Executive Summary

There are several reasons for this, with four prominent systemic barriers hindering the development, adoption, and commercialisation of innovative healthcare technologies and solutions:

- Workforce capabilities: There is a lack of capacity and capabilities for translational research and innovation in the UK, an area where the NHS plays a critical role. This is due to poorly defined and declining career pathways for innovation, limited protected time for innovation, and a gap in digital/AI fluency within the workforce.

- Data and digital infrastructure: Within the NHS, digital systems are often siloed and characterised by data quality challenges, limiting the potential value of hugely powerful data sources. Mechanisms for data sharing and integration are poorly defined between organisations, hindering how the NHS can partner to unlock insight.

- Cross-sector partnerships: Across the UK, there is a lack of sufficient pathways to establish and scale collaborative efforts. Industry innovators often struggle to identify the right NHS entry point and, even when pilots succeed, there is rarely a clear route to scale promising solutions to achieve system-wide adoption.

- Policy and regulation: There is a systemic problem here. The current approach fundamentally inhibits deployment of innovations. Weak incentives discourage innovators, the NHS, and industry partners across the translational space. Furthermore, limited regulatory testing environments, and conservative guidance in some areas are perceived to police and slow innovative efforts, rather than enable and accelerate. These regulatory barriers apply not only to medicines and technologies, but also to the adoption of new digital models of care (e.g., AI-enabled physiotherapy or remote monitoring in mental health) where unclear or slow approval processes prevent effective scale-up.

- Strengthen the NHS as an innovation platform by setting a clear national strategy for innovation with transparent pathways for testing and scaling solutions. This strategic approach should be supported with initiatives to build workforce capability and to unlock the potential of data through effective data sharing and integration. International examples show how this can be done, such as the National University Health System in Singapore, which has established a clear pipeline to select, fund and support a small number of “practice-changing” innovations.

- Facilitate cross-sector partnerships and cross-sector collaboration by establishing hubs and pathways to connect academia, industry, and the NHS. Denmark’s Trial Nation illustrates the power of national coordination across hospitals to run clinical trials, while the UK’s Meridian Ventures fund shows it can be possible to accelerate innovation through NHS-anchored investment in collaboration with partners. The scale of ambition now needs to be greater.

- Incentivise innovation with effective policy and regulation by rewarding innovators with competitive intellectual property (IP) frameworks and R&D tax credits, and by streamlining approval processes whilst maintaining safe testing environments. Boston Children’s Hospital demonstrates how clear IP policies that deliver returns to those who generate and deploy innovations can motivate frontline clinicians and Germany’s fast-track approvals for digital health show how regulation can accelerate safe adoption.

The Healthcare Sector Holds Significant Value for the UK

Healthcare innovation is the catalyst that turns discovery into impact, driving growth while radically improving the way that patients, clinicians, and operational teams experience care. It is a significant and vital national asset to any country and a powerful driver of socio-economic value. Over the next five years in the UK, the healthcare sector could deliver significant economic returns, but only if a more deliberate approach is taken to harness its full potential.

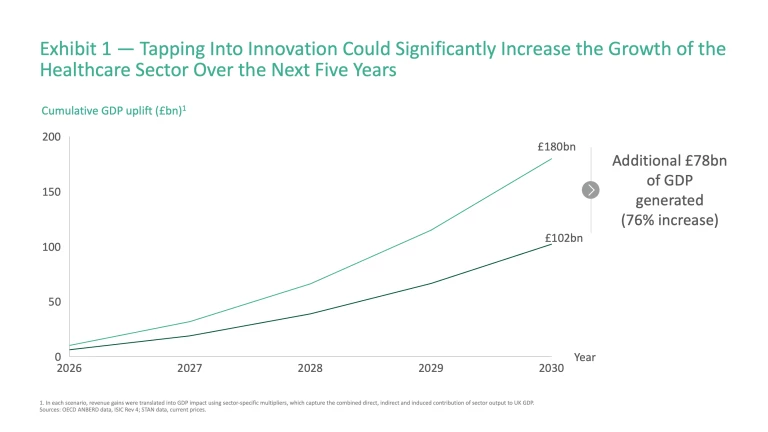

On its current trajectory, the UK healthcare sector – which covers the biopharma, medtech and healthtech sub-sectors – will contribute ~£102 billion to the UK’s GDP by 2030, capturing ~3% of the global market. This represents a continuation of the current trajectory: a growth rate of 7.16% in the UK across these sectors, slightly below the global average of 7.25%.

The future could look different if the UK can translate investment in innovation and R&D into value creation across the biopharma, medtech and healthtech sectors as effectively as peers. For example, between 2015 and 2023 Denmark saw growth in value added in the biopharma sector of more than double that of the UK (~13% vs. ~5% average annual growth), whilst growth in the US’s healthtech and medtech sectors have also surpassed the UK over the same period (~7% vs. ~5%). As another demonstration of the untapped potential, the healthtech sectors of nations such as Italy and Spain are projected to expand faster than the UK through to 2029 (~9% vs. the UK’s ~8%). If the UK could match these successes, GDP uplift could rise to £180 billion cumulatively over the next 5 years, an additional £78 billion (76%) above the baseline (Exhibit 1).

This raises a key question: how can the UK unlock this potential? To answer this, it is necessary to examine the country’s position across the innovation value chain, highlighting areas of strength, and the practical steps needed to deliver greater impact.

The Current Picture: Strengths in Early Stages of the Innovation ‘Funnel’, but Lagging in Translation

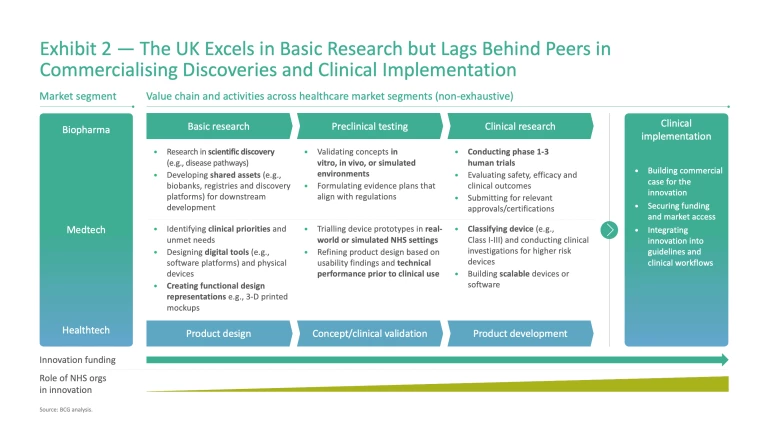

Healthcare innovation in the UK covers a diverse ecosystem spanning biopharma, medtech, and healthtech. Across each sub-sector, innovative technologies and solutions follow a defined approach to progress solutions from basic research or invention through to clinical research and patient impact (Exhibit 2).

There is a strong contrast in performance across this value chain. The UK excels in discovery and early-stage development, underpinned by world-class research institutions and universities. Yet these strengths are not consistently carried through to patient impact — translating research through to clinical trials, scaling innovative technologies and solutions, and delivering patient benefit. Understanding the underlying drivers is essential to identify how to change the picture.

Investment and Funding

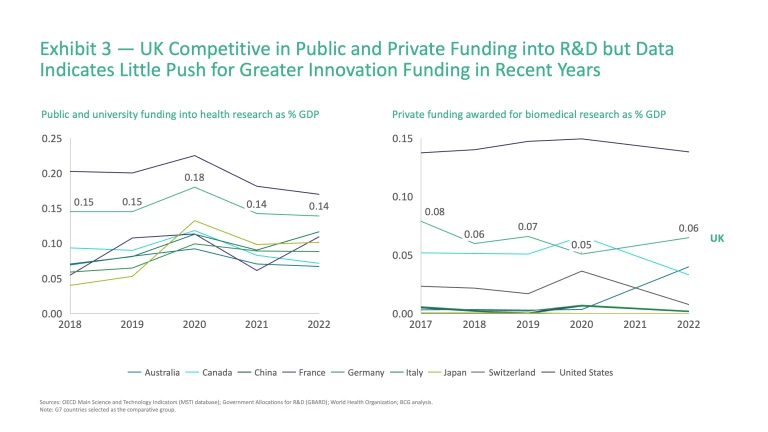

A crucial factor shaping performance across the value chain is the level and mix of public and private investment that supports innovation. As a percentage of GDP, public funding has remained flat since 2018, whilst private investment has fallen by ~5%, leaving the system underpowered for sustained growth (Exhibit 3).

There are nuances to consider in both instances. From a public funding perspective, basic research has historically held the lion’s share of non-commercial health research funding in the UK, ranging from 45% to 52% between 2014 and 2022, surpassing the combined levels of funding for preclinical and clinical research across this period. Despite limited global benchmarks in this area, it is clear that basic research has been the historical funding priority from a non-commercial perspective.

In terms of private funding, an already uninspiring picture seems likely to worsen, owing to several high-profile corporate reversals. In January 2025, AstraZeneca cancelled a planned £450 million expansion of its vaccine manufacturing facility in Speke, Liverpool, citing reduced government support and delays in meeting funding commitments.

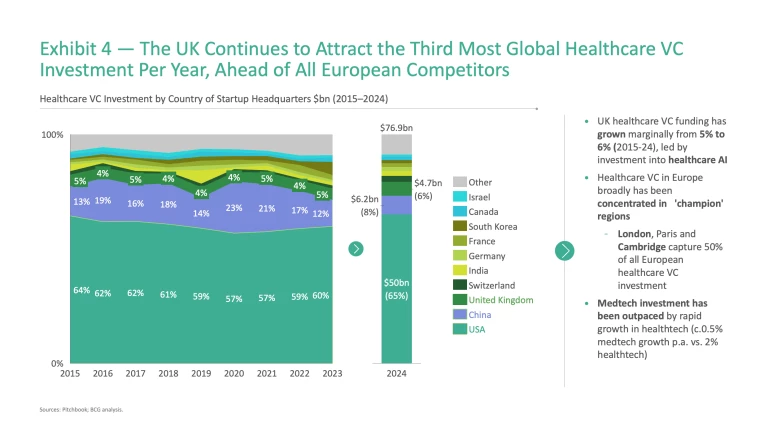

Beyond ‘big pharma’, healthcare venture capital (VC) funding levels would suggest that the UK holds a solid, if unspectacular, position in this area. The UK ranks third globally for annual healthcare VC investment (Exhibit 4), slightly ahead of European competitors, and its share of global healthcare VC has grown from 5% to 6% (2015-24) as China’s momentum has slowed.

As an ‘input’ into the system, funding is one part of the equation; the ambition should be to translate this input into tangible ‘outputs’ across the value chain. Below, we explore this translation to outputs and results in more detail.

Basic Research

For decades, the UK has been globally recognised as a powerhouse in basic medical and life sciences research,

This hypothesis is reflected in the data. The UK maintained its position as the fourth-ranked country worldwide for natural science and healthcare research from 2014 to 2024.

This excellence at the at the top of the innovation funnel underpins a dynamic pipeline of early-stage start-ups. The UK shows strong capacity for generating pre-seed ventures. In 2024, it produced 294 pre-seed healthcare start-ups, representing 56% of the nation’s healthcare total – a higher share than both US and global averages.

Preclinical and Clinical

Three funding trends highlighted above would indicate that the UK is likely to be less productive further along the value chain: the relatively smaller proportion of public funding historically available for preclinical and clinical innovation/research vs. basic research; an increasingly limited private funding landscape; and less competitive investment potential for later-stage ventures.

Again, the data supports this hypothesis. Patent data provides one indicator of how effectively countries turn ideas into market-ready products. Compared to peers, the number of medtech patent applications filed in the European Union with the UK as the applicant’s country of origin is significantly lower: Switzerland produces 18 times more patent applications per million of the population (likely due to favourable IP and R&D tax structures)

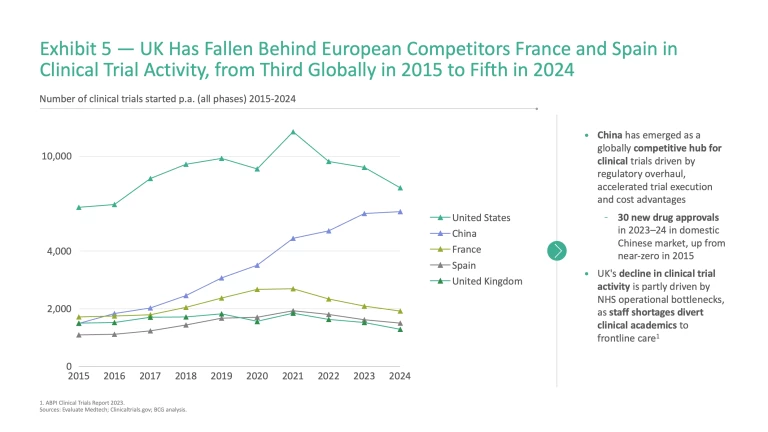

Clinical trial activity further highlights the UK’s difficulties in driving discoveries downstream. The UK has slipped from third in clinical trial activity globally in 2015 to fifth in 2024, overtaken by France and Spain (Exhibit 5).

Even when new discoveries are developed and patented, they do not necessarily translate into patient access in the UK. Between 2020 and 2023, only 65% of patient-approved EU medicines were available to patients in England, compared to 90% in Germany and 83% in Italy.

It is clear that the UK is not as competitive or successful in translating scientific and innovative breakthroughs to patient impact. This represents significant potential that is being left unrealised.

The Case for Investment in Translation: A £20 Billion Annual Opportunity

If the UK can strengthen its ability to translate world-class research and early innovation into real-world solutions, the benefits would not only improve patient outcomes and reduce NHS costs but also boost economic productivity. To illustrate the scale of this potential, it is useful to look at examples across condition areas which represent a significant burden to patients, the NHS, and society more broadly.

Emerging Solutions in Four Chronic Condition Areas Exemplify the Potential Value of Innovation

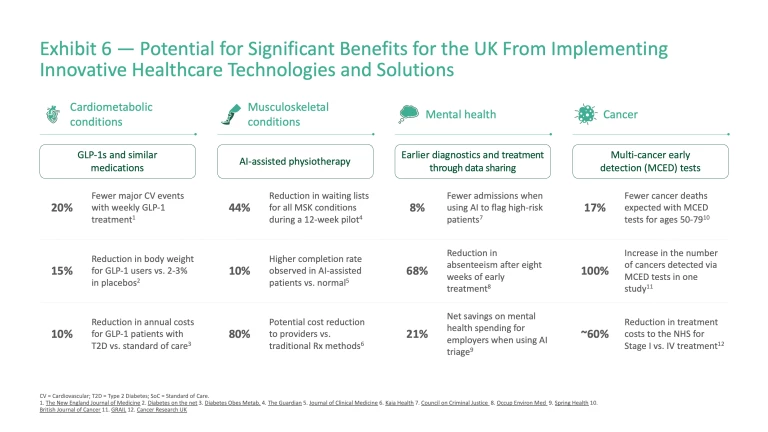

Together, cardiometabolic conditions, musculoskeletal disorders, mental health, and cancer cost the NHS more than £70 billion annually. These conditions significantly reduce productivity, with millions of people either absent from work or living with reduced capacity to contribute to the economy. Across these four condition areas, specific innovations are already emerging that show how outcomes could be transformed if adopted at scale (Exhibit 6).

Cardiometabolic diseases: Cardiometabolic diseases such as diabetes, obesity, and heart disease affect 13.4 million people in the UK

Musculoskeletal (MSK) conditions: Over 10 million people in the UK are self-diagnosed with MSK conditions,

Mental health: The prevalence of mental health conditions is rising sharply. Around one in five UK adults live with a common mental disorder

Cancer: Cancer care costs the NHS ~£19 billion annually,

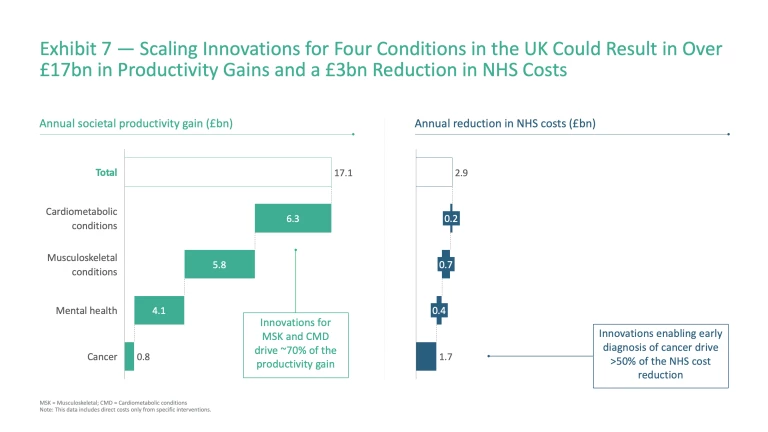

Taken together, scaling innovations across these four chronic conditions could deliver enormous benefit to both society and the NHS, with the potential to generate £17 billion in annual productivity gains through reduced absenteeism, improved presenteeism, and the return of long-term sick workers to the labour force – alongside £3 billion in reduced NHS treatment costs (Exhibit 7).

These examples are not prescriptive recommendations; rather, they serve to illustrate the scale of opportunity that could be unlocked if key innovations are pursued at scale, mirroring similar work done by Frontier Economics

The Current Landscape Hinders the Scaling of Innovative Solutions

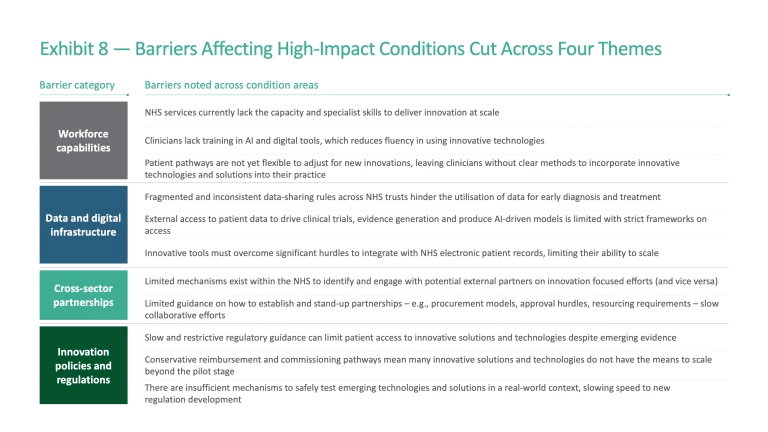

Despite the significant potential to transform outcomes across these condition areas, systemic barriers hinder progress. Whilst these barriers vary by condition, four common themes emerge and highlight that fundamentally the current policy approach inhibits innovation across the system (Exhibit 8):

- Workforce capabilities: Limited workforce capacity and capabilities (e.g., in digital and AI) at the translational interface – where the NHS plays a critical role – constrain the development and delivery of new technologies and solutions.

- Data and digital infrastructure: Inconsistent data-sharing and limited data integration across organisations hinder the effective use of data for insight generation. External innovators also face restricted access to datasets, slowing the generation of real-world evidence and limiting validation of new tools.

- Cross-sector partnerships: Innovators often struggle to engage NHS partners, limiting opportunities for collaboration. Pathways to establish and scale partnerships are unclear, with little guidance on contracting, procurement, or resource-sharing.

- Innovation policies and regulation: Regulatory frameworks remain slow and restrictive in areas, delaying patient access to novel technologies. Incentives at all levels, from the individual to the organisation, are often ineffective, discouraging innovators or making them look elsewhere for opportunities.

Cardiometabolic disease

- Restrictive regulation: Restrictive guidance on the GLP-1 roll-out plan has limited access to narrow patient groups, despite strong evidence of cardiovascular and weight-loss benefits. In the UK, fewer than 50,000 people are projected to start treatment on NHS-funded GLP-1s each year up to 2028;

49 49 Obesity Health Alliance. New Position Statement: A Way Forward for the Treatment of Obesity, 16 October 2024. whereas in the US, 12% of adults have taken a GLP-1 for weight loss or diabetes, in part due to the continual expansion of coverage by agile insurance companies.50 50 Reuters. Roughly 1 in 8 US adults have taken GLP-1 drugs like Wegovy, poll shows, 10 May 2024. - Limited workforce capacity: NHS services currently lack the capacity and specialist skills to deliver GLP-1s at scale. Current GLP-1 weight loss therapy must be delivered at specialist clinics, but these clinics are significantly under-resourced: as early as mid-2024, one in six integrated care boards (ICBs) stopped accepting new weight management patients.

51 51 BMJ Group. Specialist weight-loss services in England unable to keep up with spiralling demand, 27 June 2024. Expanding NHS access will require either changes to NICE guidance or significant investment in specialist capacity. - Weak partnership structures: Providers of GLP-1s (in biopharma and healthtech) have struggled to identify, engage, and scale innovation via NHS partners and, even once a partner is identified, there is often little guidance on how to stand-up these partnerships. For example, one weight management service provider reached out to general practitioners within an integrated care system, rather than engaging through the trust or ICB, causing confusion among providers.

52 52 North West London Integrated Care System. NHS North West London statement on Oviva, 13 November 2024. This lead the ICB to release an announcement stating that they would perform a due diligence process and seek clarification from NHS England.

Musculoskeletal conditions

- Data integration challenges: Applications such as AI-physio apps require significant effort to be integrated with NHS electronic patient records, limiting usability and continuity of care. Companies often need to integrate with different systems across organisations, increasing implementation burden and slowing timelines. As of March 2025, in England, there are 21 different EPR vendors across 214 trusts, highlighting the scale of the implementation challenge.

53 53 6B. List of EPRs in NHS Trusts in England, 25 August 2025. - Regulatory bottlenecks: Slow and restrictive regulatory guidance has limited patient access to AI-assisted physiotherapy tools. UK pathways for software as medical devices are often described as “overly bureaucratic” and slower than international comparators.

54 54 Global Counsel. Unleashing innovation in the NHS: barriers and opportunities for the adoption and uptake of Healthcare technologies, 08 May 2024. In the UK, similar products must meet requirements from four different organisations, often taking over 36 months to achieve clearance for patient use.55 55 VCLS Consulting. Selection of a Notified Body for Medical Device Development, 27 April 2023. ,56 56 NICE. Digital technologies for managing non-specific low back pain: early value assessment, 05 March 2024; NHS England. Digital Technology Assessment Criteria (DTAC). Even after clearance, rollout is slow, with tools often stuck in pilots for years.57 57 Global Counsel. Unleashing innovation in the NHS: barriers and opportunities for the adoption and uptake of Healthcare technologies, 08 May 2024. By contrast, the US FDA offers centralised, faster routes: depending on risk, devices may secure clearance quickly (6-24 months) and then proceed straight to market.58 58 Med Device Online. The U.S., EU, or U.K.: Which Medical Device Market Should I Enter First?, 06 November 2023; Greenlight Guru. The FDA Medical Device Approval Process: Pathways, Timelines, and Tips, 18 November 2024. Manufacturers who pursue a “breakthrough” designation can significantly shorten the approval window, even for complex high-risk devices.59 59 Cardiovascular Business. FDA gives AI-powered blood test for obstructive CAD breakthrough device designation, 13 May 2025. The UK has introduced pilots to simplify this process, such as NICE’s Early Value Assessment60 60 NICE. Early Value Assessment (EVA) for medtech. and the Innovative Devices Access Pathway,61 61 GOV.UK. The Innovative Devices Access Pathway (IDAP), published 19 September 2023 (updated 19 June 2025). a sign of positive change – even if currently at small scale. - Digital skills gaps: Physiotherapists often lack training in digital and AI, particularly in data and machine learning. A 2020 study found that only around 10–15% rated their knowledge of AI systems as “good” or “very good”, while the majority reported limited understanding.

62 62 Tack, Christopher. OpenPhysio Journal. Digital confidence, experience and motivation in physiotherapists: A UK-wide survey, 2020. This indicates that the right systems and tools need to be in place – but also that teams must be empowered and educated to use them effectively.

Mental health

- Fragmented clinical data systems: Ineffective and inconsistent data infrastructure across the NHS makes it difficult to share information within and beyond providers. As of the most recent National Audit Office Report on improving mental health (2023), 5% of NHS providers and up to 33% of non-NHS mental health providers were not submitting records to the Mental Health Services Data Set (MHSDS).

63 63 National Audit Office. Progress in improving mental health services in England, 09 February 2023. The Care Quality Commission has already flagged these types of data silos within the NHS as a “ticking time bomb” for patient care.64 64 Health Service Journal. Patient Safety Watch: Warnings of ‘cover-up culture’ while experts say patient safety ‘requires improvement’, 05 April 2024. - Limited access to data for insight: Similarly, innovators face major challenges in accessing NHS data to test and validate solutions in real-world settings. Restricted access to patient-level datasets slows evidence generation and prevents new technologies from scaling. For example, 73% of mental health researchers reported delays in accessing patient-level data.

65 65 The Lancet. The challenges and opportunities of mental health data sharing in the UK, June 2021. Without more reliable access, promising tools and AI models cannot be validated effectively. - Digital skills gaps: Clinicians lack training in AI and digital tools, which reduces confidence in the use of predictive technologies for mental health care. Similar to the case with physiotherapists, only 29% of doctors have used AI in any form during their practice within the last year, with 70% of doctors from the study highlighting that they have not received adequate training for using AI in their work.

66 66 The Alan Turing Institute. Majority of doctors using AI are optimistic about its benefits, 23 October 2024.

Cancer

- Weak partnership structures: MCED test developers have encountered barriers in forging partnerships with the NHS. To date, the Galleri blood test developed by GRAIL is the only MCED to secure a large NHS partnership, while other MCED companies like Freenome or Exact Sciences’ Thrive have not launched comparable NHS partnerships – indicating a high barrier to entry into the UK market. MCED developers face an uphill battle to get “through the door” with the NHS unless they bring both a mature technology and the funding to support large-scale evaluation (GRAIL, for example, fully backed a £150 million three-year trial itself).

67 67 BMJ Group. New evidence casts doubt on a much-hyped blood test for early cancer detection, 08 August 2024. - Conservative evaluation hurdles: The UK demands high levels of clinical evidence and lengthy evaluation before adopting new technologies. On the surface, this could be interpreted as a positive, but international examples demonstrate there may be approaches that expedite access to effective technologies and solutions without compromising safety. In the US, the Galleri blood test was introduced clinically in 2024

68 68 American Cancer Society. Multi-cancer Early Detection (MCED) Tests, no date. while its PATHFINDER trials were still ongoing,69 69 OncLive. PATHFINDER 2 Trial Releases Positive Topline Data for Multicancer Early Detection Test, 19 June 2025. enabling real-world data collection ahead of FDA premarket approval (expected in 2026).70 70 OncLive. PATHFINDER 2 Trial Releases Positive Topline Data for Multicancer Early Detection Test, 19 June 2025. Unlike the US, the NHS will likely wait until the trial’s final year (2026) before even considering patient access.71 71 NHS England. An updated on the ongoing NHS-Galleri trial, 29 May 2024. While this cautious approach minimises risks, it discourages companies from making the UK an early destination for innovative trials. - Unclear evaluation frameworks: Currently there is no clear methodology to assess the cost-effectiveness of these solutions,

72 72 UK National Screening Commitee. UK NSC’s multi-layered approach to understanding multi-cancer detection tests, 12 July 2024. which both slows the approval process (as with clinical evidence challenges) and prevents innovators from designing solutions aligned with existing frameworks.

How To Succeed: Where To Focus To Overcome Critical Barriers to Innovation

Addressing the barriers noted above will be essential if the UK is to translate its scientific and early-stage strengths into real-world impact, by ensuring that innovative solutions and technologies can move along the value chain effectively. Success will require targeted action in three areas:

- Strengthen the NHS as an innovation platform

- Facilitate partnerships and cross-sector collaboration

- Incentivise healthcare innovation with effective policy and regulation.

International experience shows that progress is possible, and the UK can learn from these examples to shape its own path.

1. Strengthen the NHS as an Innovation Platform

To serve as a wellspring for innovation, it is essential for the NHS to define a clear vision and strategy for innovation, enable the workforce and unlock the potential of data.

Set a strategic framework to drive a pipeline from innovation to impact

Solution: The NHS must treat innovation as a core strategic priority. NHSE and DHSC have central roles to play in defining and coordinating a national innovation strategy, by setting strategic priorities which are relevant across organisations to allow impact at scale, and by ensuring protected, ring-fenced innovation funding to ensure that initiatives do not compromise financial or operational sustainability.

Closer to the coalface, establishing pathways for designing, testing, and scaling innovative solutions is critical. Coordinating organisations such as the University Hospital Association could support trusts to drive a consistent approach across university hospitals, enhancing these organisations’ roles as test beds for innovation. Establishing a well-defined approach can provide innovators with clarity on the pathway from funding to pilot to broader roll-out, and help trusts adopt a structured approach to understanding value and impact.

Best practice – National University Health System, Singapore: Singapore’s National University Health System (NUHS) Centre for Innovation in Healthcare shows how innovation can be embedded into long-term strategy. Its Practice Change Innovations Programme aims to deliver six practice-changing innovations by 2030. The programme follows a clear framework: upfront ambition setting, expert evaluation, challenge mapping, and milestone-driven plans, with each step supported by an international expert panel and a tiered funding system. As of April 2025, NUHS has nine targeted programmes receiving multi-year support and one under provisional review.

Best practice – Intermountain Health, USA: Similarly in the US, Intermountain Health, a not-for-profit healthcare system, has set a clear innovation strategy and process through its investment and innovation arm, Intermountain Ventures. Intermountain Ventures has a three-step approach to investment: evaluation of the solution including a pilot to assess on-the-ground production, targeted investment, and dedicated implementation support.

Enable the workforce

Solution: To drive innovation at scale, the NHS needs a workforce with both the capability and the capacity to innovate. This means upskilling clinicians with digital and AI skills and embedding innovation into career pathways by giving staff dedicated time, built into job plans, particularly at university hospitals.

Best practice – Digital Health Agency, Australia: Australia has taken a structured approach to building digital and AI skills within its health workforce. The Australian Digital Health Agency published a National Digital Health Workforce and Education Roadmap in 2019–20, followed by a seven-year Digital Health Capability Action Plan released earlier this year.

Best practice – Alder Hey Children’s Hospital, UK: The UK has promising but small-scale equivalents. The Alder Hey Children’s Hospital NHS Foundation Trust provides dedicated time for staff to pursue innovation,

Streamline data integration and sharing to unlock insight and value

Solution: Data is the lifeblood of innovation, yet access and sharing remain challenging. Realising its potential requires two shifts: improving how information flows within the NHS so that clinicians and researchers can seamlessly access and use data across settings; and enabling external access and interoperability so innovators can safely generate evidence and link new tools with NHS systems.

Initiatives such as the Federated Data Platform (FDP) and Secure Data Environments (SDE) aim to address these challenges and, earlier this year, Wellcome and the UK government announced the establishment of the Health Data Research Service (HDRS), a single secure gateway to health and care data within the UK. These efforts are at different stages of maturity and development – with the HDRS particularly nascent – but they indicate that the UK is moving in the right direction.

Momentum exists behind these systems, but driving effective adoption and deployment has been significantly challenging to date. As an example, the Chief Data and Analytical Officer Network recently highlighted several concerns with the deployment of the FDP: limited integration of data (both within NHS data sources and across broader public service data sources), concerns around data quality and usability, and a perceived imposition of specific tools/modules,

Best practice – Medical Informatics Initiative, Germany: In Germany, the Medical Informatics Initiative (MII) has linked all university hospitals through interoperable data integration centres, merging clinical and research records for secure, federated analysis.

2. Facilitate Partnerships and Cross-Sector Collaboration

Strengthening the NHS as an innovation platform is a necessary foundation, but it will not be sufficient on its own. Unlocking the full value of innovation requires stronger collaboration between the NHS, industry, and academia. International models show what is possible, and the UK already has pockets of success that could be expanded nationally.

Establish single points of contact to coordinate translational partnerships

Solution: Accelerating partnership formation requires clear and accessible coordination points with the NHS. In some cases, this may be through physical innovation zones or campuses, whilst across local, regional, and national levels, effective coordination can be achieved through digital platforms that provide visibility into opportunities, pathways, and contacts. These coordination points need to be clearly integrated within the NHS, rather than arms-length bodies that operate independently. This is vital if these hubs are to not only attract funding and start-ups, but also deliver tangible impact to patients.

Best practice – Biopolis, Singapore: Biopolis was developed as a national start-up/private sector R&D collaboration. Since opening in 2003, it has grown into a purpose-built biomedical campus housing research institutes, biopharma and biotech companies, and shared facilities to foster collaboration.

Best practice – Trial Nation, Denmark: An example of similar efforts comes from Denmark’s Trial Nation initiative, a public-private partnership established in 2018 which acts as a single coordination point for companies, patient organisations, and clinical researchers. All university hospitals in Denmark participate, with Trial Nation supporting 40+ clinical trial units.

In the UK, Health Innovation Networks have seen a degree of success at a regional level. A well-known example, Health Innovation Manchester (HInM), has effectively leveraged physical innovation districts such as CityLabs

Moving forward, NSHE and DHSC could continue to double-down support for regional and local hubs to incentivise grassroots innovation, building on the government’s Life Sciences Sector Plan and the creation of Health Innovation Zones. These initiatives, if effectively integrated with care delivery organisations across the NHS, could help provide the same kind of national coordination and long-term focus that has underpinned international successes.

Supercharge coordination points with a diversity of funding and expertise

Solution: Coordination hubs are far more effective when they attract a mix of partners who can contribute not just funding but also the right expertise to scale innovation. Private sector investors and venture partners often bring additional rigour, experience in growing companies/platforms, and international networks, while the NHS provides access to clinicians, patients, and data, as well as routes to adoption. Blending these perspectives helps move promising technologies beyond pilot projects into wider clinical use.

Best practice – Mayo Clinic, USA: Mayo Clinic in the US has curated this blend through its Innovation Exchange, launched in 2019. Mayo provides innovators with access to clinicians, de-identified patient data, and regulatory know-how. For start-ups, this provides a trusted environment to test and refine products, while also connecting them with investors and funding pathways. For Mayo, the Exchange offers early sight of new technologies, opportunities to shape solutions to clinical needs, and the potential for financial returns through licensing or partnerships. A key success factor for the Innovation Exchange has been external funding sources – in June 2025, Mayo Clinic announced a $50 million gift to accelerate innovation through the exchange. These efforts have results in considerable impact: one company, Neuroglee Therapeutics, co-developed a digital Alzheimer’s treatment through the Exchange and subsequently secured $10 million in Series A funding,

In the UK, Guy's and St Thomas' NHS Foundation Trust and King’s College Hospital NHS Foundation Trust have partnered with leading venture investors such as General Catalyst and Speedinvest to launch Meridian Health Ventures, the first-NHS anchored venture capital fund.

3. Incentivise Healthcare Innovation With Effective Policy and Regulation

The third priority should be the creation of a regulatory and policy environment that shifts the emphasis away from policing innovation to safely enabling it. Current approaches are often too slow or complex, preventing promising solutions from reaching patients quickly. Three areas stand out for action.

Strengthen incentives for individuals and organisations

Solution: Strengthening incentives is essential to ensure that clinicians, trusts, and industry partners are motivated to engage in innovation. This requires a mix of measures, for example: trusts and university hospitals could set fair IP frameworks that reward inventors, government can use the tax system to offset the financial risks of innovation through R&D tax credits, and co-investment models can be developed in which public and private actors share both the costs of developing new solutions and the returns when they succeed. Together, these incentives can create a system where individuals and organisations see clear value in supporting innovation.

Best practice – Boston Children’s Hospital, USA: Intellectual property is a powerful lever. Boston Children’s Hospital shows how clear policies can incentivise innovative behaviour. After covering patenting and other expenses, it distributes licensing revenue so that inventors receive 30% personally, with an additional 25% directed to their department. This ensures that frontline staff clearly benefit, creating a strong incentive to take ideas forward. The result has been a steady flow of spinouts, from digital platforms like Circulation to diagnostic tools such as Rebion.

The tax system offers another lever: the UK still offers a relatively strong regime for R&D tax relief, but its edge is weakening. As it stands, loss-making, R&D-intensive SMEs in life sciences can claim back around 27% of qualifying spend as a cash credit under the Enhanced R&D Intensives Support scheme.

Another lever to incentivise innovation is co-investment, where public and private actors commit resources together so that the risks and rewards of innovation are shared. The UK can already point to examples: Innovate UK grants often require match-funding from industry, and regional initiatives such as the West Midlands Health Tech Innovation Accelerator have used public money to draw in private capital.

Create the right testing environments

Solution: Creating the right testing environments is essential to accelerate adoption of new technologies. National test beds and sandboxes should be expanded to move beyond small-scale pilots and opened up to a wider range of innovations, generating robust real-world evidence for innovative solutions. By providing a safe but scalable space for experimentation, these environments can speed evaluation, reduce uncertainty and support faster adoption.

Best practice – Licensing Experimentation and Adaptation Programme, Singapore: In 2018, the Singaporean Ministry of Health pioneered the use of regulatory sandboxes to enable innovation in healthcare delivery by launching the Licensing Experimentation and Adaptation Programme (LEAP) as a sandbox for telemedicine services.

The UK has already shown that it sees the benefit of regulatory sandboxes for new innovations: the MHRA notably launched a sandbox for AI-based medical devices called AI Airlock in 2024. However, the UK is only at the cusp of unlocking the power of regulatory sandboxes. AI Airlock is a rare example, which operates at a small scale – only four projects ran over the past financial year.

Streamline regulatory frameworks for innovation

Solution: Finally, streamlining evidence generation is essential to ensure promising innovations reach patients faster and at scale. NICE processes should be updated with rapid reviews, interim guidance, clear decision-making milestones, and – once appropriate and safe – NHSE/DHSC should collaborate with NICE to set ambitious adoption targets so that technologies can be rapidly embedded into clinical pathways. Industry can further support this by providing clear inputs to help shape policies and regulations.

Best practice – Digital Healthcare Act, Germany: Germany has pioneered streamlined regulation for digital health and AI innovation by creating a “fast track” pathway for digital health applications under its 2019 Digital Healthcare Act.

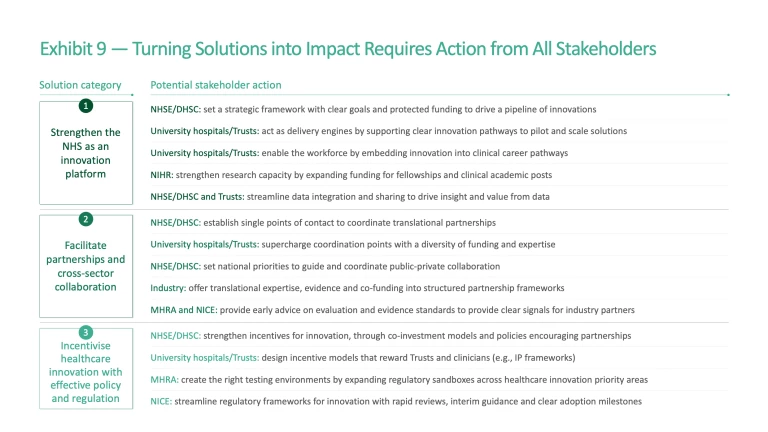

Across all solutions, progress will depend on coordinated action across five groups. The NHSE/DHSC must translate the strong vision outlined in the NHS 10 Year Health Plan into concrete actions by setting long-term priorities, aligning funding and incentives, and creating supportive national policy. NHS bodies at all levels must translate strategy into action, enable their teams, unlock the potential of their data, and establish the best structures to partner effectively. Regulators such as MHRA and NICE must streamline evaluation and approval processes to ensure innovation reaches patients quickly without compromising safety. Finally, industry partners can bring evidence, talent, and investment (Exhibit 9).

Conclusion

The UK stands at a crossroads. It has one of the strongest healthcare research systems in the world, supported by globally leading universities, and significant early-stage investment. Yet this strength is not consistently translated into patient outcomes or system-wide adoption. Clinical trial activity has slipped from third to fifth globally since 2015; only 3% of healthcare start-ups progress to late-stage venture funding; and patients in England typically gain access to 65% of newly-approved EU medicines compared with 90% in Germany. Without reform, these trends risk eroding the UK’s competitiveness and delaying access to life-saving innovation for patients.

The opportunity, however, is clear. Scaling innovations in cardiometabolic disease, musculoskeletal disorders, mental health, and cancer alone have the potential to save the NHS £3 billion annually and deliver £17 billion in workforce productivity gains per year. By 2030, the healthcare sector could contribute a further £78 billion to GDP than currently projected, if the UK catches up with peers, reinforcing the sector’s role as a driver of national prosperity.

Realising this potential requires addressing the four systemic barriers identified in this report: a workforce without the time or pathways to innovate, fragmented and siloed data infrastructure, poorly defined partnership structures, and policies that slow innovation and adoption rather than incentivising it. Tackling these barriers means committing to three priority changes:

- Strengthen the NHS as an innovation platform by setting an ambitious national strategy supported by defined innovation pathways, enabling innovators across the workforce, and implementing effective data sharing and integration systems.

- Facilitate partnerships and cross-sector collaboration by creating accessible coordination hubs which work hand-in-glove with the broader system, and establishing clear frameworks to guide and support these collaborative efforts.

- Incentivise healthcare innovation, by implementing policies which encourage and reward innovators and their parent organisations, creating effective environments for testing, and designing regulation which allows solutions to reach the market faster, without compromising patient safety.

Collaboration is essential to make this a reality. By working together across the NHS, government, regulators, and industry, the UK can establish itself as a world leader in translation to deliver a more sustainable NHS, build a more prosperous economy, and provide better outcomes for patients.

The authors would like to thank Aman Mehan and Paulina Koutroubis for their important contributions to this paper.

Methodology

Methodology: Five-year value creation model

Our methodology combines data on R&D expenditure, sectoral value added, and market-sizing projections to test how different innovation environments could translate into UK growth.

- Scenario 1: Baseline – Growth continues at current rates across biopharma, medtech, and healthtech.

111 111 Because international and UK statistics are reported on a standardised industrial classification basis, we have used proxy sectors to represent our focus areas: C21 for biopharma (manufacture of basic pharmaceutical products and preparations), C26 (and relevant sub-categories) for medtech (computers, electronic and optical products, including medical instruments), and J62–63 for healthtech (computer programming, consultancy, and information services). While these categories do not perfectly map onto healthcare innovation segments, they provide the best available proxies for cross-country comparison and economic modelling. - Scenario 2: Upside – The UK achieves growth in line with peer nations where sustained healthcare R&D investment has translated into tangible GDP gains (e.g., Denmark in pharma, US in medtech), and at the rate of growth expected of peers such as Italy and Spain for healthtech.

112 112 Statista digital health.

Methodology: Productivity uplift and reduced costs resulting from key innovations

Our methodology assesses the impact of innovation on workforce productivity and NHS cost savings. The model comprises separate calculations that estimate effects under a future state where innovations have been fully scaled, based on eligibility criteria and expected uptake.

- Workforce productivity – Productivity gains are estimated from reduced absenteeism and increased presenteeism, as well as faster return to work among people previously out of the labour force due to the targeted condition.

- NHS costs – NHS cost impacts are calculated as the net effect of reduced patient care costs due to the innovation, offset by the additional costs of delivering the innovation itself (e.g., diagnostics, drugs, or treatment).

For more information or questions on these models or broader data analysis, please contact the authors of this report directly.