Software has become the backbone of businesses, and spending on it continues to grow, currently making up about one-fifth of total IT spending. At the same time, software procurement has become exceedingly complex, and companies are struggling to reduce spending in an increasingly fragmented landscape. Shifts in the industry—including a surge of new vendors, the rise of open-source solutions, the transition from on-premise software to SaaS, new pricing models, frequently changing product offerings, and consolidation among vendors—are all raising the degree of difficulty.

As a result, companies need to rethink their approach to software procurement. Doing so can not only slow spending but also reduce complexity in the technology landscape, lower technical debt, and free up cash to reinvest in high-impact areas, such as data, AI, and automation.

Through our work with companies of various sizes across industries and markets, we have identified specific ways that they can reduce their enterprise software costs. The actions fall into three main categories: commercial measures, demand management, and technical optimization. This three-pronged approach can help companies stay ahead in the ever-changing SaaS game.

Stay ahead with BCG insights on digital, technology, and data

Complexity Is Growing

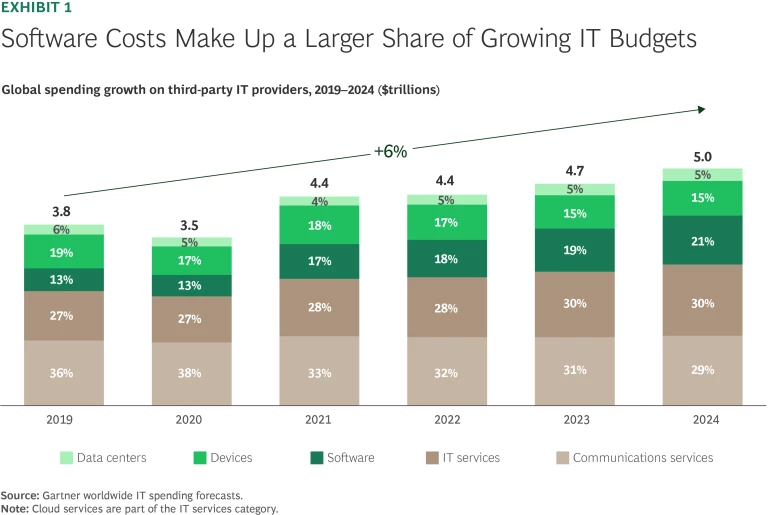

Overall, IT budgets for third-party services grew by about 6% a year from 2019 through 2024 (far greater than inflation), but software spending rose even faster. During that same period, software costs increased by 50% as a share of the total tech budget, from 13% in 2019 to 21% in 2024. (See Exhibit 1.)

CIOs, CTOs, CFOs, and procurement leaders that want to control software costs face a variety of challenges.

Vendor Proliferation. The number of vendors in certain domains (including business intelligence, project management, and cybersecurity) has exploded, making it harder for organizations to standardize and optimize their software stack. In a recent survey of chief information security officers, respondents expressed a clear desire to manage the complexity of vendor proliferation—for example, by making purchases from a smaller number of software suppliers.

Consolidation Among Providers. The implications of notable acquisitions (for example, Broadcom’s acquisition of VMware and CA Technologies, as well as Salesforce’s purchase of Tableau) is evident in vendor negotiations. This trend has also been continuing, for example, with Cisco System’s acquisition of Splunk and Google’s acquisition of Wiz. Through these deals, major players are gaining greater leverage over customers, leading to vendor lock-in, steep price increases, and more-rigid contract terms.

New Pricing Models. Beyond the shift to SaaS, software vendors are also adopting newer consumption-based pricing models, creating both challenges and opportunities for enterprise customers in how they manage costs. For example, many companies are struggling to track consumption across the enterprise, increasing the risk of cost overruns. These pricing shifts make traditional, flat-rate negotiations obsolete while increasing the risk of “shelfware”—software that remains underutilized.

Hidden Infrastructure Costs. As companies scale applications that run on public cloud platforms such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, infrastructure costs rise accordingly. Boosting the scalability and performance of many software solutions—including new GenAI offerings—requires increasing the amount of cloud resources available for data storage, compute power, or API calls, for example, raising infrastructure costs.

Increasing the amount of cloud resources for data storage or compute power raises infrastructure costs.

Decentralized Procurement Decisions. As new technologies emerge, business units and functional leaders have domain expertise and are often the best positioned to make software purchasing decisions. But without some degree of centralized control, companies end up with a proliferation of redundant software, including an unmanageable volume of long-tail solutions with extremely narrow utility.

Compliance Requirements. Standards—such as the European Union’s General Data Protection Regulation, the Health Insurance Portability and Accountability Act in the US, and the System and Organization Controls 2 developed by the American Institute of Certified Public Accountants—add yet another layer of complexity to procurement and asset management. These rules require stringent data security, privacy controls, and auditable systems, directly influencing software selection, vendor negotiations, and contract terms.

Ever-Changing Offerings. Some software vendors often change the products and versions they offer more for their own commercial needs rather than the needs of their customers. Their new product releases may be only marginally different from what’s already available—the same capability repackaged with a fringe benefit or an analytics add-on—leading to complexity in how companies negotiate with vendors.

Traditional Cost-Saving Methods Aren’t Enough

Most organizations have a set of traditional cost-saving methods in place, such as bulk discounts and licensing negotiations. But many of those are past the point of diminishing returns—particularly in large organizations that have already realized the benefits of scale.

Other factors that render these approaches less effective include:

- Misalignment Between Software Cost Savings and Business Goals. Traditional procurement strategies tend to focus on upfront cost savings—for example, choosing a vendor because of steep discounts in the first year of a contract, only to see those costs rapidly rise in subsequent years. That not only fails to reap long-term savings but also neglects the need to align software investments with an organization’s long-term business goals. This lack of alignment can limit visibility into a vendor’s long-term product roadmap and stifle opportunities to derive meaningful value from the software.

- Missed Opportunities for Technical Optimization. Legacy methods rarely address technical adjustments, such as configuration changes or performance tuning, that can effectively optimize costs. These opportunities are often left unexplored, even though they hold the potential for significant savings and operational improvements.

- An Excessive Focus on Compliance. Software asset management teams sometimes focus primarily on contract compliance to ensure that there are no volume overages. That kind of compliance mindset is understandable, but companies also need to ensure that the actual demand for software is justified and aligned to ongoing business requirements.

A Three-Pronged Approach to Reduce Costs

To manage software costs effectively, companies need to adopt a multifaceted approach, comprising commercial measures, demand management, and technical optimization. Companies don’t need to do everything on this list; they can pick and choose to identify the right set of options for their needs.

Commercial Measures. Most companies have focused their software cost-management efforts on commercial levers, such as negotiating prices with suppliers for individual assets. But they can get better results with a more holistic, systematic approach.

- Develop enterprise requirements—both current and future—along with a product roadmap for each software asset. Ensure that vendor negotiations use this comprehensive vision.

- Look beyond pricing benchmarks and use market intelligence to evaluate the potential for negotiation among vendors. For example, when assessing a particular vendor, understand which products it is pushing and how a contract could impact the vendor’s product goals—especially for large, multiyear deals.

- Build long-term strategic partnerships with software firms, prioritizing less-aggressive vendors and considering strong tier 2 players.

Demand Management. The second prong is managing demand to ensure that business units buy what they need—with the right capabilities—and use what they buy.

- Map the software asset portfolio to enterprise business capabilities to help uncover overlapping assets and provide insights into the tradeoffs between best-of-breed solutions and scalable software suites.

- Objectively assess whether the business units need add-ons and additional service elements. For example, if a vendor offers premium user support, an organization should evaluate whether it is sufficiently different from the baseline customer support to warrant the higher cost.

- Put strong software asset management in place, including clear guardrails around license reallocations and audits, to ensure that software requirements from business units are justified.

Uncovering overlapping assets provides insights into the tradeoffs between best-of-breed solutions and software suites.

Technical Optimization. The third prong is adjusting technical aspects of the company’s software to change consumption patterns, usage policies, or infrastructure configurations to lower costs.

- Use open-source software, even for critical applications, to reduce costs and reliance on bigger SaaS vendors. Open-source applications can be significantly less expensive than legacy products, even with the same capabilities and security features.

- Move old records to cold storage to reduce data storage costs while maintaining accessibility. For example, companies that use AWS S3 Glacier can put some less-critical data in lower tiers of accessibility—making it available within 12 hours instead of immediately—for a lower price.

- Refactor code so that it consumes less mainframe computing capacity—and thus, mainframe software costs. Similarly, consider reducing unnecessary tags from custom metrics to reduce the total number of unique tag-value combinations—for example, by using Datadog custom metrics.

- Create service level agreements with vendors to track and reduce usage across product and test environments, as well as among apps of varying importance to the business.

Making Cost Reductions Sustainable

Once companies have taken steps to reduce software costs, it’s critical to ensure that costs don’t creep back up over time. Several factors can help.

Create centralized oversight. Manage all applications and contracts through a centralized system, typically either a contract life cycle management application or a software asset management program. Develop organization workflows to raise timely alarms for contracts that pose compliance or risk issues in order to avoid costly penalties. Implement specialized SaaS management platforms like Productiv or Torii to centralize visibility into software usage, costs, and owners.

Increase transparency. Ensure visibility into costs and usage. Monitor not only contractual costs but also operational and labor expenses associated with software to gain a more complete view of expenditures. Track software utilization metrics, such as single sign-on logins, storage consumption, and provisioned versus in-use licenses, to identify underutilized tools.

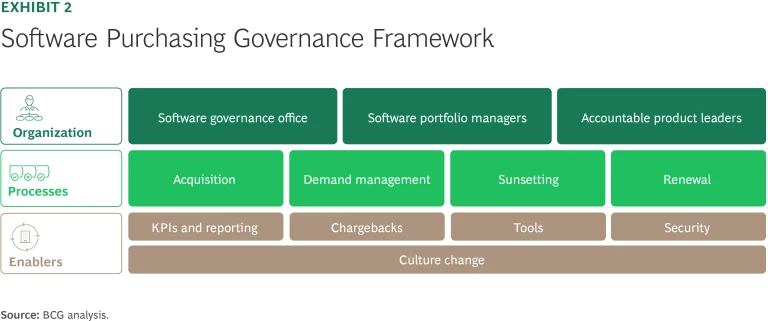

Set governance. Establish a clear governance framework for software spending that has three key components. (See Exhibit 2.)

- The overall organization should include a software governance office that manages the enterprise-wide portfolio, establishes guardrails, and reports to the CTO. Staffed within the office are managers who oversee the software portfolio for a domain or business unit, along with product leaders who make the actual purchasing and sunsetting decisions for their units.

- Processes within the framework should include acquiring new software, managing demand (such as monitoring usage and ensuring that licenses are being optimized), sunsetting software that is no longer needed, and renewing programs nearing the end of their contract term.

- Enablers should include clearly defined KPIs and reporting mechanisms, chargebacks to ensure that costs are allocated to the function or business unit using the software, tools to facilitate governance (such as catalogs of preapproved options and contract management solutions), and security to ensure that the company complies with regulatory requirements. Underpinning the entire framework is a culture change to ensure that teams are more conscious about software costs and usage.

Automate for efficiency. Take advantage of automation and tools to improve efficiency and compliance. Implement agentic GenAI-based tools to support procurement teams in estimating demand, understanding utilization, and benchmarking costs.

Communicate clearly about tradeoffs. Reducing software expenses comes with inevitable tradeoffs that organizations must manage. Consolidating vendors or streamlining tools may lead to adjustments in features, user interfaces, or workflows. Without strong top-down support, resistance from teams can delay optimization efforts. Clear communication and leadership alignment are crucial for prioritizing efficiency over convenience and ensuring that business units and employees are not surprised by software changes.

In a more complex software environment, traditional approaches to procurement are no longer enough. Navigating this complex landscape demands a mix of technical expertise and decisive action. Companies that embrace innovative procurement practices and adapt to the evolving dynamics of software spending can improve their financial performance, reduce complexity, and equip themselves to compete more effectively.