Insurers globally must define an integrated strategy that will allow them to pick up the pace of transition to net zero within their own business and across their spheres of influence.

Net zero isn’t just a climate imperative—it’s a business one. Across the globe, the accelerating rate of climate change is finally being met with an accelerating rate of action to counter it. The war in Ukraine is not only having devastating consequences for those directly affected, but also imposing hardship on millions of people struggling due to gas shortages and price hikes. In the EU, for example, gas prices have more than doubled since June of 2021. And although wind and solar energy capacity are expected to double between now and 2030, the current fuel shortages have prompted some public-and private-sector leaders to consider returning to old assets such as coal.

It’s important to prevent this regression. To avoid the worsening effect of climate change and meet the targets set by the Paris Agreement, the world must continue to take swift and decisive action to cut carbon emissions. Reaching net zero will require old assets in nearly every industry to be repurposed, sold, or scrapped in favor of low-carbon, clean-tech solutions. Globally, this transition will require up to $150 trillion in investment.

The insurance marketplace is in an ideal position to foster this transformation. Insurers provide the business interruption protection, casualty and property assurance, and employee benefits that every company needs in order to operate, no matter its size. In the way they set pricing, proffer advice, and manage claims payouts, insurers can help businesses accelerate their path to net zero. The industry also manages more than $26 trillion in assets globally, giving it considerable influence over business decision making. However, while some insurers have set ambitious long-term climate targets, few have articulated short-term business priorities to help reach these targets, and most insurers acknowledge the need to act more swiftly. Now is the time to develop net-zero strategies.

Doing so can pay positive dividends, mitigating the risk of stranded assets and opening up new avenues for value creation. And there is plenty of potential. In the UK alone, BCG estimates that by 2050, green assets will account for about 66% of the property and casualty market. This is up from less than 1% in 2020 and could represent £30 billion in premiums.

The bottom line is that net zero is a net positive not only for the planet, but also for insurers’ future prosperity.

Need for Clarity on What Opportunities to Prioritize

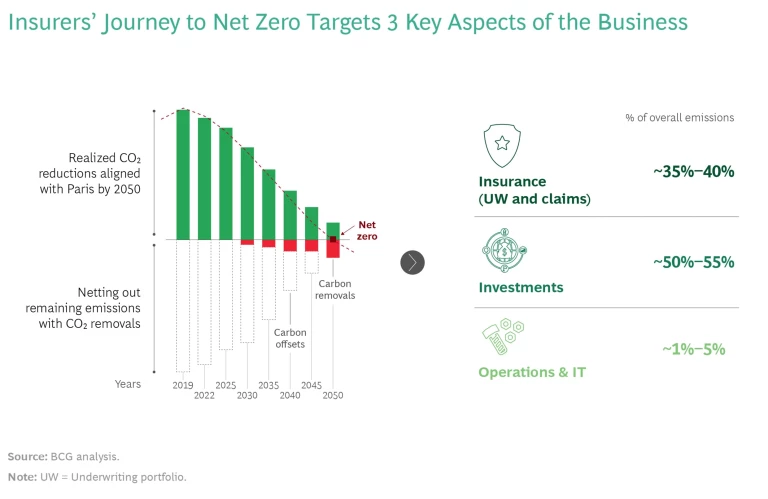

Climate transition is complex, and insurers globally have faced a similar set of challenges in transforming their business and portfolios. One obstacle to success has been setting the right focus. To date, many insurers have concentrated on their internal operations and taken steps to improve energy efficiency and lower IT emissions in their offices. But operations and IT represent less than 5% of the average insurer’s carbon footprint on average. In contrast, its investment portfolio typically accounts for 50% to 55% of its emissions output. To get real impact in the near term, insurers must also address their core—their underwriting portfolio and claims management activities, which make up the remaining 35% to 40%. (See the exhibit.)

Another obstacle to transforming to net zero has been a lack of reliable references. While many ratings agencies publish environmental, social, and governance (ESG) scores, different agencies often weight factors differently, making it hard for insurers to know which measures to prioritize and what targets to set. To improve knowledge sharing and come to their own consensus, insurers have begun to band together, forming the Net Zero Asset Owner Alliance in 2020 to set emissions reduction targets for their investments and the Net Zero Insurance Alliance in 2021 to support emissions reduction targets for their underwriting activities. But as important as these collaborations are, insurers should not treat them as a substitute for defining a robust net-zero strategy that advances the needs and goals of their own business.

A third challenge is amassing the right data. Insurers need to gather inputs on the emissions produced by their investee companies and the assets held by policyholders. But right now, few institutions are able to collect this type of information in a repeatable and consistent fashion.

Building a Net-Zero Insurance Strategy

Climate touches everything, which makes acting on it hard. To shift to a net-zero strategy requires plunging into a still-emerging field, designing offerings that will meet the evolving needs of clients and policyholders, and delivering business value. That’s difficult, but with the right strategic approach, such uncertainties don’t have to be a barrier.

In addition to enabling better prioritization, a net-zero strategy can enable competitive advantage. Customers are making it clear that they want low-carbon alternatives. First movers that anticipate how markets are transitioning will be able to price better and provide customers with relevant new services. Insurers with a more active net-zero posture in the market can also attract new funding. One global insurer saw its market capitalization double in value after it took more visible and active steps on ESG. The extra funding significantly lowered its cost of capital.

Through our work with clients, we have distilled three key steps that insurers can take to develop a successful net-zero strategy:

- Set a baseline. To understand the total decarbonization opportunity available to them, insurers need to look across the whole business—their investment portfolio, underwriting portfolio, and operations. As major shareholders, for instance, insurers are indirectly responsible for a portion of the emissions their investees produce. To understand just how big that portion is, they need to calculate the carbon output generated by the securities and assets they own directly and by the companies within the funds they oversee. This exercise can allow insurers to isolate industries or companies that are most in need of transition: Are they overweight in high-carbon sectors? Underweight in clean tech? Or do they have a reasonable balance? And is the insurance company using the right materials and processes to repair policyholders’ claims? To enable this modeling, advanced players are building tools that measure portfolio exposure, pulling in data from sources that encompass everything from the economy and the environment to customer, market, and technological trends. Leaders can apply the same techniques to other parts of their organization and weight the emissions intensity of their underwriting and claims-management processes.

- Define targets. Scenario modeling can help insurers assess the gap between their inertial volume growth (assuming no changes in their current business model) and the potential new volume growth they could capture as different industries and customer segments progress toward net zero and shift to low-carbon offerings. By understanding the trajectory of this growth under different net-zero conditions, leaders can then set specific emissions-reduction targets to nudge favorable outcomes that protect the planet and support their own business. For example, scenario modeling showed one insurer that its automotive insurance portfolio was still overly concentrated in fossil-fuel-powered vehicles. Without more aggressive steps to steer its underwriting toward electric and hybrid vehicles, the insurer would not be able to reach its net-zero targets. By determining the delta between its projected inertial growth and its desired net-zero state, it was able to define targets that put it on a healthier trajectory. Similarly, in claims management, insurers have the opportunity to set emissions reduction targets and then help reach them—actions that would improve costs, service, and the business value generated.

- Take action. By seeing which way value is likely to flow—and how quickly—insurers can begin to shift their portfolios. Knowing that electric vehicle adoption was about to soar, for example, the underwriter mentioned above worked to get ahead of that shift, reshaping its go-to-market strategy and designing products and services it hoped would command strong market appeal, such as “pay as you drive” incentives that reward policyholders who own traditional internal combustion engine vehicles with discounts for cutting their mileage. In claims management, repair-over-replace initiatives could help lower emissions and costs, since reusing parts from similar vehicles is less expensive than sourcing original parts from an OEM and can result in shorter wait times for customers.

Insurers can also use the power of their portfolios to accelerate climate transition among their clients. For example, some of the world’s heaviest emitters, such as steel and transport businesses, face not only the most intense pressure to decarbonize but also the highest costs to do so. By helping businesses set the right goals and providing guidance, protection, and long-term capital, insurers can set up a virtuous cycle.

Within operations, insurers have three main levers they can deploy. They can reshape demand to avoid or reduce purchases that have a high carbon footprint. They can employ technologies to cut down on energy or paper consumption. And they can adjust sourcing strategies to favor suppliers that have a strong track record on ESG.

Communication and Governance

A formal communication and reporting plan needs to be part of the net-zero insurance strategy. Stakeholders will be looking for organizations to outline in specific terms how they will be implementing a net-zero emissions policy within their own business and across their value chain. Transparency is key. Most investors, regulators, customers, and employees recognize that decarbonization is a complex, multiyear process. But growing awareness of the widespread negative impacts of climate change has also made them less patient with superficial changes. Insurers that are upfront about their journey and engage openly in detailing their targets and actions will be taken more seriously and thus gain brand advantage.

In terms of reporting, insurers must continue to satisfy the disclosure requirements of ratings agencies and those of other regulatory bodies such as the US Securities and Exchange Commission’s climate disclosure requirements. They must also comply with requirements laid out by the Task Force on Climate-Related Financial Disclosures, a set of financial risk disclosures created in 2015 by the Financial Stability Board that now applies to most global companies, banks, and insurers. But responsibility for satisfying these requirements and delivering on an insurer’s net-zero agenda extends beyond the sustainability function to the business itself. Leaders should define a business-driven governance model that includes clear roles and expectations for their management teams. Under that model, the sustainability function should serve as the day-to-day coordinator, overseeing the roadmap to meet ESG-related targets across the investment, underwriting, and operations sides of the organization.

Though net zero is often held up as a 2050 opportunity, meeting the commitments the world has signed up to will require a significant steer from insurers. That work must start now. For the sake of the planet and to protect their own balance sheets, insurers globally must define an integrated strategy that will allow them to pick up the pace of transitioning to net zero within their own business and across their spheres of influence.

The authors gratefully acknowledge the contributions of Douglas Beal, Tjun Tang, Simone Schwemer, Philippe Removille, and Chris Freese.