Pressure is mounting on the global shipping industry to improve its ships’ energy efficiency in the face of new greenhouse gas regulations. In April 2025, the International Maritime Organization (IMO) introduced a new landmark decarbonization framework, slated for adoption in October. The new regulations contain a wide-ranging set of rules that will come into effect beginning in 2028, including new decarbonization targets tied to new fuel standards and significant financial incentives and penalties.

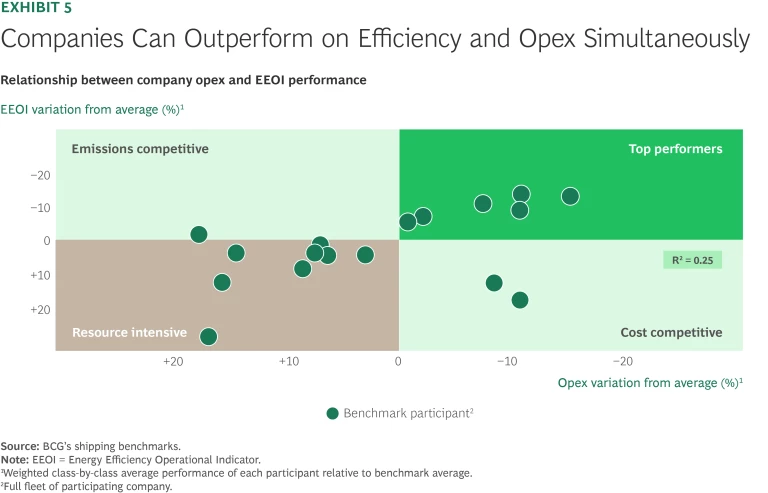

Shifting the global shipping fleet to low-carbon fuels is by no means the only low-carbon tactic available to the industry, however. In fact, many shipping companies are focusing on energy efficiency as the first critical lever to pull on their decarbonization journey. In 2024, as part of its Shipping Benchmarking Initiative (SBI), BCG launched the Carbon Emissions Benchmark in partnership with the Maersk McKinney Møller Center for Zero Carbon Shipping to analyze company- and ship-level energy efficiency. Drawing on vessel-level data from leading shipping companies, the benchmark shows that some companies outperform their peers on both carbon emissions and vessel operating expenses (opex). These companies achieve, on average, 10% greater vessel efficiency and 8% lower opex spending, demonstrating that decarbonization and cost performance can go hand in hand.

Companies whose fleets outperform on energy efficiency have found success not just by installing various energy-saving devices (ESDs), but also by pursuing several company-level management initiatives. Together, these measures can significantly boost energy efficiency using current technologies, with limited impact on operational spending. And the value potential of greater energy efficiency will grow as adoption of more expensive net-zero fuels increases, since reduced fuel consumption can help offset some of the higher fuel costs.

Navigating to Greater Efficiency

As the shipping industry accelerates its decarbonization efforts, shipping companies can increase their fleets’ energy efficiency and elevate decarbonization from mere compliance to competitive advantage. Companies that take action on energy efficiency now have the opportunity to decrease costs, tap into new green value pools, and stay at the forefront of regulatory compliance. As the regulatory environment in the maritime industry evolves—increasingly linking compliance to economic incentives and penalties—the business case for maritime decarbonization continues to strengthen.

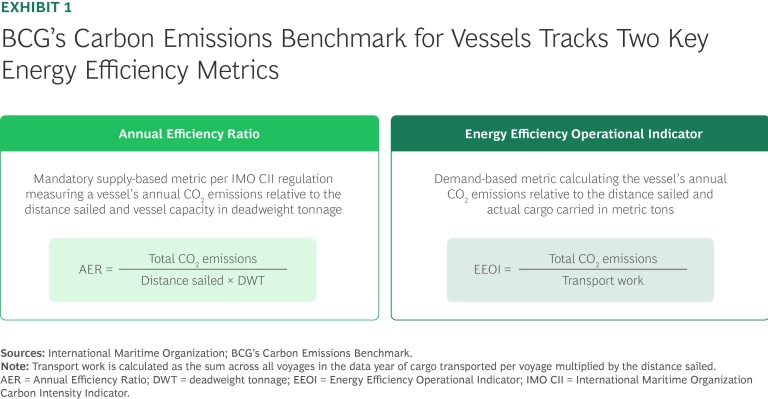

How large are the potential efficiency gains, and what strategies and technologies are shipping companies using to improve the efficiency of their ships and fleets? To find out, we used the Carbon Emissions Benchmark to conduct a class-by-class analysis focused on two key energy efficiency metrics. (See the sidebar, “Creating the Benchmark.”) The first metric is the Annual Efficiency Ratio, which accounts for emissions relative to vessel capacity regardless of actual cargo carried. (See Exhibit 1.) The second is the Energy Efficiency Operational Indicator (EEOI), which captures emissions per unit of transport work—the vessel’s emissions relative to the amount of actual cargo carried across all voyages within a given period. Lower values on both metrics indicate better vessel performance, although each variable is influenced by a range of factors, including vessel design, utilization, and operating profile.

Creating the Benchmark

In 2024, SBI collaborated with the Maersk Mc-Kinney Møller Center for Zero Carbon Shipping—a not-for-profit, independent R&D center focused on accelerating the transition toward a net zero future for the maritime industry—to launch the Carbon Emissions Benchmark. Incorporating data from 27 leading shipping companies that are taking significant strides toward improving energy efficiency, the benchmark permits class-by-class analyses of upward of 1,400 vessels across containers, tankers, dry bulks, and liquid natural gas carriers to see how their 2023 carbon emissions performance compares to that of other benchmarked companies.

The benchmark also accounts for relevant technical and operational drivers of energy efficiency, such as vessel age, country of build, vessel utilization, and fuel composition, while also providing company-level insights into the qualitative dimensions of decarbonization that impact vessel-level efficiency.

Featured Insights: Explore the ideas shaping the future of business

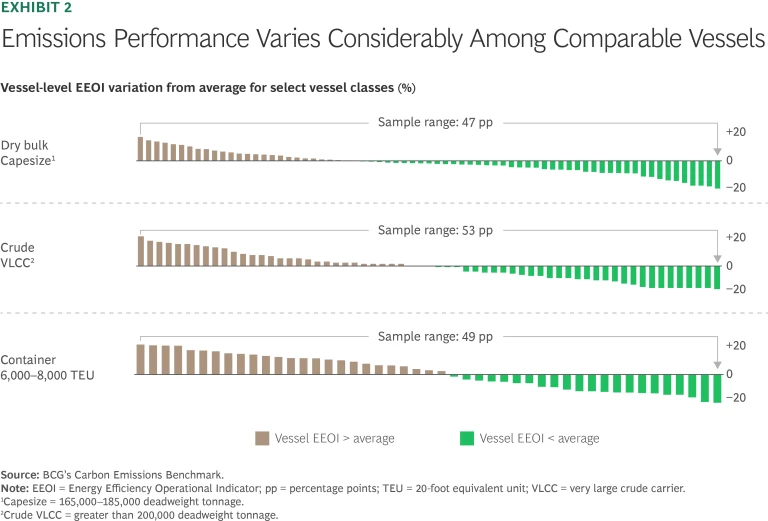

Efficient Strategies

The results indicate that both the shipping companies participating in the benchmark and their ships are more energy efficient overall, as measured by EEOI, than the broader shipping industry, as judging by the IMO’s Data Collection System reports. Even within the benchmark sample, a subset of participating companies outperformed their vessel class peers on EEOI. The difference in EEOI between the highest- and lowest-performing companies in the benchmark was more than 30 percentage points. The difference in EEOI was even starker at the vessel level, where the benchmark revealed significant variation among comparable vessels that should in theory perform similarly. (See Exhibit 2.)

At the company level, four key differentiating characteristics set the highest-performing companies apart in their decarbonization strategies:

- Decarbonization Leadership. Top companies set ambitious decarbonization targets backed by clearly defined roadmaps. They invest in building ships with state-of-the-art energy efficiency technologies and alternative fuel propulsion systems, such as methanol- and ammonia-fueled engines. And they use biofuels and other established alternative fuels that are currently available in the market.

- Fleet Excellence. Leading companies operate more efficient fleets at optimized speeds, while undertaking comprehensive efforts to optimize their fleet portfolios, including fleet composition and deployment. They also systematically implement established energy efficiency solutions, such as hull coatings and propeller improvements, across their fleets.

- Organizational Capabilities. By forming teams dedicated to energy efficiency and long-term sustainable solutions, these companies align their organizational structure with decarbonization goals. They pursue continuous digitization and data quality efforts, and they integrate decarbonization into governance structures, including management KPIs linked to efficiency performance.

- Experimental Approach. Leaders actively invest in energy efficiency pilot projects and emerging technologies, promote the skills needed for future technological requirements, and regularly engage with the broader shipping ecosystem on knowledge sharing and best practices.

Shipping companies have several reasons to act now to gain the benefits of greater efficiency. Many current energy efficiency technologies for maritime vessels offer a return on investment within relatively short payback periods. Growing recognition of maritime decarbonization as a source of strategic differentiation gives companies a chance to tap into future green value pools, such as offering low-carbon freight solutions and other green product offerings. Furthermore, addressing energy efficiency and decarbonization now, while freight markets are still relatively profitable, is likely to help secure regulatory compliance in the future.

Efficient Ships

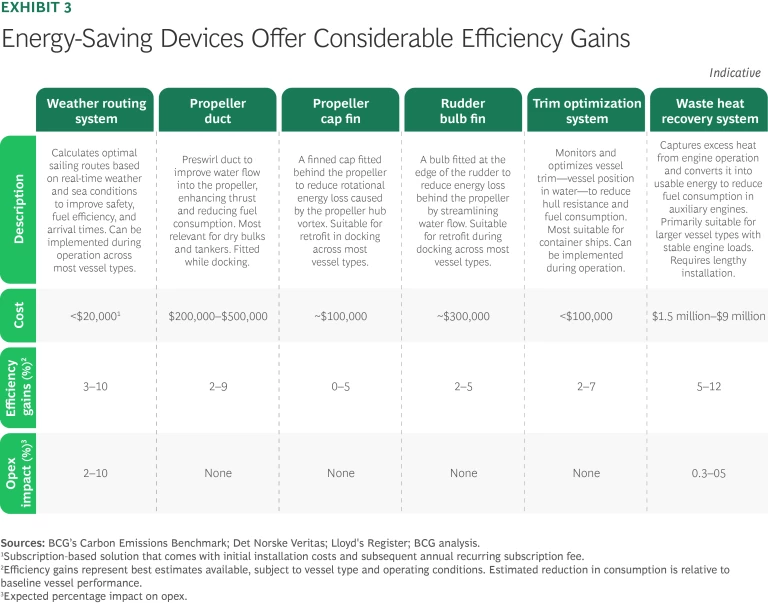

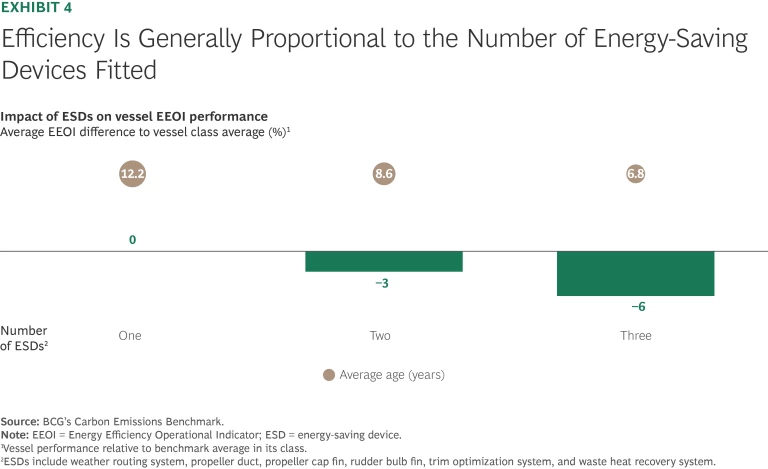

Top-performing vessels typically have greater adoption of ESDs, higher vessel cargo utilization, and more efficient vessel designs. Not surprisingly, energy efficiency improves incrementally with the number of ESDs fitted, offering shipping companies a scalable and cost-efficient lever to boost fleet efficiency. (See Exhibit 3.) Benchmarked vessels fitted with two ESDs outperformed the vessel-class average on EEOI by an average of 3%, while those with three ESDs outperformed by 6%. (See Exhibit 4.)

Top-performing companies have a greater appetite for fitting ESDs on newer vessels. That’s because many ESDs represent one-time investments with limited operational costs in the vessel’s life cycle, making them particularly attractive for younger vessels, which have longer ROI horizons. For example, propeller ducts—which improve water inflow to the propeller and increase thrust efficiency—can unlock efficiency gains of between 2% and 9% across the vessel’s lifetime for an upfront capital expenditure of approximately $500,000 on a standard dry bulk Capesize vessel, according to market estimates. Assuming that the propeller duct provides a 4% gain in efficiency, this implies a payback period of three to four years, with a minimal increase in maintenance costs.

ESDs offer shipping companies a clear win-win—not just improving fleet efficiency, but also reducing fuel costs and helping meet future regulatory compliance goals. The estimated efficiency gains from ESDs range from 2% to 15%, depending on the technology and each vessel’s specifications and operational profile.

Nevertheless, adoption of ESDs remains uneven across shipping segments and companies, owing to a range of technical, financial, and structural barriers. The technology readiness of some ESDs is still maturing, which leads to uncertainty about performance and ROI horizons. In addition, the broader maritime industry lacks consistent standards for monitoring and validating efficiency gains.

Many ESDs must be fitted during a vessel’s initial construction or retrofitted while it is dry-docked, presenting a limited number of windows for implementing the technologies. However, some ESD suppliers are pioneering installation approaches that align with vessels’ standard dry-docking cycles, helping reduce downtime and facilitating adoption.

ESD adoption could also be hindered by the fact that vessel owners typically bear the costs of installing these technologies, while operators benefit from the resulting efficiency gains and fuel savings. As the impact of emissions pricing grows, however, more efficient vessels should increasingly be able to command premium charter rates, which could provide some compensation to shipowners for bearing the investment burden.

No Tradeoffs

Greater efficiency does not necessarily require a tradeoff with higher operational spending. In fact, some shipping companies manage to outperform on both emissions and operational spending. (See Exhibit 5.) Some top-performing companies achieved, on average, 10% lower EEOI and 8% lower opex on the Carbon Emissions Benchmark, confirming that strong efficiency performance can go hand in hand with optimized opex, as highlighted by data from our comprehensive database on vessel opex performance. Indeed, top-performing companies balance strong efficiency and cost performance, driven not just by the fleet characteristics but also through the organizational processes, systems, and management practices they’ve put in place.

Moreover, companies can reap further second-order savings on the operational side. For instance, enhanced fleet digitization will drive greater transparency on emissions and can be aligned with cost-focused levers such as predictive and condition-based maintenance.

Setting Sail

If shipping companies are to realize the maximum value potential of both proven and emerging efficiency levers, they must take full advantage of the enabling prerequisites.

For example, implementing digitized operations, high-quality data foundations, and KPIs that focus on efficient operations will provide greater clarity regarding fleet performance and the impact of decarbonization projects. Similarly, vessel-level benchmarking can provide critical insights into competitive positioning versus peers and help identify underperforming vessels and suboptimal operational practices. Companies should also take maximum advantage of periodic dry-docking windows by integrating energy efficiency retrofits alongside routine maintenance activities.

In addition, companies should bolster their organizational processes and capabilities to support decarbonization efforts. One way to do this is by incorporating vessel-level suitability and validated efficiency gains into the investment process by leveraging available market knowledge, including insights from peer companies and R&D centers, while also piloting new technologies where needed. Companies can also accelerate the buildout of internal capabilities by acquiring expertise in the marketplace, whether through strategic hires, partnerships, or targeted investments, thus reducing the need to scale internal resources from scratch.

To limit the upfront investment burden of particular ESDs, shipowners should explore alternative financing solutions, such as private credit or pay-as-you-save models, which involve repaying the investment cost over time through the fuel savings that the ESD generates.

Although company scale can provide certain advantages in terms of cost and capabilities, sheer size is not a prerequisite for outperformance on energy efficiency. Instead, outperformance on emissions and cost metrics is closely linked to a company’s ethos, resources, and strategic priorities. Success in these areas entails putting in place the right employees, processes, and systems and mobilizing them in accordance with a clear decarbonization framework and roadmap.

As its many benefits make clear, maritime decarbonization is evolving beyond regulatory compliance and becoming an essential competitive advantage and company differentiator. As the maritime industry transitions toward more expensive low-carbon fuels, the value potential of energy efficiency will only increase. It’s critical to remember, however, that a shipping company’s ability to outperform on energy efficiency depends not just on the particular characteristics of its fleet, but also on its capabilities and its decarbonization strategy.