Some companies are pressing “pause” on sustainability investment. But operational demands haven’t paused with them. Customers and buyers are requesting emissions data. Regulators and investors are looking for action. Managers are facing delivery targets they were never trained to meet.

These are structural challenges. And they require new capabilities to manage.

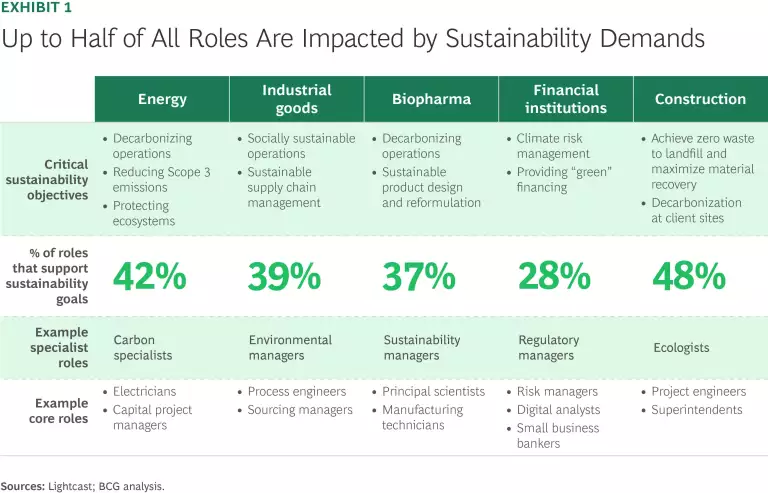

This is where many companies are vulnerable. Our analysis shows that 25% to 50% of roles across sectors will need to evolve to meet sustainability priorities. Most are existing positions—not new “green” jobs—and many fall within core functions. For example, operations leads are managing energy intensity, procurement is redesigning supplier incentive models, and finance is recalibrating forecasts for climate-induced physical risk.

But while some organizations have begun to retool, many others still underestimate the impact of the shift. Smart leaders will use the current lull as lead time to bring in scarce expertise and retrain their workforce—before the transition becomes more difficult and more expensive.

Sustainability Is in the Job—Even If Not in the Title

Fewer than 1% of job postings include “sustainability” in the description. But many involve work that directly impacts emissions reduction, compliance, resource use, social responsibility, or environmental resilience. Although some new positions are being specifically created to address climate issues, responsibilities for sustainability measures are increasingly embedded in existing roles. Several key insights emerged from our analysis. (See “About Our Research.”)

Although some new positions are being specifically created to address climate issues, responsibilities for sustainability measures are increasingly embedded in existing roles.

About Our Research

We began by defining a model set of “best practice” sustainability objectives for each sector and then used AI-enabled tools to identify the roles contributing to their delivery, regardless of whether sustainability appeared in the title or job description. This approach enabled us to identify a much wider range of supporting roles.

Each role was mapped to its associated skills and job family, enabling us to pinpoint which functions are most affected, where specialist talent is in short supply, and where generalist roles can be reskilled or scaled. Cross-sector benchmarking allowed us to see where certain skills or roles were in demand across multiple sectors.

- Demand is high across sectors. A quarter or more roles across industries are linked to delivering sustainability objectives. In biopharma and industrial goods, the figure stands around 40%. In construction and energy, it’s between 40% and 50%. (See Exhibit 1.) Sustainability-linked responsibilities are being folded into day-to-day duties for manufacturing technicians, project engineers, risk managers, and R&D scientists, among other non-specialist employees.

- A focus on specialist talent can create blind spots. Many CEOs and CHROs conflate sustainability needs with the need for experts such as carbon accountants or environmental specialists. But specialist positions represent only about 5% of sustainability-related roles. The bigger pressure is building in core functions such as procurement, tech, operations, and finance. These teams are increasingly involved in sustainability-linked activities and expected to support delivery of environmental or social goals, but often without formal mandate or training. That disconnect leaves managers and frontline staff absorbing new responsibilities without the tools to deliver.

- Early movers are quietly building an edge. Some companies are already adjusting. We’ve seen in-house tech teams building ESG reporting platforms, employees training to conduct life-cycle assessments, and construction project managers learning to quantify emissions impact as part of project plans. In a tight labor market, some companies are looking inside the organization and targeting “green-adjacent” talent—people who have foundational domain knowledge and emerging relevant skills or interest. Firms making early moves in this strategy are locking in scarce capabilities and buying time to scale sustainability practices.

Five Ways Leaders Can Get Ahead

Focused action in five areas can help companies meet rising sustainability demands and build long-term talent advantage in the process.

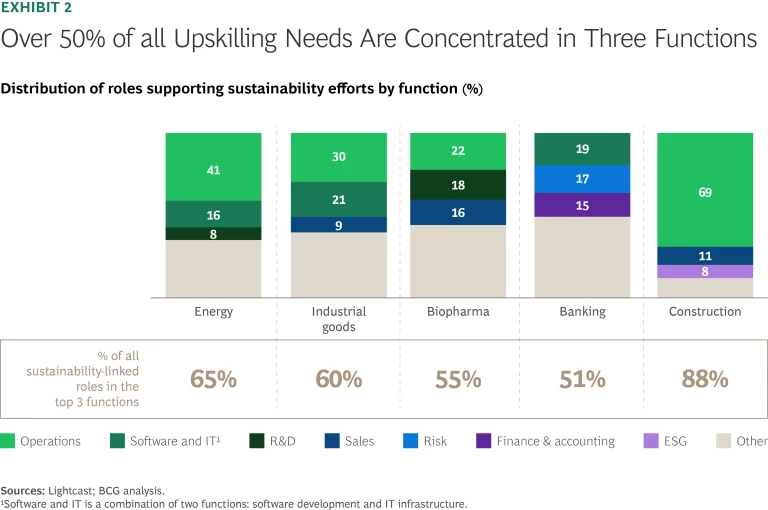

Target role clusters. In every sector we studied, 50% to 88% of sustainability demands fall within a narrow set of functions. (See Exhibit 2.) This makes the upskilling challenge more targeted than many leaders assume.

Across industries, operations, including logistics, is the most common area of focus. In construction, this function accounts for nearly 70% of sustainability-linked roles, from technicians learning to work with low-carbon materials, to project managers coordinating energy-efficient builds, to logistics supervisors managing new “zero waste to landfill” processes. In biopharma, nearly 20% of sustainability-linked roles sit in R&D, tied to product design, formulation, and packaging. Finance, risk, and tech functions dominate in banking as teams adapt investment strategies and stress-test frameworks to reflect environmental exposure.

By identifying these concentrations in their workplaces, leaders can respond to their sustainability needs without having to rewrite the organization chart.

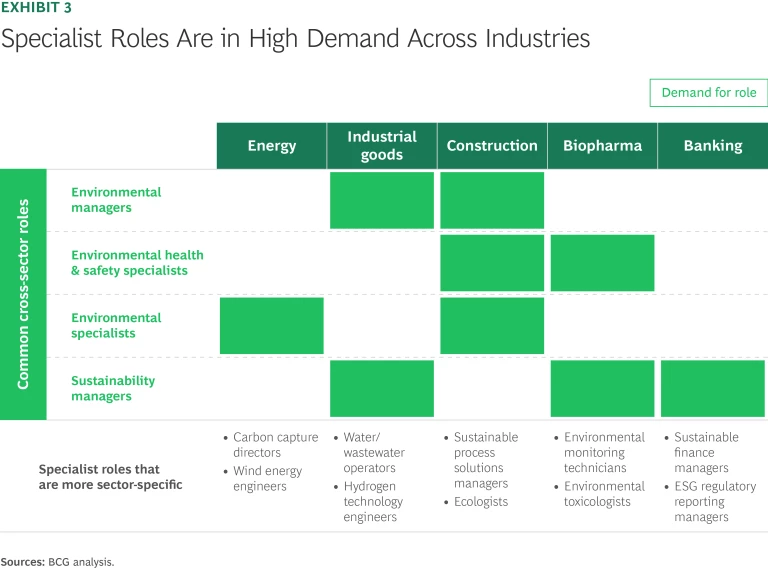

Prioritize specialist hotspots—before they slip out of reach. Although specialists account for a small share of sustainability-related needs, this talent is often the hardest to secure because companies across industries are chasing the same small pool of people. (See Exhibit 3.)

This challenge is especially acute in some core roles. Environmental specialists, health and safety experts, and sustainability managers are in high demand in nearly every sector. The same is true in key operational areas such as production, logistics, and process improvement, where hiring needs are consistently high across construction, energy, and industrials.

Inconsistent titles mask this demand. One company’s “production technician” may be another’s “process engineer” or “project lead.” But increasingly, they share similar mandates: reduce emissions, improve traceability, and ensure compliance. In biopharma, energy, and construction, these overlaps are accelerating.

The cost of misreading the market can be steep. One industrial firm suffered delays to its sustainable procurement strategy after struggling to find external hires and having to upskill internally instead.

Stay ahead with BCG insights on climate change and sustainability

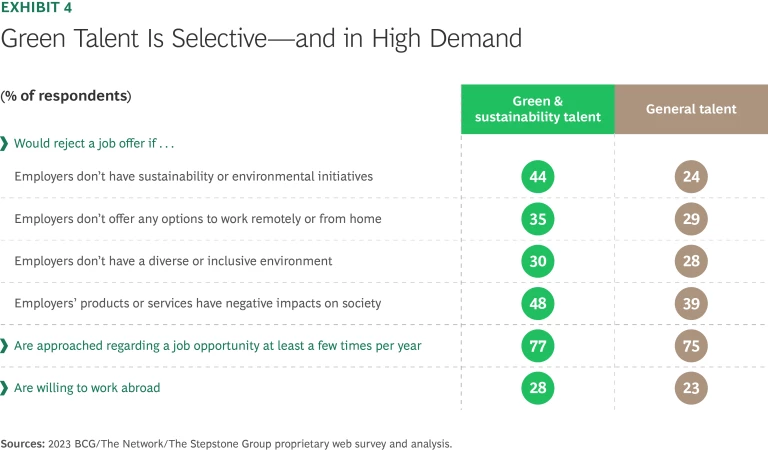

Understand what sustainability talent looks for in an employer. Young and midcareer workers know their worth. Even in this challenging economic environment, 64% believe they have a strong negotiating position and can choose among job offers. And 75% are contacted about attractive employment opportunities a few times a year. As a result, knowing what the next generation of talent wants is essential.

“Green talent” is equally confident. BCG research shows that 57% of sustainability professionals are actively exploring new roles and 77% are approached with job opportunities several times a year. Their choices hinge on employer behavior. They are nearly twice as likely as the general population to reject offers from companies that fall short on environmental commitments. (See Exhibit 4.) That makes differentiation on sustainability matters essential not only to attract this talent, but retain it.

Early moves—whether hiring, upskilling, or redesigning roles—can create breathing room before the talent race tightens. Companies need to identify where demand is rising and be open to candidates without sector-specific experience, especially in areas where talent gaps could trigger downstream disruption.

Companies need to identify where demand is rising and be open to candidates without sector-specific experience, especially where talent gaps could trigger downstream disruption.

But even the best talent strategy will falter if the employee value proposition (EVP) isn’t competitive. Retaining people through periods of change requires more than training programs. It takes a workplace they choose to stay in. Companies need to have an unvarnished view of how their EVP stacks up on the factors employees value most and how it compares with competing offers. When roles and pay are similar, EVP is often what tips the balance.

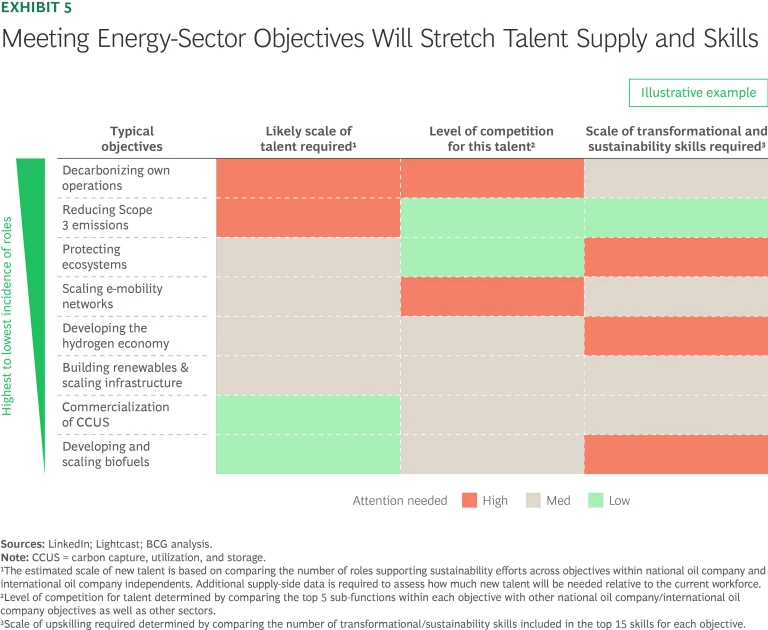

Build a reskilling and upskilling roadmap to achieve scale quickly. In sectors such as energy, where workforce needs and competition for talent are fierce, reskilling and upskilling aren’t optional. They’re the only viable path to execution at scale. (See Exhibit 5.)

Fortunately, however, many key roles in energy and related sectors require only incremental capability lifts—making targeted upskilling a faster, cheaper, and more durable solution. For example, technicians already working in production can often be trained to detect and reduce methane leaks—building on skills they already use to monitor operations and equipment. Specialists who manage mechanical equipment can acquire tools and know-how that allow them to shift toward predictive maintenance approaches that cut downtime and improve energy efficiency.

Understanding where the greatest needs lie and which skill sets can adapt to meet them is essential. Some transitions can happen in months. Functions like finance, sales, and facilities management lend themselves to fast-track programs reinforced by on-the-job learning. Others may require structured reskilling pathways and stronger change support, particularly where roles face obsolescence or are highly technical. BCG research shows that 57% of workers are open to reskilling—with even higher willingness among younger people (63% of 21- to 40-year-olds) and those with less specialized education (61% of bachelor’s degree holders versus 46% of those with PhDs).

The key is to build a plan that’s both pragmatic and targeted: Where can existing programs be enhanced? Where must new curricula be developed? And where should upskilling be prioritized to preserve institutional knowledge while adapting to new demands?

Plan Precisely, Act Early

Enhancing capability requires more than broad-brush workforce planning. It demands a detailed, role-level understanding of where gaps are emerging—and a structured view of how to close them before they grow costly. To get there, leaders should consider the following measures:

- Forecast where sustainability will reshape the work. Start with function-level heatmaps, informed by your sustainability roadmap: What roles will be most affected, and how? In manufacturing, process engineers may need to cut energy or water use per unit produced. In IT, system architects may need to design infrastructure optimized for emissions. Clear visibility into emerging role requirements helps focus investment where it matters most.

- Build a baseline in current capability, don’t assume it. Most firms lack a role-level view of existing skills—making reskilling plans little more than guesswork. Building that baseline in priority areas is foundational to skills-based organization models. It reveals underutilized talent, identifies adjacent skills, and enables smarter workforce deployment.

- Sequence by criticality. Target the roles that matter most. Assess where reskilling is feasible and where hiring is unavoidable. Prioritize roles that are critical to sustainability delivery, costly to leave unfilled, and concentrated in functions with internal mobility potential. This ensures that early moves deliver outsized impact. Focus initial efforts on these segments, and fast-track functions where transitions can happen most quickly.

At first glance, the climate transition may feel like it’s stalling. But operational shifts, from climate risk exposure to supply chain and resource demands, are unfolding regardless of policy direction. Instead of waiting things out in hopes of saving resources or channeling them elsewhere, the smart money will start building the sustainability talent they need now—when doing so is less pressured, less costly, and more likely to give leaders competitive advantage.

The authors are grateful to Tabeer Memon, Charlie Tanas, Avishek Adhvaryu, and Anna Bryant for their contributions to this article.