Image generated by AI.

This report is a joint initiative of Boston Consulting Group and OpenAI.

The days of fragmented, opaque, and frustrating car-buying journeys are numbered. Use of GenAI by consumers has already forced companies in many sectors to play catch-up—and the auto industry will be no exception. GenAI has the potential to transform the auto buying experience. As a conversational, all-knowing advisor, the technology will fundamentally reconfigure how consumers discover, evaluate, and purchase cars, turning complex, multi-step journeys into seamless, human-centered experiences.

For automotive players, speed is of the essence. As our recent comprehensive report on the rise of AI-enabled car sales argues, the leaders will be those that act now to build the infrastructure, partnerships, and organizational capabilities to lead in an AI-first future. And the impact reaches beyond OEMs—dealers, car marketplaces, financial institutions, and other automotive players must also adapt to this AI-first future.

Stay ahead with BCG insights on the automotive industry

Transforming the Consumer Experience

GenAI has already begun transforming the travel industry. Booking travel is a complex process that must consider a wide range of personal preferences, needs, and constraints. Now consumers in large numbers are navigating the booking process using GenAI-enabled guides that are ready to understand their full story and help sort through endless choices in seconds, with infinite patience.

The lessons for the auto industry are clear. Today, there is no neutral, all-knowing, multidimensional advisor that consumers can consult on the purchase of their next car. This makes the car-buying journey well-positioned for transformation by GenAI—both in terms of user experience and commercial impact. Buyers can receive unbiased recommendations across brands, informed by real-time inventory, prices, discounts, resale values, usage costs, and other relevant data. If offered by a truly independent and trusted third party, this brand-agnostic capability could flip the traditional brand-focused sales model, shifting power to the consumer and challenging OEMs to compete more strongly on relevance and value.

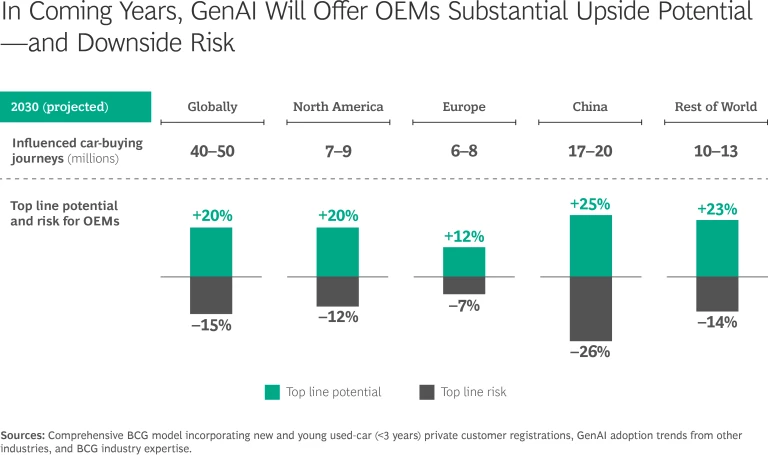

The effects of this transformation will become economically relevant very soon. We estimate that by 2030, more than 40 million car-buying journeys will be meaningfully influenced by GenAI every year. For fast-moving OEMs, this shift presents a potential top line increase of up to 20%. But OEMs that fail to adapt quickly risk losing up to 15% of their top line, primarily due to customer attrition and a downward price spiral. (See the exhibit.)

How to Buy Cars in the Future

GenAI will transform the two critical stages in the car-buying process.

The Product Advisor. The first stage in the car-buying journey involves deciding what brand and model to buy and how to configure it—a complex and challenging process. GenAI allows buyers to narrow the choices based on any number of factors, including stated preferences, life circumstances, prior driving patterns, opinions of friends, and possibly even additional data sources such as telemetry data from their current car.

The Deal Finder. According to BCG research, a significant source of consumers’ dissatisfaction with the car-buying journey is having to find the best deal on offer for their car of choice. Simply comparing the price of the exact same vehicle if purchased outright, financed, or leased through either the automotive OEM’s captive bank or an external provider can be overwhelming. However, GenAI can assess both quantitative elements, such as total cost of ownership, and qualitative elements, such as financing preferences, to recommend not just where to buy, but also when and how.

Three Strategic Priorities for OEMs

Original equipment manufacturers (OEMs) must decide how they want to be present in these new interfaces. We see three strategic priorities emerging. How OEMs emphasize each one may vary, but they are not mutually exclusive; OEMs should actively pursue all three in parallel.

- Enhance visibility in AI assistants. OEMs should ensure that their brands and models show up prominently, accurately, and attractively in generic GenAI-powered chatbots. To stay relevant and show up in these conversations, generative experience optimization (GXO) becomes critical.

- Partner with multi-brand car marketplaces. Online comparison marketplaces will start to use GenAI to offer multi-brand car purchasing advice. OEMs should invest in strategic partnerships with these players to ensure they are not outmaneuvered by their competition.

- Build their own branded assistant. Leading OEMs will choose to integrate GenAI into their interfaces to build their own, one-of-a-kind, hyper-personalized car-buying experience for their customers. OEMs should leverage all the data they have about prospective buyers, including prior configurations, financial services contracts, car and app usage patterns, and even car telemetry data. This approach enables them to fully own the customer relationship, provide a seamless, personalized experience, and even upsell customers to add-on features and services.

The Role of Other Industry Players

OEMs won’t be the only ones affected by the GenAI transformation in car sales. Other players, too, must prepare for how GenAI will disrupt their business models.

- Online car marketplaces must become GenAI-powered advisors, offering seamless, end-to-end, GenAI-native consumer journeys while maintaining their perceived independence as a trusted, objective advisor.

- Dealerships will need to evolve from gatekeepers of product information and relying on the best pricing deals to become physical, on-the-ground experience centers—the “trusted closer.”

- Financial institutions and insurers must prepare for tighter integration with OEMs’ AI interfaces, providing consumers personalized financing and coverage offers as part of a seamless, GenAI-powered user experience.

Embracing the AI-First Future for Car Sales

The rise of GenAI represents a transformative shift in automotive marketing and sales. It is not an incremental improvement; it’s a fundamental reconfiguration of how consumers discover, evaluate, and experience car purchases. The winners will be those who act now—building the infrastructure, partnerships, and organizational capabilities to lead in the AI-first future of car buying.

This publication was made possible through the valuable contributions and insights of several colleagues. We would like to extend our special thanks to Julien Bert (BCG), Robert Derow (BCG), Christoph Heuser (BCG), Eric Jesse (BCG), Dan Sack (BCG), Jonas Hiltrop (BCG), Amir Kolton (BCG), Manuel Diehn (BCG), Julian Feldhäuser (BCG), Emily Kos (BCG), and Marc Montanari (OpenAI) for their support, expertise, and thoughtful input throughout the development of this paper.