BCG's Centre for Growth conducts a monthly Consumer Sentiment Snapshot to track public attitudes towards spending habits, disposable income and the UK's economic outlook.

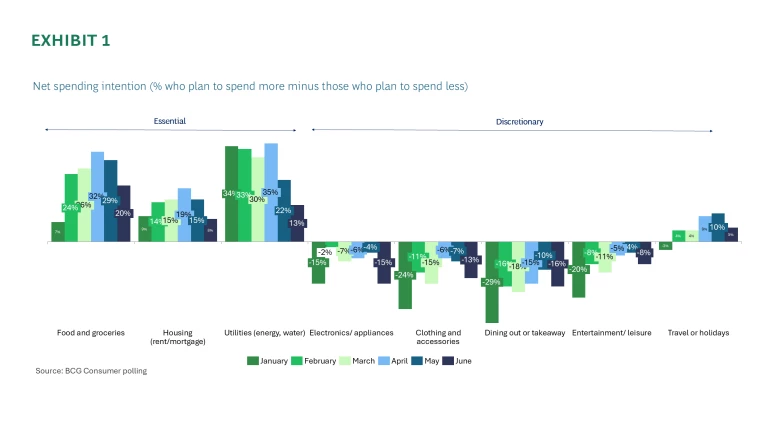

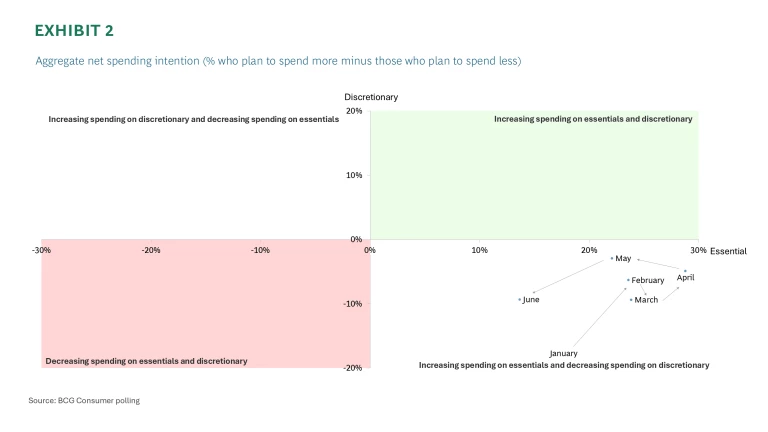

In the third instalment of BCG’s monthly Consumer Sentiment Snapshot, we see the public feeling less optimistic about the direction of the UK economy and their own personal finances than in May. This is despite pressure on essential spending easing this month. While more people expect to increase their spend on essentials than to decrease it, the proportion has declined. Net expected increases in spend have dropped to +20% for food, +8% for housing, and +13% for utilities – the lowest levels since the snapshot began in January 2025.

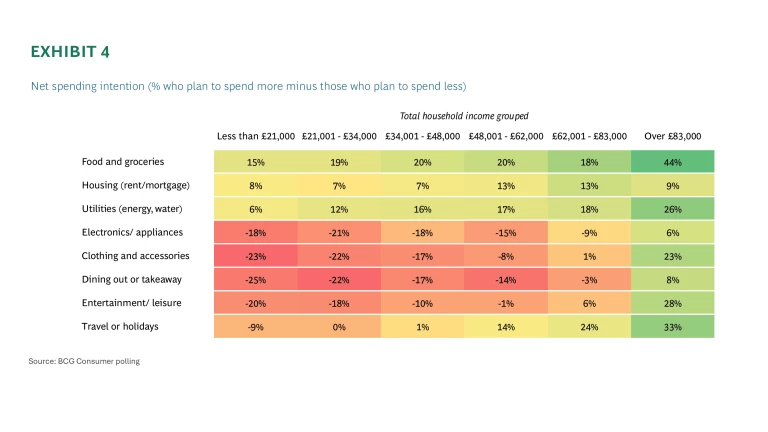

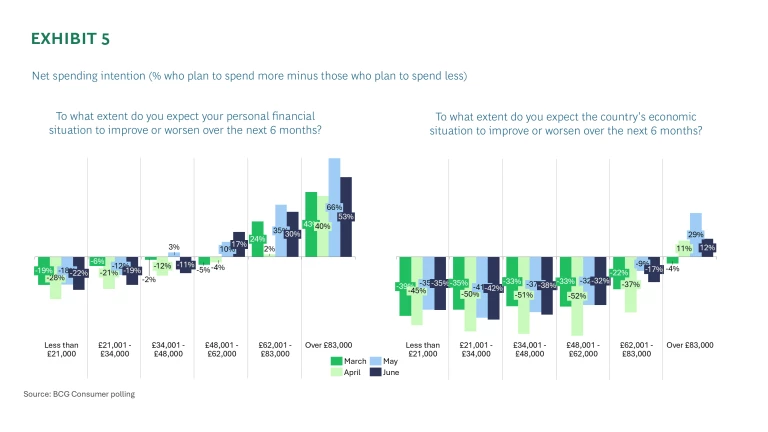

Notably, for the first time, it is higher income individuals who are primarily driving the decline in sentiment, slowing the trend seen in previous months where they have tended to be far more optimistic – there has been a net 13pp fall in respondents expecting their financial situation to improve among those in higher income households earning over £83,000.

The survey of 1,500 UK adults, which was in the field between 30th May and 2nd June, also found discretionary spending has declined to net -9%, reversing three months of gradual improvement and returning to March levels.

Key findings

We have now seen three consecutive months where the net spending intention on essential items (those planning to spend more on essentials over those who plan to spend less) has declined. While the public still generally expects their spending on essential items to increase, the public are starting to feel less pressure from groceries and household bills – notably utility bills where there has been a 9pp fall compared to May - suggesting the cost of essentials may be becoming more manageable.

Despite pressure from essentials easing somewhat, consumers are not directing this to more discretionary spending this month. Discretionary spending intentions have dropped back to March levels (net -9%) after three months of improvement. This appears to be particularly driven by lower spending on electronics, which has fallen 11 percentage points compared to May.

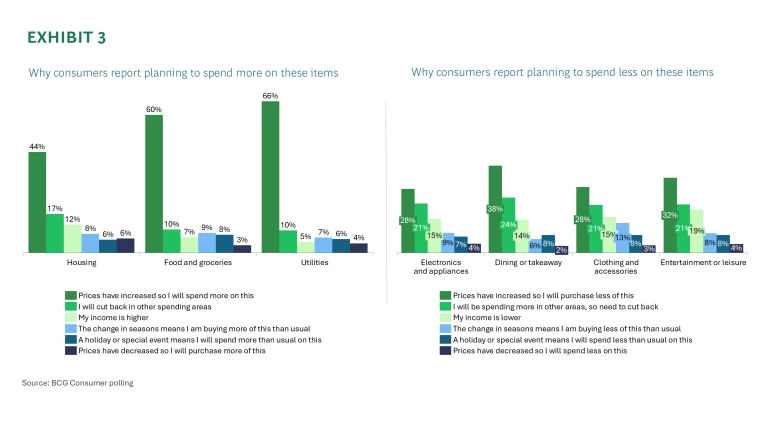

Price increases continue to be the main driver of households spending more on essential items, but there is greater variance on why households plan to spend less on discretionary items. Two thirds of individuals (66%) who say they will spend more on utilities this month view price rises as the reason for this (net +12pp compared to May). Where individuals are cutting back on essentials, price rises continue to be the main driver for this, however there has been an increase in individuals reporting that they will spend less on discretionary items because their income is lower this month.

In line with previous months, higher income households continue to be driving the overall increase in essential spending, but the extent of this has been declining (with a higher share saying they plan to spend less). The share of the wealthiest households who say they are more likely to increase (over decrease) spending on different items has fallen across every category compared to May. Meanwhile lower income households are most likely to cut back on spending on dining out or takeaways, followed by clothing and accessories. The reduced spending on electronics appears to apply to all income groups but is most prominent among the wealthiest households, where net spending has fallen from +24% in May to +6% in June.

After May saw the highest optimism yet, in June the public generally feel more pessimistic about the direction of the country’s and their own finances. The biggest fall has been among those in households earning over £83K, where there has been a net 13pp fall in respondents thinking their personal financial situation will improve. This reflects a general weakening of consumer sentiment across the highest income households.

Raoul Ruparel, Director of BCG’s Centre for Growth, said:

“After signs of improvement last month, consumer sentiment has weakened again – this time led by higher income households, who are typically the most resilient. For the first time this year, they are showing a notable drop in confidence about both their personal finances and the broader economy, and this is reflected in their spending habits.

“Although pressures on essential spending have continued to ease, that relief hasn’t translated into increased discretionary spending. Instead, we’re seeing households across income groups pulling back, particularly on categories like electronics, where even the wealthiest are cutting back sharply.

“The key question is at what point households will feel confident enough to start increasing their spend on more discretionary items, or if lower spending and higher saving rates are here to stay.”

Details on the survey:

These results are from a nationally representative poll of UK adults with a sample size of 1,500. Fieldwork was conducted between the 30th May and 2nd June. The poll results were weighted to the latest UK figures for gender, age, education, and region to ensure overall representativeness.

For further information on the findings, please contact Adam Mawardi