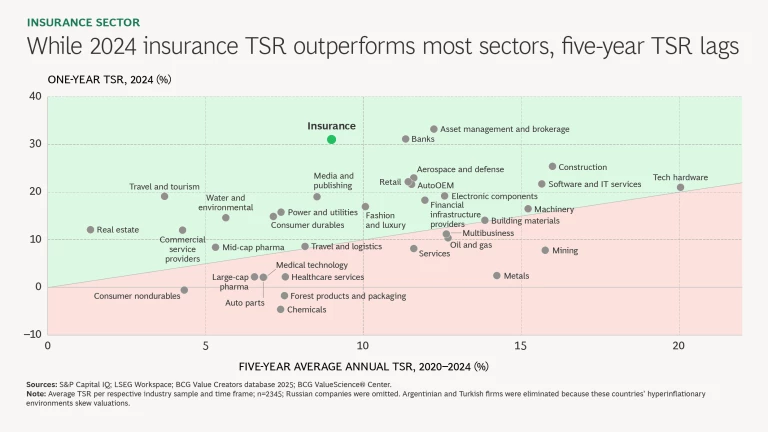

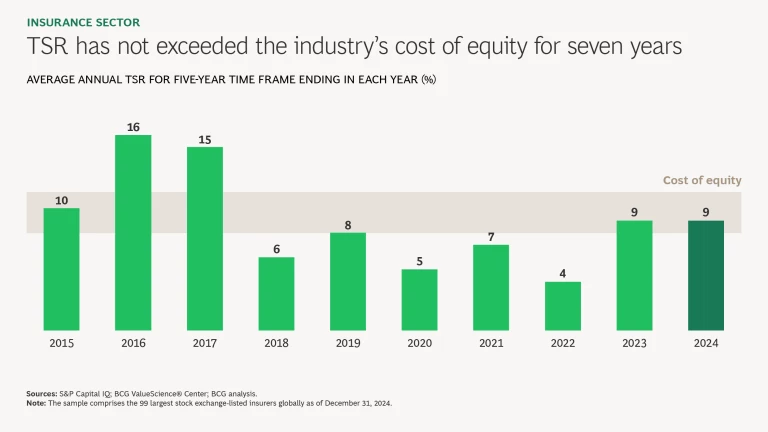

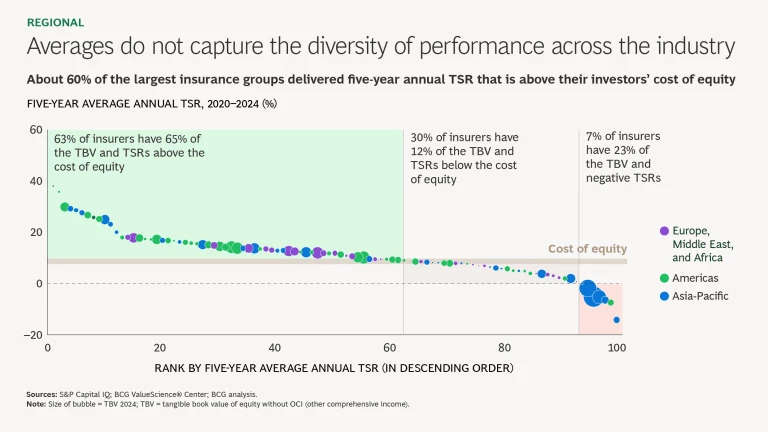

From a value creation perspective, the insurance sector presents a mixed picture. Good performance in the capital markets boosted the global industry’s average total shareholder return (TSR) to 31% in 2024. But five-year (2020–2024) TSR of 9% lags many other sectors—and does not exceed the industry’s cost of equity of 8% to 11%. (See “About the 2025 Insurance Industry Research.”)

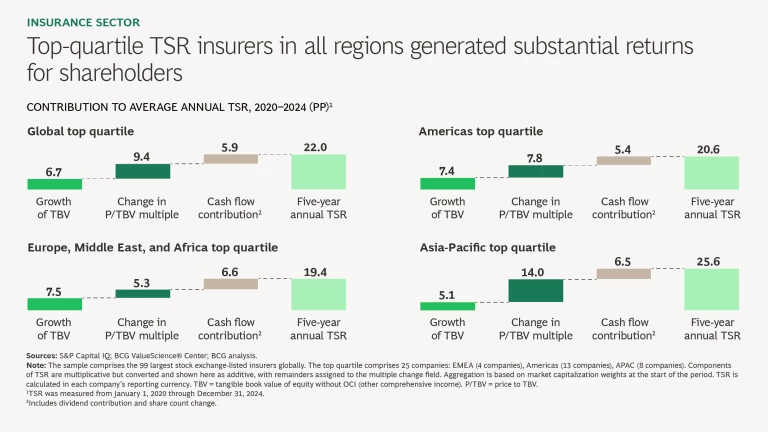

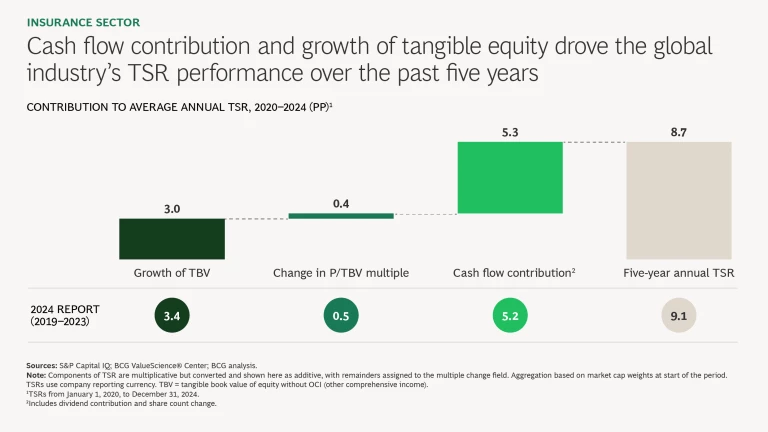

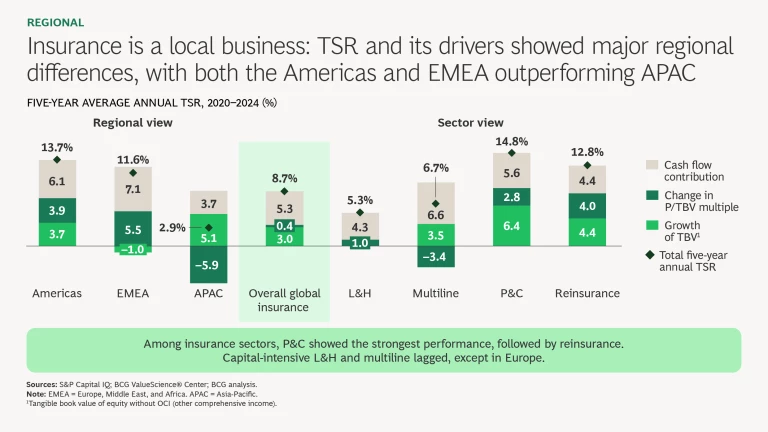

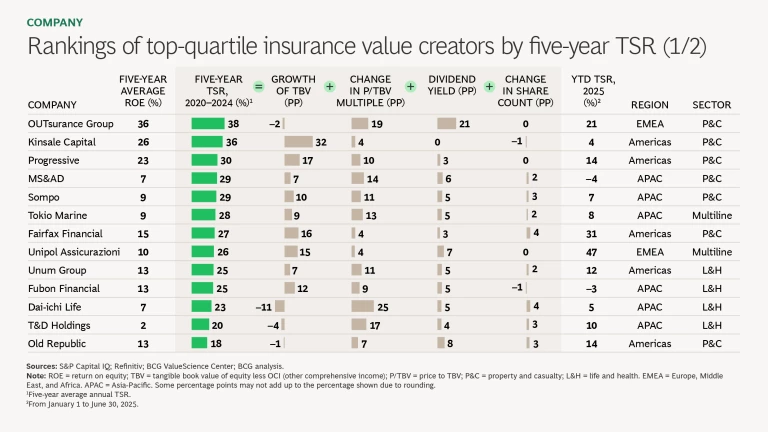

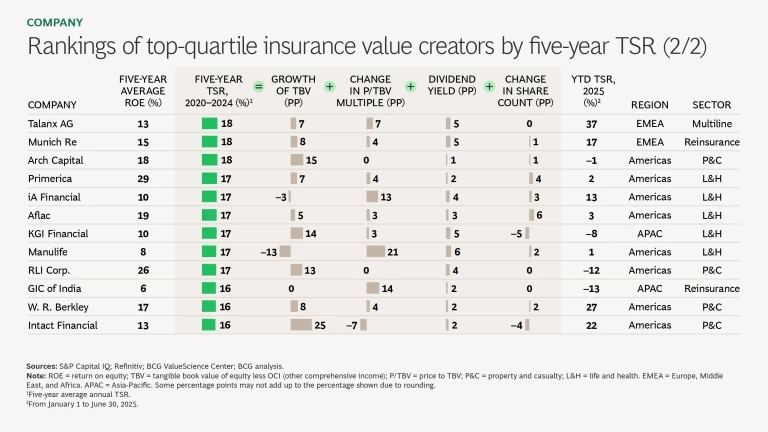

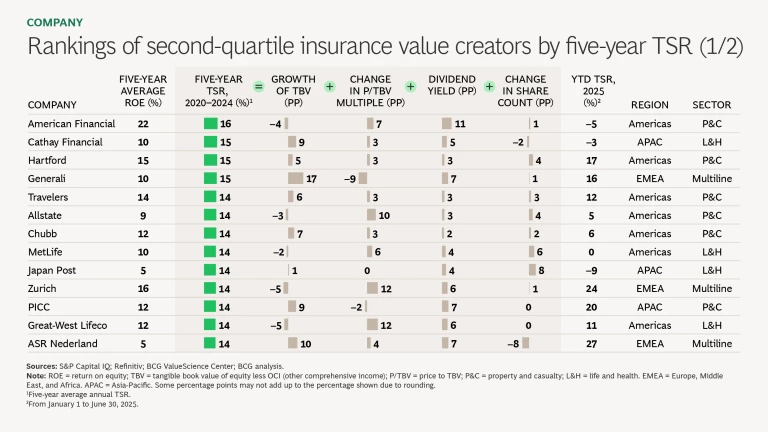

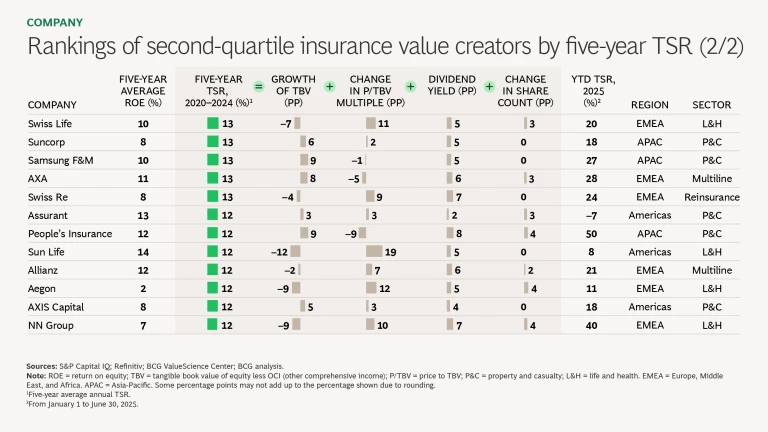

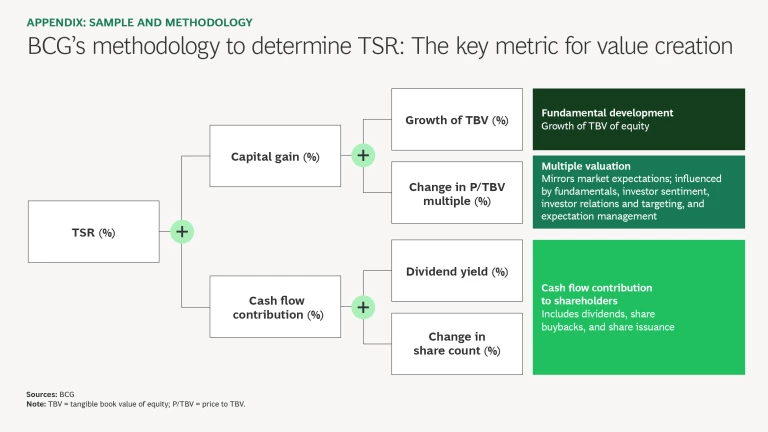

That said, many companies in all regions and segments outperformed in this period. Top-quartile insurers generated excellent returns for shareholders from 2020 through 2024, ranging from 20% to 26%, well above the all-industry average of 9%. The principal drivers of TSR in insurance over the past five years for all companies were cash flow contribution and growth of tangible equity.

Regions, Segments, and Companies

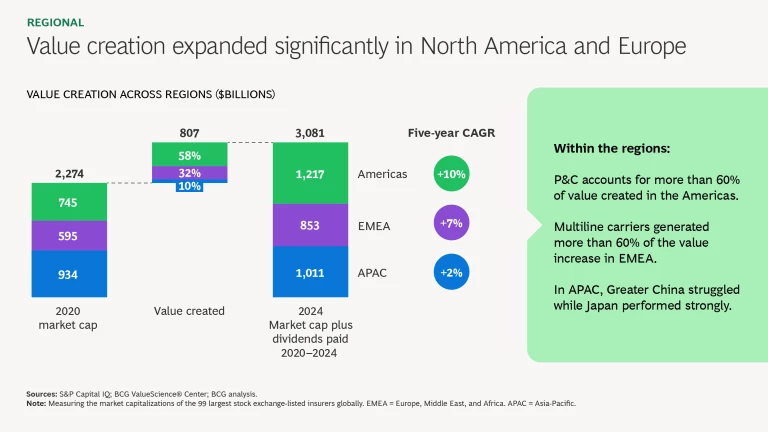

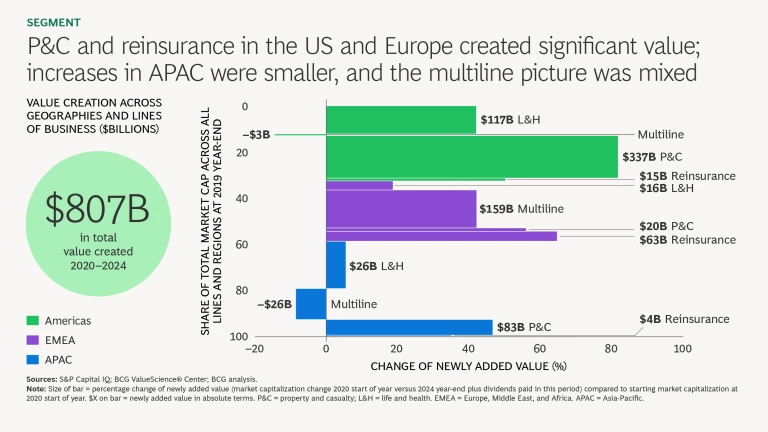

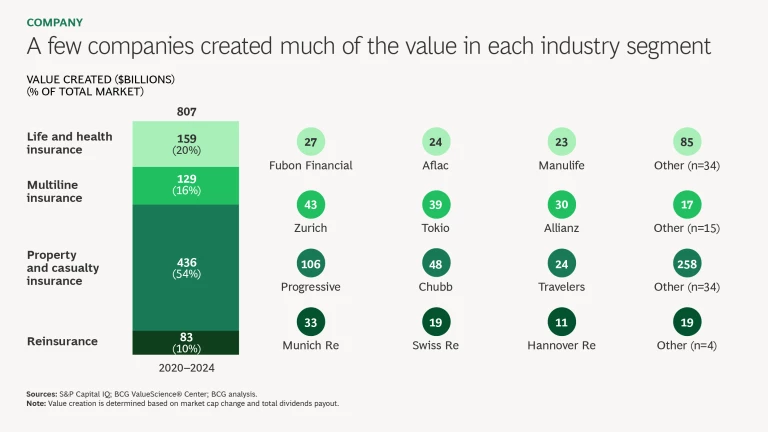

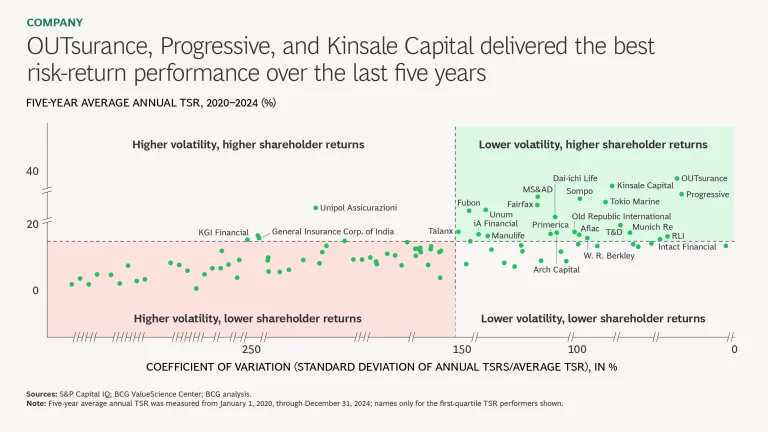

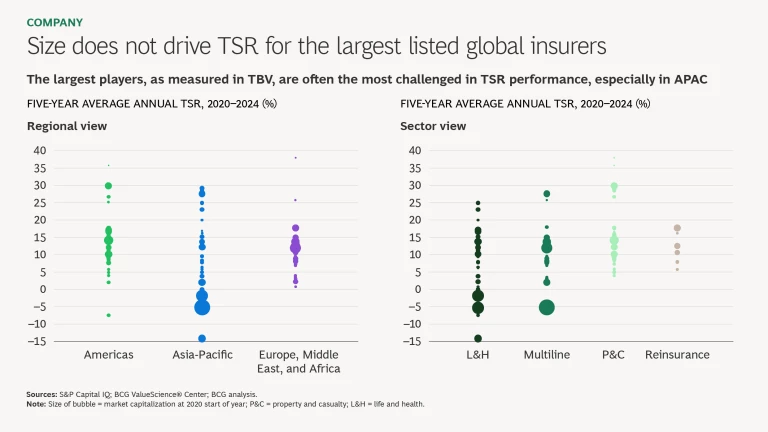

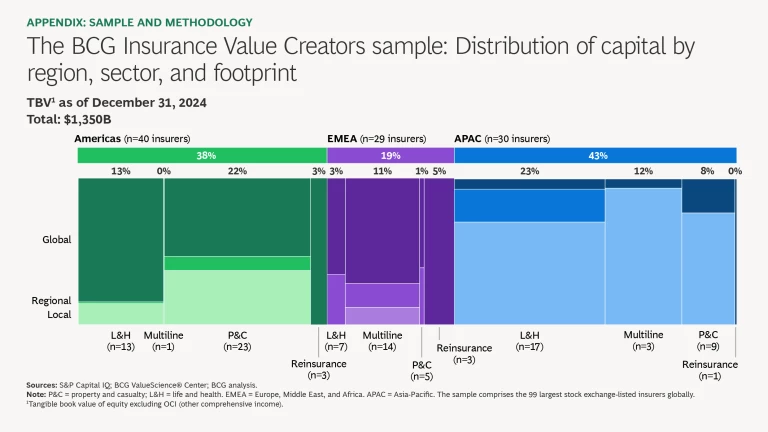

The picture becomes clear at the regional, industry segment, and individual company levels, as explained in the slide show. There we can see that insurance is mostly a local business. TSR and its drivers showed significant regional differences, with pockets of exceptionally good performance. Value creation expanded in North America and Europe, but contracted in Asia-Pacific among multiline insurers. While the insurance industry created more than $800 billion of shareholder value from 2020 through 2024, the property and casualty (P&C) segment produced more than 50% of this result.

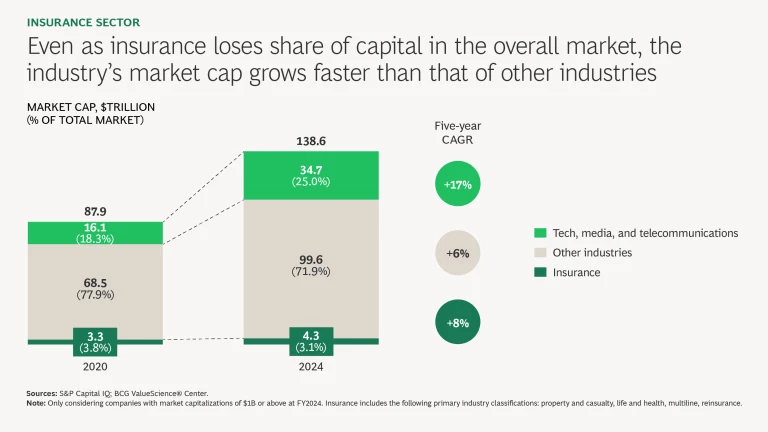

At the company level, a small handful created much of the value in each industry segment. Progressive was the biggest single insurance value creator during the period. And even as the insurance industry loses share in capital markets, it attracts capital at a faster rate than other industries, with the exception of technology, media, and telecommunications.

Lessons for All

This year’s research results reinforce several fundamental lessons for value creation in insurance. Long term, there is no substitute for growth in tangible book value. In the medium term, drivers such as cash flow and return on tangible equity, which is key for multiple expansion, are important contributors. Top performers tend to excel in all facets of value creation.

The following slide show provides a detailed look at the insurance industry’s 2020–2024 TSR story. For further insights, see the reports BCG has produced on the reinsurance and US P&C segments.