Automotive OEMs in Europe and North America face a massive challenge: slowing demand for new cars and light trucks has left them with excess production capacity and manufacturing costs that are simply too high. At the same time, new competitors, including many based in China, are able to produce high-quality cars for about one-third the cost, giving them a huge advantage, particularly as consumers in many markets become more price sensitive.

BCG recently analyzed the cost gap between traditional OEMs and new entrants and identified four key areas in which the latter have the biggest manufacturing cost advantage. Also, in partnership with Automotive News, we surveyed nearly 400 automotive executives and found that some incumbents may be underestimating the need for change. (See “Auto Executives May Need a Wake-up Call.”) The good news? Our research and work with clients point to specific steps that automotive OEMs can take to close the cost gap and compete more effectively against new competitors.

Auto Executives May Need a Wake-up Call

Some companies are not taking sufficient steps to respond. C-level respondents to our survey said they are acutely aware of the challenges faced by their companies. But two-thirds of respondents overall said they feel very confident or somewhat confident that they can simultaneously manage short-term cost pressures and invest in long-term competitiveness. When asked about the impact of new competition, 24% of European respondents said they are “monitoring closely but have not taken action.” Notably, a significant portion of respondents were midlevel managers, who may not be aware of the challenging financial situation that their company is in. This discrepancy suggests that at most incumbents, any strategies that have been deployed in response to the threat are not well-defined, not well communicated to all levels of the organization, and not broken down into specific, actionable steps.

Cost reduction measures have been marginal and incremental. Companies taking action to reduce costs have focused on continuous improvement. These measures are necessary but not sufficient, yielding efficiency gains of 3% to 7% a year. Instead, companies need to consider larger-scale changes in the production system, increased reliance on automation across processes (which requires larger capex investment), and structural changes to the manufacturing organization, especially in indirect functions.

Incumbents may have unrealistic ROI expectations. Forty-one percent of respondents said they require a payback period of two years or less for new manufacturing investments. Among OEMs, only 13% said they would look beyond five years. Still, many incumbents are cash-strapped right now and may not have the means to invest in new manufacturing technologies—underscoring the challenge of transforming amid near-term financial pressure.

Only about 15% of companies lead across multiple dimensions. We segmented incumbents by their performance in such areas as cost strategies used, technology deployed at scale, and confidence balancing short- and long-term pressures. Our analysis indicated that just 15% are tech-enabled (with leading, advanced technologies at scale), proactive about modernizing, and willing to make long-term investments to transform. Only 9% of European respondents fall into this category, underscoring the need for companies to take more aggressive steps to catch up.

The Cost Gap Is Growing

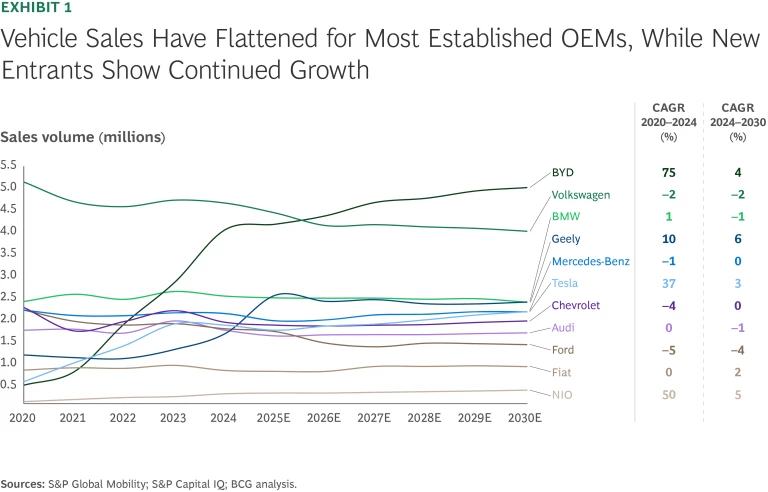

Several factors are increasing the cost gap between established players and new entrants. Global demand for cars and light trucks is limited, with projections of roughly 1% to 1.5% growth through 2035, even as new entrants (many from China) gain market share. At the same time, the shift to electric vehicles has removed some of the engineering advantages that benefit traditional OEMs. Electric-vehicle designs are often less complex, which enables more streamlined manufacturing processes and a greater reliance on automation.

Stay ahead with BCG insights on industrial goods

Chinese manufacturer BYD, for example, has seen sales nearly triple over the past five years. Other manufacturers, by contrast, have seen sales flatline over the same period, and market stalwarts like Ford and Volkswagen have even experienced declines. (See Exhibit 1.)

Operational Advantages Translate to Lower Costs

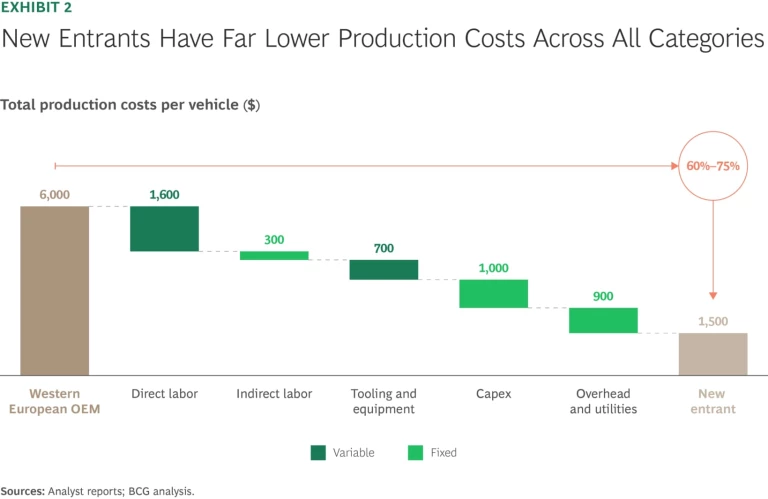

New players have cost advantages across the entire value chain, including engineering, procurement, and supply chain. (See Exhibit 2.) In manufacturing, specifically, cost differences can run as high as 60% to 75%. Direct labor costs account for a significant share of this cost advantage.

It’s not surprising that labor costs are a key advantage for new competitors. Wages for frontline manufacturing employees are simply higher in some markets than in others. Automotive employees in Europe and North America benefit from unions, work councils, and often stricter regulation—all external factors that companies cannot control on their own.

In our conversations with leadership teams at established players, some pointed to these labor cost differences as a reason for inaction. That is a recipe for failure. Companies do have control over those parts of the manufacturing cost difference that are not associated with labor, specifically, automation, tooling, production facilities and equipment, and overhead. These are the areas that they need to understand and prioritize.

Automation. Much of the manufacturing cost differential stems from new players’ greater reliance on automation through simplified production processes. (See “Automation and AI Are a People Challenge, not a Technology Challenge.”) For example, automated press-shop solutions can reduce the need for employees in material handling and end-of-line inspection. Large-scale die casting can replace more than 100 individually pressed parts with a single cast piece in areas such as the vehicle underbody. Tesla has been a frontrunner in this area in recent years, but innovative Chinese OEMs, such as Xiaomi, are now making the technology standard and are increasing the size of such die-casted underbodies, enabling them to remove more stamped parts from the body in white.

Automation and AI Are a People Challenge, not a Technology Challenge

- 40% have deployed automation solutions at scale.

- 30% have implemented AI-supported real-time factory analytics.

- 28% have invested in predictive maintenance systems.

In addition, advanced robotics and automated guided vehicles (AGVs) can handle many of the steps involved in vehicle assembly. Even advanced painting technologies eliminate the need for labor-intensive processes like masking. Because new entrants employ less complex vehicle designs, they can capitalize on all these advantages with faster and more precise automation, modular components, and smarter modularized, prebuilt parts.

Further, automation removes the need for workers in areas like intralogistics, where some Chinese manufacturers have automation rates of 80% to almost 100%. New competitors even have an advantage in AGVs: they use designs that cost less and navigate more efficiently around the plant. These vehicles can operate outside of predefined routes, using lidar or other visual systems to avoid obstacles. Some manufacturers rent AGVs rather than owning them outright, an asset-light approach that allows them to keep capex investments low.

A prerequisite for automating production at scale is the development of an entirely new vehicle platform from scratch. Often, established OEMs have to deal with many constraints driven by their broader product portfolio and sometimes by the various vehicle brands within their automotive group. In addition, the complexity of the offering structure of established OEMs—with a large number of vehicle and option configurations—limits their ability to apply these automation technologies.

Tooling. Many Western OEMs still buy components like stamping dies, injection molds, and casting molds from suppliers in Germany and Japan, often because they are still assumed to be of higher quality. But low-cost countries, especially China, India, and even Vietnam, can now produce competing products of comparable quality at up to 50% lower cost. For example, a large stamping die from a German or Japanese producer typically costs about $1.5 million, whereas a similar die from a Chinese company costs about $800,000 and one from a producer in India or Vietnam can cost even less.

Because many new automotive OEMs are based in Asia, they also benefit from geographic proximity and preferential relationships with these suppliers, leading to faster delivery times for new equipment. They often receive more favorable contract terms as well, with sourcing based on the price of individual purchases rather than long-term agreements.

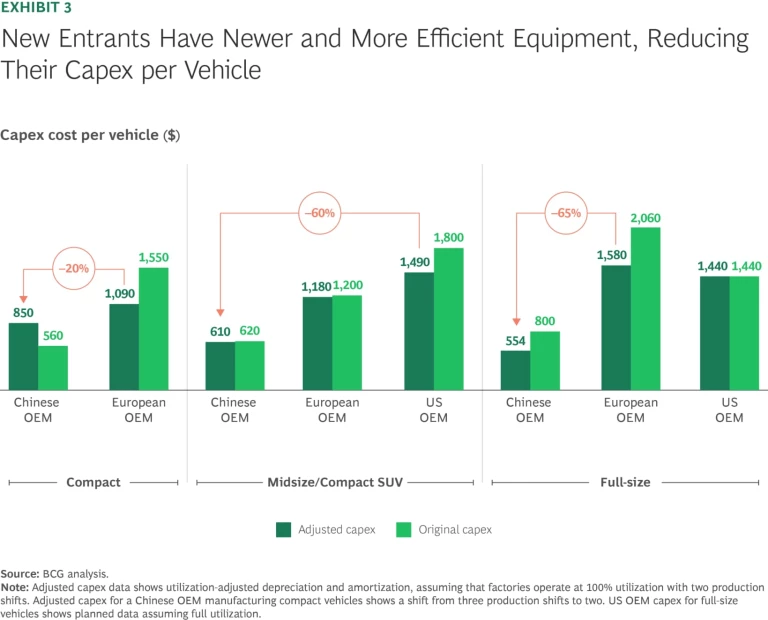

Production Facilities and Equipment. New competitors benefit from purchasing less-expensive machinery and operating it more efficiently. (See Exhibit 3.) These companies have set up their operations relatively recently, with fully connected machinery and digitized processes. Meanwhile, incumbent OEMs are hampered by relatively large production capacity that is now seeing lower utilization rates as demand for their cars and light trucks slows.

When new market entrants build factories, they can apply a greenfield approach, consolidating the entire process—press, body, paint, and assembly—into a compact layout under one roof. That results in faster material flows, reduced intralogistics costs, and fewer maintenance requirements for buildings and infrastructure.

In contrast, incumbents often have modular production facilities with separated shops, leading to longer production times, higher intralogistics and utility costs, and less flexibility if expansion or contraction is necessary. In the aggregate, these differences result in construction costs that are about 30% lower for new entrants.

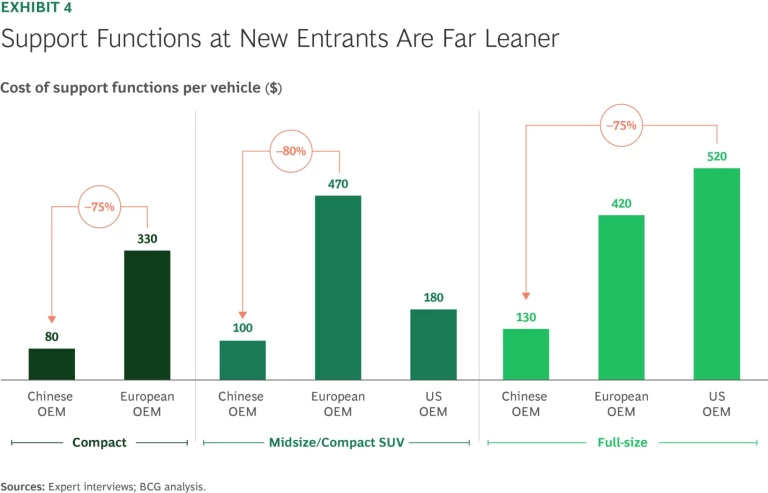

Overhead. Indirect labor is a major source of inefficiency at incumbents—including large numbers of employees in production planning, manufacturing engineering, quality, maintenance, and logistics. New players leverage technology more effectively in these areas. Also, they have leaner organizations with flatter structures. Spans of control can exceed 20 employees in indirect functions. Support functions, too, are set up for efficiency, with smaller teams that capitalize on data-driven approaches and artificial intelligence. (See Exhibit 4.)

How to Close the Cost Gap in Manufacturing

We have identified a number of concrete measures that established OEMs can take to close the manufacturing cost gap and remain competitive with new market entrants. These recommendations apply to manufacturers not only of passenger cars and light trucks but of commercial off-highway vehicles as well, such as those used in mining, energy, construction, and related industries.

Figure out where your organization is falling short. Gain a precise understanding of where the biggest inefficiencies lie within your organization’s manufacturing setup. Benchmark across operational, financial, and personnel KPIs, comparing performance among your own plants and against peer OEMs, including both incumbents and emerging players.

Upgrade to more-efficient equipment. Perform a detailed audit of manufacturing equipment based on age and expected lifespan. Develop a capex roadmap for investments in advanced technologies to improve equipment efficiency and increase automation. Support investment decisions with rigorous business cases. Simultaneously, target high-maintenance or downtime-prone equipment for replacement.

For example, French automotive component supplier Forvia applied this approach, investing to automate logistics, assembly, and quality control, and implementing predictive analytics to optimize performance. The company developed a clear business case for all investment decisions, factoring in reduced labor requirements, increased energy efficiency, and improved throughput.

Switch to lower-cost suppliers, particularly for equipment and tooling. Reassess your supplier portfolio for equipment and tooling. Consider transitioning to lower-cost suppliers in Asia—particularly in China and India—many of which now offer comparable products at a fraction of the cost. Remove any excessive technical specifications and requirements that inhibit sourcing flexibility, while still maintaining critical quality standards. For example, leading OEMs like Mercedes Benz now use manufacturing equipment from Chinese suppliers in their German plants. These suppliers’ prices are estimated to be 30% to 40% lower than those of established European suppliers.

Redesign the organization for efficiency. Redesign all manufacturing and supply chain functions to maximize efficiency and control. Delayer to achieve lean structures that reduce excessive bureaucracy and increase spans of control at each level. Tailor organizational models to account for plant-specific factors such as regional cost structures (especially low- versus high-cost countries), utilized technologies, and size. Assess tasks, roles, and responsibilities across workstreams—and analyze the interfaces between process steps—to determine optimal FTE levels in each function and eliminate structural redundancies.

Reshape the culture. Many established OEMs have deeply entrenched cultures, which can be a strength in stable markets but make them resistant to change in shifting markets. Foster a culture that embraces transformation and operational discipline. Clearly define the target state and develop a communication plan with consistent messaging across all levels of the organization. Rethink incentives, performance assessments, and other people elements to create a culture of performance, efficiency, and accountability grounded in measurable outcomes that support long-term business goals.

Be relentless about shrinking the production footprint. Objectively analyze the production network. In cases where production capacity outstrips realistic demand forecasts, consider divesting some facilities and potentially moving some capacity to lower-cost countries. Shifting dynamics in other industries may create a wider pool of buyers; for example, the defense industry in Europe is looking to increase production and has a growing need for factories that can be easily converted to meet its goals.

Plan and develop the next generation of vehicle platforms. To achieve a step change in production costs and efficiency, incumbents need to redesign vehicle platforms from scratch. This involves not only body-shop technologies like gigacasting but also major changes in how systems are controlled across the vehicle. Zonal architectures allow cars to operate with far fewer electronic control units than is typical in many of today’s cars, dramatically reducing complexity and cost in both engineering and manufacturing. Further, reducing the number of vehicle variants will increase efficiency in each manufacturing process. Fewer part variants and a smarter bundling of high-demand and profitable vehicle options lead to a better-balanced assembly line and more streamlined content per workstation. Volkswagen, for example, has instituted a project it calls Gamechanger to redevelop its vehicle platforms—and thus simplify production processes. The company projects dramatically lower manufacturing costs through these changes.

Established automakers are at a serious cost disadvantage with new competitors, but they can take control of their future. Those that stick with outdated manufacturing practices will continue to lose ground. Conversely, those that take an objective view of their position, understand the threat, and implement the steps we recommend will close the cost gap and position themselves to compete more effectively.