Only a couple of years ago, the incumbents that dominated the global power market could afford to be casual onlookers as the distributed energy resources (DER) segment began to emerge. The impact of DER companies—which provide localized power, usually from renewable energy sources, and which sell equipment for behind-the-meter energy storage and usage management—was limited, and it appeared that it would take some time before they would be able to offer customers an acceptable alternative to the traditional grid distribution and meter-based systems.

But that wait-and-see period for large power companies has ended—perhaps sooner than anyone expected. Rapid technological advances in battery storage, smart-home technology, and energy management devices are making DER much more attractive in terms of cost and convenience for various types of customer applications, including reducing carbon emissions. Because of this, power companies must drastically change their strategic calculus. Simply put, traditional utilities can no longer rely on incremental internal expansion to tap into the DER market. Instead, they must take more immediate action—namely, pursuing M&A deals with DER companies that have complementary offerings and can expand utilities’ coverage areas and broaden their scale, enabling them to aggressively grab market share.

Why M&A Now

A combination of factors explains why traditional power companies must pursue M&A with urgency. One is that the growth of the DER market has been significant and sustained; incumbents can’t afford to forego this potential source of revenue when the industry is on the cusp of change. The DER market has expanded annually by double digits, with the greatest gains coming from sales of power storage equipment, photovoltaic (PV) systems, and systems that manage energy and the response to demand. For instance, in California, about 10% of residences already use solar power, and beginning in 2020, every new residential construction must include a PV system. In Australia, rooftop PV equipment generates sufficient power to satisfy up to 48% of the country’s electricity demand at midday. Recent policy moves point to continuing growth of the DER segment. The European Union has adopted new energy savings policies that call for an annual reduction in national energy sales of 1.5%. In addition, more than 100 global companies have announced plans to shift to using 100% renewable energy in the short term.

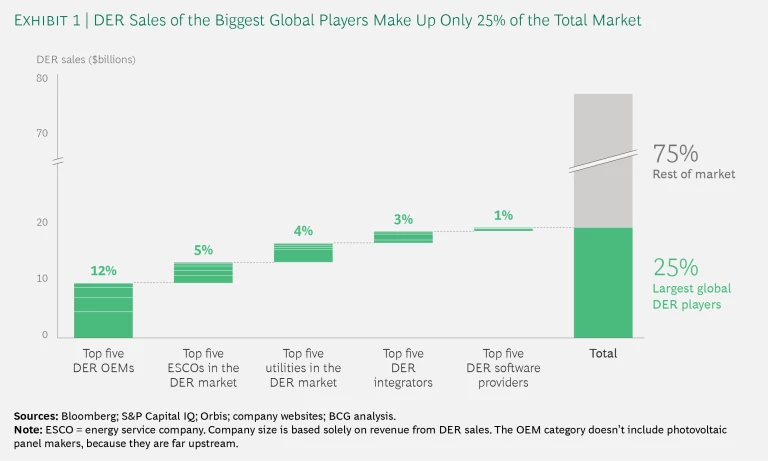

M&A is imperative not only because of market growth but also because the DER segment is still immature and fragmented. Revenue assessments of the top five players in five categories—OEMs, energy service companies (ESCOs), utilities, integrators, and software providers—show that their DER sales represent only 25% of the total DER market. (See Exhibit 1.)

Indeed, except for the companies that manufacture DER systems or components (primarily a concentrated group of multinationals, including Johnson Controls and Honeywell), DER players tend to be regional companies with revenues that span the gamut. Save for a few rare cases, even the DER companies with the highest revenues would not be considered flush. For instance, traditional utilities’ annual DER revenues range from $200 million to $2 billion, while DER integrators, which offer equipment and energy services, may take in $100 million to $1 billion. (See “Finding the Sweet Spot in Distributed Energy,” BCG article, May 2017.)

This growing but fragmented market represents a huge opportunity for utilities that are ready to take bold steps. With few DER market leaders so far, power companies that strike quickly to increase scale, expand DER R&D, and develop new skill sets in DER applications can rapidly realize a competitive edge. By bringing the latest technology and a lean cost structure to the wide-open DER market, power companies could gain first-mover advantages and become dominant in a segment that promises to soon become as palatable to consumers as the traditional power segment is today. Moreover, since the core business of utilities is being challenged by DER, power companies cannot sit idly by and let DER players of any size encroach on their shrinking markets. Indeed, private-equity companies are already beginning to invest in small DER ventures, creating a cushion of support for startups that could heighten the threat to utilities.

This is where M&A comes in. Although some utilities can build scale organically by internally developing and marketing DER technologies, for most power companies, acquiring DER players that already have a market footprint is the only option that makes sense. The DER landscape is expanding and evolving too rapidly for home-made solutions that take a long time to implement and that improve market share slowly, if at all.

Scale considerations aside, most traditional power companies lack the capabilities that would enable them to use operating models based on the distribution of renewable resources and the management of onsite energy and storage. Consequently, M&A becomes the principal channel to productively acquire the skills and market share to become a leader in DER.

An M&A Blueprint

For those who are skeptical about the prospects for DER market growth or M&A as the path to that market, several transactions in the power arena should change their minds, or at least give them pause. Some large traditional power companies that view renewable energy distribution and services as a pathway to new revenue streams have already made assertive M&A moves in the segment in order to stake a permanent claim in the DER market—and stymie potential rivals.

For instance, in 2015, Duke Energy acquired a majority share of Phoenix Energy Technologies, a provider of energy management systems and services for commercial customers. Then, three years later, Duke Energy took full ownership of solar-equipment installer REC Solar. In 2017, Italy’s Enel bought US-based Demand Energy, which manufactures and maintains energy storage systems and software. And Edison International has brought at least four ESCOs under its umbrella.

Even with these and many other similar transactions, the DER market is still immature and overly localized. As a result, it offers plenty of room for growth and numerous opportunities for OEMs, ESCOs, power companies, integrators, and software companies. Carefully crafted M&A strategies could speedily place DER companies in privileged positions in multiple markets and box out potential competitors. By examining the benefits that can accrue through M&A—scale, capabilities, and innovation—companies can determine the best strategy and timeline.

The DER market is still immature, offering plenty of room for growth and numerous opportunities.

Scale. In the DER segment, M&A can help companies attain operational, local, and customer-centric scale. Of these, perhaps the most important is operational scale. By centralizing the vital business design, development, and back-office processes of two or more companies, and then having those processes used by a large number of local operators, a traditional utility can cut expenses and boost efficiency.

Established utilities should target building scale in several business units—including engineering, R&D, finance, and procurement—as well as energy distribution monitoring, optimization, and analytics. Scaling such operations and reducing costs could enable a utility to increase investments—earmarking a substantial amount of money for battery storage R&D, for example—without much pain, especially compared with a more provincial company that has fewer markets and fewer subsidiaries. Scaling operations could also enable a power company to make bulk purchases of distribution hardware at a discount, giving the utility a leg up on a smaller company with more limited hardware needs.

Operational scale in the DER segment cannot be easily developed organically. Rather, expanding operational scale requires taking a classic consolidation approach: companies with similar business models merge operations in order to reduce costs while gaining market share.

An apt illustration is a complex megadeal that was initiated in 2018 between E.ON and RWE, two of Germany’s largest traditional utilities, which had begun to make inroads in DER markets. Although this deal encompassed the utility assets of each company, it essentially transformed E.ON into a customer-oriented ESCO targeting the European market, with a particular focus on behind-the-meter technology, battery storage, and e-mobility, such as electric-vehicle charging stations. Ultimately, the deal will allow E.ON to significantly scale its expanded DER business in Europe, especially in the companies’ shared home market of Germany. When the smoke clears, E.ON will be the number-two DER player in Europe after Engie. This example also shows that a company’s search for suitable M&A targets can start at home and need not always focus on much smaller companies.

The second type of scale—local—speaks to the roots of the utility business. Like politics, all electrical power generation is local, as people depend on having electricity in their homes, workplaces, stores, factories, and schools. DER, virtually by definition, is intended to amplify the role of the end user in the energy equation, in part by helping customers produce, store, and manage their own energy. Therefore, providing the most reliable, convenient, and technologically advanced local customer interfaces and networks is a priority for success.

Still, inexpert energy customers may require a lot of attention and support. To build a robust customer-facing organization that is also efficient and cost-effective, utilities will need a critical mass of local customers.

Much like M&A is the best way to expand operational scale, so, too, is it the optimal way to achieve local scale. Power companies should acquire DER providers or, perhaps more important, services companies that are already operating successfully in a local market with a strong, if small, customer base. Incumbents could also go a step further, acquiring a number of local DER operators whose coverage areas are contiguous.

M&A is the best way for utilities to achieve operational, local, and customer-centric scale.

With several DER providers under their umbrella, utilities can centralize functions, such as accounts management, automated energy usage, generation monitoring, and online or phone-based troubleshooting. This will allow incumbents to cost-effectively service the large number of customers while providing them with customized solutions and personal service when necessary. Utilities can invest the savings in enhancing local offerings, such as energy system customization and installation, which will provide a competitive edge. Local players can bring more to a joint effort than only customers. Given their familiarity with regional power regulations and policies, as well as the political and financial support that is available for renewable energy activities, local providers have knowledge that is of tremendous value to utilities.

Attaining the third type of scale—customer-centric—requires that a company’s products and services satisfy specific customer subsegments. Namely, before developing relatively niche products for a subsegment (for example, energy solutions for data centers), a utility should sign up a sufficient number of customers to cover the cost to ensure that it will realize a profit. Without a threshold of accounts, the expenses will outpace the returns.

In most cases, after a company has identified the DER customer subsegments that it wants to target, as well as the products and services that interest these subsegments, it should pursue an M&A strategy that seeks out partner companies that are already established in that slice of the market. For instance, German ESCO Getec Energie significantly increased its customer-centric scale in the real estate subsegment by acquiring Urbana Energy Services, which specializes in power and heating contracts with proprietors of residential rental properties.

Capabilities. To succeed in the DER arena, a company must have integrated digital solutions for both business and residential customers—primarily to differentiate its offerings from those of the many small competitors that are eyeing this market. However, most companies lack the wide range of capabilities needed to provide such an array of products and services and to continually add new features that distinguish them from their competitors.

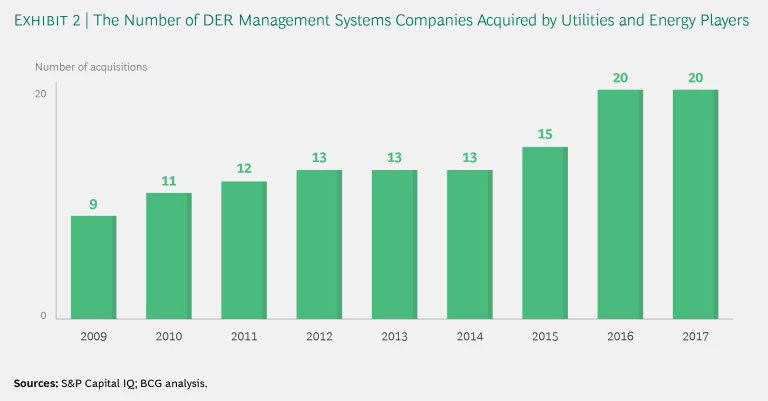

For these reasons, established power companies will have to rely on M&A to fill their capabilities gaps, particularly to initiate applications in the areas of energy usage and local power generation analytics, as well as to develop DER management systems. Most traditional power companies and ESCOs generally lack the skills needed for these efforts, because they were not part of the mix in traditional grid-based power systems. A clear illustration that utilities have begun to realize the importance of building capabilities is the increasing number of acquisitions of DER management systems companies by these players. (See Exhibit 2.)

A good example of a capabilities-based M&A strategy is Total’s recent purchase of GreenFlex, a deal that gives the global oil and gas company access to some of the most advanced data intelligence systems and equipment for managing energy consumption. It is a central part of Total’s recent move into applications for energy efficiency and emissions reduction, chiefly for commercial customers.

Innovation. A remarkable amount of innovation has occurred recently in the DER segment. And many of the hardware-based disruptive breakthroughs—for instance, advances in battery storage, PV equipment, and energy management equipment—will have a growing and significant impact both in the short term and in the long term. But equally important, and often overlooked, is the explosion in the amount of digital data that is generated by this hardware and how this data can be used by traditional power companies to build out a DER network.

Recent hardware-based innovations will generate an explosion of digital data that power companies can use.

For instance, the introduction of smart meters will increase—by a factor of ten—the amount of customer data that utilities can access. And with this information, utilities can more precisely match the amount of power consumed with the cost of generating it. Power companies can also ensure a more predictable revenue stream by optimizing pricing on the basis of historical usage at specific times of the day and in specific seasons.

The next data explosion is right around the corner. It will be brought about by the increasing dominance of smart appliances and equipment that are connected via the Internet of Things (IoT). As hardware—such as thermostats, refrigerators, dishwashers, energy management devices, and power usage monitors—begins to amass vast amounts of information about energy usage, customer data will balloon by a hundredfold, compared with today’s baseline. Customers will gain more control over their energy profiles and have an easier path to set up and maintain DER systems in their homes and businesses. At the same time, utilities and large technology players will have a substantial opportunity to build new businesses around DER networks that rely on this data—businesses that provide cost-effective and reliable power generation to each cluster of energy users.

Virtually all of the innovation in the IoT sphere is coming from startup companies with deep wells of knowledge about how to manage and use large data streams. Consequently, traditional utilities will have no choice but to rely on M&A to gain a foothold in this facet of the DER segment.

However, for many utilities new to M&A activities in the technology sphere, these types of transactions can be difficult to evaluate, manage, and integrate—and can even fail—if they are not put together with a coherent strategy, deep alignment with an organization’s goals, a dispassionate assessment, and a clear set of expectations about a timetable for positive returns. (See “Dealing in the Digital World.”)

DEALING IN THE DIGITAL WORLD

DEALING IN THE DIGITAL WORLD

In September 2018, a group of utilities joined forces to create Energy Impact Partners, an investment fund that has earmarked nearly $700 million for DER and other advanced energy technologies, such as electric-vehicle power stations and power grid diagnostic systems.

Two conclusions can be drawn from the creation of this consortium. First, utilities are well aware that they must expand their traditional lanes of operations and provide advanced technology that optimizes energy storage, monitors usage, provides simple access to renewables programs, and automates facilities management. They understand that they must acquire startups that have tackled digital energy technologies and dared to pick off lucrative aspects of the energy distribution market, blocking utilities from a potential revenue stream in the process.

Second, and equally important, a joint investment group is attractive to utilities because, in the past, M&A transactions involving new entrants in the power market have not always gone smoothly. That is largely because established power companies have little experience in dealing with technology startups, whose culture, ways of supporting innovation, and speed-to-market expectations differ immensely from those of utilities. With that in mind, BCG has distilled the lessons learned from prior transactions between old-line businesses and technology companies to come up with three best practices for established power companies to follow:

- Do not treat the acquisition of tech companies as a substitute for organically building up an innovative product portfolio. Rather, tech M&A should be viewed as an additional element of a continuous technology transformation plan—a way to complement or extend in-house innovation and R&D. In fact, it is a good idea to build an internal organizational wing that is devoted to identifying attractive tech firms to consider as possible acquisition targets or partners. This unit should not rely on investment banking relationships solely—the traditional way—to negotiate, finance, and close these deals, but rather cast a wider net that could include corporate venture capital or relationships with universities that support startups.

- Be flexible, particularly when competing for a tech company against agile bidders, such as venture capital firms. Consider more customized and lean approaches to M&A to facilitate a speedier execution of the tech deals. Seasoned tech M&A players know that these deals differ from traditional M&A in that they can succeed with shorter due diligence time frames and less focus on traditional metrics, such as the quality of a company’s earnings.

- Be open to unorthodox business structures. For example, consider minority investments, contractual agreements to incentivize the sellers to meet certain financial goals (so-called earn outs), and stock options for achieving performance metrics. These varied approaches allow tech targets to keep their entrepreneurial independence even as they become part of larger corporate organizations.

Companies in every industry are finding that M&A is increasingly the way to access technologies that can advance their businesses and to successfully integrate them into their current operations. Established utilities are not alone. (See The 2017 M&A Report: The Technology Takeover, BCG report, September 2017.) By learning from the experiences of other organizations, power companies can fast-track their efforts.

Avoiding the Pitfalls of M&A

Given the rapid expansion of and interest in the DER market, it wouldn’t be surprising to see some power companies rush headlong into this segment to get a foothold before their rivals do. On the face of it, such an approach—girded by a series of acquisitions—makes a lot of sense. But that good market judgment could be compromised by a lack of strategic discipline in designing an M&A campaign.

One comprehensive consideration should propel any M&A effort: the company’s overall DER strategy and how M&A will help realize it. Remember, M&A is not a goal, but the means to an end. And since the number of potential acquisition targets may be limited, developing a clear decision tree is necessary to assess which partners offer the most attractive and relevant returns. That decision tree should grow out of the answers to the following questions:

- Can a specific deal’s broad prospective gains—such as expanding product and service offerings, market reach, the customer base, branding efforts, skill sets, and the talent base—be achieved by organic growth? What is achieved by securing those gains sooner through an M&A transaction or a partnership?

- How does a deal create short- and long-term value? Note that neither revenue enhancement nor cost reduction necessarily constitutes a sufficient reason to acquire another company. Those outcomes may impact the company’s income statement, but they won’t enhance the company’s market position or its reputation as a leader in a dynamic power segment.

- Does a deal help the company improve its capability to understand its customer base and give new customers what they want? Increasingly important in the DER segment is knowing customers’ energy profiles and customizing solutions to meet their needs.

- Will an acquisition “move the needle” for the company, putting it in an advantageous position as a differentiated player? It’s important to be aware that just putting a toe in the water of the DER market, as many large utilities and even oil and gas companies are doing, is unlikely to deliver sustainable success in the competitive DER segment.

- If a deal involves the acquisition of a startup, is an integration plan in place to retain the best of the company’s talent and innovative spirit after the merger is completed?

The Path Ahead

Becoming a leader in the DER market is well worth the effort for traditional utilities. The new approaches and solutions are poised not only to change how power is generated and distributed but also to transform the relationship between power companies and their customers. Established companies are fortunate in that M&A offers them a clear channel for quickly taking a privileged position in this soon-to-be lucrative market.

But if M&A gives traditional utilities a potential leg up, it does the same for other types of companies, too—specifically, oil majors, midsize ESCOs, IT conglomerates, and even private-equity investors. This, in turn, makes having a cogent plan—with an M&A centerpiece—more crucial than ever if utilities are to successfully deal with the full measure of the DER disruption. Simply put, the combination of an opportunity and a strategic tool to take advantage of it should be a weapon that’s too powerful for smart, established power companies to ignore.