The gap between digital top performers and laggards is wide, according to a study that The Boston Consulting Group conducted with more than 1,300 companies in Europe and the US in 2017. While the top performers have set a high bar for digital performance, around 25% of the participating companies are significantly behind in their digital transformation.

In fact, digitization is creating a divide in the corporate landscape worldwide. Digital laggards face a real threat to their competitive standing and future prospects if they do not take steps to close the gap with digital top performers. Between now and 2020, according to our survey results, digital leaders plan to emphasize revenue-generating activities such as customer experience reinvention and next-generation sales. Digital low performers, meanwhile, are playing catch-up, trying to ramp up their basic digital capabilities.

The study’s foundation is BCG’s Digital Acceleration Index (DAI), a metric based on companies’ self-assessments of their digital maturity on a scale of 0 to 100. (See the sidebar.) As part of our analysis of these results, we identified what top performers and laggards do differently. We also compared levels of digital performance between the US and Europe, as well as among specific industries, and we identified appropriate next steps for companies that want to improve their digital game and close the gap between themselves and the leaders.

Our Methodology

For our 2017 study, we asked 1,300 companies in Europe and the United States to estimate their digital maturity on a scale of 1 to 4 in 27 categories.

We then aggregated those raw scores, assigned values to their responses on a scale from 0 to 100, and weighted them to determine each company’s overall performance on our Digital Acceleration Index (DAI). Companies with a DAI score of 67 to 100 qualify as top performers, while those with a DAI score of 43 or less are laggards.

Top performers had an average maturity level of at least 3 out of 4 on all maturity dimensions, whereas laggards had an average maturity level of less than 2 in 66% of the assessed dimensions and an average maturity level of 3 in 33% of the assessed dimensions. Top performers had an average DAI score of 80, while laggards had an average DAI score of 30.

We collected data from companies with at least 2,500 employees in the US, Germany, the UK, France, and Austria across seven core industries: mechanical and electrical equipment manufacturing, chemicals, technology, banking, telecommunications, and consumer goods and retail. Only senior leaders participated: 30% were C-level, 30% were division leaders, and 40% were general managers.

Common Traits of Digital Leaders

Our study identified three practical strategies that top performers have adopted to deal with major challenges that all companies face when transforming themselves into digital enterprises:

- They invest. In our survey, 43% of all companies mentioned financial resources as the biggest obstacle to implementing their digital vision. Over half of the top performers invest at least 5% of operating expenses in areas such as new digital offerings, products, and business models; digital customer engagement; and digitally optimized processes.

- They recruit digital experts. Just over one-third of companies see difficulty in recruiting digital experts as being one of the three biggest obstacles to digital transformation. Crucial measures to take include infusing digital talent throughout the workforce, dedicating a significant percentage of employees to digital functions, and engaging employees in digital processes. Around 50% of the top performers have increased their share of digital jobs to more than 10%.

-

They embed digital in their organization. Nearly one-third of participating companies report that changing their corporate culture is among the top three challenges involved in digitization. To match the speed and agility of digital pure-plays, traditional companies need to manage the business digitally from end to end. To do so, they must integrate digital capabilities into existing functions and permit business units to manage digital in their own business lines. Top performers say that digital is well advanced and firmly embedded within their company.

In our survey, 85% of the digital top performers use at least one of these digital boosters, and those that use all three scored 16 points higher on the DAI, on average, than those that use one or two.

Digitization Results by Region

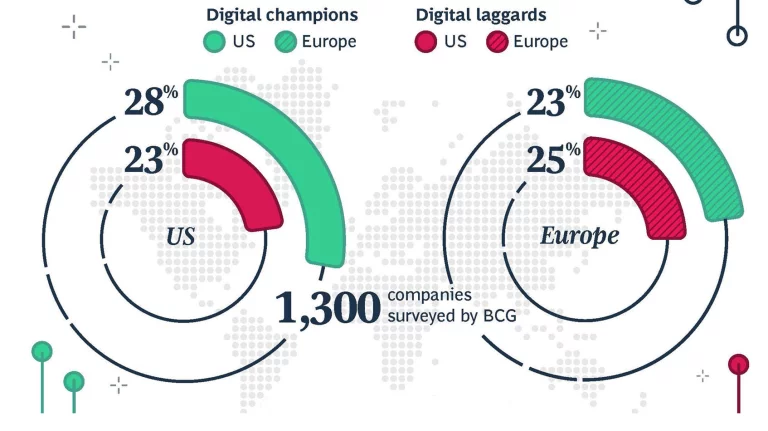

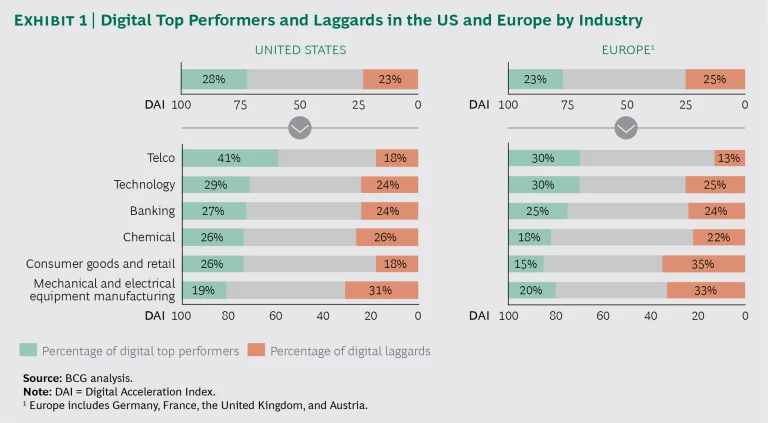

Our survey revealed that the US has 20% more digital top performers than Europe has, putting the US market on a faster track toward digital transformation. Overall, 28% of US companies were digital champions and 23% were laggards. In Europe, 23% were champions and 25% were laggards. (See Exhibit 1.) Much of this edge in performance is due to the stronger technology and telco sectors in the US, which enable other industries’ digitization efforts. Among US telcos, 41% are digital champions with their own digital offerings (such as Internet of Things applications) and digital customer journeys, whereas only 30% of European telcos are.

The US top performers excel at reinventing or disrupting their own business models (with an average DAI score of 90 compared with an average of 84 among top performers in Europe), using analytics (for example, collecting machine data in the agriculture industry in order to optimize harvests), and reinventing the customer experience. US companies are also farther along than their European counterparts in creating digital acceleration centers to coherently drive innovation (a DAI score of 85 compared with 80), and in extracting financial gains from digital (a DAI score of 78 compared with 72). Both US and European top performers still need to simplify IT and improve prototyping to speed product development.

Laggards on both sides of the Atlantic need to incorporate digital into their manufacturing production lines and processes. Another common trait among low performers is a very low level of ambition for digital transformation (an average DAI score of 43 in the US and 41 in Europe) relative to top performers. Ambitious goals, clear implementation timelines, and confident executive leadership are crucial for transformation and competitiveness.

Digitization Results by Industry

As part of our analysis, we concluded that a company’s digital development was more industry specific than country specific, driven by similar starting points and a similar affinity for digitization. Not surprisingly, the telco and technology industries are the most advanced. Companies in these industries have long used experienced software developers to help create digital products and services, and interacted with customers through digital channels. Other industries have yet to learn many of the digital tactics that tech companies and telcos have been deploying for years and that have become integral to their value creation.

The tech universe includes software and internet sectors (which are digital leaders) along with handheld devices, semiconductors, and equipment (which lag in comparison). If we had restricted the tech category to tech software and internet, it would have ranked even higher than telco.

Besides these two leading industries, we took a close look at several more traditional industries to understand their digital journeys, their specific challenges, and their options for closing the maturity gap. Following are in-depth descriptions of two of those industries: banking and mechanical and electrical equipment manufacturing.

Banking. Banking ranks third in digitization after telcos and technology among the sectors we examined, thanks to a history of strong investment in IT (about 15% to 25% of a typical bank’s total cost goes toward IT), long-term experience using online and mobile channels to handle customer interactions, and intensifying competition from financial technology companies.

As a result, some top performers among banks have achieved a step change in digitization. US top performers report high digital maturity in disrupting their own business (a DAI score of 93) and in data-driven marketing (a DAI score of 85). For their part, European banks report higher digitized customer engagement and core offerings, with DAI scores of 87 for new digital service and product offers and 88 for customer experience reinvention.

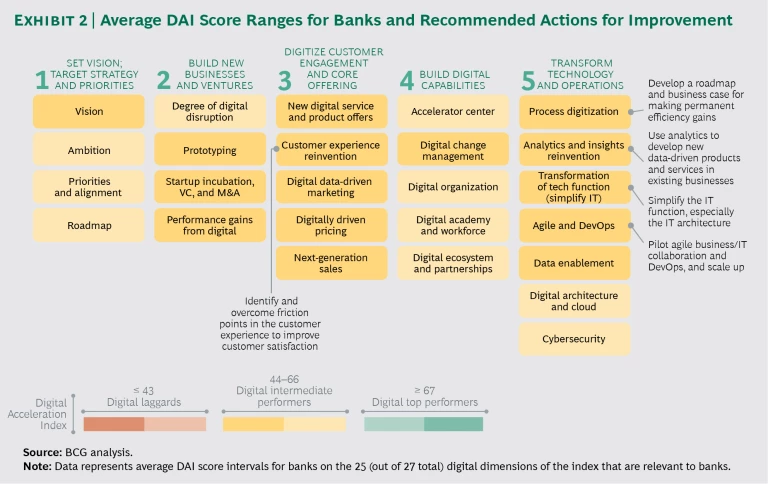

Banks in both regions still face challenges in connection with transforming the tech function and making the enterprise digital ready, which requires simplifying the IT landscape to cut complexity and free up monetary and human resources to support the digital transformation. (See Exhibit 2.) For example, by freeing up these resources, banks can begin to scale up agile and DevOps practices that will speed time to market for new products and services. In addition to improving efficiency (with an impact of 15% to 25% on development costs), these changes will improve customer satisfaction and increase overall returns on digital investments.

A more digital-ready enterprise can also use advanced analytics to mine its data for relatively precise customer insights, and it can start to apply robotic process automation (RPA) and artificial intelligence to manual tasks in the back office, potentially yielding tremendous efficiencies. Indeed, some banks have accelerated mortgage applications by up to 80% with RPA and customer journey redesign. By combining increasingly personalized customer offerings, efficient back-office processes, and agile IT dedicated to supporting business demands and delivering high-quality products, banks can reinvent the customer journey.

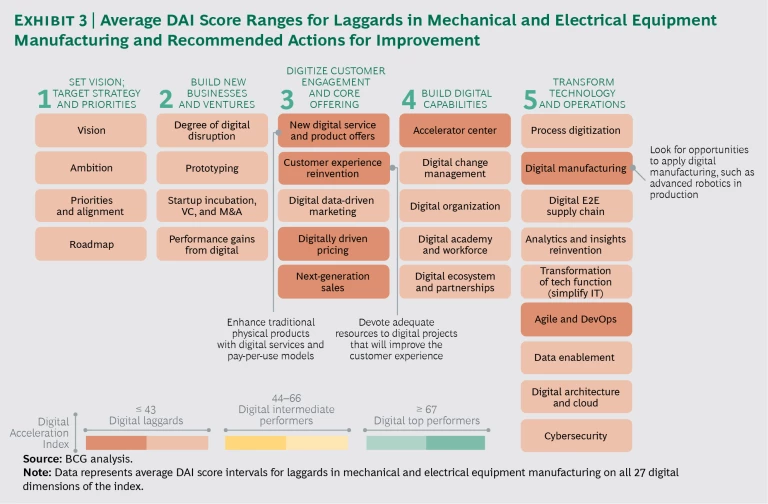

Mechanical and Electrical Equipment Manufacturing. This industry faces digital challenges in both the US and Europe, with a high share of digital laggards in both regions (31% in the US, and 33% in Europe). M&E includes an inordinate number of laggards largely because of its traditional focus on producing great physical products, which limits IT’s role mainly to support for office and back-end systems such as supply chain logistics. Digitization of core processes or products has not been a priority for companies in this sector.

Digital represents a completely different business model for M&E companies, but it introduces exciting new opportunities to sell software-driven offerings, such as predictive maintenance and machine as a service. For example, by placing sensors on industrial cranes, crane vendors could gather data and analyze wear and tear on these machines, and dispatch a service technician prior to a costly failure and idle time. Companies could also offer to store each machine’s data in the cloud, giving customers access to the data to analyze it and (potentially) optimize operations. Future crane design might benefit from accumulated data on real-life usage and load situations. To make such digital products and services available, companies must invest more in digital. If they do not, they will be unable to unlock the full value of their machines, and they may lose market share to forward-looking competitors that offer a broader range of digital products and services.

The laggards in the industry are behind in certain distinct areas. (See Exhibit 3.) For example, M&E laggards earned a very low DAI score of 22 on reinventing the customer journey and offering new digital services and products, indicating that there is an enormous opportunity for companies to enhance their mostly physical product portfolio with new digital products and services. By rethinking the customer journey, M&E companies can create entirely new business opportunities.

The 2020 Perspective

When we asked survey participants about their priorities between now and 2020, the top performers and the laggards gave markedly different answers.

The digital leaders are focusing on further simplifying their IT to multiply the benefits they’ve already gained by cutting complexity and freeing up resources. They also plan to continue their efforts to digitize manufacturing (Industry 4.0) in order to make processes and technologies even more efficient and flexible. Besides pursuing these initiatives to reinforce the core, leaders are focusing on customers—personalizing digital products and services, and implementing next-generation sales approaches.

Although laggards, too, want to satisfy digital customers, they are still working on the basics of setting up the right technological environment (digital architecture and cloud) and making customer data available across the company in order to understand customer needs. Companies in this predicament also emphasized the importance of developing process digitization to overcome legacy IT applications that require frequent manual intervention in the back office. Installing this “digital plumbing” is vital for laggards if they are to compete effectively for digital customers.

Steps for Moving Forward

For top performers, the most pressing question is how to accelerate their digital transformation, cashing in on their previous digital investments and maintaining their edge over competitors. For digital laggards, the challenge is to get the basics in place in order to jump-start digital transformation and begin gaining ground. Laggards might want to consider a few specific actions that digital champions have taken to steer their digital journeys in the right direction:

- In navigating their journey, they look beyond the hype. To steer their digital investments in the right direction and to retain their competitive edge, champions holistically assess their industry position (compared with best-in-class players and peers). They inquire into how digital attackers are disrupting their industry and what digital trends and opportunities are emerging. And they understand the necessity of setting ambitious goals (their average DAI score on this measure was 84) and setting the right priorities (average DAI score: 83) early on.

- Leadership is strongly committed to the digital strategy. Champions know that a digital transformation requires strong commitment from top management, which must integrate the digital strategy into the overall corporate strategy and creatively incentivize change at all levels of the organization. Achieving success depends on having a digital roadmap for holistically translating ambitious goals and priorities into action across the company. Champions show very high maturity in designing the digital roadmap (average DAI score: 85). Leaders understand that individual business units should control their own digital agendas, since they know their customers’ needs best and are likely to extract the most value from digital initiatives. Also, when rolling out a new business model that is very different from the company’s core offering, leaders typically create a separate organization for the business model and give it significant operational freedom.

- They continue to deepen their digital organization. While laggards struggle to lay the digital foundation, champions devote at least 5% of their operating expenses to digital investment. A significant portion of these investments goes toward acquiring digital talent, but investment alone will not suffice to retain such talent. Champions have also altered their organization’s culture to appeal to digital recruits—for example, by adopting new, agile ways of working. They have also built digital acceleration centers to digitize their workforce; and now, with those centers fully operational, they can speed up the process.

- They measure success and build momentum. For every digital initiative, change must be visible and results must be transparent. To this end, champions define KPIs linked to digital (such as share of sales in digital channels, and profits from digital businesses). Besides being important for measuring digital progress, KPIs help champions build momentum within the organization for other digital initiatives.

Our survey reveals that digitization is creating a deep divide in the corporate landscape worldwide. This disparity will become more pronounced between now and 2020 as top performers focus on revenue-generating activities such as customer experience reinvention and next-generation sales, while laggards play catch-up. The good news for companies late to digital transformation is that they can take clear steps to catapult themselves ahead of their competitors.