Trade tensions, geopolitical shocks, and tariffs: all are top of mind for CEOs. But do these alone explain the weakness we’re seeing across key industry sectors? And are CEOs taking the right actions to jump-start performance, resist the shocks, and bolster long-term resilience?

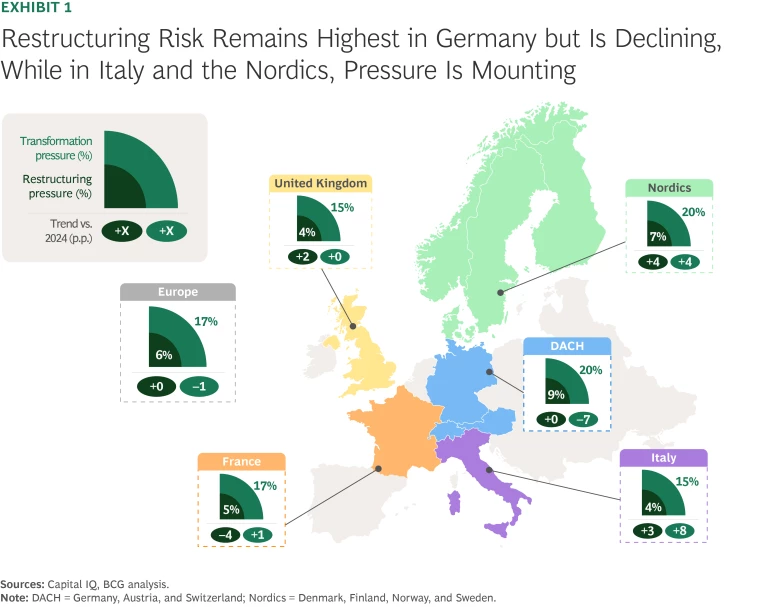

According to BCG’s third annual Transform and Special Situations (TSS) Index covering 1,700 publicly held European companies, 17% are under significant pressure to transform and more than 6% face even more severe pressure, indicating the need to restructure. The companies facing pressure to transform or restructure represent more than $300 billion in GDP and account for 3.5 million jobs—with a sizeable portion of them at risk. (See “About the Study.”)

Which sectors are most vulnerable—and in which regions? In this article, we share analysis from our study and suggest specific measures that CEOs can take to shore up their strength.

About the Study

Using 12 performance and financial stability KPIs (such as EBITDA, operating cash flow, TSR, average broker recommendation, net debt/EBITDA ratio, current asset/liability ratio, leverage ratio, and S&P rating), we developed a score for operational performance (based on P&L analysis) and a score for balance sheet robustness (based on balance sheet analysis and the ability to absorb shocks). We assessed companies’ exposure to macroeconomic risks based on their sector’s vulnerability to tariff impacts and demand-supply dynamics. These assessments were based on targeted, in-depth interviews with industry experts. With these two sets of data, we positioned companies on a pressure spectrum.

Restructuring pressure was calculated based primarily on public companies. To estimate the broader impact on GDP and jobs, we extrapolated the findings to the private sector. We did this by applying the share of public companies under restructuring pressure (weighted by revenue) to the total GDP and employment contribution of private companies with more than 250 employees.

The Transformation and Special Situations Index reflects the revenue share of companies showing signs of operational challenges and financial instability relative to the total revenues of all companies under review. Companies were weighted to more accurately reflect their importance and impact in the sample.

Featured Insights: Explore the ideas shaping the future of business

The Big (and Mixed) Picture

Transformation and restructuring pressures are being felt by European businesses across many sectors. We identified the most vulnerable companies based on their financial health and exposure to macroeconomic risks. Those showing early signs of weakening operational performance and stability are deemed in need of transformation, and those demonstrating clear signs of weak or negative performance and undercapitalization require structural remedies.

The Organisation for Economic Co-operation and Development’s business confidence index shows a steep drop this year—as does our sentiment analysis of earnings calls—in large part due to geopolitical uncertainty and ongoing tariff volatility. Trade policy shifts are fueling pricing uncertainty and weakening investor confidence. Disruptions in supply chains, especially for energy and grain, triggered by the Ukraine war are contributing to price spikes and regional instability. The turmoil in the Red Sea is hammering shipping, forcing detours, raising freight costs, and disrupting delivery timelines.

The news isn’t all bad. Across the continent, inflation, interest rates, and GDP are showing modest improvement over last year. Bankruptcy rates, although still above pre-COVID levels, are stabilizing: up 10% in 2024 compared with 28% in 2023.

Nonetheless, while stress levels are down slightly from last year, macro risks such as tariffs are exacerbating existing financial vulnerabilities. Importantly, not enough CEOs are focusing on shoring up company fundamentals.

Which Countries Are Most at Risk, and Why?

Our first-level analysis explored the overall financial health of Europe’s leading economies: the UK, France, Germany (along with Austria and Switzerland), the Nordic countries, and Italy. This country view highlights the impact of sectors that contribute predominantly to each nation’s GDP and employment—as well as those sectors that rely heavily on exports or consumer spending. (See Exhibit 1.)

Germany faces the most elevated restructuring risk and the second-highest transformation pressures in Europe. Although pressure has eased slightly over the past year, due to signs of recovery in Industrials and Transportation & Logistics, current pressures are most acute in Consumer & Retail, Chemicals, and Automotive. The companies in question represent 2.2 million jobs under pressure, a reflection of the outsized role Automotive plays in the nation’s economy. The output potentially at risk amounts to more than one-third of the total $300 billion-plus in GDP at risk in Europe.

The UK and France, on the other hand, are stabilizing overall. Relative to the European countries, the UK shows the least restructuring pressure, although that pressure has increased since 2024. Real Estate’s solid improvement is in large part responsible for the easing of overall transformation pressure. In France, transformation pressure remains steady, mostly driven by Transportation & Logistics and Automotive. De-averaging explains the apparent signs of modest recovery in France; namely, the strong performance of Health Care and Consumer & Retail. Still, the volume of jobs under pressure remains worrisome. France faces the second highest number of jobs at risk—489,000—which also accounts for more than one-third of Europe’s total GDP at risk ($115 billion). The impact of political uncertainty on GDP over the next 24 months is also a concern in France.

More concerning are Italy and the Nordics. Both are experiencing heightened transformation and restructuring pressure: Italy, because of Telecommunications, Media & Technology, and the Nordics, due to the Energy sector. In both regions, the depressed performance of large players in these sectors trickles down through their supplier ecosystems.

The Most At-Risk Sectors and the Measures CEOs Can Take

Combining the degree of financial soundness and exposure to macro risks, we identified the most at-risk sectors across Europe.

Consumer & Retail

Some improvement, but pressure lingers—and could swell. Inflation and interest rate pressures have prompted consumers to cut back on discretionary spending, including in such categories as apparel and electronics. Inflation in transportation, warehousing, and labor costs has raised operational costs. And companies are trying to diversify away from Asian suppliers to avoid volatility and shipping delays. Near term, tariffs could affect up to $11 billion in Consumer & Retail output, especially in Germany, the UK, and France.

Four strategies can help Consumer & Retail CEOs build resilience.

- Reshape the portfolio. Focus on profitable growth areas, reduce exposure to underperforming segments, and offer more affordable options for budget-conscious consumers.

- Manage prices and margins. Improve your optimization of promotion and trade spending while continuing to rationalize cost.

- Boost demand generation. Increase marketing ROI by focusing on the most high-impact channels. Innovate with generative AI and AI.

- Get serious about sustainability. Integrate consumers’ sustainability requirements into products and communicate green benefits to attract the environmentally conscious.

Automotive

Profits squeezed, sales flat. Car sales in 2024 stagnated across Europe. In Germany and France, they declined slightly amid subsidy cuts and dampened consumer confidence. Input inflation, elevated inventories, and R&D investments for EVs eroded margins. Hybrids gained ground as the shift to EVs accelerated, although growth in battery electric vehicles stalled. Meanwhile, competition from Chinese manufacturers flooded the market in 2024 and continues to be a threat.

Automotive CEOs can build resilience in three ways.

- Respond strategically to Chinese competition. Reassess your cost base and expand your footprint in China to benefit from lower costs. Consider revenue growth via large Asian markets, especially China—including potential M&A opportunities.

- Monetize innovation to stay ahead of disruption. Accelerate EV rollout, adopt circular models, and scale AI-driven platforms to boost demand, cut costs, and capture recurring revenue.

- Improve cash position for sustained R&D investment. Unlock cash tied up in car dealership relationships as much as possible, divest legacy assets, reduce fixed costs, and secure low-cost capital across the value chain.

Chemicals

A tough year that could get tougher. Capacity utilization fell to 74%, well below historical averages, as demand sagged. Energy prices squeezed margins, and tighter regulations—notably REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals)—increased compliance costs substantially, especially for smaller companies. Finally, up to $4 billion of production could be subject to trade tariffs.

With macro risks as the greater threat, Chemicals CEOs can deploy three main strategies.

- Rewire your cost base. Find ways to better insulate your company from volatility, such as shifting to lower-cost, lower-emissions operations or prioritizing automation.

- Localize and decarbonize your supply chains. Consider such measures as establishing regional hubs, nearshoring, or adopting green logistics.

- Finance the green transition smartly. Balance sheet levers like JV structures and green bonds can help fund decarbonization and R&D.

Transportation & Logistics

Despite disruption, freight maintained pricing resilience. Volumes fell in 2024 because of shipping route disruptions and prolonged transit times stemming from geopolitical tensions (the Red Sea, Russia-Ukraine). But ongoing port congestion and the resultant supply chain pressures allowed sea freight companies to price advantageously and preserve margins. The truck driver shortage is worsening, threatening to cripple road freight. In good news for consumer travel, the airline and cruise sectors are now fully recovered from the impact of the pandemic, both slightly surpassing 2019 levels. Tourism revenues were up nearly 8%, and demand is growing at a robust pace

Transport & Logistics CEOs can implement three measures to bolster protection from macro risks.

- Build resilience into your revenue streams. Revamp pricing models, adapt services (for example, multimodal, warehousing), or expand geographically into growth corridors. Any or all such measures can offset tariff and demand shocks.

- Simplify and modernize your cost base. There are many ways to accomplish this: digitize core operations (like routing), automate terminals and warehouses, and streamline processes, to name a few.

- Decarbonize. Shift to low-emission fuels, electrify short-haul fleets, and prepare for carbon pricing.

Seven Vital Steps for All CEOs, Regardless of Sector

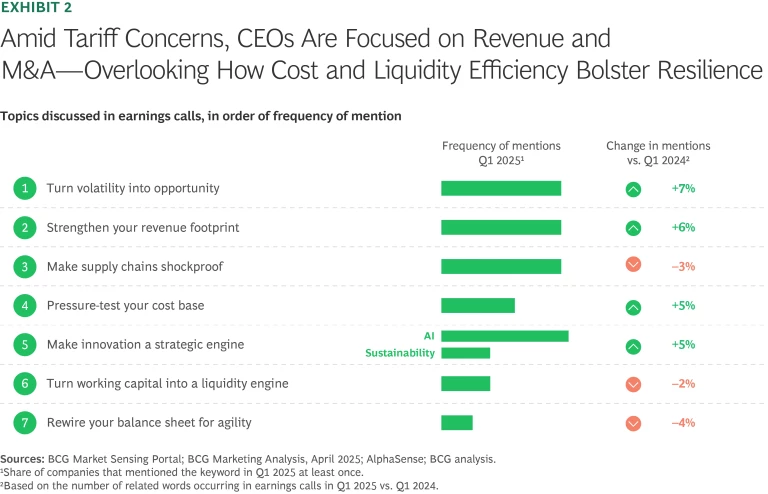

Clearly, many CEOs are not putting their attention where it needs to be. From our AI-enabled earnings calls analysis, we know that most CEOs and CFOs are preoccupied with top-line levers: M&A, market opportunity, and revenues. Amid tariff uncertainty, this makes sense. Other leaders think resilience is chiefly a matter of cost-cutting and innovation.

All too often, the balance sheet is overlooked. Attention to balance sheet items and to turning working capital into liquidity has declined since Q1 2024. This is not the case in Energy, Industrials, Automotive, and Real Estate—not surprising, given these sectors’ capital intensiveness. (See Exhibit 2.)

To fortify their businesses and approach 2026 on a stronger footing, CEOs need to leverage the full toolkit of transformation levers. Consider these pivotal steps:

- Turn volatility into opportunity. Instability is unleashing new demand and M&A opportunities. Act fast to capture the advantage.

- Strengthen your revenue footprint. Proactively build tariff-resilient revenues by revamping pricing, adapting products, and shifting market focus wherever possible.

- Make supply chains shockproof. Diversify suppliers across regions to reduce exposure to tariffs, disruptions, and political risk.

- Pressure-test your cost base. Identify three to five high-impact levers (for example, digitizing and automating processes and streamlining sourcing) to protect margins before volatility bites harder.

- Make innovation a strategic engine. Focus investments where innovation (like AI) will drive measurable results. Innovation must fuel core growth, competitiveness, and productivity.

- Turn working capital into a liquidity engine. Free-up trapped cash. It’s the lowest-cost funding lever in today’s environment.

- Rewire your balance sheet for agility—now. High funding costs and volatility require leaner, smarter capital structures.

With these actions, leaders can ensure that disruption doesn’t equal destiny—and instead, be the first to capture advantage.

Explore the BCG Transform and Special Situations Index for Countries and Regions

BCG TSS Index: Europe

Download the analysis

BCG TSS Index: UK

Download the analysis

BCG TSS Index: France

Download the analysis

BCG TSS Index: Nordics

Download the analysis

BCG TSS Index: Germany, Austria, Switzerland

BCG TSS Index: Italy

Download the analysis