Dealmakers face the most challenging environment for M&A since the financial crisis of 2008–2009. Soaring inflation, rising interest rates, and a looming recession have put an end to the buying spree that followed the lifting of COVID-19 lockdowns.

Although corporate and financial acquirers are exercising greater caution in their pursuit of targets, they have not closed shop. Indeed, the level of M&A activity in 2022 is in line with recent pre-pandemic levels, despite slowing down relative to 2021’s frenzied pace and trending lower throughout the year.

Looking ahead, savvy buyers and sellers will continue to use M&A to create value even in unfavorable conditions. As we previously discussed, downturns can be a good time for deal hunting. In addition to the traditional motivations, sustainability is gaining importance as a reason to acquire or divest businesses.

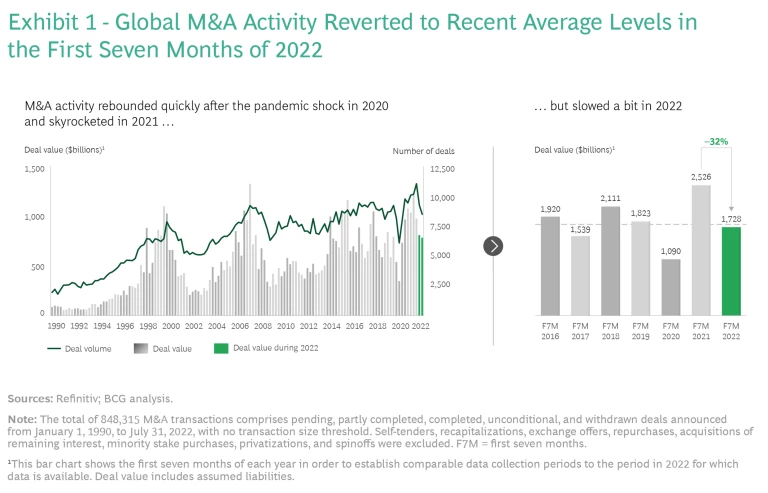

M&A in 2022 Reverts to Historical Averages

So far, M&A activity in 2022 has been close to the recent historical average. (See Exhibit 1.) Through the end of July, companies have announced slightly more than 22,000 deals, with a total value of $1.73 trillion. Although still very active, the M&A market has cooled considerably since 2021: through the first seven months of 2022, deal volume was down 13% compared with the same period in 2021, and deal value fell by 32%.

The reversion toward historical averages follows an exceptionally busy year for dealmaking in 2021. After the disruptions of 2020, the post-pandemic catch-up was in full force last year, as volume reached approximately 40,700 deals—28% higher than in 2020 and 17% higher than in pre-pandemic 2019. Deal value climbed to a staggering $4.3 trillion, 46% higher than in 2020 and 67% higher than in 2019.

Through the end of July 2022, despite a slowdown in the second quarter, the US M&A market was especially active, constituting approximately 30% of global volume and approximately 50% of global value. Activity in the UK was above average. In contrast, the recurrence of COVID-19 lockdowns has depressed M&A activity in China, where dealmaking has not returned to pre-pandemic levels and remains well below the record highs set in 2015.

From a regional perspective, year-to-date market activity in 2022 has been similar to that 2021, when dealmaking rebounded in all regions and almost all countries from pandemic lows. The US was the most active country in 2021, with deal value and volume rising by 88% and 27%, respectively, compared with 2020.

The most active sectors in year-to-date 2022 and in 2021 were technology (especially software and internet services), energy (primarily oil and gas), and health care (led by pharma and biotech). Other active sectors include financial services, real estate, and infrastructure.

In many sectors, geopolitical tensions have, perhaps counterintuitively, promoted higher deal volumes. For example, many companies are seeking to sever their ties to Russia by selling or otherwise transferring their businesses to local investors. And many Russian companies and investors are exiting their investments in Western countries. For instance, Roman Abramovich, a sanctioned Russian oligarch, sold the Chelsea Football Club to a consortium led by American businessman Todd Boehly. The $3.1 billion acquisition price was the highest ever paid for a sports team.

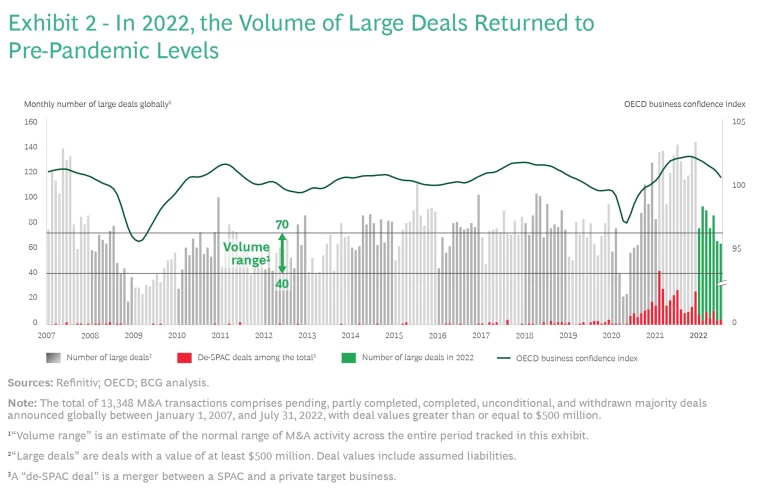

Like overall M&A activity, the number of large deals (deals with a value greater than $500 million) in 2022 has returned to pre-pandemic levels. (See Exhibit 2.) The declining number reflects a drop-off in the general level of business confidence, as well as a decrease in the number of mergers involving special-purpose acquisition companies (SPACs).

The market for megadeals (deals with a value exceeding $10 billion) remains strong. There were 23 in the first six months of 2022, compared with 50 during all of 2021 and 27 during all of 2020. As of September 2022, the following deals were the year’s four largest:

- Microsoft’s acquisition of the gaming company Activision Blizzard, valued at $75.6 billion

- Unilever’s bid for GSK Consumer Healthcare (since withdrawn), valued at $68.4 billion

- Broadcom’s $68.1 billion bid for VMware, a US-based cloud computing and virtualization technology company

- HDFC Bank’s planned acquisition of its biggest shareholder, HDFC Ltd, an Indian mortgage lender, valued at $60.4 billion

In addition, at a slightly lower value level, Elon Musk announced, and then attempted to cancel, the acquisition of Twitter for $41.3 billion via a merger with his newly formed X Holdings company. As we went to press, Musk had proposed going forward with his original offer, but the deal’s fate remained uncertain.

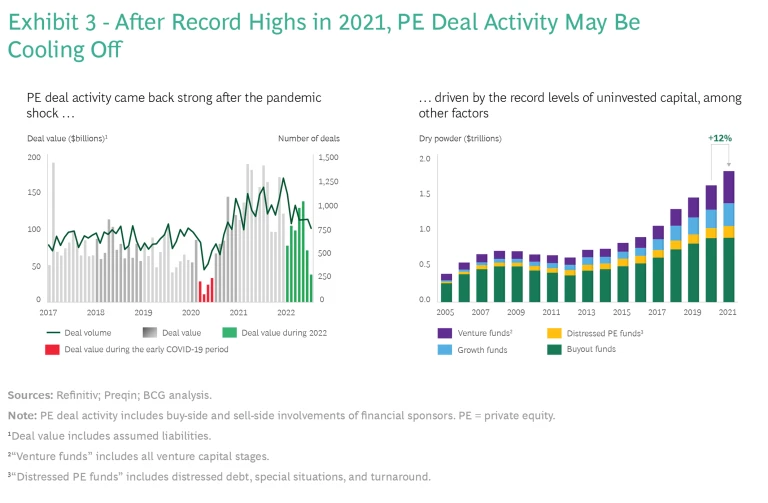

Deal activity by private equity and venture capital funds in 2022 is well below the record highs seen in 2021 but remains above the historical average. The strong performance continues to be fueled by record levels of dry powder (that is, uninvested capital). (See Exhibit 3.) Corporate venture capital (CVC) investments have also declined in 2022, largely because decision makers are exercising greater caution in light of the prevailing uncertainty and the significant decrease in technology companies’ valuations. However, CVC investments still represent approximately one-quarter of the total venture capital invested. Lower technology-company valuations have contributed to the declining number of initial public offerings (IPOs) this year, along with the additional burden of volatility in capital markets.

The number of SPAC IPOs has remained low since dropping sharply in the second quarter of 2021. Given SPACs’ recent extreme underperformance—on average, their share prices have fallen by approximately 70% from their IPO prices—we do not expect a swift turnaround in the number of new SPAC IPOs.

The negative sentiment surrounding SPACs has also led to a decline in the number of “de-SPACs” (that is, mergers between SPACs and target private businesses), which in turn has contributed to the lower number of large mergers in 2022. The two largest SPAC mergers that have occurred since September 2021 were the combinations of Lionheart Acquisition Corporation II with MSP Recovery (valued at $32.5 billion) and of Gores Guggenheim with Polestar Performance (valued at $20.0 billion).

Looking Through Dark Clouds for Rays of Value

Macroeconomic conditions over the next year will likely test the resilience of the M&A market. The persistent drumbeat of bad economic news—related to geopolitical tensions, supply chain disruptions, inflation, and rising interest rates—naturally dampens enthusiasm for dealmaking. Corporate decision makers are taking a more cautious approach to acquisitions and other investments, fearing that revenues will not keep up with rising costs, particularly given the ominous threat of a recession. Furthermore, higher interest rates make deal financing more expensive. And corporate cash holdings have started to shrink, constraining the funds available for acquisitions.

Declining valuation levels, especially for technology companies, have created a gap between sellers’ and buyers’ expectations for deal prices. Although buyers focus on higher financing costs and lower valuations, many sellers continue to base their price expectations on the higher valuation levels of previous years. Historical experience suggests that sellers will need several months to realign their expectations in response to the new reality.

Even in the current environment, however, we see tailwinds and longer-term trends that are conducive to deal activity. For example, because the weakening economy leads companies to focus on balance sheets and the corporate portfolio, executives and board members may seek to sell assets or prepare assets for divestiture via corporate carve-outs. In addition, activist investors continue to pursue agendas that often lead to deals.

Some sectors, such as airlines and tourism, are still experiencing a post-pandemic rebound that could propel M&A activity. Companies emerging from pandemic disruptions in a stronger competitive position may seek to acquire weaker companies or perhaps even engage in large transformational deals that shape the sector’s future. For example, JetBlue Airways outbid Frontier Airlines to acquire Spirit Airlines. If the deal clears regulatory hurdles, the combined company will become the fifth-largest airline in the US. We also expect further consolidation in the technology sector and in consumer products industries such as food and beverages.

Geopolitical tensions could drive dealmaking on both the sell and buy sides. For example, ByteDance, a Chinese company, considered selling the US operations of TikTok because of security concerns raised by the US government. Efforts to secure, diversify, or localize supply chains (including “friend-shoring” to allied countries) could further spur M&A activity. For example, Germany-based Schwarz Group, owner of supermarket chains Lidl and Kaufland, agreed to buy Stora Enso’s Maxau paper production site to secure its supply chain.

The troubling economic news and prevailing uncertainty have not altered companies’ longstanding need to invest in digital capabilities. Acquisitions remain an important way to gain required technology, talent, and capabilities. Valuations in the technology sector have dropped sharply—for example, as of June 30, 2022, the enterprise value-to-sales multiple of the Nasdaq 100 had fallen by 35% from its level a year earlier. The lower valuations could lead to bargain hunting, and even companies that recently had IPOs might become affordable.

Although some companies face cash constraints, private equity firms have ample dry powder to use for acquisitions. Rising interest rates and an internal talent shortage may impede their efforts, but we expect them to adapt quickly. In addition, financial sponsors are increasingly pursuing club deals (that is, forming consortia with other sponsors or companies) and minority investments. They are also on the lookout for attractively priced corporate divestitures.

Moreover, approximately 300 SPACs currently in the market must find a company to merge with. If they fail to merge within the period specified in their governing documents (typically two years), they must repay their investors.

Beyond these traditional headwinds and tailwinds, we anticipate that environmental, societal, and governance (ESG) considerations will motivate an increasing number of deals, as discussed below.

Perspectives on Strategy and Value: Learn how to lead with advantage

A First Look at Green Dealmaking

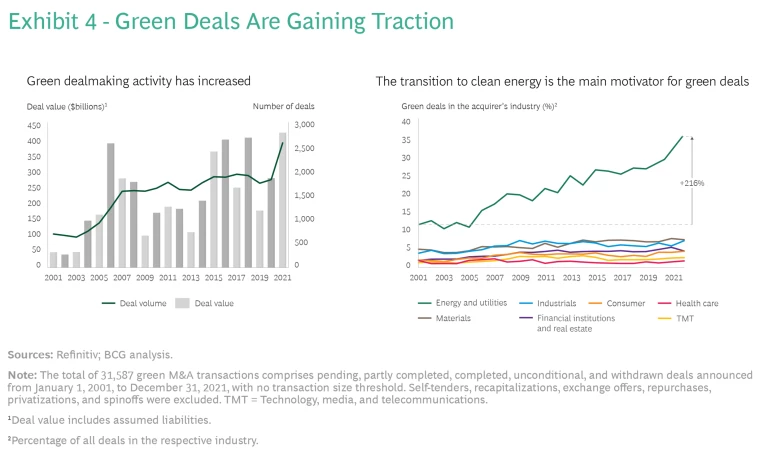

Buyers have traditionally assessed corporate governance and environmental risks before signing a deal. Today’s ESG due diligence provides a more comprehensive view, combining a governance assessment with consideration of environmental and societal issues—and does so with regard to risks as well as opportunities.

In today’s business landscape, the importance of ESG considerations—especially those related to environmental and societal issues—extends well beyond due diligence. Because these considerations are a source of value, all companies should apply an ESG lens (among others) in evaluating their strategies and portfolios. They can then use acquisitions and divestitures to adjust their portfolios to increase their appeal to investors. Energy, oil and gas, and consumer products companies face especially high scrutiny, and many will actively manage their portfolios to achieve better ESG ratings.

According to BCG’s analysis, the number of deals primarily motivated by environmental considerations (that is, “green deals”) has doubled during the past 20 years, with a huge uplift during the past two to three years. (See Exhibit 4.) The value of these deals has also been increasing. In the next article in this series, we will examine green dealmaking trends in detail.

So far in 2022, M&A dealmakers have managed to “keep calm and carry on” in the face of dizzying stock market plunges and escalating geopolitical tensions. It remains to be seen whether the M&A market can stay resilient in today’s environment of high inflation, rising interest rates, and slowing economic growth. Dealmakers that adapt—such as by intensifying their focus on acquisitions and divestitures related to digital capabilities or ESG—will help their organizations emerge from this challenging time with a competitive edge.

The authors are grateful to Professor Sönke Sievers, Chair of International Accounting at Paderborn University, and Tobias Söllner, Yiran Wang, Sedef Özer, and Jan Haubrich of BCG’s Transaction Center for their valuable insights and support in the preparation of this article.