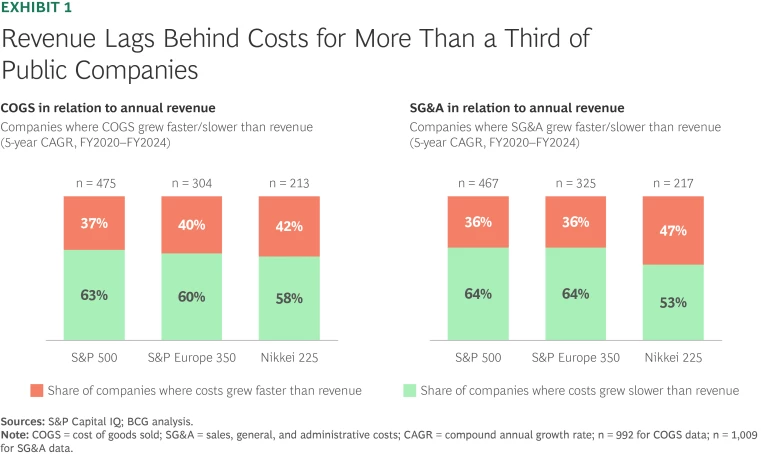

Companies across markets face a perennial challenge: how to drive revenue growth while managing costs. BCG analysis of more than 1,000 companies across major global indices found that one-third are seeing costs grow faster than revenue, ultimately eroding profitability. As Exhibit 1 illustrates, that is true for both major categories of cost:

- Sales, general, and administration

- Cost of goods sold

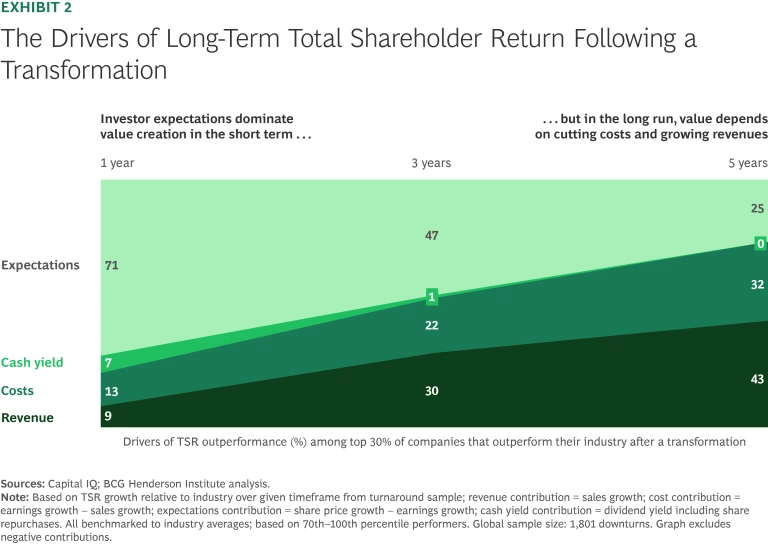

Traditional cost-cutting efforts may deliver short-term relief, but costs often creep back, weakening the company’s ability to reinvest in the capabilities and innovation needed for long-term growth. BCG’s extensive data on value creation shows that over a five-year time period, revenue and costs are the two biggest drivers of financial performance, driving three-fourths of total shareholder return. (See Exhibit 2.)

Top-performing companies meet the challenge by launching transformations with the dual mandate to reduce costs throughout the organization while also turbocharging revenue growth. Structured correctly, this kind of transformation helps companies achieve both objectives, leaving them better equipped to unlock investment capacity and grow profitably and sustainably over the long term.

Three Core Principles to Cut Costs and Grow Sustainably

Based on our experience and research, companies that outperform peers in balancing sustainable cost reduction with long-term growth consistently launch transformations that focus on three principles.

Go big and go fast. Companies that are bold and fast at the outset of a transformation are more likely to sustain bottom-line impact over time. This bold ambition needs to come from the top. Among the most efficient, high-performing organizations, more than 80% communicate their ambitions directly from senior leaders. Such involvement significantly increases the likelihood of realizing a transformation’s full impact.

Many executives feel pressure to avoid risks, with the reasonable concern that cost programs may adversely impact critical capabilities or profit drivers. This conservative approach may ease short-term pressure, but it significantly limits the value a transformation can unlock. Moreover, as cost efforts unfold, C-suites often regret not setting more ambitious targets early on—especially when macroeconomic and various business factors dilute a transformation’s impact. Up to 20% of value can leak out of the P&L even before accounting for inflation, currency volatility, and other market headwinds.

In contrast, top performers start with stretch targets to reset cost expectations from the ground up using a zero-based organization mindset. This approach prevents costs from creeping back and ensures that every dollar spent is tied to an explicit purpose.

Speed is equally critical—not just in capturing value, but in setting the tone. It is tempting to spend significant time at the beginning of a cost program to nail down every detail, but that approach keeps the organization suspended in uncertainty and often results in worse, more complex plans. Conversely, acting quickly builds organizational momentum and sends a clear signal that change is real. It energizes teams, creates early wins, and helps overcome internal resistance. When companies move with urgency, they are able to unlock benefits faster, giving them the breathing room and credibility to tackle deeper, structural changes. Organizations typically need to deliver 20% to 40% of a transformation target value to the P&L within the first year to generate the financial “oxygen” required to fund the broader journey.

Moving fast isn’t about being reckless—it’s about celebrating quick wins, removing friction, and creating the kind of pace that keeps everyone leaning forward.

Set clear boundaries and governance between cost and growth levers. One of the most common pitfalls is blurred lines between cost reduction and growth reinvestment. Without clear separation, savings are often reinvested prematurely or without impact—diluting both cost discipline and growth ROI.

High-performing companies draw a hard line between cost initiatives and reinvestments and manage both with equal diligence. They establish dedicated governance—often through an investment board that reviews and approves reinvestment decisions. In this way, they ensure that freed-up resources get allocated into the highest-return opportunities, such as AI-powered marketing, salesforce productivity, brand building, or innovation.

This separation allows teams to stay empowered and accountable, with a sharp focus on delivering savings against the addressable base. At the same time, it provides leadership with visibility into whether reinvestments are translating into measurable growth or productivity outcomes.

Ensure lasting results through organizational changes. Delivering cost reduction and top-line growth in a transformation is only half the battle; sustaining results is the real challenge. Companies that succeed over the long term embed financial discipline through structural changes, such as rethinking activities and processes to remove work—not just redistribute it.

A robust performance management system is also crucial in ensuring that costs don’t creep back. Linking incentives to personal success metrics increases the likelihood of transformation success by 40%. Top performers implement clear KPIs and accountability structures, and they reconsider established compensation schemes like annual salary increases and/or merit increases to align incentives to reinforce desired behaviors—not just for cost, but also for growth.

They also introduce continuous review cycles that create real-time transparency across cost and revenue metrics. These checkpoints help company leaders track savings realization, monitor reinvestment performance, and allow for rapid course correction. It is important to put guardrails around reinvestment to ensure that new initiatives stay on budget and don’t lead to subsequent cost issues.

A Three-Phased Approach to Transformation

One of the most critical challenges in any transformation is knowing where and how to start the journey—especially in a constrained, high-pressure environment with limited capital. In our experience, companies that sustain success follow a three-phase approach.

1. Fund the journey. Sustainable transformation starts with funding the journey—rapid impact initiatives that quickly generate “oxygen” in the P&L. These early moves may include cost reductions, pricing adjustments, or cash-generating measures that break through typical budget silos, free up trapped resources, and create visible momentum across the organization. This early traction is essential—not just for morale, but for creating the financial flexibility to reinvest in growth.

2. Win in the medium term. With quick wins in place, the next phase focuses on winning in the medium term. The most successful companies use cost savings to change the trajectory of the organization—by strengthening brands, reinforcing category leadership, and investing in innovation. Looking beyond quarterly results boosts the odds of a successful growth transformation by three percentage points. Crucially, this orientation has to go beyond words: Leaders need to put their money where their mouth is by investing in innovation. Companies with above-average R&D spending achieve a six-percentage-point higher success rate in growth transformations.

For example, a global beverage company streamlined its portfolio by divesting low-margin brands and expanded into premium offerings. A food manufacturer reshaped its portfolio by aligning investments with long-term growth trends such as health-focused food. Another CPG company reinvested the savings from a cost transformation into automation and AI-driven supply chain tools to become more resilient. In all cases, efficiency gains enabled companies to lead their category and become more resilient—not simply more profitable.

These reinvestments begin to shift the company’s competitive positioning, setting the foundation for a fundamentally stronger market presence.

3. Make sustained improvements over time. In parallel, organizations must take on more ambitious, “big rock” initiatives to put the right culture and organization in place to revamp ways of working and ensure that changes stick. These deeper changes are critical to avoid short-term improvements that quickly fade. The goal is sustained performance improvement, in which efficiency gains continually fuel growth investments in areas like innovation to develop new products and services, expansion into new markets, enhanced brand equity, and advertising and promotion.

Successful transformation is a balancing act: it requires cutting with precision to protect margins while investing with purpose to grow. By moving boldly and quickly, setting clear boundaries between savings and reinvestment, and embedding performance management to sustain impact, companies can create the momentum and financial capacity needed to succeed. These companies will emerge from the transformation leaner, stronger, and poised for sustainable, market-leading growth.