Just as aircraft require wings to stay aloft, the world’s airlines need digital technologies to soar in today’s turbulent skies. Data and new digital technologies, especially AI, are allowing airline companies to analyze big data, make data-driven decisions in real time, and improve performance in these volatile, ambiguous, and uncertain conditions. Confronted by fast-changing customer expectations, many airlines are now focusing on developing sophisticated and innovative new digital offerings.

The trouble is, airlines face a host of challenges when trying to develop digital products. Most lack adequate digital talent and can’t attract them easily. They instinctively rely on external vendors, which shrinks internal capabilities. Moreover, the technology and business teams work in silos, which results in the creation of digital products that customers don’t need or that aren’t marketed to the right segments. Such roadblocks slow the adoption of digital technologies, dilute their impact, and cause digital product development initiatives to stall.

To tackle the problem, airlines must go beyond technology to address people-related issues such as digital talent needs, reimagined workflows, new ways of developing products, and value-driven governance as well. Embedding digital product management in the organization redefines the airline’s culture. Rethinking their product development processes will be critical if airlines are to succeed in developing portfolios of digital products and systematically capturing their full value.

Stay ahead with BCG insights on travel and tourism

Airlines’ Digital Flight Plans

Many airlines have accelerated investments in digital and AI initiatives recently. A number of surveys find that around 50% of carriers rank AI as their top technology priority today.

Strengthening foundational systems is a prerequisite for generating value from more complex digital applications. A recent BCG survey of airline executives find that almost 90% of airlines plan to invest more in passenger service systems in the next 12 months, followed by airport operations (70%), flight operations (60%), revenue management (60%), and cargo systems (50%). In addition, around 70% of the airlines BCG surveyed told us that they plan to invest in platforms that support data capture, analytics, and operational use cases.

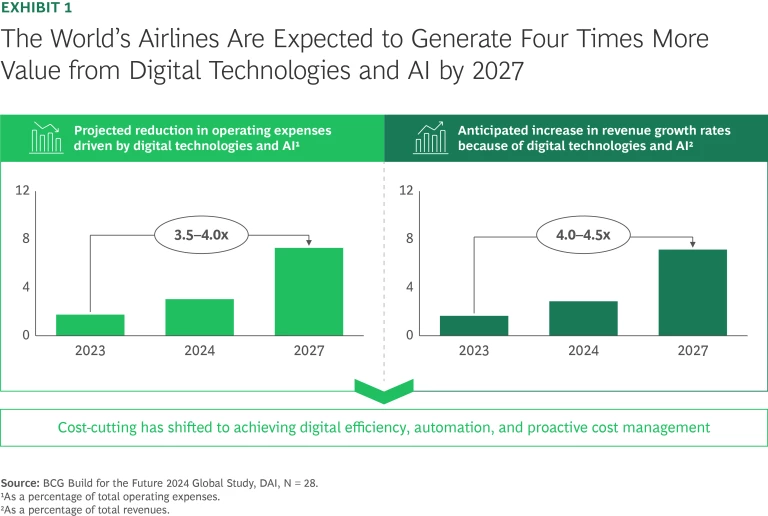

Airlines will be able to optimize costs and increase operational flexibility as well as offer a new generation of personalized products by using digital technologies and AI. Cost reductions driven by digital technologies and AI (as a percentage of operational expenses) are projected to increase by up to 4 times between 2023 and 2027, while the expected revenue growth rate (as a percentage of revenues) is expected to rise by up to 4 times in the same period. Consequently, between 2025 and 2027, the value generated by using digital technologies is likely to more than quadruple. (see Exhibit 1).

Between 2025 and 2027, the value that airlines will generate by using digital technologies is likely to more than quadruple.

Flying into Turbulence

The value that digital technologies offer the airline industry is undeniable, but the path to creating it may be far from smooth. In BCG’s experience across 1,000+ AI implementation programs, to create value, airlines must place a greater emphasis on people and processes (over 70% of digital product development resources) than on algorithms (around 10%) and technology and data (around 20%). Most airlines can only unlock value by prioritizing talent needs, changing their organizational culture, reimagining processes and structures, and focusing on value-centered governance. (See the sidebar “Four Criteria to Measure the Success of Airlines’ Digital Initiatives.”) These criteria lie at the heart of winning digital execution.

Four Criteria to Measure the Success of Airlines’ Digital Initiatives

- Business impact, which can be measured by, for example, changes in on-time performance, cost savings enabled by digital/AI, customer NPS

- Employee experience, which can be gauged by employee satisfaction survey scores.

- Quality, as shown by the tech build quality, e.g., density of defects. Each airline must develop a definition of what project completion means as well as stipulating the code quality and security standards.

- Throughput, as indicated by the number of release cycles or the time taken to execute a digital program. Each organization must adopt a standardized definition of process efficiency as well as the associated metrics.

Equally, airlines’ focus should be on global rather than local metrics. They shouldn’t optimize digital initiatives for each product or function; instead, they must optimize for business outcomes, maximizing enterprise-wide value rather than implementing improvements that benefit only one link in the system. A revenue management tool, for example, may improve short-term yields by raising fares, but if it undermines customer loyalty, the airline will lose.

However, unlike technology firms, airlines lack a bench of digital product managers who can translate strategy into scalable platforms. Digital product managers serve as a bridge between strategy, technology, commercial, and operations. Equipped with skills such as customer-centric thinking, agile delivery, and data-driven prioritization, they can define customer needs, prioritize features, balance regulatory constraints, and coordinate delivery across IT, engineering, marketing, and frontline staff.

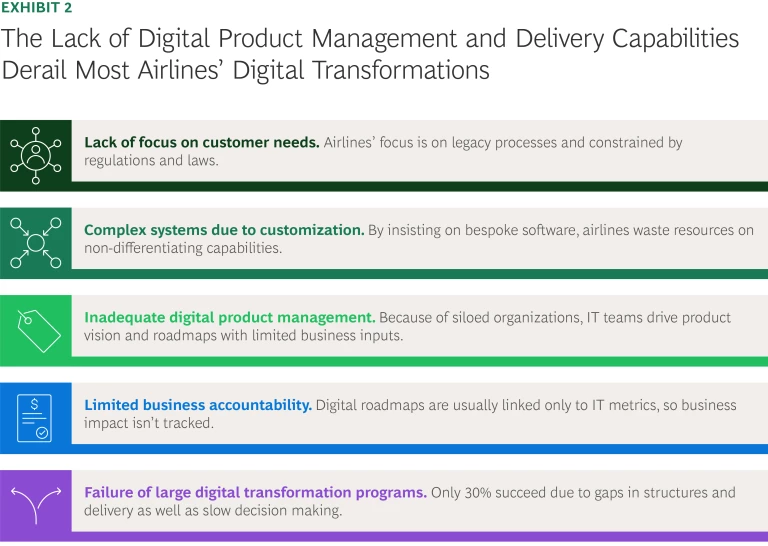

Digital initiatives that aren’t led by product managers risk missed deadlines, budget overruns, and a failure to improve customer experiences. Because of their limited product and delivery capabilities, most airlines find themselves handicapped in five ways (see Exhibit 2):

- Choosing Legacy Workflows over Customer or Employee Needs. It’s difficult to introduce new roles or restructure teams in airlines without triggering operational and organizational pushback. Instead of bringing about transformation, digital initiatives are often layered onto outdated processes. The result is digitalization without efficiency. For instance, the approval processes for European airlines’ crew pay are driven by unions and haven’t changed since the 1990s. Even though they’re now managed on portals, not paper, the task takes up time that employees and supervisors could spend more productively elsewhere.

- Preoccupation with Developing Custom Software. As large and complex organizations, airlines prefer using vendors and bespoke software rather than off-the-shelf packages. In addition to increasing complexity, boosting costs, and slowing down projects, dependence on external vendors masks internal needs. Many airlines have ended up outsourcing not only technology development, but also digital learning, leaving them with limited in-house digital capabilities.

- Siloed Product Development. Because airlines haven’t restructured to focus on the development of digital products, the business side and the technology teams don’t break out of their respective silos. Digital teams take charge of product vision and product development with limited inputs from the business teams that know customers and the features for which they will be willing to pay. As a result, airlines often end up developing bells and whistles that customers don’t want.

- Digital Products Aren’t Designed for Business Results. Instead of directing their efforts toward improving business performance indicators such as on-time departures, online booking conversion funnels, and customer satisfaction scores, too many digital product teams focus on technology-related metrics such as the number of software releases per month, the bugs ironed out, and the number of new features added. As a result, there’s a growing disconnect between digital investments and business improvements.

- Lack of Prioritization of Digital and AI Projects. In airlines’ siloed organizations, departments and functions often launch projects in isolation. As a result, projects remain scattered, each with its own budget, vendors, and priorities. This leads to duplication, wasted expenditure, and initiatives that never scale (“the thousand flowers blooming approach”), so companies often fail to extract the full value of investments. Airlines must prioritize their digital initiatives and focus on executing the most critical ones successfully.

Taking Off with Digital Product Management

At the very outset, airlines must develop a customer-focused vision of what they hope to achieve from their digital transformation programs. They must set clear targets for the business metrics they wish to improve such as on-time performance, cost savings, and employee health index scores.

To create effective digital product management processes, airlines have to change their focus in two crucial ways. First, rather than perpetuating fragmented, IT-heavy systems, they need to start creating combined analog and digital systems across the product life cycle, from ideation to development and deployment to outcome measurement. This will require creating cross-functional product teams in which managers, data scientists, airline engineers, and frontline staff work closely together. (See the sidebar “How a Global Airline Reorganized Product Development for Digital Success.”)

How a Global Airline Reorganized Product Development for Digital Success

That’s when the company decided to invest heavily in digital technologies, especially AI, as well as the development of digital talent. The airline developed an ambitious vision and drew up tangible and traceable outcomes on organization-wide parameters such as on-time performance, cost savings, and employee health index. It then created a new umbrella Operations Decision Support function in the Operations function to lead the planned transformation. The function’s head reports directly to the company’s chief information and digital officer and the chief operating officer.

The airline adopted a digital product management model, setting up an apex cross-functional team with representation from the operations, technology delivery, and technology architecture functions. The operations representative serves as the product manager for each team, and each team was mapped to an end-to-end digital journey.

The airline simplified its technology infrastructure by opting for a three-layer architecture, separating and simplifying the core systems layer from the data products layer and from the algorithmic layer, where they embedded AI models and AI agents.

Finally, the airline set up a lean program governance team in the Operations Decision Support function to manage a three-year digital and AI program roadmap. This team ensures that all the digital product development teams deliver value, tracking milestones on a quarterly basis and launching interventions to avoid value erosion.

By the end of the program’s second year, most of the company’s new digital products were generating value. The airline saw a 15-plus percentage point improvement in on-time performance and generated millions in cost savings from the use of digital technologies, along with significant increases in customer and employee satisfaction scores .

Talent is the other critical lever. In addition to working with vendors, airlines must invest in building a critical mass of internal digital and AI capabilities. Upskilling existing employees in technological literacy and digital product thinking, along with hiring fresh talent for hybrid roles that blend domain expertise with digital acumen, will help close the talent gaps in most airlines. Because this in-house talent reduces dependence on outside vendors, it also improves business resilience.

We’ve identified five levers to close the gaps that airlines face in digital product management (see Exhibit 3).

Build digital product muscle. To win with AI and digital technologies, airlines have to plan more than isolated IT projects; they need to create a portfolio of digital products. The development process should not be regarded as a supporting IT function, but as a critical role that sits alongside the business teams managing, for example, network planning and fleet management. Focusing on digital product management redefines organizational cultures, creating a mindset where teams iterate, learn, and improve continuously rather than launching and moving on.

Airlines must embed digital product development in the organization's core and treat it as a critical role.

Building digital product muscle will elevate how airlines make investment decisions. Instead of funding standalone projects, top management teams must learn to allocate resources to the development of interlinked products that have commercial impact. Leaders must systematically identify offerings that will deliver incremental margins, enhance operational resilience, and/or generate new revenues. This discipline will ensure that capital is deployed for value creation, not technical debt.

Rethink the talent model. Treating digital talent as a strategic asset will allow airlines to attract hardware and software engineers quickly. To tap into large pools of engineers and AI specialists, they must set up digital innovation centers in cost-friendly technology hotspots around the world like India, Spain, and Poland. These countries can serve as talent magnets by offering employee value propositions, such as the freedom to experiment, that differ from the structured progression paths of traditional airline staff.

In addition, airlines can create centers of excellence that deliver critical capabilities such as predictive maintenance algorithms and personalized booking engines by partnering with global technology firms and setting up joint venture laboratories. Such strategic partnerships will allow airlines to embed partners’ workforces into their own. These models also provide resilience: when talent is distributed across geographies, it reduces a company’s dependency on each hub.

Use digital technologies and AI to unlock fresh value. Smart airlines are deploying new digital technologies to unlock use cases that were not executable in the past. For instance, AI agents can reduce the size of engineering teams by 40%. Airlines must also use off-the-shelf solutions for non-differentiating systems such as crew leave or employee payroll management in order to minimize costs, speed up implementation, and ensure easier upgrades. They should invest in customized systems only for areas that build competitive advantage such as pricing and personalization

Because integrations of legacy systems rely on customization and one-off connectors, they create complex systems that can be expensive to maintain and hard to scale. For example, if an AI-driven pricing engine is tied to a revenue management system using bespoke code, it will work in the short term, but will make upgrades more complicated. Using a standardized application programming interface (API) layer will not only improve interoperability, but also allow the pricing engine to feed into customer apps, call-center tools, and distribution platforms.

Deploy a digital-product-led operating model. Depending on digital product management creates a single dimension of accountability. Product teams, including technology, business, and data teams, should be organized by journey touchpoints; for example, customer, the employee, or the aircraft. They must be given ownership of each digital product—whether booking, crew scheduling, loyalty apps, or predictive maintenance—with end-to-end accountability for customer outcomes and financial impact.

Instead of fragmented committees and functional silos, cross-functional squads consisting of product managers, delivery managers, business leads, frontline staff, data scientists, and software engineers must own each business journey; for example, the door-to-door experience or aircraft turnarounds. This operating model will empower the teams with autonomy, budgets, and data access while senior leaders manage the innovation process through outcome-related metrics such as customer lifetime value, on-time performance, and aircraft utilization.

Product teams must measure success not by IT-related milestones, but by tangible business results. This will ensure that technology isn’t bolted onto the business but built into its core. This approach will also change the perceptions of digital technology from being a back-office enabler to the architect of value creation.

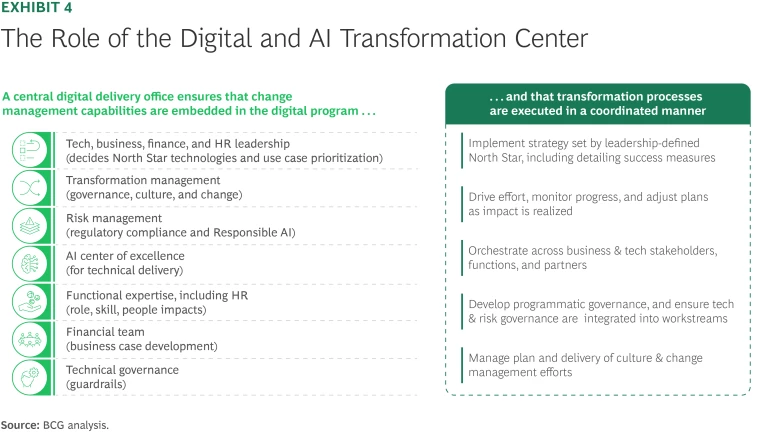

Create a digital and AI transformation center. Airlines must set up a central office that will orchestrate the execution of digital and AI transformation programs by cutting across silos, enforcing accountability, and driving quality at speed (see Exhibit 4). This structure will ensure that critical change management capabilities are embedded in the digital program. If key responsibilities are housed outside the digital product development function, the transformation center must take on the responsibilities of coordination, monitoring, and project completion.

The transformation center gives airlines the governance spine they lack and imposes coherence on digital product development. Instead of projects scattered across functions, the organization will have a unified roadmap, one investment thesis, and a single set of metrics. It will ensure that every dollar spent on developing digital applications moves the airline closer to enterprise-wide outcomes such as improved customer experience, higher asset utilization, and lower unit costs.

Finally, the center can serve as the CEO’s control tower for value realization, generating business cases and monitoring returns. This will ensure data-driven trade-offs, with top management forced to kill pet projects that don’t scale and reallocating resources to those that move the needle on profitability and customer loyalty. In an industry where margins are thin and capital is scarce, the discipline imposed by a digital and AI transformation center often proves to be invaluable.

AI and digital technologies will continue to transform the aviation business. Many airline companies project a fourfold revenue growth in just the next three years that will be driven mainly by data, digital technologies, and AI. However, airlines have large, regulated, and interconnected systems, so all too often, digital programs are rolled out in fragmented pilots. Each may or may not succeed locally, but without a unifying vision, their value will dissipate, and the airline will find itself with duplicated investments.

The foundational principle that must guide digital transformation in the airlines industry should be enterprise-wide integration, with a single North Star vision, shared data foundations, and clear accountability across the product lifecycle. For CEOs and CDOs, this means resisting the lure of quick local wins and building the discipline to generate system-wide value. The payoff will be a competitive advantage that compounds across the organization, which should be the goal of deploying digital technologies in any airline.

The authors thank Andy Levine and Ramsay Baker for all their contributions to this article.