries have done for decades. Third-party contractors offer cost-efficient solutions by pooling production in large facilities for multiple clients.

Manufacturing joint ventures (JVs) between companies operating in similar sectors offer another option for achieving economies of scale. JVs can build shared factories and devote underutilized capacity to their peers. Automotive and aerospace manufacturers are already adopting this approach to reduce cost. JVs can also serve as strategic tools for managing geopolitical risk, particularly for Chinese firms seeking access to Western markets. Some Chinese automakers, for example, have formed joint ventures with automakers based in Europe to supply core components for both companies’ brands or for other OEMs. We expect such JVs to proliferate and support broader production networks in regional supply chains.

Stay ahead with BCG insights on international business

What Leaders Must Do Next

Business leaders need a new playbook to navigate today’s disruptive trends, which are causing even some former cost leaders to fall behind. Maintaining a strong competitive position requires actions that factor in the cost of resilience. The specifics will vary by sector, company, main countries of operation, and timelines. But we see six moves that apply to most companies:

- Gain end-to-end supply chain transparency. The first step to building financially sustainable resilience and preparing for multifaceted risks is to ensure that leaders have a comprehensive, granular, real-time view of their manufacturing footprint and of supporting supply chains for their critical product lines. Visibility into the supply chains of key competitors is also vital.

- Build next-generation risk-management muscle. Strengthen the organization’s ability to continuously monitor and mitigate evolving geopolitical, climate, talent-supply, and technological risks and opportunities for the business. Action in this area is especially important for companies with manufacturing footprints and supply chains in countries that may have adversarial relationships with governments in the companies’ target markets.

- Factor automation into network design and site selection. As robotics adoption reaches a tipping point even in emerging markets, accelerate automation at home and offshore to offset the costs of labor shortages, higher tariffs, environmental regulations, and industrial policies. To ensure that robotics sourcing strategies are geopolitically resilient, consider diversifying robotics suppliers to manage country-of-origin risks, such as potential export controls or trade barriers.

- Embed climate-related risk in the supply-chain scorecard. Although many companies see climate risk as a medium- to long-term concern, they must address it in their supply chain strategies now. Especially in sectors such as consumer electronics, where production is concentrated in East Asia, extreme weather and rising sea levels are already pressing concerns. In contrast, sectors such as medtech that remain largely based in the West, where such hazards are lower, may have more time to design and implement mitigation measures. Regardless of sector, companies can take immediate, no-regret actions to mitigate disruptions to their factories’ capital investments and output. For instance, they can implement early-warning systems, relocate critical processes indoors, and build lead-time buffers. Longer-term, higher-impact, more capital-intensive moves—such as redesigning facilities with fortified critical infrastructure or enhanced water-management systems—should be part of the resilience roadmap in most sectors and may even be a day 1 priority for companies in sectors such as consumer electronics.

- Make the manufacturing workforce a key consideration in designing supply chains. It is becoming increasingly critical to follow digital talent when choosing where to make major manufacturing and R&D investments. Consider establishing innovation centers in tech hubs where key talent prefers to live. On the manufacturing side, companies should help shape the supply of labor needed for the short term and the long term to ensure that factory sites are and remain cost-effective. Engage with national and local governments in efforts to grow the local workforce pipeline. Consider establishing cross-border labor corridors and helping develop visa policies for critical worker categories. This is particularly important for companies in complex capital-intensive sectors such as automobiles, where a new factory can take three or four years to build. Companies in sectors with shorter capital expenditure cycles, such as consumer goods, must ensure access to blue-collar labor within months to kickstart operations on time and at scale.

- Adopt key performance indicators (KPIs) that measure total procurement value. To hardwire the cost of resilience into profit and loss, chief procurement officers and other operations leaders need a broad set of KPIs that can measure total procurement value. In addition to defining cost and service metrics, KPIs should help assess tradeoffs between cost and risks, such as the degree of dependence on single factories or locations versus diverse sources, the time required to switch sources of critical goods, and compliance with environmental and labor requirements in key markets. These KPIs should extend to major vendors and their suppliers, so that a clear and consistent cost-of-resilience mindset cascades across the entire supply chain.

As the world of relatively frictionless and free trade gives way to one of rising uncertainty and complexity, the skill and adaptability with which leaders manage their supply chains will determine competitive advantage. Companies that can best balance cost and resilience will be able to protect margins and seize market share through times of rapid change and volatility.

The authors wish to thank the following people for their contributions to this article:

Climate-related risk: Annika Zawadzki, Peter Jameson, Fabio Favorido, Jozef Hands

Talent: Johann Harnoss, Namita Nair, Mounia Mansouri, Verena Gattinger

Robotics: Daniel Kuepper, Kristian Kuhlmann, Jan Nordemann, Viktor Rommel

Automotive sector: Albert Waas, Aakash Arora, Nathan Niese

Medtech sector: Vikram Aggarwal, Michele Brocca, Marcus Ehrhardt, Jake ZIegeler

Consumer electronics sector: Ethan Choi, Kevin Wu

Supply chain analytics: Georgia Mavroupolos, Daniel Wong, Will Klintworth, Walid Dakka, Anna Chojnovska, Brahim Najem