The European automotive industry has been a force in the continent’s economy for decades. It directly accounts for four million jobs and 3% of Europe’s GDP. The industry is also the poster child of Europe’s industrial success, with four out of the top ten global automakers by revenue coming out of Europe: Volkswagen, Mercedes-Benz, Stellantis, and BMW. However, the traditional sources of the auto industry’s consistently impressive track record are seriously threatened.

In response, BCG analyzed the European auto industry today and its prospects for the future, looking at the industry's historical strengths as well as its emerging vulnerabilities. We examined how its pivotal position in Europe’s economy could change, particularly the possible shifts in the industry’s GDP, employment, tax contributions, and equity value.

The Evolving Threats

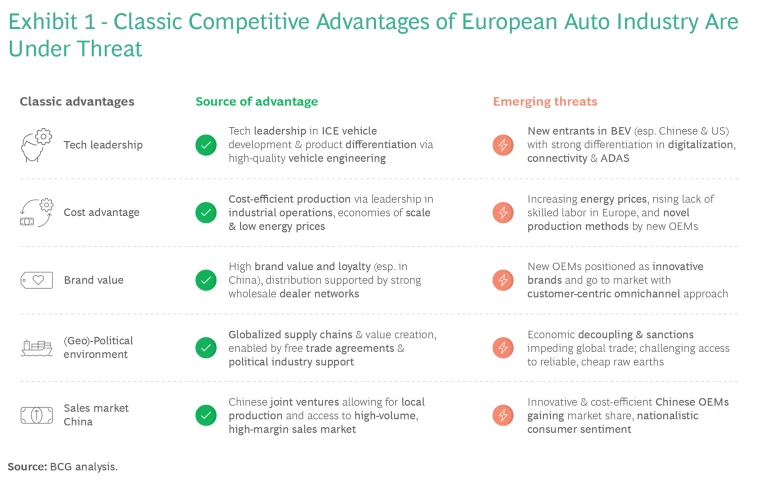

Traditionally the European auto industry benefited from five advantages: technological leadership, cost efficiency, brand value, stable geopolitics, and the Chinese sales market (see Exhibit 1). All are currently threatened.

Threat 1. Technological Leadership

The European automotive cluster developed deep expertise in complex internal combustion engine (ICE) vehicles. Their defining features—high performance, fuel efficiency, durability, vehicle handling, and design—made it possible for European OEMs to starkly differentiate their cars on the market, raising their reputations. But the advantages that European OEMs had in ICE design and high-quality engineering are increasingly losing their importance as the changeover to electric and software-defined vehicles accelerates.

The European auto sector is having difficulty keeping up with other global players in the electric vehicle competition.

In the electric vehicle (EV) realm, the European auto sector is having difficulty keeping up with other global players in battery cell design, power electronics, extending battery range, and innovative rapid charging technologies. Moreover, the shift to software-defined vehicles adds another layer to this challenge for legacy OEMs. As software becomes the distinguishing feature of automobiles—powering infotainment, performance, connectivity, autonomous driving, in-cabin experiences, and continuous vehicle updates—companies skilled in designing software first and hardware second are increasingly poised for market leadership.

Indeed, over the last two decades a teeming competitive field populated by many vehicle startups, especially in the US and China, has already emerged. These companies have had the chance to engineer their cars from scratch, building substantial capabilities in battery and other EV technology. Names like X-PENG, NIO and BYD in China and US BEV companies Tesla, Lucid, and Rivian are viewed as serious new competitors. At the same time, some EV startups have stumbled, failing to keep up with the crowded marketplace, comprised of so many rivals. Still, we believe more new entrants will follow as barriers to entry are lowered in the shift to EVs, which are significantly less complicated to manufacture than ICE vehicles. Cases in point: Vietnam, Saudi Arabia, Poland, and Turkey are seeing the establishment of their own EV automotive companies.

Threat 2. Cost

European automotive companies, especially German OEMs, have prided themselves on having excellent industrial operations with a highly skilled workforce, substantial automation, and economies of scale. Combined with low energy costs in Europe, industrial exceptionalism has enabled the production of vehicles at globally competitive prices in local plants.

These advantages are in danger, as US and Chinese factories rapidly adopt robotics, moving closer to more sophisticated automation. Moreover, many of these companies have more flexible cost structures because their labor outlays are lower due to little or no unionization at their plants. And energy price volatility is likely to be a permanent fixture, the result of geopolitical conflicts and resource scarcity, which will affect European automakers more than such companies in other regions.

Threat 3. Brand

European OEMs have long benefited from enormous brand popularity, some of it the result of decades-long sponsorships with iconic international sporting events. Premium European brands are seen as status symbols in the US, and Western car brands are also popular in China. Indeed, VW, BMW, Mercedes-Benz, and Audi together command one-fifth of unit sales in the Chinese auto market.

But a change of sentiment began with the diesel emissions scandal in 2015. As it continued with the fast pace of technological advance leaving traditional OEMs slightly behind, European carmakers risk being viewed as old world and corporate, not as hip, dynamic, young, modern, or sustainability-oriented like the new EV OEMs. In a huge strategic push, China is promoting its technological independence and breakthroughs while upgrading the Made in China reputation to no longer stand for cheap production. The result is a growing appreciation for high-quality, technologically advanced Chinese EV brands in China. With European OEMs still drawing more than 70% of their business from ICE sales, this EV-related sales spurt in China will be difficult for companies with an old-fashioned and staid brand image to navigate.

That sense of traditional companies living in yesterday’s business model also extends to how vehicles are sold. New manufacturing competitors across the globe are introducing direct sales models to replace dealerships. These direct manufacturer-to-consumer, e-commerce sales efforts, arguably pioneered by Tesla, are being mimicked by other EV makers, including Lucid and Rivian in the US and Vinfast in Vietnam. It is worth noting, as well, that some Chinese EV companies—Great Wall and BYD, among others—are piggybacking on existing dealer networks in Europe to quickly introduce their brands to local consumers, hoping to replace European OEMs in their home markets.

Threat 4. Geopolitics

The rise of globalized supply chains and value creation engendered by free trade agreements and stable political environments benefited European OEMs. Materials and supplies imported from developing countries, which welcomed the business from Western automakers and quickly adopted just-in-time delivery methods, were a boon for European companies to maintain relatively low vehicle prices and production efficiency.

Political winds turn towards de-coupling and de-risking.

Those heady days are fading into the past as the political winds turn towards de-coupling and de-risking. Planned deglobalization is more the norm now to guard against political uncertainties and disruption. Supply chains are shrinking as automakers in developed countries are encouraged to source parts and materials locally. A case in point: the US Inflation Reduction Act offers industry rebates and consumer tax credits worth up to $7,500 if a majority of a vehicle is manufactured in country. All of this, in turn, is creating cost headwinds and impeding overseas value creation for European OEMs.

Threat 5. Chinese Sales Market

Accelerated economic growth in China over the past thirty years lifted many residents into the middle class and beyond—and many chose to display their new-found wealth by owning a premium European car. For a long time, no local automaker could produce vehicles that matched Europe’s in quality or appeal. For some European OEMs, this halcyon period was highly lucrative; at some automakers, Chinese sales accounted for more than 50% of company-wide profits.

But the rise in China of local EV makers that can build vehicles with digital and design features specifically targeted at what Chinese consumers want has placed European OEMs back on their heels. Many top EU companies have been forced to cut prices in China because they are no longer able to sell as many units there as planned. As the Chinese competitors improve and Made in China sentiment grows, the Chinese sales market becomes more problematic for European OEMs.

Three Future Scenarios

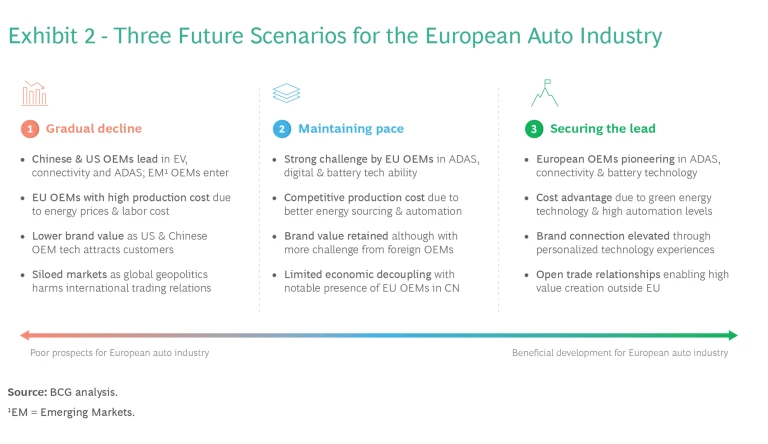

Clearly, Europe’s car industry is under pressure. The challenges it faces contain high levels of uncertainty and could evolve in different directions. But this does not mean it must inevitably succumb. To assess what is at stake, BCG modeled three scenarios based on how automakers, suppliers, and policy makers respond (see Exhibit 2). The scenarios are Gradual Decline, Maintaining Pace, and Securing the Lead.

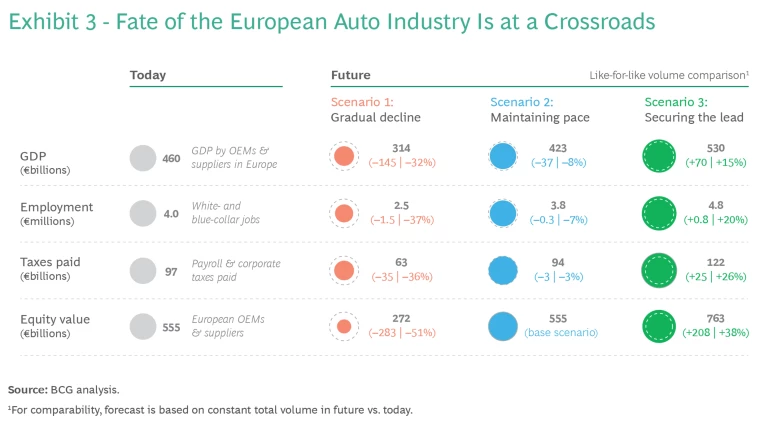

To give these scenarios added value, we quantified how the role and prominence of the auto industry in Europe may change, measuring these changes through the lenses of GDP, employment, payroll and corporate tax contributions to the region, and equity value.

BCG modeled three scenarios based on how automakers, suppliers, and policy makers respond to the challenges.

Scenario 1: Gradual Decline

This is the least desirable outcome but is perhaps a window on the direction that the European auto industry is moving unless steps are taken to stem the bleeding. In this scenario, European OEMs will forfeit significant global market share as new competitors, especially US and Chinese companies, challenge them abroad and at home. The European companies are beset by a lack of developed local technology talent and by stringent regulations that hinder the ability to catch up to their rivals in software and EV advances. These shortcomings also extend to ADAS and battery breakthroughs as well as factory automation. Worse, as US and Chinese vehicles become more feature-rich, EV performance-focused, and less expensive, European cars lose their brand cachet.

And as competitors arise, global supply chains become more siloed. While established European players struggle to disentangle their existing global supply chains, new and more nimble players are able to meet their own demand for batteries, semi-conductors, and software with local supply, fostered by large government subsidies and government-backed industrial development plans. If Europe's investment in local battery and semi-conductor production does not speed up, supply of such critical items is likely to remain prone to shortages and global dependencies.

The end result would be a gradual de-industrialization of the European automotive sector with the loss of 1.5 million jobs, a 32% drop in GDP, a 36% decline in payroll and corporate taxes, and a 51% falloff in equity value. (For a chart showing the impact of each scenario on the European auto industry, see Exhibit 3.)

Scenario 2: Maintaining Pace

This can be accomplished chiefly by European OEMs narrowing the emerging gap in technology. With focused investments in R&D and the acquisition, training, and retention of local IT talent, European automakers could develop more of their own ADAS/AD, digital, connectivity, and battery range and charging technologies. And when in-house design and engineering are not possible, European companies may form joint ventures or acquire Chinese and US tech firms. In addition, to maintain pace companies can expand local battery production, which is supported by EU greenlighting lithium mining and refining projects in places like Portugal, Spain, and Germany. All of this helps to decouple and de-risk global supply chains. Importantly, European OEMs will also need to cut costs through restructuring labor and making investments into automation, navigating headwinds from labor unions.

In this scenario, European brands are still valued around the world, but US and Chinese nameplates gain in popularity, even in the European market. As a result, European OEMs would lose a small degree of global market share, but they at least would not see significant hemorrhaging of their prospects. Equity value would be on par with today’s figures while employment would be trimmed back by about 7% and GDP would drop by about 5%. Not ideal, but better than ongoing decline.

Scenario 3: Securing the Lead

For the European automotive industry this is the most desirable outcome. It is only possible if the industry makes significant investments in vehicle and factory technology and consumer engagement, and governments unveil industry policies that protect the continent’s OEMs from unfair competition.

The automotive industry would have to attract and upskill better technology talent than US and Chinese OEMs, both through incentives and the establishment of European IT technology hubs. Joint ventures and acquisitions as well as government supported R&D clusters at universities could facilitate this. Supply chain dependencies must also be actively reduced, in part by subsidies to European semiconductor fabrication plants.

European OEMs would have to target their R&D initiatives at the most optimal global markets to deliver digital, connectivity, and battery innovation. This must more than meet local consumer preferences and build a long-term competitive advantage. As a result, European OEMs would uphold their strong premium brands reputation. But they then have to foster it through online and offline retail networks and experience centers, offering an ecosystem of products and services that customers indicate they want. Analytics and AI should become the backbone of the sales process to drive loyalty, customer experience, and value.

Two other elements are critical to reach the gains possible in this scenario: First, increased efficiency of local production plants through significant automation and robotic innovation; Second, accelerated adoption of renewable power sources in Europe, providing OEMs with inexpensive input energy.

This scenario could produce a substantial win for European OEMs and suppliers, with a sizeable gain in market share worldwide. GDP and jobs growth compared to the European auto industry today of 15% and 20%, respectively, and a massive 38% improvement in equity value would likely be evident.

The downside risk of inaction is significant. Yet considerable opportunity remains.

How to Achieve Securing the Lead

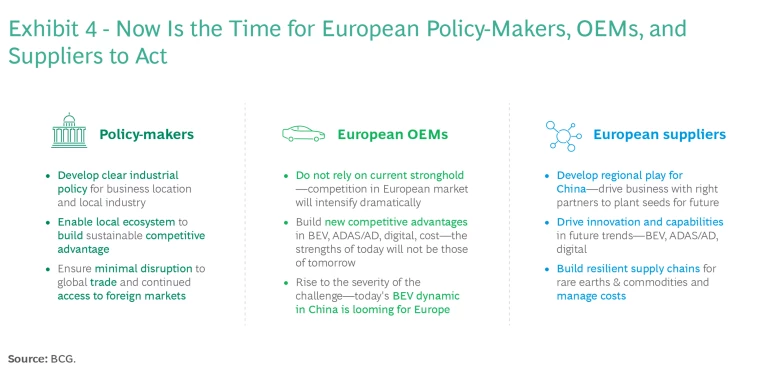

As these scenarios show for the European auto industry, staying on its current path is likely to lead to secular decline. Even taking limited steps to improve is expected to result in stagnation or only slight gains. But achieving real leadership and a positive future is not out of reach.

Based on what we learned from scenario modeling, there is a series of essential actions that the private sector and governments must take to attain the European auto industry's most desirable results (see Exhibit 4). These actions primarily involve:

- OEMs becoming more nimble and less staid, developing and adopting new technologies, and speeding up the transition towards EVs—and all of these in actuality as well as in public perception.

- Suppliers playing a big role by working with European automakers to customize parts innovation for specific and crucial global markets as well as making supply chains less prone to disruption.

- Crucially, political leaders and regulators designing clear industrial policies intended to mitigate risks to global trade and safeguard continued access to foreign markets for European OEMs.

There is little doubt anymore that the European auto industry is at a crossroads. Competition and costs, slow uptake of new technologies, the challenge to take a clear leadership role in EVs, and uncertain globalized supply chains have combined to make the potential futures of European OEMs and suppliers change and unusually difficult. As our analysis found and our scenarios show, the downside risk of inaction is significant. Yet considerable opportunity remains. Response is urgently required, but by making the right strategic, creative moves the European auto industry still has a considerable chance to thrive and even to expand its global role and influence.